May 21, 2023

Blue Star Helium Limited (ASX:BNL, OTCQB:BSNLF) (Blue Star or the Company) provides an update on progress at its maiden Voyager helium development in Las Animas County, Colorado.

Highlights

- Three well drilling program at high-grade Voyager development set to commence in August.

- Program includes two approved helium development wells (BBB 33#1 and 34#1), plus an exploratory well on the southern side of the interpreted crest designed to test the area of the new submitted OGDP application.

- New OGDP application for a further four development wells at Voyager submitted to COGCC.

- The total six development well locations deliver a robust inventory from which the initial 2-4 production wells will be selected to deliver targeted nameplate helium output at Voyager.

- Agreements with mid-stream counterparty for leased helium facility at Voyager in agreed form and, subject to final approval by mid-stream company, expected to be executed shortly.

- Mid-stream counterparty confirmed Q4 delivery with Blue Star on track for first helium production and sales from Voyager during Q4 CY2023.

Initial development well drilling program

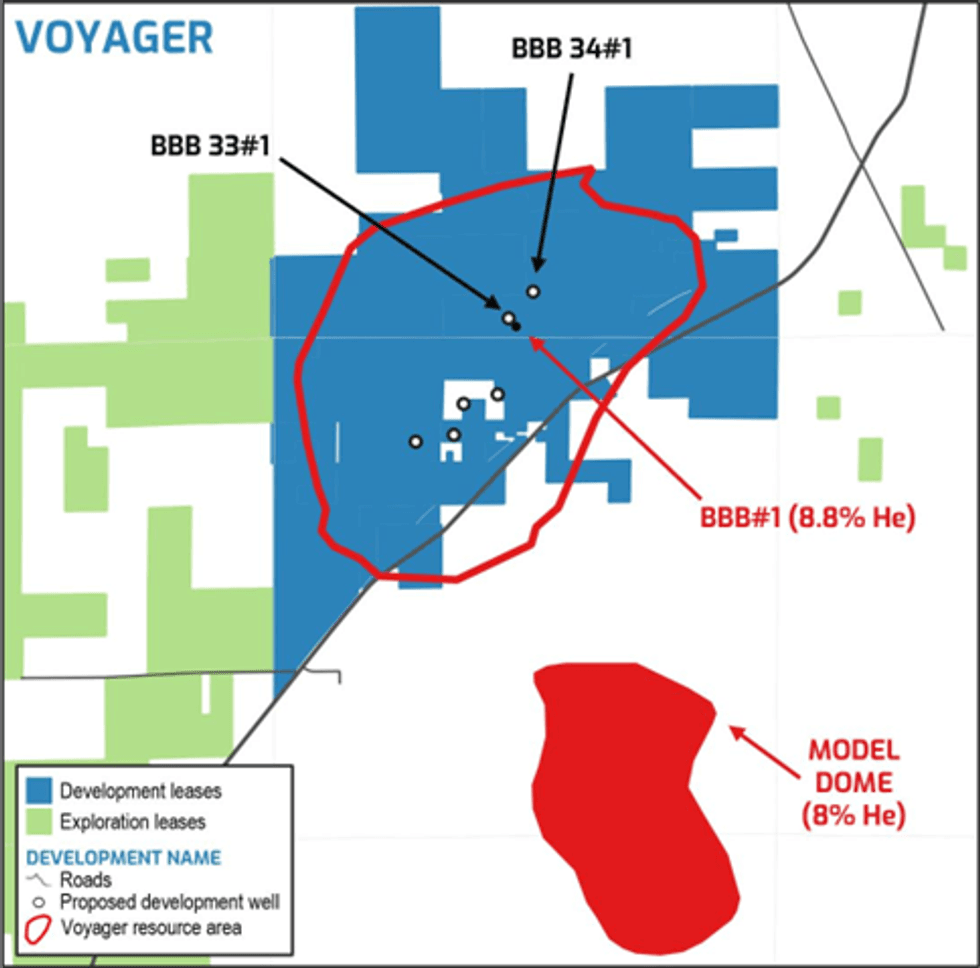

Blue Star has selected a drilling contractor to commence the development well drilling program for its maiden helium project at the high-grade Voyager discovery (BBB#1 8.8% helium; see BNL ASX release dated 17 November 2021).

Drilling is scheduled to commence during August and is planned to initially encompass three wells. These three wells are planned to be the approved BBB 33#1 and 34#1 helium development wells, as well as an exploratory well on the southern side of the interpreted crest designed to test the area of the new OGDP application.

Drilling of the wells is set to include flow and pressure testing in preparation for Voyager production activities (while noting that the exploratory well will not be capable of being a producer).

Four additional well applications submitted

The Company recently submitted its next Oil and Gas Development Plan (OGDP) for the development of the Voyager prospect to the Colorado Oil and Gas Conservation Commission (COGCC). This second OGDP comprises four additional helium development well drilling locations, which are depicted in Figure 1. The draft OGDP was amended down from the original five planned wells because of a delay in counterparty return of a negotiated signed mineral lease. This location will be the subject of a future OGDP submission as part of the Phase 2 development drilling.

A pre-submission review of this new OGDP has been completed with the COGCC. No issues were identified in this preliminary review.

The COGCC also recently advised operators that it is implementing a revised permitting process which is designed to shorten the time between application submission and approval hearing to 4.5 months or less.

These four new development well locations, together with BBB 33#1 and 34#1, are expected to deliver a robust inventory of permitted wells from which to select the initial 2-4 production wells to deliver targeted nameplate helium output at Voyager.

Helium processing facility commercial discussions

Blue Star’s discussions with a mid-stream company for the supply and operation of a helium processing facility at Voyager (see BNL ASX release dated 11 April 2023) are nearing completion and the contract documentation is now in agreed form. The mid-stream company has advised that its technical due diligence is substantially complete and, subject to final sign off, it expects to execute the documentation shortly.

The mid-stream company has also confirmed Q4 delivery, installation and commissioning of the facility. Accordingly, Blue Star remains on track for first helium production and sales from Voyager during Q4 CY2023.

Click here for the full ASX Release

This article includes content from Blue Star Helium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BNL:AU

The Conversation (0)

28 November 2022

Blue Star Helium

Developing High-Grade Helium Assets in Colorado

Developing High-Grade Helium Assets in Colorado Keep Reading...

22h

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00