September 27, 2023

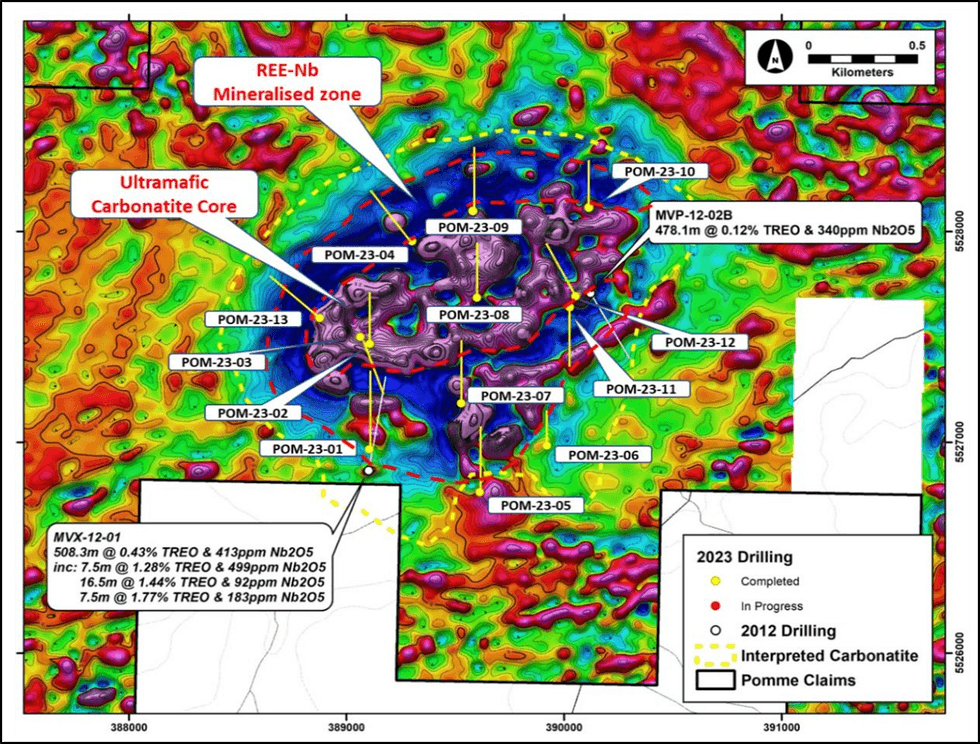

MTM Critical Metals Limited (ASX:MTM) (MTM or the Company) has returned high grade TREO assay results up to 1.62% (16.200ppm) from diamond drilling at its Pomme REE-Nb Project in Québec, including an interval of 26.5m @ 1.45% TREO and 0.02% Nb2O5.

Highlights:

- First three of 13 diamond drill holes return TREO assay results up to 1.62% (16,200ppm) at the Pomme Project in Québec, Canada.

- Rare earth element (REE) and niobium (Nb) mineralisation confirmed over broad intervals, and importantly numerous higher-grade zones of >1% (10,000ppm) TREO intersected.

- Hole POM-23-03 intersected 398m @ 0.54% TREO (5,400ppm) and 0.05% Nb2O5 from 16m.

- Best interval is 26.5m @ 1.45% TREO & 0.02% Nb2O5.

- Around 20 to 25% of TREO is high value magnet REE mineralisation - neodymium (Nd) and praseodymium (Pr).

MTM Managing Director, Mr Lachlan Reynolds said the results from the first three holes confirmed the nearly continuous presence of REE and niobium mineralisation.

“Assay results from the recent drilling show the Pomme carbonatite complex contains abundant rare earth and niobium mineralisation that extends throughout the full length of the diamond drill cores and verify the historical REE-Nb mineralisation intersected in drill hole MVX-12-01,” Mr Reynolds said.

“Furthermore, there are a number of significant higher-grade zones within the mineralised carbonatite indicating significant potential for an economic resource of some scale.

“The consistent high percentage of NdPr and the presence of niobium are particularly pleasing and increase the mineralisation basket price for the prospect.

“Our exploration team will be looking to undertake a thorough assessment and interpretation of the geological logging and the assay results in order to define high priority areas for follow-up exploration works, including drilling,” he said.

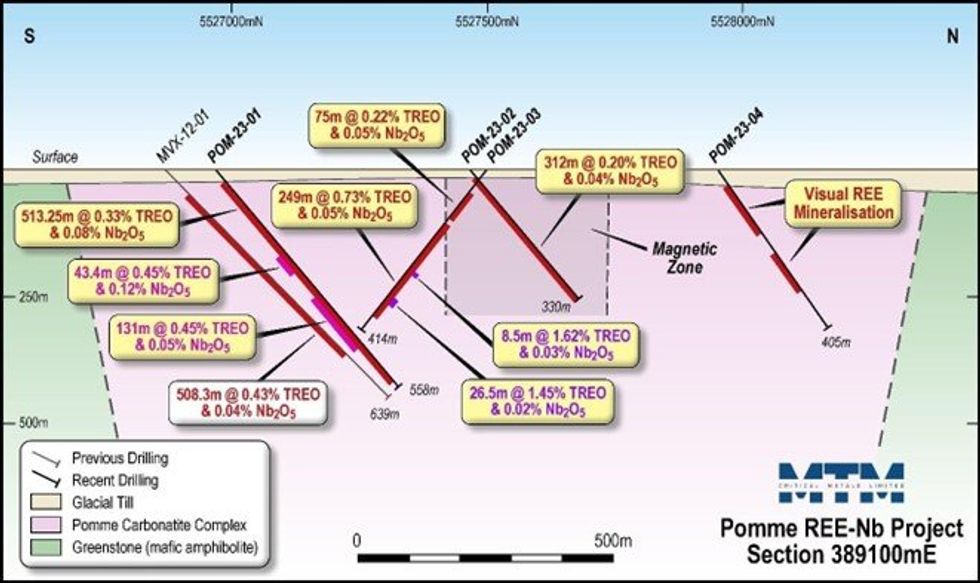

Drilling highlights

POM-23-03: 398m @ 0.54% TREO & 0.05% Nb2O5 from 16m, including:

- 30.5m @ 1.13% TREO & 0.03% Nb2O5 (from 311.5m) including

26.5m @ 1.45% TREO & 0.02% Nb2O5

- 51m @ 0.92% TREO & 0.06% Nb2O5 (from 216m) including

9m @ 1.21% TREO & 0.03% Nb2O5 and

8.5m @ 1.62% TREO & 0.03% Nb2O5

- 36m @ 0.92% TREO & 0.06% Nb2O5 (from 174m) including

18m @ 1.16% TREO & 0.03% Nb2O5

POM-23-01: 513m @ 0.33% TREO & 0.08% Nb2O5 (from 32m), including:

- 131m @ 0.47% TREO & 0.05% Nb2O5 (from 317m) including

2.65m @ 1.47% TREO & 0.02% Nb2O5, and

2.65m @ 1.48% TREO

- 43.4m @ 0.45% TREO & 0.12% Nb2O5 (from 216.1m)

Assays are awaited for the remaining 10 holes (POM-23-04 to POM-23-13). Logging of drill core has been completed and the field camp is demobilised. Interpretation and targeting for follow-up is in progress.

Pomme is a known carbonatite intrusion with exceptional results from limited historical drilling, showing enrichment in REE and Nb and is considered to be an extremely prospective exploration target.

The project is located adjacent to the world-class Montviel REE-Nb deposit (owned by Geomega Resources Inc), that has a defined total indicated and inferred resource of 266 Mt @ 1.45% TREO & 0.14% Nb2O5.

MTM has entered into a binding option agreement with Geomega Resources to acquire a 100% interest in the Pomme claims.

Assay Results

Drill hole POM-23-01

Assay results confirm that the diamond drill core from hole POM-23-01 is almost continuously mineralised from the depth where basement was intersected to the end of hole (558m) and verify the visually estimated REE grade previously reported (refer to MTM ASX announcement dated 6 June 2023). Full details of the relevant intersections are detailed in Appendix II.

Click here for the full ASX Release

This article includes content from MTM Critical Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MTM:AU

The Conversation (0)

25 September 2023

MTM Critical Metals

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00