May 07, 2024

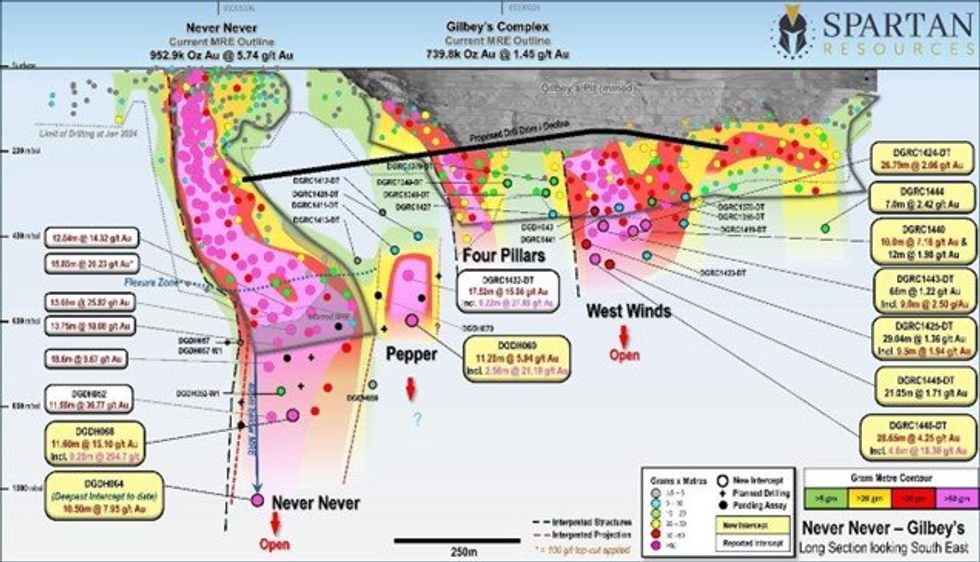

Latest high-grade assays include the deepest-ever result from the Dalgaranga Project; Spartan set to develop underground exploration drill drive; High-grade resource growth potential multiplied as new Pepper discovery grows

Spartan Resources Limited (Spartan or Company) (ASX:SPR) is pleased to provide an update on exploration and development activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

Highlights:

Never Never Gold Deposit – key high-grade gold deposit – 0.95Moz @ 5.74g/t – growing!

- 10.50m @ 7.95g/t gold from 1,042.50m down-hole (DGDH064) – deepest “project” assay

- 11.60m @ 15.10g/t gold from 861.40m down-hole (DGDH068)

“Pepper” Gold Prospect – recent high-grade discovery adjacent to Never Never – growing!

- 11.28m @ 5.94g/t gold from 585.72m down-hole (DGDH069):

- Intercept located approximately 80.0m down-dip of the initial “Pepper” discovery hole DGRC1432-DT, which returned 17.52m @ 15.86g/t gold.

- Numerous additional diamond drill-holes have intersected lower tenor mineralisation up-dip of the discovery hole, giving a possible explanation as to why Pepper remained undiscovered until now, as it appears to be a “blind” gold prospect – i.e., improving at depth (current assays detailed in Table 1 and further assays pending).

West Winds Gold Prospect – high-grade broad and strike extensive mineralised shoot – growing!

- 28.65m @ 4.25g/t gold from 458.00m down-hole, including 4.60m @ 18.30g/t (DGRC1446-DT)

- This latest intercept is one of the deepest and highest grade (gram x metre) intervals drilled at West Winds to date. The grade appears to be improving with depth, similar to Never Never.

Exploration Drill Drive – Update

- All new intercepts are from steeply-plunging, high-grade gold deposits and emerging prospects located on an 800m long, semi-continuously mineralised north-south stratigraphic horizon.

- Fully-funded exploration drill drive designed parallel and adjacent to this horizon to provide underground drill platforms to more effectively define these existing targets, as well as explore for further high-grade shoots and provide critical underground infrastructure as Spartan develops its future mine plan.

- Strong interest received from underground contractors with a competitive tender process underway, site visit completed and requests for quotation sent to multiple parties. Similar process underway for underground diamond drilling, with an initial scope of 60,000m of diamond core.

- Subject to receiving final regulatory approvals, mining of the underground drill drive is set to commence in 2H CY2024, with diamond drilling designed to follow development as it progresses north and south (see Figure 1).

This release contains updated assay information from recent surface drilling targeting the high-grade Never Never Gold Deposit, the immediately adjacent and growing Pepper gold prospect and the nearby West Winds gold prospect. This release also contains assays from early-stage ongoing surface exploration drilling north of Never Never.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “Our recent exploration updates show that our aggressive drilling strategy is continuing to deliver on its key objectives – growing our high-grade resource inventory while at the same time making new high-grade discoveries.

“We keep applying drill pressure to good geology – and the results continue to demonstrate the enormous potential of the broader Gilbey’s mineral system, which now contains multiple high-grade, steeply plunging deposits and emerging prospects along an 800m corridor running from north to south.

“The latest results also reinforce the compelling logic behind the proposed development of our underground exploration drill drive. This critical piece of infrastructure will be another game-changer for the Spartan team as it will significantly increase our resource growth and future reserve generation efforts by using more cost effective, more accurate and faster underground drilling methods from platforms located closer to our existing high-grade targets.

“The drill drive allows us to optimise our drilling strategy in a way that is simply unachievable from surface, while also unlocking the very real potential to make new high-grade discoveries from underground platforms where you are literally situated inside the geology.

“We are situating the drill drive in the hanging-wall of the Gilbey’s mineralised sequence to optimise the geotechnical advantages of the very competent gabbro wallrock and to optimise the drilling angles and stand-off distance to all of our main high-grade targets. Lastly, we are developing the exploration drill drive at standard underground development dimensions in order to maximise the value of the sunk capital by future-proofing its inclusion in any potential mining scenarios.

“In the two years since discovery, we have built a Mineral Resource of almost 1 million high-grade ounces at Never Never, and we can clearly see potential growth beyond 1,000m.

“The newly discovered Pepper gold prospect, situated less than 100m along-strike from Never Never, is showing better grades at depth, and we are also beginning to see some of the best high-grade intercepts to date as we drill deeper at both Four Pillars and West Winds. This trend of improving grades at depth is exactly what we saw at Never Never.

"Fresh from our recent $80 million equity raise, Spartan is in a position of unparalleled strength as we move ahead with our multi-pronged strategy to unlock the potential of the Dalgaranga Gold Project.

“Surface drilling is continuing with four rigs, preparatory work is underway for the start of the exploration decline and mine development study work is in full flight.

“The stage is well and truly set for what is shaping up to be an extremely busy and exciting 6-12 months as we deliver further resource growth, mine studies and establish the underground infrastructure required to bring this outstanding asset into production.”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

30m

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

17h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00