- WORLD EDITIONAustraliaNorth AmericaWorld

Top 4 ASX Uranium Stocks

How to Invest in Vanadium Stocks

Overview

Australian Vanadium Limited (ASX:AVL) is a Western Australia-based company focused on the Vanadium supply chain, from mining to batteries. The company has a “pit to battery” strategy, which involves processing the vanadium and creating vanadium electrolytes to manufacture vanadium flow batteries (VFB) and become a VFB supplier in Australia.

AVL will generate vanadium concentrate at the mine, which will be fed to the company’s processing plant to produce vanadium pentoxide, which will then be used as feedstock for its vanadium electrolyte manufacturing facility. AVL will leverage its wholly-owned subsidiary, VSUN Energy, to create safe and reliable renewable energy storage solutions using VFB.

Currently, around 85 percent of the vanadium is sourced from China, Russia and South Africa. Vanadium is classified as a critical mineral in several countries, including the US, EU and Japan, and with its geopolitically stable environment and mining-friendly policies, Australia makes for an attractive, secure supply source.

AVL boasts a world-class vanadium asset in a tier-1 mining jurisdiction. The company’s flagship Australian Vanadium project is one of the most advanced vanadium projects in the world. The asset comprises vanadium, titanium and magnetite ore body located on wholly-owned tenements, making it scalable. The project will consist of a simple open pit mine and a processing plant, which will be close to a major port bringing lower-cost energy, water and manpower.

AVL’s recent merger with Technology Metals Australia (TMT) has provided several key benefits, including the consolidation of each company’s tenements into one big project. The merger has created a 17 kilometre strike for the high-grade magnetite domain, allowing for efficient mine infrastructure. Moreover, the merger improves the project's economics through access to high-grade mineralization, which is now unconstrained.

A bankable feasibility study (BFS) prior to the merger had the following key parameters:

- Annual production of 11,200 t V2O5

- Mine life of 25 years

- Pre-production capex of $435 million

- Opex of $4.43/lb of V2O5

Following the merger, the company is preparing an optimized feasibility study (OFS) to improve the capex and opex and deliver better project economics. The next steps for the project include a combined mineral resource estimate, publishing the OFS report, certain approvals, offtake agreements, and financing.

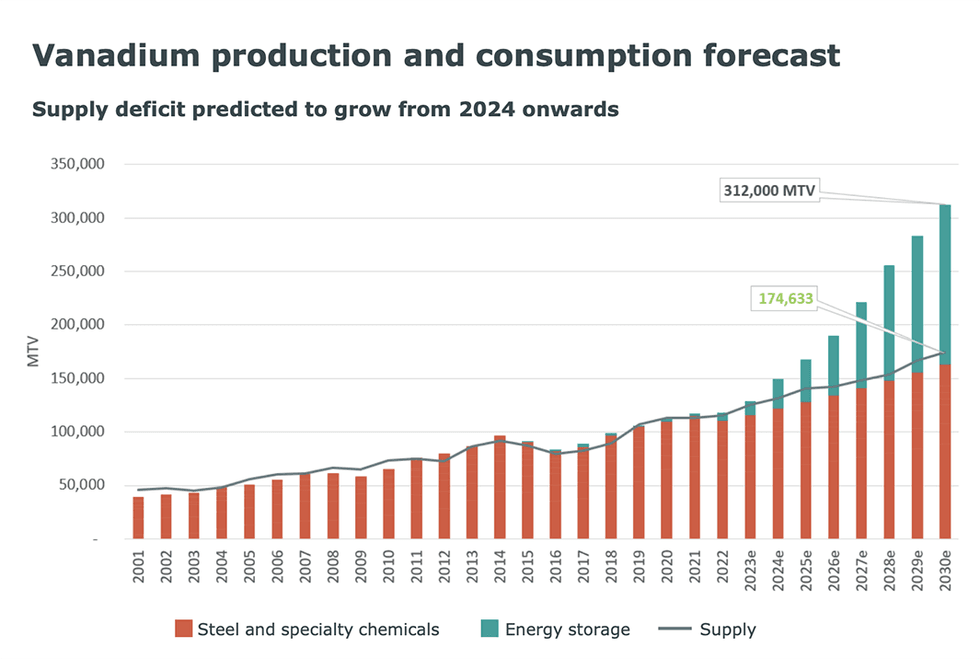

The demand for vanadium is expected to increase significantly due to the growth of VFBs. However, the fundamental demand for vanadium remains strong across the end markets, including its application in steel production, aerospace and energy storage. In fact, a sharp rise in demand for energy storage applications will result in a supply deficit that will grow from 2024 onwards.

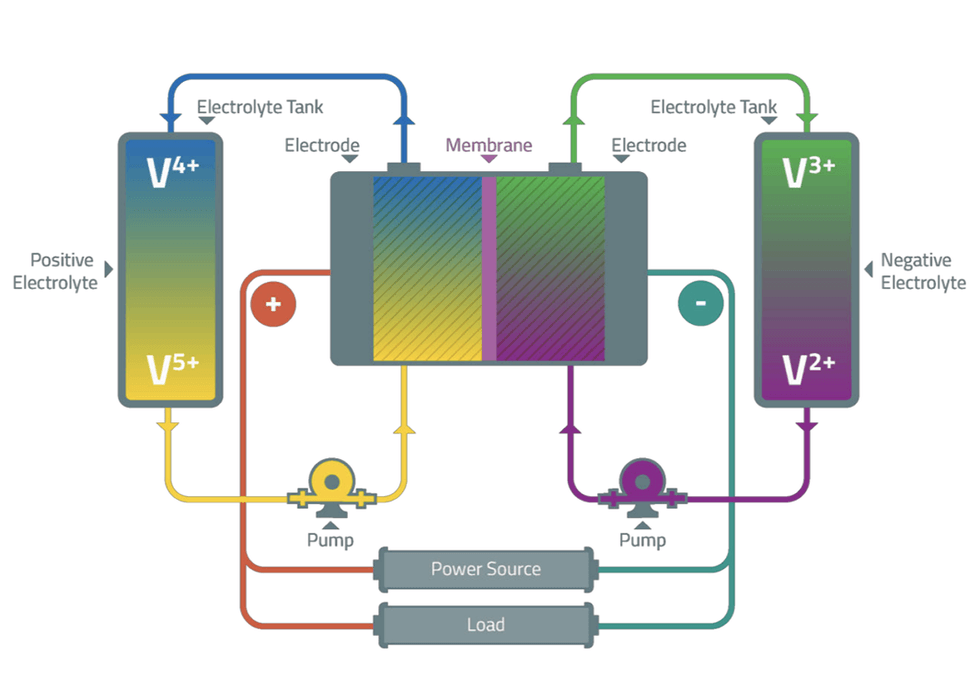

Vanadium flow batteries have two tanks filled with vanadium electrolyte fuel. First invented 40 years ago, VFBs have since been commercialized for large-scale applications. The technology offers compelling cost savings for applications with greater than four hours of storage.

The VFB technology has several technological and economic merits that are driving the scale of the projects. First, it is superior economically for long-duration storage applications. Second, it is non-flammable, making it very stable. Third, it provides 100 percent depth of discharge with multiple cycles. Fourth, it offers a life span of over 25 years. Fifth, it is easy to scale. It is well proven at MWh scale and is now moving towards GWh scale.

Given these techno-economic benefits, the VFB industry is experiencing unprecedented global growth, led by China. Currently, 208 VFBs are in operation, 51 are under construction, and 87 new projects have been announced. To give an idea of this rising demand, in 2025, China alone will consume 11 times AVL's annual production of 11,200 tons of V2O5.

The company has a well-crafted vertical integration strategy to participate across the vanadium supply chain. In addition to supplying vanadium, the company is present in the manufacturing of vanadium electrolyte and batteries.

AVL’s Vanadium Electrolyte Facility official opening by Australian Government minister for resources and Northern Australia Hon. Madeleine King MP alongside non-executive director Anna Sudlow, chair Cliff Lawrenson, CEO Graham Arvidson and non-executive director Miriam Stanborough.

AVL has completed the construction of a vanadium electrolyte manufacturing plant in Perth, Western Australia. The project has received funding from the Australian Government. The plant has a capacity of 33 MWh per annum of energy storage. The first production was completed in 2024, and VFB manufacturers will test samples. The electrolyte produced is further processed by AVL’s wholly-owned subsidiary, VSUN Energy, to create large scale energy storage solutions using VFBs.

Company Highlights

- Australian Vanadium Limited (AVL) is a Western Australia-based company focused on the entire vanadium supply chain, from mining to batteries. The company’s “pit to battery” strategy includes processing the vanadium to create vanadium electrolytes for vanadium flow batteries (VFB), as the company intends to become a VFB supplier in Australia.

- The Australian Vanadium project is the company’s flagship mining project and is one of the most advanced projects globally.

- The company recently completed its merger with Technology Metals Australia (TMT), which is likely to significantly boost the project's economics. The company is working on the project's optimized feasibility study (OFS) report.

- Given that only three countries (Russia, China and South Africa) contribute 85 percent of the global supply of vanadium, an Australian supply source makes the project attractive.

- The demand for vanadium is poised to grow across the end markets, including steel, aerospace and battery storage. Growing demand for VFBs has the potential to provide a sizable end-demand market for vanadium. Vanadium demand from batteries could reach 50 percent of the total demand by 2030, from the current share of just 7 percent.

- The company has a well-crafted vertical integration strategy. In addition to vanadium supply, it is also focusing on vanadium electrolyte manufacturing and the supply of VFBs to the Australian market.

- VSUN Energy, AVL’s subsidiary, creates safe and reliable renewable energy storage solutions using vanadium flow battery technology.

Get access to more exclusive Vanadium Investing Stock profiles here