June 25, 2023

Barrick to fund exploration at Charaque Project in Peru

Valor Resources Limited (Valor) or (the Company) (ASX: VAL) is pleased to advise that it has entered into a binding Earn-in agreement (Earn-in Agreement) with leading global gold and copper producer Barrick Gold Corporation (Barrick) covering Valor’s Charaque Project in Peru.

HIGHLIGHTS

- Valor has executed an Earn-in Agreement with leading global gold and copper producer Barrick Gold Corporation covering its Charaque Project in Peru.

- Under the agreement, Barrick has been granted a 5-year option to acquire a 70% interest in the property for cash payments totalling US$800,000 and US$3 million of exploration expenditure.

- During the first two years, Barrick guarantees a minimum exploration expenditure of US$500,000.

- Once it has acquired a 70% interest, Barrick can earn an additional 10% by exercising a second option with a US$1 million cash payment and the delivery of a sole-funded pre-feasibility study, taking its interest to 80%.

- The agreement secures the involvement of a sector-leading gold and copper producer and explorer to advance the exploration of the Charaque Project, allowing Valor to focus on the upcoming drilling of multiple advanced large-scale copper targets at its flagship Picha Project.

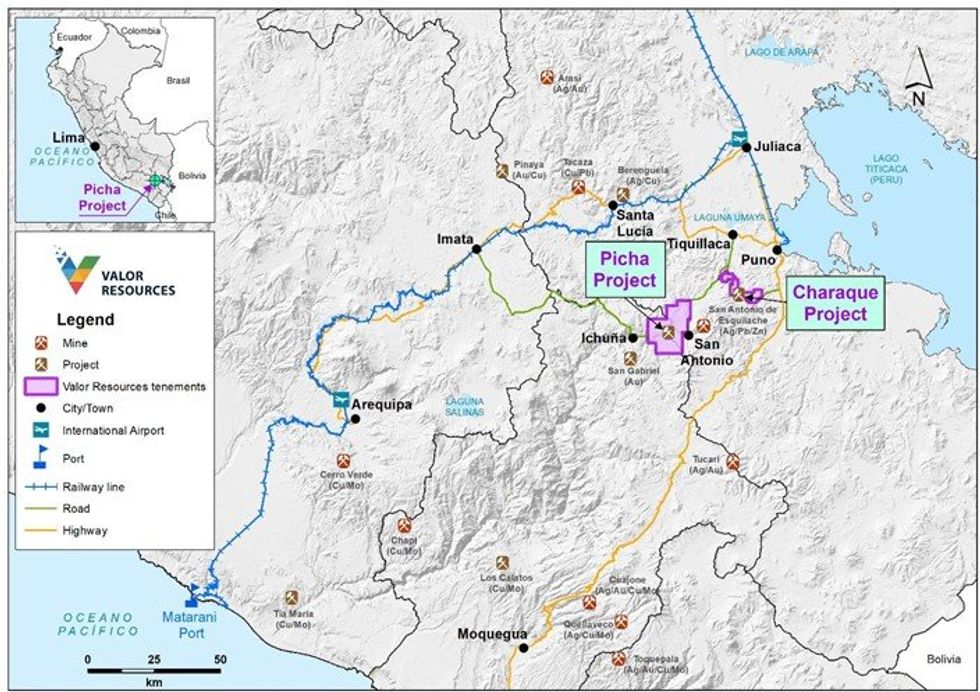

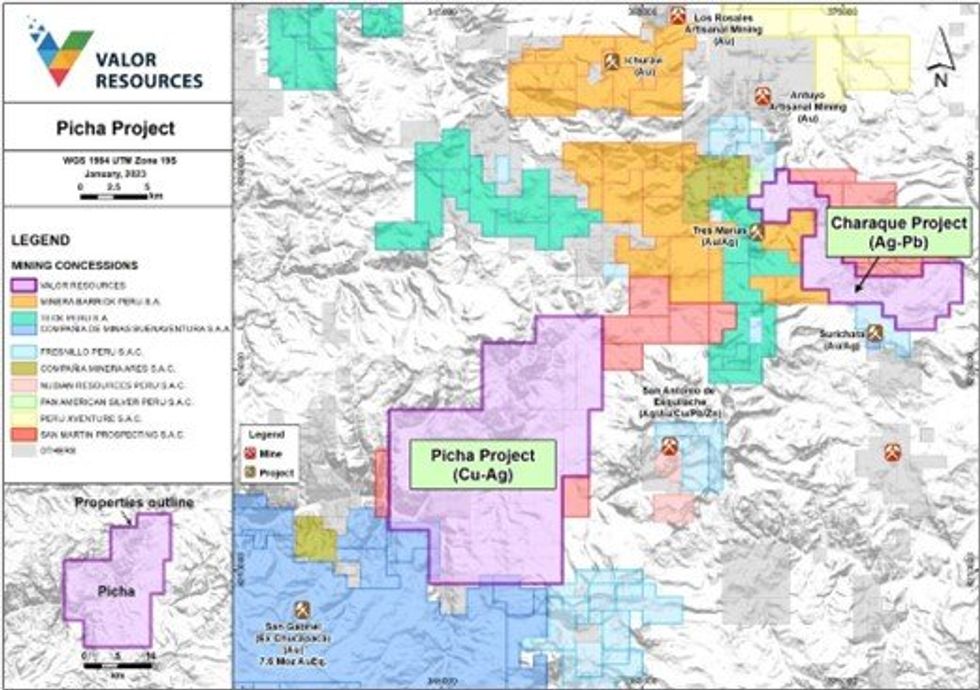

The Charaque Project is located 30km north-east of Valor’s flagship Picha Copper Project and comprises eight claims covering an area of around 6,000 hectares (60km2).

Valor acquired the Charaque Project 12 months ago given its highly prospective geology and strategic location in the midst of an active exploration area where a number of major mining companies including Barrick, Teck (NYSE: TECK) and Fresnillo (LSE: FRES) all have significant landholdings.

Since acquiring the Charaque Project, Valor has completed ground reconnaissance exploration work and recently commenced an extensive soil sampling program across the entire Charaque Project area.

The agreement with Barrick secures the involvement of one of the world’s leading gold and copper producers and explorers to fund exploration at Charaque, with the agreement including cash option payments to Valor.

Valor Executive Chairman, Mr George Bauk, said: “This is a very exciting outcome for Valor, with the participation of a leading global miner such as Barrick in the Charaque exploration program demonstrating the enormous discovery potential in this district.

“Barrick already holds land in the area, including tenements immediately adjacent to Charaque, and we look forward to them bringing their significant expertise to lead the exploration program while Valor retains strong, free-carried exposure to any discoveries.

“Barrick’s involvement in the ongoing exploration of the Charaque Project will enable Valor to focus our efforts on advancing our flagship Picha Copper Project, where we expect to commence an inaugural drilling program in the September 2023 Quarter.

“This part of Peru has become a very active exploration hotspot, with several major deposits including the San Gabriel and Berenguela polymetallic deposits. The 7.6Moz gold equivalent San Gabriel Gold- Copper Project – which lies just 7km south-east of Picha within the same mineralised corridor – is currently under development, with first production targeted for 2025.”

EARN-IN Agreement Terms

Under the terms of the Earn-in Agreement, Barrick will be granted a 5-year option providing the right to acquire a 70% interest in the Charaque Project for cash payments totalling US$800,000, and exploration spending incurred of US$3,000,000 as follows:

- Barrick will make an upfront cash payment of US$200,000 upon granting of the option.

- Barrick will make payments of US$100,000 on each of the first, second, third and fourth anniversary dates (totalling US$400,000).

- To complete the 70% Earn-in interest, Barrick will make a payment of US$200,000.

- To exercise the option, Barrick must incur exploration spending of a minimum of US$3,000,000. During the first two years, Barrick guarantees a minimum expenditure of US$500,000.

- Barrick may earn an additional 10% interest (totalling 80%) by exercising a second option with a US$1,000,000 cash payment and sole fund all costs and deliver to Valor Resources a Pre-Feasibility Study.

Charaque Project – background

The Charaque Project is located 30km north-east of Valor’s flagship Picha Copper Project and comprises eight claims covering an area of around 6,000 hectares (60km2).

The area around Charaque is an active exploration area with major mining companies such as Barrick, Teck (NYSE: TECK) and Fresnillo (LSE: FRES) all having significant land-holdings around the project area.

The Charaque Project was acquired by Valor in April 2022 (see ASX announcement dated 27th April 2022 titled “Valor secures additional concessions in highly prospective Gold-Copper-Silver region in Peru”).

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

2h

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00