August 28, 2024

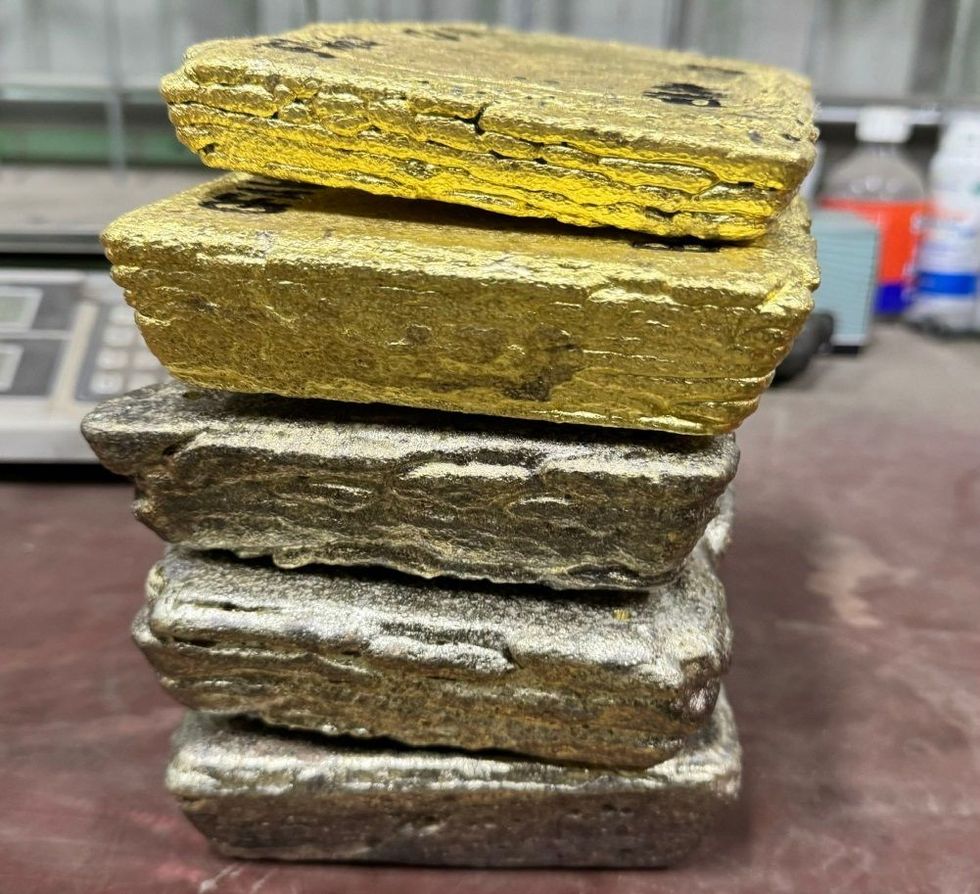

Auric Mining Limited (ASX: AWJ) (Auric or the Company) is pleased to announce the second gold milling campaign for 2024 from the Jeffreys Find Gold Mine (the Project) has produced further cash with gold selling at the Perth Mint for an average of A$3,667 per ounce. A total of 4,973 ounces have been sold.

HIGHLIGHTS

- Gold sales for 2024 exceed $18.23 Million.

- Current campaign gold sales reach $13.77 Million.

- Highest gold price achieved is A$3,727 per ounce.

- 154,000 tonnes delivered to the Mill, haulage continuing.

- Current campaign to conclude on 4 September 2024.

- First cash of $3.0 Million to be received by Auric shortly.

Managing Director, Mark English, said: “Gold has sold at up to $3,727 per ounce during August with more to come.

“BML have delivered in excess of 154,000 tonnes to the Coolgardie mill with haulage and milling continuing. Some of that ore will be processed in another campaign later in the year. The current campaign is continuing to produce thousands of ounces of gold.

“Already we have passed $13.77 Million in gold sales for this current campaign of the year and total gold sales for 2024 passing $18.23 Million. We are in the middle of a highly successful time for the Company.

“By the middle of September, Jeffreys Find Gold Mine is expected to generate in excess of $25 Million in gross gold sales for 2024. This current campaign is due to finish in early September. Unforeseen power outages and some inclement weather have slowed the whole process down, but we are hopeful more than 130,000 tonnes of the 150,000 tonne allocation at the Mill will get utilised in this campaign.

“A further campaign is planned at the Greenfields Mill towards the end of this year.

“The mill contract is to process 300,000 tonnes in 2024 so everyone is focussed on making that happen,” said Mr English.

The Greenfields Mill (Greenfields or Mill) is contracted to process up to 150,000 tonnes of ore for the current campaign through Auric’s Joint Venture partner, BML Ventures Pty Ltd of Kalgoorlie (BML). As of 25 August 2024, just over 110,000 tonnes have been processed by the Mill.

Click here for the full ASX Release

This article includes content from Auric Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AWJ:AU

The Conversation (0)

09 August 2024

Auric Mining

Western Australian gold producer, explorer and developer with world-class deposits

Western Australian gold producer, explorer and developer with world-class deposits Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00