April 18, 2023

Valor on track to earn 80 % interest in highly prospective Canadian project

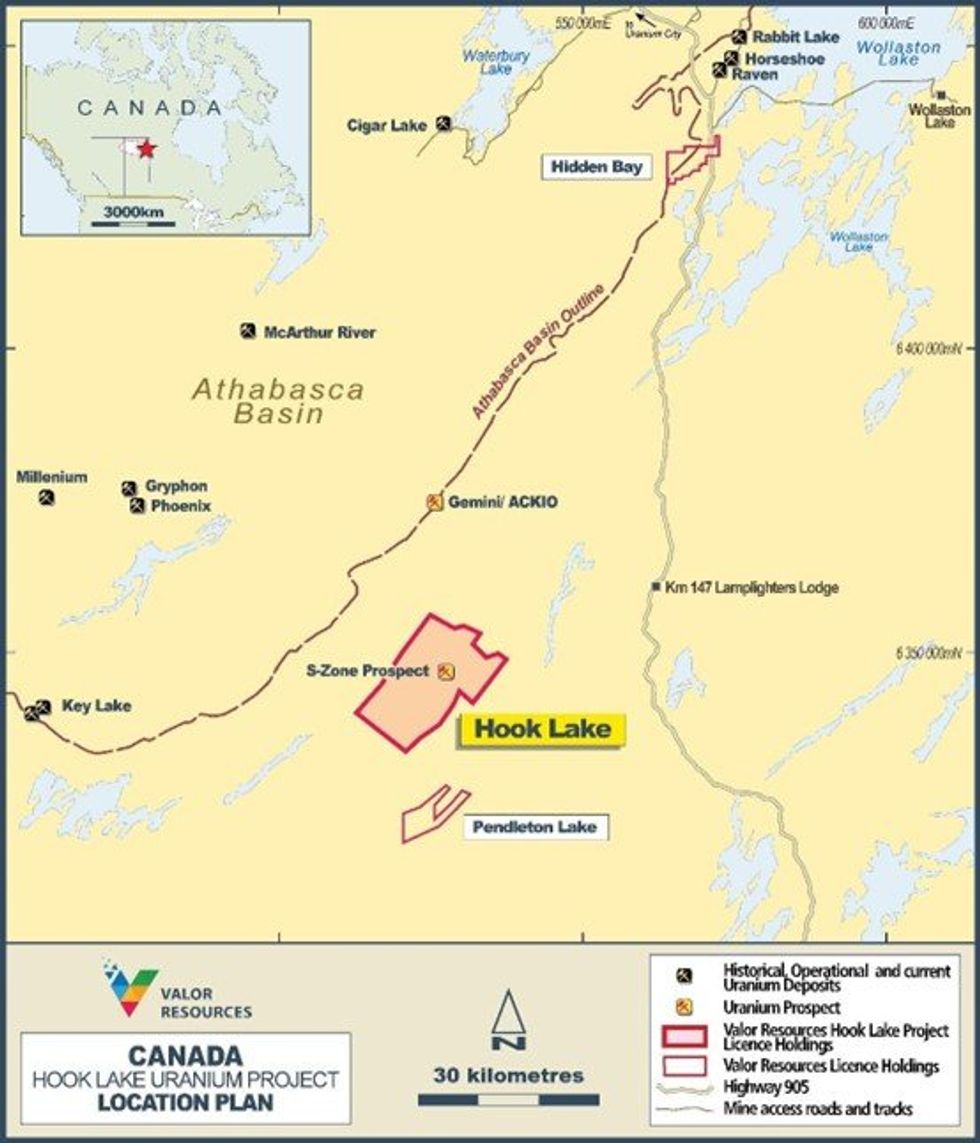

Valor Resources Limited (Valor) or (the Company) (ASX: VAL) is pleased to advise that it has completed the second anniversary payment to Skyharbour Resources Limited (TSXV: SYH) under its farm-in agreement at the Hook Lake Uranium Project located in northern Saskatchewan, Canada.

HIGHLIGHTS

- Valor has completed expenditure requirements totalling $3.5 million to date.

- Second Anniversary Payment has now been completed, comprising cash and shares.

- 80% interest to be completed following the final payment in February 2024.

Under revised terms negotiated with Skyharbour, Valor will issue SkyHarbour 30,000,000 shares and make a C$50,000 cash payment to complete the second earn-in milestone, with C$5,000 to be paid immediately and the balance within 60 days of this announcement.

Valor has also completed its expenditure commitments under the earn-in, being C$3.5 million over a 3-year period. Following the drill campaign completed in 2022, together with the airborne gravity survey completed last year, the Company has met its exploration expenditure commitments under the agreement.

The final payment of C$175,000, due in February 2024, is the last hurdle before the Company earns its 80% interest in the Hook Lake Project.

Valor Executive Chairman, George Bauk, said: “This part of the Athabasca Basin continues to be a focus of significant uranium exploration activity, particularly since the recent discoveries by 92 Energy (ASX:92E) and Baselode Energy (TSXV: FIND) at Gemini and ACKIO, located just 30km to the north of Hook Lake.

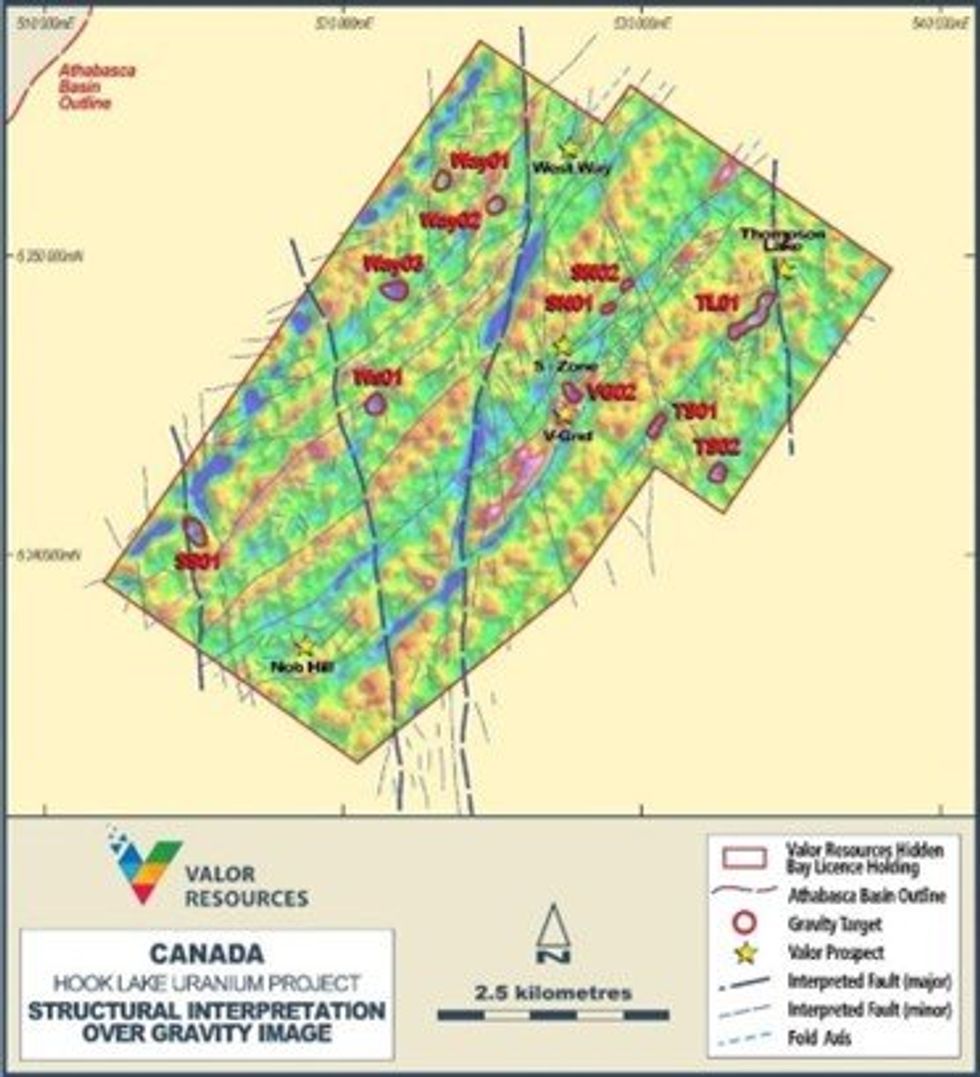

“The Hook Lake Project has a large number of prospective targets identified by last year’s airborne gravity survey (see announcement on 21 September 2022 titled “Eleven new targets in the Athabasca Basin uncovered through modern exploration surveys”). Work has been completed in 2022 to review all of the newly-acquired exploration data resulting in confirmation of a number of priority targets that will continue to be worked up to drill target status.

"The most significant of the 11 targets include V-Grid, West Way (-1, -2, -3) and Thompson Lake, where gravity lows have been identified and are near coincident with uranium radiometric anomalies or north-south Tabbernor fault structures, as shown in Figure 2 below.”

This announcement has been authorised for release by the Board of Directors.

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00