Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports today that crews have mobilized in preparation for drilling on the newly acquired Puro Corazon claim, contiguous to its 100% owned Cerro Las Minitas project, Durango Mexico.

The exploration program, which is the first step in the integration of the nine hectare Puro Corazon claim into the much larger Cerro Las Minitas project, will include up to 12,000 metres of core drilling utilizing three drill rigs, the compilation of existing underground geological data, new sampling in the historic underground workings to tie the remaining mineralization in the upper part of the claim into the larger resource model and a Lidar survey of the historic workings designed to better understand the full extent of underground mining.

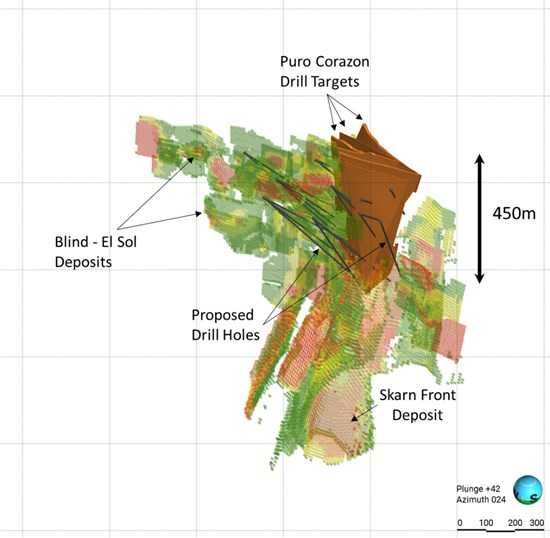

The Puro Corazon mine, which is operated privately, is currently mining approximately sixty tonnes of ore per day and produces a silver-lead concentrate and a zinc concentrate. Current development at the mine extends for approximately 200 metres laterally and to 250 metres below surface. Drilling will test the further projections of the mined mineralization both laterally for an additional 200 metres and to depths of up to 450 metres below surface where the mineralization then transitions across the claim boundary and into the modelled Skarn Front deposit. Drilling will also target the projection of up to six hangingwall structures identified outboard of the main mineralized Skarn Front zone which was previously identified in both historic drilling within the Puro Corazon claim and in Southern Silver's own drilling outside the claim boundary. Historically, mining has focused on only three mineralized zones within the projection of the Skarn Front deposit, which is the largest single deposit within the Cerro Las Minitas project accounting for over 50% of the known mineral resources.

Drill results from the upcoming program will be incorporated into the current modelling of the Cerro Las Minitas project in preparation for an updated Technical Report and Preliminary Economic Assessment ("PEA") in accordance with the provisions of National Instrument 43-101, scheduled to begin in the first quarter of 2026.

The acquisition of the Puro Corazon claim represents a significant milestone toward the development of the Cerro Las Minitas project with the potential to unlock significant capital and operating synergies between the two projects. Key synergies include:

- Strong Potential for Near-term Resource Growth: infill drilling program to support incremental resource additions for the consolidated Cerro Las Minitas project.

- Capital Efficiency Gains: opportunity to improve capital efficiency through faster access to higher value mineralization, while avoiding development around the Puro Corazon mining claim.

- Enhanced Mine Plan Sequencing: incorporating Puro Corazon material early in the mine plan, given its near-surface and high-grade characteristic, is anticipated to strengthen project economics.

- Improved Project Economics: combination of capital efficiencies, optimized sequencing and potential throughput increases resulting in potential improvements to NPV and IRR.

- Additional Benefits: potential synergies and efficiencies across permitting, environmental management, safety and data collection.

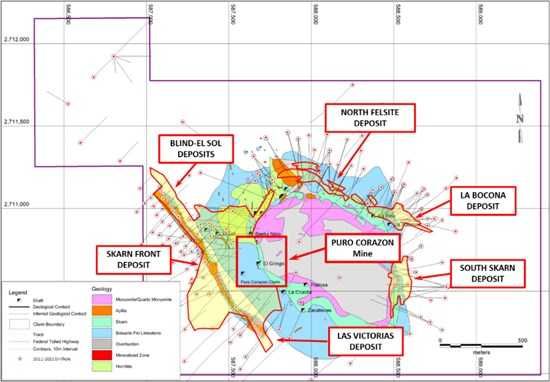

Figure 1: Location of Puro Corazon Claim Location Relative to Existing Cerro Las Minitas Deposits

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5344/269150_bbf8d6f0746f3a8f_002full.jpg

Figure 2: Projected Puro Corazon drill targets within the Skarn Front and Blind-El Sol block models with proposed the drill pattern for Q4 drilling on the Puro Corazon claim

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5344/269150_bbf8d6f0746f3a8f_003full.jpg

Corporate Update

Southern Silver has granted incentive stock options to directors, officers and consultants to purchase an aggregate 13,900,000 common shares of the Company at an exercise price of $0.41 per share, exercisable for a period of five years. The stock options are subject to the terms and conditions of Southern Silver's stock option plan and the policies of the TSX Venture Exchange. This stock option grant follows the recent expiration on September 24, 2025 of 8,500,000 stock options an at exercise price of $0.51 per share.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico's Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. Located in the same State as the Cerro Las Minitas property is the newly acquired Nazas property. Our property portfolio also includes the Oro porphyry copper-gold project and the Hermanas gold-silver vein project, where permitting applications for the conduct of a drill program is underway, both are located in southern New Mexico, USA.

Robert Macdonald, MSc. P.Geo, is Vice President of Exploration for Southern Silver Exploration Corp., is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of data from the Cerro Las Minitas project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

"Lawrence Page"

Lawrence Page, K.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver's website at southernsilverexploration.com or contact us at 604.641.2759 or by email at corpdev@mnxltd.com.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. In particular, this press release contains forward-looking information relating to, among other things, the proposed drilling program on the Puro Corazon claim as well as the preparation of a technical report and PEA. These statements are based on a number of assumptions, including, but not limited to, general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the Company's projects, and the availability of financing for the Company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269150