November 30, 2022

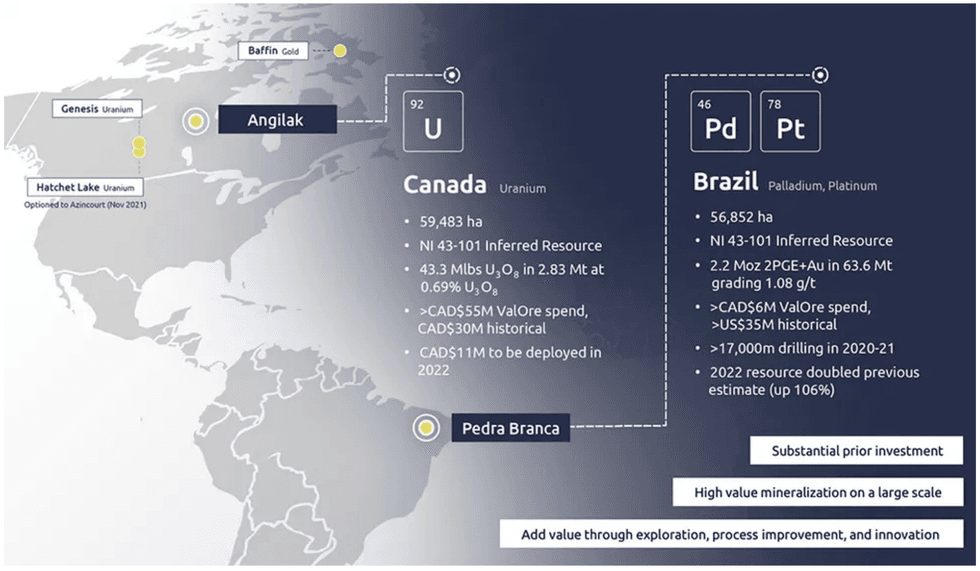

ValOre Metals (TSX:VO) focuses on high-quality metals and projects. The company's flagship uranium asset Angilak is located in Nunavut, Canada, covers 59,583 hectares, and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

The Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

The company a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

This ValOre Metals profile is part of a paid investor education campaign.*

Click here to connect with ValOre Metals (TSX:VO) to receive an Investor Presentation

VO:TCM

The Conversation (0)

29 November 2022

Valore Metals

Exploring District-Scale Uranium, PGE & Gold Projects

Exploring District-Scale Uranium, PGE & Gold Projects Keep Reading...

19 November

Hydrogeological Testing Underway at Lo Herma

Hydrogeological testing has commenced at AMU’s flagship Lo Herma ISR Project in Wyoming’s Powder River Basin to validate aquifer performance concurrent with Phase 1 drilling which aims expand the 8.57Mlb resource at Lo Herma.

American Uranium Limited (ASX:AMU, OTC:AMUIF) (American Uranium, AMU or the Company) is pleased to advise that hydrogeological testing at its Lo Herma ISR uranium project in Wyoming’s Powder River Basin has commenced. Testing is being undertaken by Petrotek Corporation, a leading injection well... Keep Reading...

11 November

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

11 November

Generation Uranium Eyes Discovery Near 43 Million Pound Lac 50 Uranium Deposit

At the 51st annual New Orleans Investment Conference, Chris Huggins, CEO of Generation Uranium (TSXV:GEN,OTCQB:GENRF), shared how the company is positioning itself in one of Canada’s most promising uranium belts. “We have a property called the Yath. It's a uranium grassroots project that is in... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00