July 16, 2025

Surface Metals (CSE:SUR,OTCQB:SURMF) is a diversified exploration and development company advancing a portfolio of lithium and precious metals assets aligned with the global push for electrification and gold as a strategic hedge.

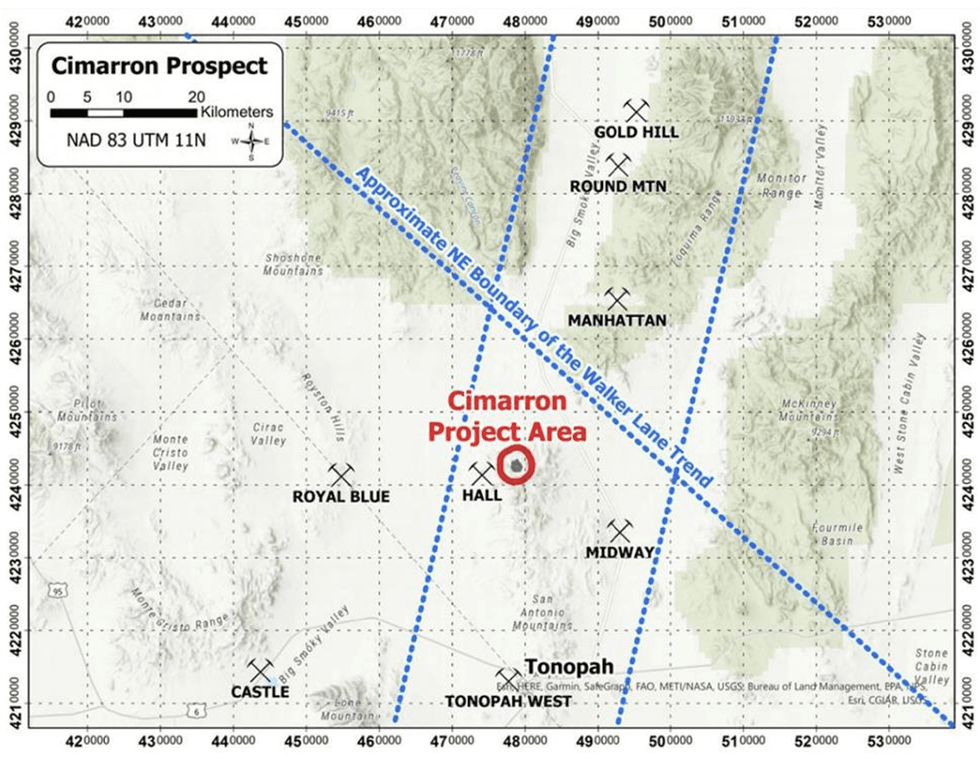

The company’s flagship Cimarron Gold Project in Nevada is a high-grade, underexplored oxide gold system with historic drilling by major operators including Newmont and Echo Bay. Located at the north end of the San Antonio Mountains, approximately 18 miles north of Tonopah, Cimarron hosts shallow, structurally controlled, low-sulfidation epithermal gold mineralization. Surface Metals holds a 90% interest in the project through its U.S. subsidiary, Surface Metals US Inc. The project consists of 31 lode claims in the historic San Antonio (Cimarron) mining district.

Through its subsidiary ACME Lithium US, Surface Metals is developing a suite of lithium projects in Nevada and Manitoba, Canada. These include:

- Clayton Valley: a lithium brine asset with a defined resource,

- Fish Lake Valley: a claystone-hosted lithium project,

- Shatford and Cat-Euclid claims: pegmatite-rich assets in Manitoba, developed in partnership with Snow Lake Resources.

With exposure to both critical battery metals and gold, Surface Metals is strategically positioned to capitalize on dual macroeconomic trends—electrification and financial resilience.

Company Highlights

- Dual Focus Portfolio: Combines precious metals and energy transition minerals, including a 90 percent stake in the Cimarron gold project and multiple lithium assets in Nevada and Manitoba.

- Gold Asset with Legacy Database: Cimarron contains over 190 historical drill holes with high-grade intercepts and a non-compliant historic resource of 50,000+ oz gold, open in multiple directions.

- NI 43-101 Lithium Resource: The Clayton Valley project hosts an inferred lithium carbonate equivalent (LCE) resource of 302,900 tonnes, backed by geophysics, drilling and pumping test data.

- Strategic Lithium Locations: Lithium claims are adjacent to Albemarle’s Silver Peak mine and Ioneer’s Rhyolite Ridge development in Nevada, and contiguous to the Tanco mine in Manitoba.

- Experienced Leadership: Led by resource sector veterans with a track record of successful exits, technical development and public company management.

- Energy Transition Strategy: Well-positioned to benefit from macro tailwinds in lithium demand and US domestic critical minerals supply chain policies.

This Surface Metals profile is part of a paid investor education campaign.*

Click here to connect with Surface Metals (CSE:SUR) to receive an Investor Presentation

SUR:CC

Sign up to get your FREE

Surface Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 July 2025

Surface Metals

Gold and lithium portfolios in Nevada’s most prolific locations

Gold and lithium portfolios in Nevada’s most prolific locations Keep Reading...

3h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

4h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Sign up to get your FREE

Surface Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00