- WORLD EDITIONAustraliaNorth AmericaWorld

November 06, 2023

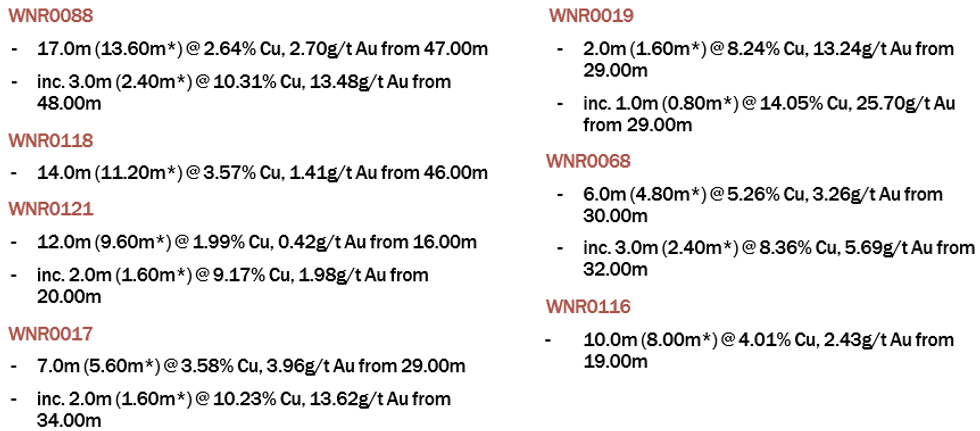

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce its advanced grade control drilling program at its copper-gold Wallace North project identified high grade zones of copper and gold mineralisation, which exceed the current updated resource model. Results are anticipated to have a positive impact on future resource estimates and open-pit designs.

HIGHLIGHTS

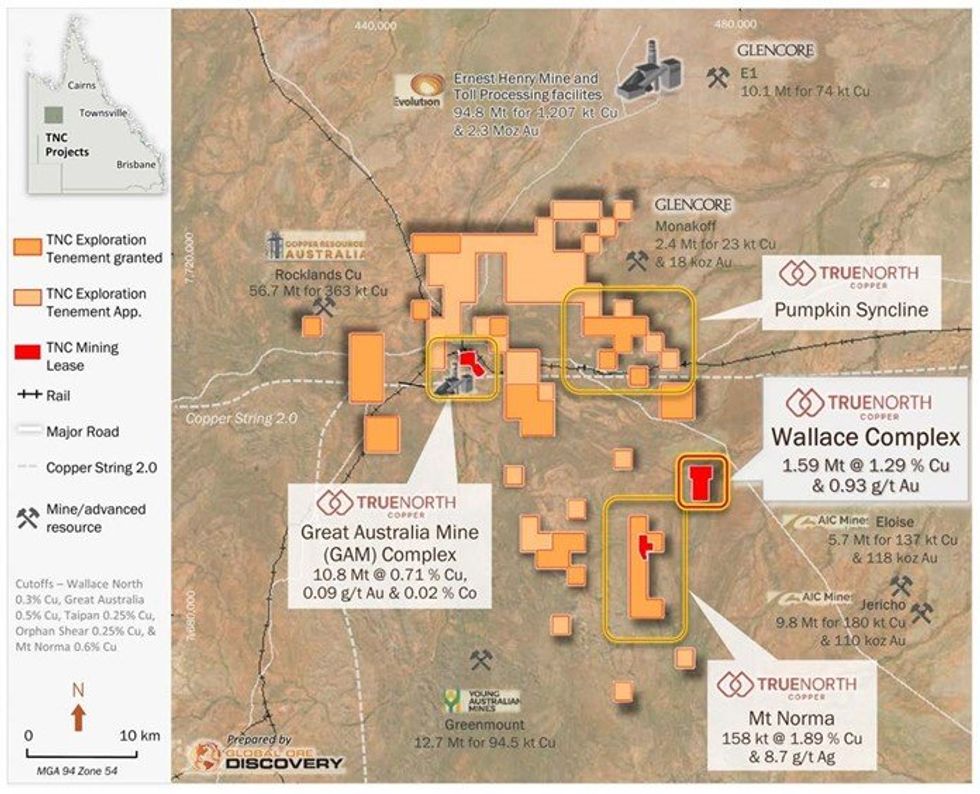

- Completed in September 2023, TNC’s Wallace North advanced grade control drilling program included 142 Reverse Circulation (RC) drillholes across 7,594m. The Wallace North Resource (Indicated and Inferred of 1.59Mt @ 1.29% Cu and 0.93 g/t Au)1 is on a fully permitted Mining Lease and is part of TNC’s Cloncurry Project. It is a target for near-term production.

- Results are still in the process of being interpreted. Initial assessment highlights multiple zones of higher grade than predicted. The results are anticipated to have a positive impact on future resource estimation and open-pit designs.

- Assays are pending for intercepts that remain open up or downhole and for those requiring QAQC checks. Final assay results of the program will feed into optimisation studies and early mine planning.

- Copper-gold (Cu-Au) shoots remain open at depth and will be a target for future drilling.

COMMENT

True North Copper’s Managing Director, Marty Costello said:

Results from the advanced grade control program further confirm our position Wallace North has the potential to deliver significant near-term value to the company, in an early production scenario.

These initial results confirm and, in some cases, exceed expected grades from comparisons to the current resource model. Not only do they indicate the potential to increase grade within the existing block model but also the potential to increase the overall resource.

With the return of all assays by the end of November 2023, mine optimisation and metallurgical studies will commence. These studies will assess the possibility of producing a copper-gold concentrate and will be finalised Q1 2024.

Wallace North is on a fully permitted Mining Lease, which allows near term development options to be assessed during the optimisation study phase. The Wallace North resource is an important part of our Cloncurry Project mining plans, with its near-term value reinforced through recent infill drilling and resource upgrade work completed across the resource.

Wallace North - Advanced Grade Control Drilling

The Wallace North Advanced Grade control drilling was completed September 2023 and consisted of 142 RC holes for 7,594m drilled (Figure 3, Figure 4). These holes were drilled on a regular grid pattern on 15m centres at a nominal 60 degrees dip, orientated strike perpendicular and targeted the top ~55m of the Wallace North Au-Cu resource Resource (Ind. Inf. 1.59Mt @ 1.29% Cu and 0.93 g/t Au)1. All meters were pulverised, with 4,577 samples selected for assay at the lab based on PXRF analysis of RC chips returning >500ppm Cu. Assays results have all been received and are reported in this release.

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00