August 28, 2023

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to announce the completion of the Ta Khoa Nickel (“TKN”) plant pilot programme and significant progress toward completion of the variability testwork programme at the existing mine site in Vietnam. The completion of the TKN pilot programme is in addition to completing the Ta Khoa Refinery (“TKR”) pilot programme (Refer to ASX announcement 15 November 2022). This demonstrates completion of all scheduled piloting activities for the Ta Khoa Project.

Work conducted to date has confirmed the baseline flowsheet to treat ore through to concentrate from the nickel mine. Both pilot and variability testwork programmes have successfully achieved or exceeded pre-feasibility study (“PFS”) testwork assumptions. These important milestones for the site metallurgy and project team will enable consolidation of data and learnings to progress the TKN mine and concentrator definitive feasibility study (“DFS”).

Key highlights of the programme are:

- 97,280 labour hours of operation without injury,

- Achieved PFS recovery assumptions, improving average nickel grade from PFS assumed 8.0% to 10.2% (Refer to ASX announcement 28 February 2022),

- Achieved concentrate grade between 8.0% to 20.0% nickel,

- Produced 172 dry metric tonnes of concentrate,

- Completed over 350 bench scale flotation tests and over 100 baseline variability flotation tests,

- Recovery upside within the existing concentrator plant of up to +6% points when compared against pilot plant recoveries for the same lithologies,

- 5,795 tonnes of feed via existing concentrator plant and pilot plant,

- Over 300 hours of operation of existing concentrator and pilot plant,

- Successfully generated over 7.5 tonnes of concentrate samples for the Ta Khoa Refinery DFS pilot programme.

Piloting and Testwork Programme Overview

The following major activities were part of the piloting and testwork programme:

- Confirmed various circuit configurations and reagent regimes,

- Confirmation of ore comminution characteristics and power consumption,

- Completion of third-party technical review of the TKN DFS piloting and testwork programme, including onsite supervision by GR Engineering Services,

- Completion of a bulk sample drive and metallurgical drilling programme supporting a comprehensive metallurgy programme for the TKN DFS,

- Completion of trials and production of concentrate through the existing plant,

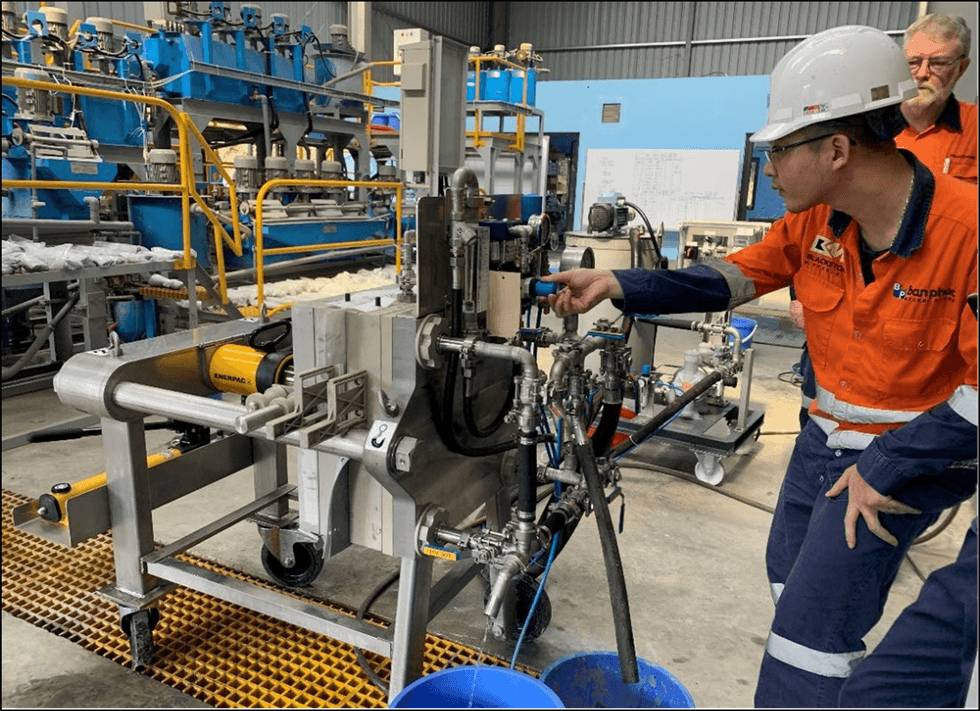

- Successfully tested Glencore and Metso vendor equipment for DFS flowsheet development,

- Variability testwork programme ongoing.

The DFS testwork programme, inclusive of process variability testwork and reporting, is due to be completed by CY 2023.

Blackstone Minerals’ Managing Director, Scott Williamson, commented:

“Testwork at Ban Phuc is approaching completion and continues to build our understanding of the disseminated sulphide ore body whilst addressing key recommendations arising from independent review of the PFS works. The programme has been conducted safely at our site facilities and is providing substantial knowledge, training, and understanding for our project and technical teams. Importantly, the results to date validate, support and in many areas improve on PFS assumptions and criteria that will underpin our definitive feasibility study. Outputs confirm that our project flowsheet will be suitable for processing of Ban Phuc ores to deliver critical feedstock for our downstream refinery, confirming our strategy for developing the Ta Khoa Project, being an integrated mine to pCAM project.”

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 February

Blackstone Minerals

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00