September 15, 2022

Torrent Gold (CSE:TGLD) focuses on gold exploration and development backed by a management team with the right expertise and experience. The company’s flagship project is Jessup, a drill-ready, gold-silver asset in Nevada. Jessup currently has a measured resource estimate of 331,800 ounces of gold equivalent, and there is potential for additional deposits as much of the asset is unexplored. Torrent Gold’s management team has operational experience in Nevada, technical experience in gold, and prioritizes transparency throughout its organization.

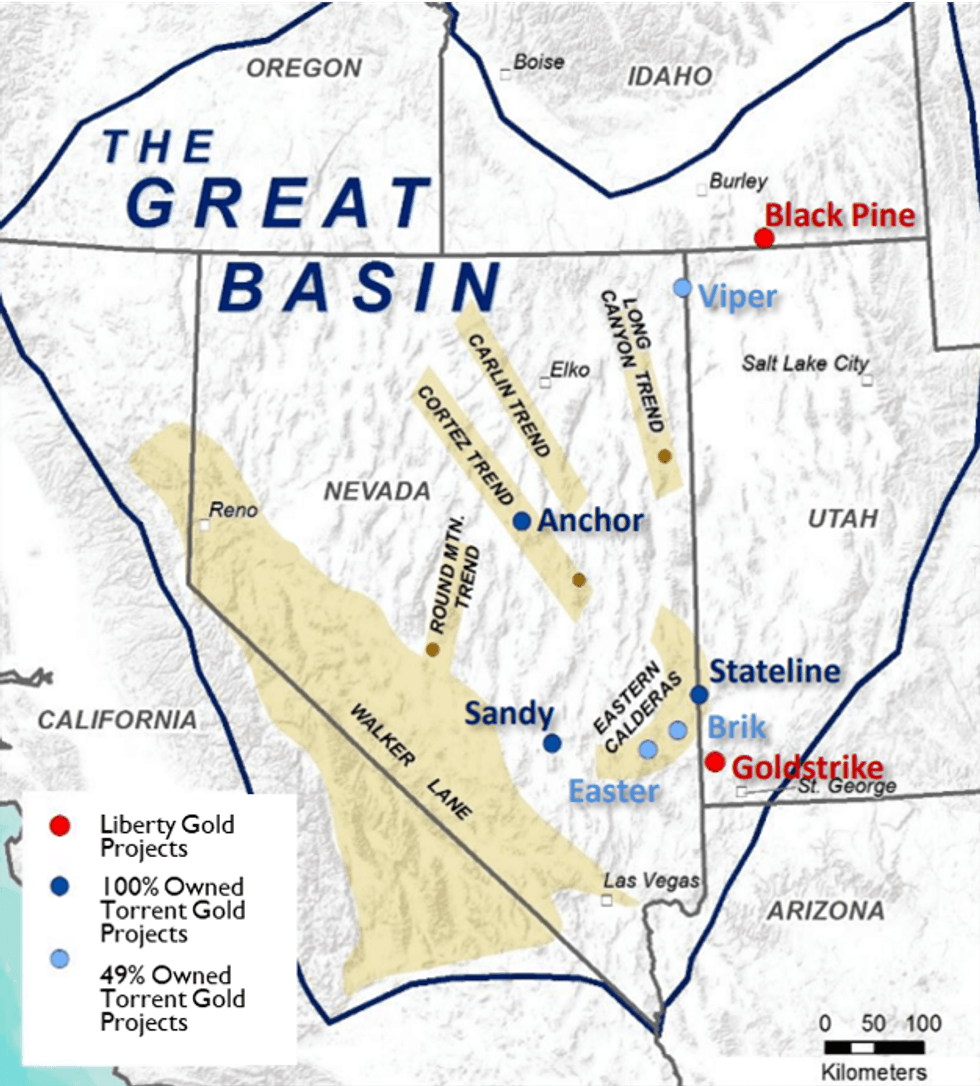

The company also has an exploration portfolio of properties throughout Nevada, each of which is primed for a potential JV model, creating an additional revenue stream. In addition, Torrent Gold is continuously evaluating new projects for synergy potential with Jessup and its early-stage assets. The company is also exploring its Clover Mountain Project in Idaho, which has excellent development potential following additional exploratory campaigns.

Company Highlights

- Torrent Gold is led by a management team that has found success in previous gold-focused companies, with expertise and experience in gold exploration and development, as well as managing and building operations in Nevada.

- Daniel Kunz, executive chairman, is the former CEO of Ivanhoe Mines and MK Gold Company as well as Prime Mining, playing a critical role in the companies’ growth and success.

- Torrent Gold’s flagship Jessup asset has historic results that build initial confidence in its potential, prompting the company to acquire and fully explore the project.

- The Jessup Project has demonstrated a resource composition of 84 percent gold and 27 percent silver.

- Torrent Gold also has exploration opportunities throughout its portfolio of early-stage assets in Nevada and Idaho, creating potential for a joint venture (JV) model.

This Torrent Gold profile is part of a paid investor education campaign.*

Click here to connect with Torrent Gold (CSE:TGLD) to receive an Investor Presentation

TGLD:CC

The Conversation (0)

24 May 2023

Torrent Gold

Drill-Ready Exploration in Nevada

Drill-Ready Exploration in Nevada Keep Reading...

10h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00