November 30, 2022

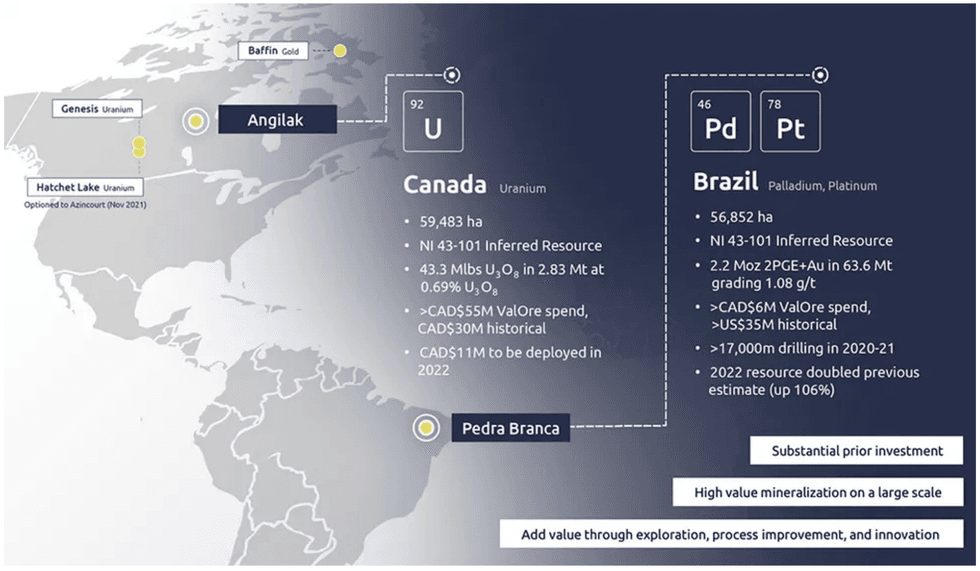

ValOre Metals (TSX:VO) focuses on high-quality metals and projects. The company's flagship uranium asset Angilak is located in Nunavut, Canada, covers 59,583 hectares, and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

The Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

The company a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

This ValOre Metals profile is part of a paid investor education campaign.*

Click here to connect with ValOre Metals (TSX:VO) to receive an Investor Presentation

VO:TCM

The Conversation (0)

29 November 2022

Valore Metals

Exploring District-Scale Uranium, PGE & Gold Projects

Exploring District-Scale Uranium, PGE & Gold Projects Keep Reading...

3h

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

3h

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

23 January

Investment establishes valuation of C$50M for the polymetallic Häggån project

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that MMCAP International Inc. SPC (‘MMCAP’) and certain other strategic investors (together the ‘Strategic Investors’) will provide funding of C$10 million for a 19.7% interest in the Company’s... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00