(TheNewswire)

Vancouver, BC, November 20, 2025 TheNewswire - Global Stocks News - Sponsored content disseminated on behalf of West Red Lake Gold. On November 18, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) provided a mid-Q4 update on ramp-up activities at the Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

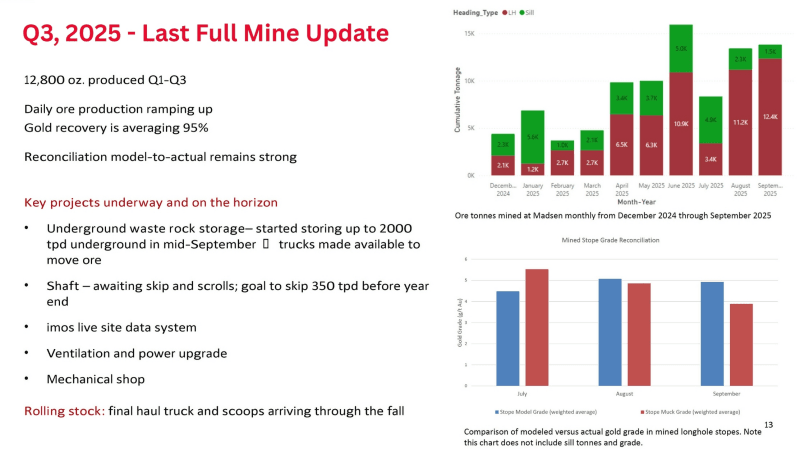

Mining companies typically release results on a quarterly basis. Madsen's current ramp-up phase features a month-over-month 24% ore output increase, improved underground waste-rock handling, expanded haul-truck availability and an existing shaft coming online.

Given the velocity of operational changes, West Red Lake Gold has chosen to update investors at the six-week mark - halfway through the current quarterly cycle.

"We have worked diligently through the stages and challenges of mine ramp up, always focused on getting the Madsen Mine into full-scale operations early in 2026 , and we are now in sight of that goal," stated Shane Williams, President and CEO.

"Seeing ore production increase 24% in October month-over-month after initiating the underground waste rock storage program, reinforced the impact of final site projects in advancing towards commercial production," continued Williams. "The team is motivated to get the shaft operational and take receipt of the final haul truck to complete this list."

In a YouTube video posted on November 18, 2025, West Red Lake Gold VP of Communications, Gwen Preston, discusses how the mine is advancing toward sustained ore growth.

"West Red Lake Gold just put out an update from the Madson mine now that we're halfway through the fourth quarter," stated Preston in the video. "This wasn't a full ramp-up update. We do those quarterly because a three-month period is a better time frame to capture performance when you're discussing a variable entity like a mine."

"But at Madsen, we are approaching full operations, and we are ticking items off our to-do list. And so we wanted to talk about those, mostly so that others can start to share our confidence that we really are successfully marching Madsen into commercial production."

"In our last mine site update, we discussed how ramping up the Madsen mine is really about moving more tonnes each month. In September, we started to be able to store our waste rock underground, instead of trucking it to surface. That was exciting because it freed up our haul trucks to move ore instead of moving waste."

"In October, we produced 24% more tonnes of ore each day, on average, than we had done in September," continued Preston. "Our ore production trend is moving clearly in the right direction. In December, in just a few weeks, we expect to get the shaft operational, which will add another 300 or so tonnes per day of capacity. That's painting a solid picture for ore production, which is the critical path for ramp up at Madison."

"In the first half of the quarter, we also took delivery of three more four-yard scoops, and that leaves just one haul truck as the only item of rolling stock that we're waiting to be delivered to the mine site. The components to build a maintenance shop were also just delivered. So the infrastructure side of things, both rolling and fixed at Madison, is just about complete," concluded Preston.

In Q2, 2025, the Madsen Mine welcomed Sean McCormack as Mine General Manager. Mr. McCormack joined from Wesdome Mines where he had been General Manager of the Kiena Mine for five years. Prior to that he was Mine General Manager of the Holt Complex for Kirkland Lake Gold, managing three operating mines feeding one central mill. His extensive experience is evident in his site leadership.

Over the last two months, Mr. McCormack welcomed several strong new members to the site management team.

Bright Asamoah joined as Chief Engineer . Mr. Asamoah spent the last 13 years with Newmont Gold, where he led the shift at the Ahafo mine in Ghana from Long Hole Stoping to Sub Level Shrinkage, a transformation that doubled production at that mine. Subsequently, Mr. Asamoah moved to the Porcupine Mine as Senior Mine Engineer and then to the Hoyle Pond and Borden Mines, where he was Senior Underground Engineer.

James Armstrong joined as Mill Manager . Armstrong's previous two roles were also mill manager positions, primarily at the Middle Tennessee Mines for Nyrstar, where he worked up from Senior Metallurgist to Processing Manager to Production Manager before becoming Mill Manager. Mr. Armstrong has 30 years of experience.

William Curry joined as Senior Operations Manager . Mr. Curry most recently came from Talisker Resources' Bralorne Mine, where he was Mine General Manager, charged with full site management. Previous to that, he was a Vice President with Sinomine Resources at the Tanco mine in Manitoba and Project Superintendent at the Macassa Mine in Ontario. Mr. Curry is a mining engineer with 28 years of underground mining experience.

"We are on track for commercial production early in Q1 2026, as we've been promising," concluded Preston in the video. "I'm now at a one-to-one investment conference in London. With full operations at something like 50,000 ounces a year, just around the corner, I've been having meetings with investors who are showing a lot of interest in West Red Lake Gold Mines."

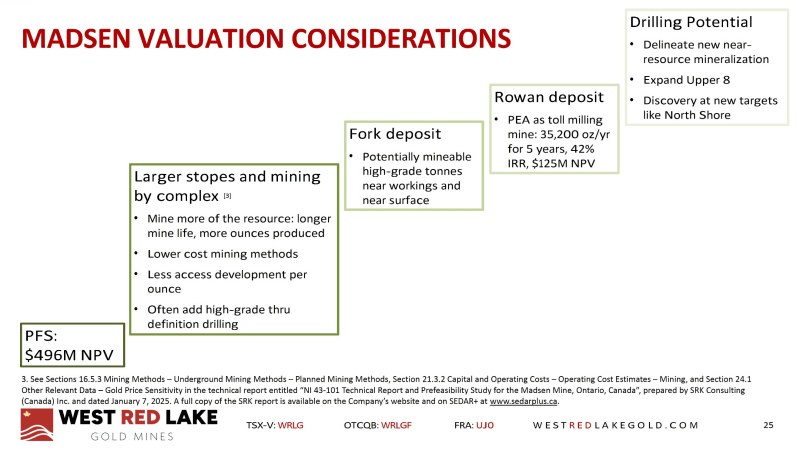

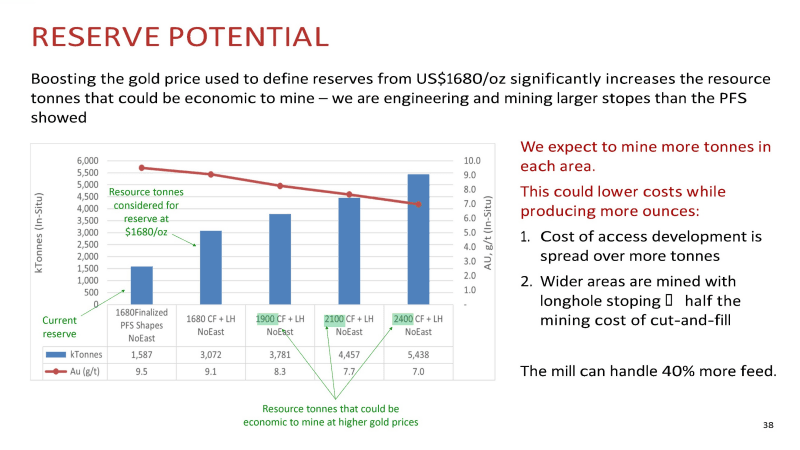

The mine plan in the Madsen Mine Pre-Feasibility Study (PFS) [1] used a gold price of US$1,680 per oz – about 40% of the current gold price. This led to a mine plan with 60% of the mining being small, high-grade stopes requiring the use of cut-and-fill mining, which is selective and relatively high cost. [2]

For its current mine design, West Red Lake Gold is using the "consensus long-term price" of US$2,350 per ounce – a conservative number about $1,700 per ounce below the current gold price.

The price of gold peaked a month ago at USD $4,395. It is now trading at $4,060 - double the price it was two years ago.

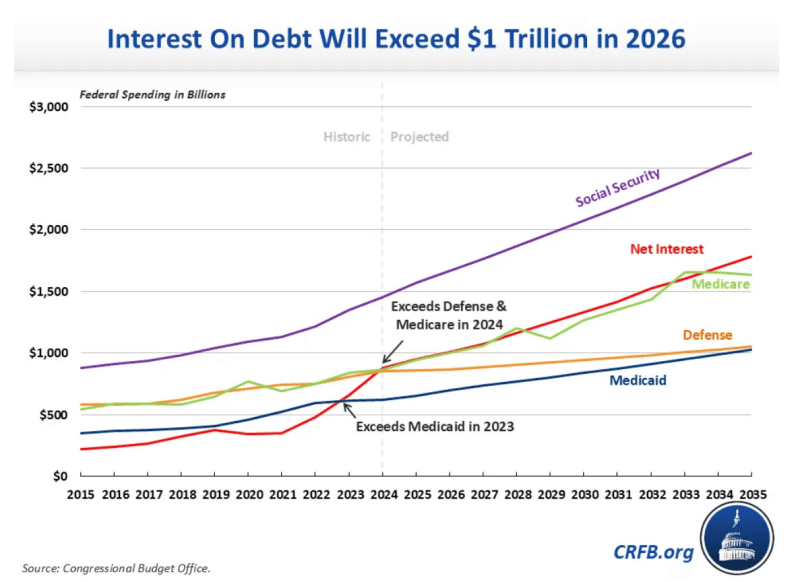

Fiat currency (cash) is losing value because central governments have printed too much money. This is bullish for gold, a hard asset in limited supply. No act of congress can make a brick of gold appear on the Whitehouse lawn.

"Business leaders, policymakers, and investors are growing increasingly concerned by the United States's borrowing burden, currently sitting at $38.15 trillion ." reports Fortune Magazine on November 17, 2025 .

"The worry isn't necessarily the size of this debt, but rather America's debt-to-GDP ratio—and hence, its ability to convince investors that it can reliably pay back that debt," continued Fortune.

Annual interest payments on U.S. debt are now higher than its military budget.

Investing in a junior gold miner with rising production and free cash flow, is one way to hedge against the effects of exploding U.S. debt.

Source : Congressional Budget Office

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Hayley Halsall-Whitney, P.Eng., Vice President of Operations for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as "project," "anticipate," "expect," which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

1. Please refer to the technical report entitled "NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada", prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025. A full copy of the SRK report is available on the Company's website and on SEDAR+ at www.sedarplus.ca.

2. See PFS Section 16.5.3 Mining Methods – Underground Mining Methods – Planned Mining Methods.

Additional References:

3. See PFS Report Section 21.3.2 Capital and Operating Costs – Operating Cost Estimates – Mining.

4. Mineral reserve estimates based on a gold price of US$1,680/oz and an exchange rate of 1.31 C$/US$. Longhole stope cut-off grade of 4.30 gpt Au based on an estimated operating cost of C$287.34/t including mining, plant and G&A. Mechanized Cut and Fill stope cut-off grade of 5.28 gpt Au based on an estimated operating cost of C$354.90/t including mining, plant and G&A. Incremental development cut-off grade of 1 gpt Au. A small amount of incremental longhole tonnes were included at a cut-off grade of not less than 3.4 gpt Au, these must be immediately adjacent to economic stopes that will pay for the capital to access area.

5. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources are not considered mineral reserves as they have not demonstrated economic viability.

6. See Section 24.1 Other Relevant Data – Gold Price Sensitivity.

Copyright (c) 2025 TheNewswire - All rights reserved.