- AUSTRALIA EDITIONAustraliaNorth AmericaWorld

September 19, 2024

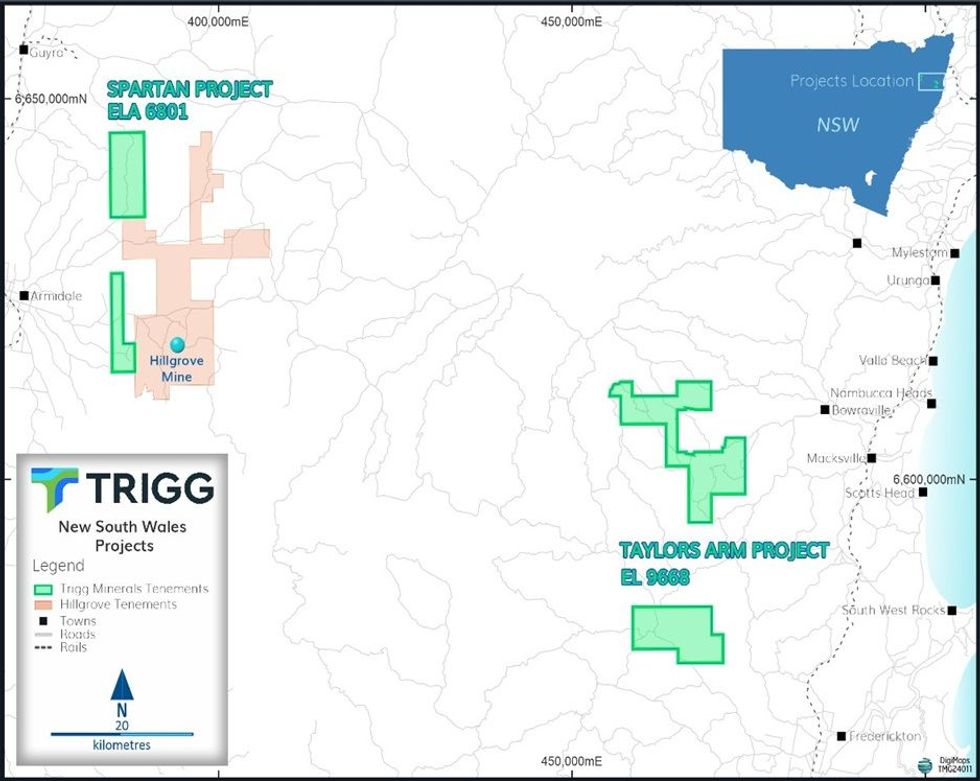

Trigg Minerals Limited (ASX: TMG) ("Trigg" or the "Company") is pleased to announce it has signed a binding purchase agreement with Bullseye Gold Pty Ltd to acquire the ultra-high-grade Taylors Arm and Spartan Antimony Projects in northern NSW (Acquisition) (Figure 1).

HIGHLIGHTS

- Trigg signs a binding purchase agreement to acquire 100% of the Spartan and Taylors Arm Antimony projects in northern NSW after completing due diligence. The projects are in the New England Orogen and are considered highly prospective for antimony ± gold mineralisation.

- Taylors Arm Antimony Portfolio features 71 historical workings on granted EL have produced ultra- high-grade antimony. The portfolio includes:

- Swallows Nest Mine – extracted antimony from 1940 to 1955 at a 40% antimony (Sb) concentration and 30% Sb on reopening in 1972. Recent rock samples revealed extremely high-grade antimony mineralisation with grades of 29.8% Sb and 31.4% Sb1.

- Testers Mine – featured massive stibnite veins grading up to 63% Sb, Australia's highest- recorded antimony grade.

- Little Purgatory Mine – stockpile samples produced antimony with grades up to 27.7% Sb.

- Real McKay Mine – recent exploration identified a stibnite-bearing fault breccia hosting high-grade antimony mineralisation, reporting 15.2% Sb and 52.7% Sb.

- Taylors Arm Portfolio contains various other historical workings/prospects with antimony grades up to 20.6% Sb (Walfords Claim), 27.5% Sb (Neil & Taylors Prospect), 18.3% Sb (Bowraville), and 17.7% Sb (Kia Ore Mine).

- Spartan Antimony Project – immediately adjacent to Larvotto Resources' (ASX: LRV) licences containing its Hillgrove Antimony-Gold operation, covering parts of the Hillgrove Fault and the same rocks that host the Hillgrove deposit.

- Antimony prices are trading at all-time highs following China’s export ban on some antimony products from 15 September 2024.

- Antimony is on the Critical Mineral lists of countries, including Australia, the USA, Canada, Japan and the EU2 due to its defence and military applications.

- Trigg has an established exploration team and is funded to commence exploration activities immediately.

The Spartan Project covers parts of the Hillgrove Fault and the same rocks that host the adjacent Hillgrove Antimony-Gold Mining Operations, owned by Larvotto Resources (ASX: LVR).

The Taylors Arm Project includes Swallows Nest, Munga Creek, and Testers Mines, which have recently produced antimony. The latter features massive stibnite veins grading up to 63% Sb (Table 1), Australia's highest-recorded antimony grade.

The projects comprise one granted tenement (EL 9668—Taylors Arm) and one pending tenement application (ELA 6801—Spartan) across 288km2 of the New England Orogen.

Trigg Minerals Executive Chair Timothy Morrison said, "Trigg's acquisition of ultra-high-grade antimony assets in NSW represents a transformative transaction for the Company, significantly enhancing its strategic resource portfolio. The move into the antimony space positions Trigg to capitalise on the growing demand for the critical mineral and strengthens our market presence. We can achieve a strong foundation for future growth and profitability with successful exploration."

Click here for the full ASX Release

This article includes content from Trigg Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 November 2025

Trigg Minerals

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies.

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies. Keep Reading...

Latest News

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00