triumph gold Corp. (TSXV: TIG) (OTC Pink: TIGCF) (FSE: 8N6) ("triumph gold" or the "Company") is pleased to announce the discovery of a new Silver-Gold vein system, now named the Proton Zone, at its 100%-owned Freegold Mountain Project in Yukon, Canada. The discovery lies 1.3 km northeast of the Nucleus Deposit and 2.75 km northwest of the Revenue Deposit.

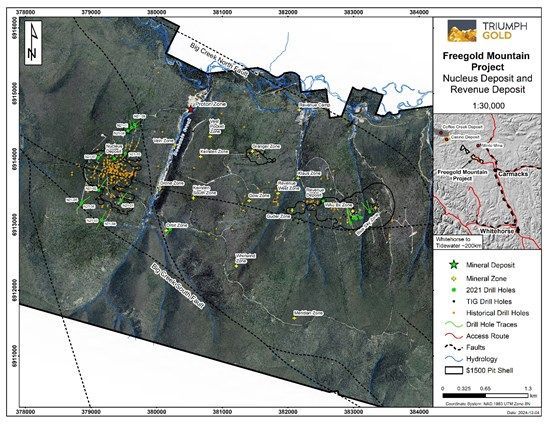

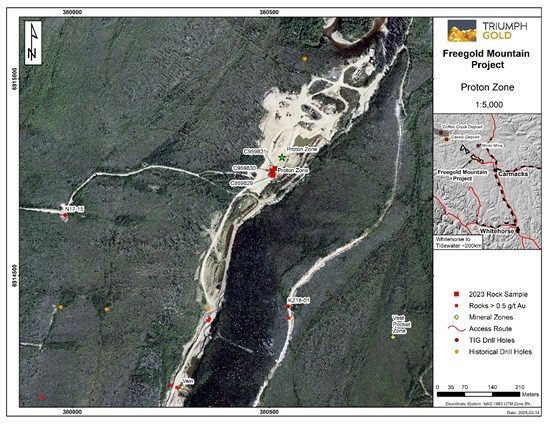

The Proton Zone was uncovered in fresh bedrock exposed by placer mining at Mechanic Creek in a previously unexplored area. The mineralized zone spans approximately 15 x 15 metres and lies over 300 metres from the nearest historic sampling or drill hole (Figures 1-3). The shear-hosted quartz-sulfide veins share a similar geochemical signature to the nearby Nucleus deposit but are hosted in granodiorite, similar to the Revenue deposit.

Highlights from Proton Zone Sampling (see Table 1):

- Grab sample C959830: 1.68 g/t Au, 8.99 g/t Ag, >10,000 ppm As

- Chip sample C959831 (30 cm): 5.95 g/t Au, 7.17 g/t Ag, >10,000 ppm As

Table 1: Assay Results from the Proton Zone

| Sample Number | Easting (NAD83-8N) | Northing (NAD83-8N) | Sample Type | Au g/t | Ag g/t | Cu ppm | As ppm | Sb ppm | Bi ppm |

| C959829 | 380510 | 6714755 | Grab | 0.50 | 1.26 | 153 | 9,030 | 94.4 | 8.57 |

| C959830 | 380508 | 6914767 | Grab | 1.68 | 8.99 | 212 | >10,000 | 153 | 68.3 |

| C959831 | 380515 | 6914772 | 30cm Chip | 5.95 | 7.17 | 161 | >10,000 | 38.8 | 49.6 |

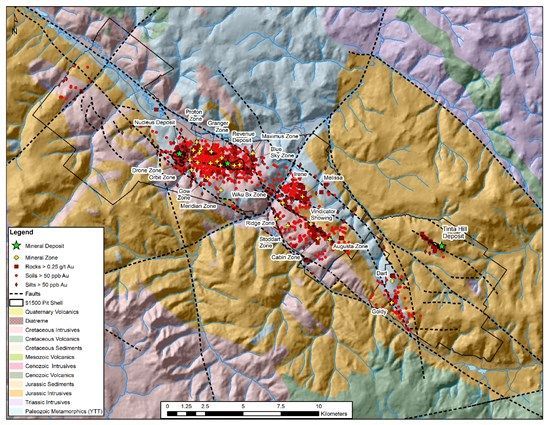

Other high-grade vein zones have been sampled along Mechanic Creek. The Drone Zone, located 1.3 kilometres south of the Proton Zone, returned up to 450 g/t gold and 19 g/t silver (March 2019). An additional zone 600 meters south of the Proton Zone returned values up to 6.58 g/t gold and 13.6 g/t silver.

These zones all feature gold-silver-copper-arsenic-antimony-bismuth geochemistry and have not been followed up with drilling. Their proximity to the Nucleus and Revenue deposits suggests a potential link to the Revenue porphyry mineralizing event. The Revenue system is similar in style to the Casino deposit, part of the Tintina Gold Belt.

Sample Descriptions:

- C959829: Silicified vein-breccia with up to 10% arsenopyrite

- C959830: Similar to above, about 10 meters away along the same structure

- C959831: Clay-altered, gossanous zone with no visible sulphides, east-trending

triumph gold's VP of Exploration Jesse Halle comments: "Mechanic Creek continues to generate highly prospective exploration targets, demonstrating the significant growth potential of the Revenue and Nucleus deposits. This new zone shows gold-and-silver-dominant geochemistry like the Vest Pocket and Granger zones, the latter being added to the 2020 resource estimate. A new mineralized trend is emerging, and we are excited to see where it leads."

Figure 1: Nucleus and Revenue deposits as well as additional zones of mineralization (Map scale 1:30,000)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/251686_fc7500020495ba1d_001full.jpg

Figure 2: Proton Zone Map (1:5,000 scale)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/251686_fc7500020495ba1d_002full.jpg

Figure 3: Proton Zone Sampling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/251686_fc7500020495ba1d_003full.jpg

Nucleus Deposit Overview

The Nucleus deposit hosts epithermal gold-silver-copper mineralization within Paleozoic schists and gneisses, crosscut by quartz-feldspar porphyry dykes and a leucogranite stock. Structural control is related to the Big Creek fault system.

2020 Resource Estimate (at 0.30 g/t AuEq cutoff):

- Indicated: 31 million tonnes grading 0.65 g/t gold, 0.07% copper, and 0.7 g/t silver

- Inferred: 9.4 million tonnes grading 0.56 g/t gold, 0.04% copper, and 0.7 g/t silver

triumph gold's Principal Geologist, Marty Henning, comments: "With rising gold and silver prices, the Nucleus resource is showing strong potential for growth. Mineralization extends below the current $1,500 per ounce gold pit resource, and further drilling along key structural trends could significantly expand the resource."

Figure 4: Distribution of anomalous Gold within surface rock, soil and silt samples

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/251686_fc7500020495ba1d_004full.jpg

The last major exploration program at the Nucleus deposit was conducted in 2021. Figure 1, Table 2 and Table 3 provide details of the program and demonstrate the growth potential of the Nucleus deposit. Drilling completed in 2021 was designed to test mineralization continuity along the four corners of the main and northern satellite pit resource, the Big Creek South Fault, and the newly defined Orbit Zone (New Release May 4, 2022). Drill hole attributes are summarized in Table 1, and gold equivalent (AuEq) composite grades are highlighted in Table 2.

Table 2: Nucleus 2021 Drillhole Summary

| Hole-ID | Easting (NAD83-8N) | Northing (NAD83-8N) | Elevation m | Depth m | Azimuth | Dip |

| N21-01 | 379458 | 6913364 | 852 | 306.32 | 35 | -60 |

| N21-02 | 379120 | 6913528 | 951 | 449.58 | 30 | -60 |

| N21-03 | 379162 | 6913073 | 895 | 320.43 | 210 | -60 |

| N21-04 | 379162 | 6913073 | 895 | 295.66 | 30 | -60 |

| N21-05 | 378859 | 6913336 | 974 | 288.04 | 220 | -60 |

| N21-06 | 378859 | 6913336 | 974 | 316.99 | 40 | -60 |

| N21-07 | 379111 | 6914021 | 1003 | 312.42 | 70 | -70 |

| N21-08 | 379566 | 6914430 | 902 | 327.5 | 60 | -60 |

| N21-09 | 379666 | 6914527 | 860 | 215.49 | 45 | -70 |

| N21-10 | 379525 | 6914090 | 906 | 257.86 | 210 | -70 |

| N21-11 | 379620 | 6914482 | 880 | 232.56 | 340 | -60 |

| O21-01 | 380343 | 6912498 | 812 | 242.32 | 220 | -50 |

Table 3. Significant Intercepts >0.50AuEq with sub-intervals >1.0 g/t AuEq.

| Hole-ID | From m | To m | Interval m | AuEq 1750 | Au g/t | Ag g/t | Cu % |

| N21-01 | 21 | 38.5 | 17.5 | 0.45 | 0.33 | 1.39 | 0.07 |

| N21-01 | 57 | 84.25 | 27.25 | 0.75 | 0.60 | 1.65 | 0.08 |

| Including | 67 | 84.25 | 17.25 | 1.02 | 0.85 | 1.72 | 0.09 |

| N21-01 | 218 | 224.7 | 6.73 | 0.29 | 0.11 | 1.20 | 0.11 |

| N21-01 | 268 | 272.5 | 4.5 | 0.52 | 0.24 | 1.72 | 0.16 |

| N21-02 | 15.24 | 46.5 | 31.26 | 0.76 | 0.71 | 0.67 | 0.02 |

| Including | 28.5 | 33 | 4.5 | 2.10 | 2.00 | 1.57 | 0.05 |

| N21-02 | 61.5 | 65.45 | 3.95 | 1.30 | 1.08 | 2.20 | 0.12 |

| Including | 61.5 | 65.45 | 3.95 | 1.30 | 1.08 | 2.20 | 0.12 |

| N21-02 | 114.08 | 119.5 | 5.37 | 0.79 | 0.74 | 0.39 | 0.03 |

| N21-02 | 223.41 | 236.7 | 13.29 | 1.17 | 0.90 | 2.24 | 0.16 |

| Including | 228.8 | 236.7 | 7.9 | 1.58 | 1.25 | 3.15 | 0.19 |

| N21-03 | 90.1 | 109 | 18.9 | 0.55 | 0.48 | 0.54 | 0.04 |

| Including | 90.1 | 95.5 | 5.4 | 1.00 | 0.93 | 0.57 | 0.04 |

| N21-04 | 135.5 | 138.5 | 3 | 1.24 | 1.18 | 0.25 | 0.03 |

| N21-06 | 276.38 | 280.1 | 3.73 | 1.22 | 0.87 | 1.85 | 0.21 |

| N21-07 | 75 | 82 | 7 | 0.46 | 0.43 | 0.59 | 0.01 |

| N21-08 | 70 | 86.5 | 16.5 | 0.66 | 0.66 | 0.25 | 0.00 |

| Including | 70 | 82 | 12 | 0.71 | 0.70 | 0.25 | 0.00 |

| N21-09 | 85.5 | 88.5 | 3 | 0.89 | 0.87 | 0.25 | 0.01 |

| N21-09 | 153 | 163 | 10 | 0.46 | 0.33 | 0.25 | 0.08 |

| N21-10 | 4 | 13 | 9 | 0.41 | 0.36 | 0.87 | 0.02 |

| N21-10 | 54 | 63 | 9 | 0.71 | 0.65 | 0.69 | 0.03 |

| N21-11 | 31.6 | 51.6 | 20 | 0.96 | 0.92 | 1.46 | 0.01 |

| Including | 31.6 | 41 | 9.4 | 1.41 | 1.36 | 2.25 | 0.01 |

| N21-11 | 194 | 198 | 4 | 0.55 | 0.42 | 1.05 | 0.07 |

| O21-01 | 94.5 | 98.3 | 3.8 | 0.68 | 0.47 | 1.22 | 0.12 |

| O21-01 | 141 | 146.4 | 5.43 | 0.69 | 0.56 | 0.69 | 0.08 |

References and Disclosures

The AuEq composite was calculated using a >0.50 g/t AuEq and >1.0 g/t AuEq cutoff and

Gold equivalent [AuEq] is used for illustrative purposes to express the combined value of gold, silver, and copper as a percentage of gold. No allowances have been made for recovery losses in a mining scenario.

AuEq is calculated using US$1,750.00 per troy ounce of gold, US$24.00 per troy ounce of silver, and US$4.00 per pound of copper.

AuEq = Au g/t + (Ag g/t X $24.00 / $1750.00) + (Cu% X $4.00 X 22.0462) / ($1750.00 / 31.10)

Sample Preparation and QAQC

Rock samples from the Freegold Mountain Project Proton Zone were submitted to the ALS Geochemistry laboratory in Whitehorse for sample preparation. Sample pulps were shipped directly to ALS Vancouver for analyses.

Rock samples were weighed, dried and crushed to 70% passing 2 millimetres, then riffle-split to obtain a 250-gram sub-sample pulverized to greater than 85% passing 75 microns (PREP-31). A 0.25-gram sample from each pulp was analyzed for multi-element geochemistry using 4-acid (near-total) digestion and induced coupled plasma mass spectroscopy (ICP-MS), giving 48 elements (ME-MS61). A 30-gram sample from each pulp was analyzed for Au using fire assay and atomic absorption spectroscopy (Au-AA23).

Diamond drill holes at the Freegold Mountain Project are drilled using HTW and NTW core sizes (70.92 millimetres and 56.00 millimetres diameter, respectively). Sample preparation is completed at ALS Whitehorse, and sample pulps are shipped to ALS Vancouver for analysis. Samples are dried and crushed to 70% less than 2 millimetres with a 250-gram riffle-split and pulverized to better than 85% passing 75 microns (PREP-31).

A 50-gram sample from the pulp is analyzed for gold using fire assay techniques and atomic absorption spectroscopy with detection limits of 0.005-10 parts per million ("ppm") (Au-AA24). Gold over-limit values are re-analyzed using a gravimetric finish with an upper detection limit of 10,000 ppm (Au-GRA22). A 0.25-gram sample from the pulp is analyzed with multi-element geochemistry (ME-ICP61) using a 4-acid near total digestion and induced coupled plasma atomic emission spectroscopy (ICP-AES) providing 33 elements.

Sample Quality Assurance/Quality Control ("QAQC") measures include unmarked certified reference materials (CRMs), rock blanks, and field duplicates inserted into the sample sequence. These make up 5% of the samples submitted to the lab for holes reported in this release. Additional QAQC checks are ongoing in accordance with 43-101 standards.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by triumph gold's Principal Geologist Marty Henning, P.Geo., a "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101"). He has also verified the data disclosed, including sampling, analytical and test data, and the underlying technical information in this news release.

About triumph gold Corp.

triumph gold is a Canadian-based, growth-oriented exploration and development company with a district-scale land package in the mining-friendly Yukon. Led by an experienced management and technical team, The Company is focused on actively advancing its flagship Freegold Mountain Project using multidiscipline exploration and evaluation techniques.

The road-accessible Freegold Mountain Project in the Dawson Range Au-Cu Belt hosts three NI 43-101 Mineral Deposits (Nucleus, Revenue, and Tinta Hill). The Project is 200 square kilometres and covers an extensive section of the Big Creek Fault Zone, a structure directly related to epithermal gold and silver mineralization and gold-rich porphyry copper mineralization.

The Company owns 100% of the Big Creek and Tad/Toro gold, silver, and copper properties along the Freegold Mountain Project strike within the Dawson Range.

The Company also owns 100% of the Andalusite Peak copper-gold property, 36 km southeast of Dease Lake within the Stikine Range in British Columbia.

triumph gold acknowledges the traditional territories of the Little Salmon Carmacks First Nation and Selkirk First Nation, on which the Company's Yukon mineral exploration projects are located. triumph gold has a longstanding, ongoing engagement with these First Nations through communication, environmental stewardship, and local employment.

For more information, please visit triumphgoldcorp.com.

On behalf of the Board of Directors

Signed "John Anderson"

John Anderson, Executive Chairman

For further information about triumph gold, please contact:

John Anderson, Executive Chairman

triumph gold Corp.

(604) 218-7400

janderson@triumphgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectations. Important factors - including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities - that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time on SEDAR (see www.sedarplus.ca). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/251686