July 02, 2023

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to announce that RC drilling has intersected spodumene-bearing pegmatites at the Enterprise Prospect of the Bynoe Lithium Project, Northern Territory. 1

- Spodumene-bearing pegmatites up to 22m thick have been intersected in first-pass reverse circulation (RC) drilling at the Enterprise Prospect at Bynoe1

- 1,500m diamond drill programme will commence this week at the Enterprise Prospect to test down-plunge and along strike from the spodumene pegmatite intersections

- A further 5,000m of RC drilling is also planned to commence next week10 RC drill-holes have been completed for 1,663m at the Enterprise Prospect, with selected intersections sampled and submitted for laboratory analyses – assays pending

Charger’s Managing Director, Aidan Platel, commented:

“The intersection of spodumene-bearing pegmatites at Enterprise, approximately 900m along strike from Core Lithium Limited’s (ASX:CXO; “Core”) Blackbeard Prospect, is validation of our targeting methods and a compliment to the systematic approach taken by our technical team.

The Company will now proceed to ramp up exploration to the next phase, with a diamond rig commencing this week to test for down-plunge extensions to the intersected pegmatites at Enterprise. This is an important step as we have seen from Core’s spodumene deposits in the region that the spodumene content has the potential to increase with depth. A further ~5,000m of RC drilling is also scheduled to begin next week to test both new and existing lithium targets at Bynoe, including the high-priority 7Up Prospect.

All samples from Enterprise to-date are in the lab, and assay results are expected within 4-5 weeks.”

Technical Discussion

First-pass reconnaissance drilling has been completed at the Enterprise Prospect, with ten RC holes drilled for 1,663m (Table 2), in addition to the fourteen drill-holes for 2,045m that were completed at the Megabucks and Old Bucks Prospects (Figure 2). 2

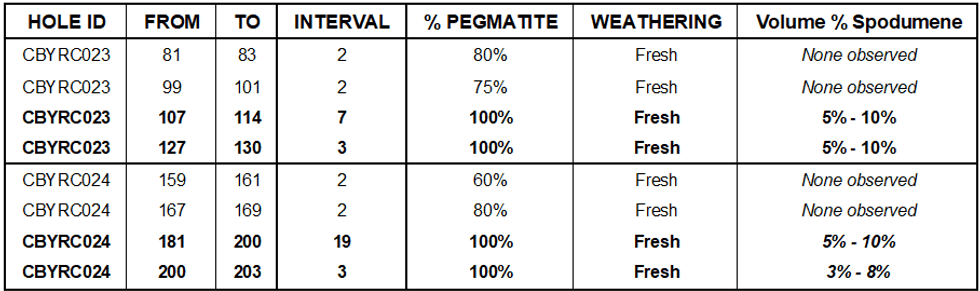

As part of this programme, two holes (CBYRC023 and CBYRC024) were drilled to test below a weathered pegmatite outcrop located near the centre of a lithium soil anomaly that defines the Enterprise Prospect, approximately 900m along strike from Core’s Blackbeard Prospect.3 Both drill- holes successfully intersected zones of spodumene-bearing pegmatite, with CBYRC024 intersecting 22m from 181m (down-hole), approximately 65m down-dip from hole CBYRC023’s intersections of 7m from 107m and 3m from 127m (Figures 1 & 2; Tables 1 & 2).4 The pegmatites appear to strike northeast – southwest and dip steeply to the southeast; however more drilling is required to better define the orientation and potential plunge of the pegmatites.

Spodumene was identified in the RC chips by the Company’s geologists and confirmed with a qualitative analysis of the chips with a LIBS (Laser-Induced Breakdown Spectroscopy) scanning machine. Logged estimates of the RC chips of drill-holes CBYRC023 and CBYRC024 are shown in Table 1; a range is provided due to the difficulty of estimating percentages of the very fine material that is inherently produced by RC drilling.

Next Steps

A 1,500m diamond drill programme will commence to test for economic lithium mineralisation down-plunge from the recently completed RC drill-holes at Enterprise. Diamond drilling is important as it will provide valuable information regarding the orientation and thickness of the pegmatite veins, as well as any controlling structures in the area. It also enables the Company to test deeper than what is possible with RC drilling.

In addition to the diamond drilling, a further ~5,000m of RC drilling is scheduled to begin in the second week of July. The RC drilling will test along strike at Enterprise, Megabucks and Old Bucks, as well as first-pass drilling into other priority targets such as the 7Up Prospect.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00