THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES

South Star Battery Metals Corp. ("South Star" or the "Company") (TSXV:STS)(OTCQB:STSBF), is pleased to provide the Company's 2023 year in review, a Santa Cruz Phase 1 construction update and the anticipated 2024 catalysts for Santa Cruz and BamaStar. Additionally, under the Brazilian regional development incentive program administered by the Superintendência do Desenvolvimento do Nordeste ("SUDENE"), South Star's Santa Cruz project has also been granted eligibility to receive certain income tax exemptions, including a 75% corporate income tax reduction for ten years

Overview

South Star had a very exciting and eventful 2023. While we are pleased with our overall progress, we are never satisfied as we advance bringing Santa Cruz Phase 1 operations online in Brazil and transitioning from a development company to the first new graphite miner/processor in the Americas since 1996. Santa Cruz had zero lost time accidents in 2023, and the overall construction advanced significantly. However, equipment supplier delays (mills), contractor workforce shortages, and weather all contributed to an overall Phase 1 construction delay of 6 months (June 2024) compared to the original schedule. While most of the delays are not in the Company's control, the team has put significant time and effort into minimizing the risk and associated impacts while ensuring continued advancement safely and responsibly. The delays are disappointing, but the positive news is that Santa Cruz should still be able to produce close to our original goals of 5,000 tonnes ("t") of graphite production and sales in 2024, assuming the team can ramp up to the plant nameplate production capacity of 1,000 tonnes per month ("tpm") in Q4 of 2024. BamaStar also advanced significantly over the year, and the project continues to show promise and be derisked with the continued favorable results of the studies. Two drilling campaigns were completed, and a National Instrument ("NI") 43-101 technical report with the maiden resource estimate during the year was issued, again with no loss time accidents. The contracts for the NI 43-101 Preliminary Economic Assessment ("PEA") were recently released in March 2024, and this should be completed in approximately 3-4 months.

While equity markets have been extremely challenging in 2023, South Star outperformed the S&P500 (26.3% return), TSX (8% return), and S&P/TSX Capped Materials (-1.3%). South Star was the best-performing graphite stock of the 40 publicly listed companies on the TSX/ASX/AIM/US exchanges that our finance team tracks, with an outstanding return of 36% in 2023. Despite challenging headwinds, the Company has successfully raised capital in progressively less dilutive, non-brokered private placements while also attracting significant institutional capital partners who are invested for the long term.

The team is working hard to continually raise the profile of the Company and expand our retail investor network. We ended 2023 with C$6.5M in cash on our balance sheet, no debt, and a clear path to positive cash flow in 2024. It's also important to highlight that approximately 50% of Santa Cruz's Phase 2 estimated CAPEX is already arranged under the Sprott Streaming Agreement. Once the Santa Cruz Feasibility Study is completed and the Brazilian mining licenses are approved, the Company's goals are to make an investment decision quickly and advance to a detailed design so the operations can scale, given positive economics and commercial scenarios. There is also a scenario where Phase 2 is skipped, and both Phases 2 and 3 are advanced in parallel.

This 2023 review will start by looking back at the stated milestones for the year to see what was achieved versus our stated goals from the end of 2022. Subsequently, we will go through 2023 financial results and close by looking forward to 2024 goals and catalysts.

2023 Goals/Catalysts Santa Cruz Graphite Mine (Brazil)

- Phase 1 Construction: Contractor mobilization and earthworks began at Santa Cruz in mid-December 2022, and a 12-month construction schedule was planned, followed by a 30-45 day commissioning schedule. Currently, substantial completion is scheduled for June 2024, followed by a 45-day ramp-up and commissioning schedule. The delays are caused mainly by holdups in equipment fabrication, structural steel manufacturing/deliveries, contractor labor shortages, as well as delays in specialty electric/hydraulic parts. In addition, weather delays from heavy rains impacted some of the earthworks and structural steel assemblies. Currently, the delivery of the mills is scheduled for April/May 2024, and this is the last major equipment outstanding. A total of 425 days and over 177,204 manhours have been completed without lost time accidents during the construction, which is a real accomplishment. While delays are never ideal, the stated goal was to produce and sell 5,000 tonnes/year ("tpy") in 2023, and that remains the overall financial target. The revised 2024 budget still considers selling nearly 5,000 tpy by assuming the Phases 2 & 3 mining licenses are approved in Q2 2024, and the team ramps up production to 1,000 t/month in Q4 2024.

- Environmental Permitting for Phases 2 & 3: Permitting documents for Santa Cruz Phase 2 (25,000 tpy concentrate) and Phase 3 (50,000 tpy concentrate) for eight of the mining claims were submitted in mid-2023 in Itabela, Bahia. Subsequently, the permits were approved in February 2024, including all the main areas required for Phases 1 and 2.

- Definitive Mining License for Phases 2 & 3: All life-of-mine ("LOM") licensing documents for the 13 current claims have been submitted to the Brazilian Mining Agency ("ANM") in 2023 and are in review. Six of the claims, including all areas required for Phases 1 and 2 operations, have been technically approved by the regional office in Salvador, Bahia, and sent to Brasilia for final review. The goal is to have the definitive mining licenses for the main areas approved for Phases 2 and 3 in Q2 of 2024 so that all permits and licenses are approved, and decisions on scaling production can be made.

- Commercial Sales Agreements: South Star has advanced several commercial conversations and has several signed LOIs for both domestic and global sales for refractory, steels, friction products, and other industrial applications. Several potential clients have technically approved kilogram samples of Santa Cruz concentrates and are waiting for the start of commercial production and the ability to deliver 1 to 5-tonne samples for industrial-scale tests. The team should be able to produce large scale samples while Phase 1 is commissioning, and our commercial team continues to pursue firm commercial agreements for our near-term production.

2023 Goals/Catalysts BamaStar Graphite Project (U.S.)

- 2022 Drilling Campaign: In January 2023, the team completed a 12-hole (506m) maiden drilling program confirming at or near-surface mineralization.

- NI 43-101 Maiden Resource Estimate: In March 2023, the maiden resource estimate was completed, resulting in a pit-constrained resource estimate (1.1% Cg cut-off) of 22Mt at an average graphitic carbon ("Cg") grade of 2.4% for a total in-situ graphite estimate of 520,000 t of graphite. The maiden mineral resource estimate and initial open pit optimization confirms the deposit is amenable to open pit mining operations with at-surface mineralization and low strip ratios.

- 2023 Drilling Campaign: In November 2023, the 2023 drilling program, which totaled 1900 meters of diamond drilling in 15 holes, was completed, including final laboratory analytics. All the holes confirmed graphite mineralization with promising intersections. The results will be incorporated into an updated resource estimate as part of the upcoming NI 43-101 Preliminary Economic Assessment.

- Mineral Rights and Surface Rights Extension: The main mineral rights and the surface access rights have extended the current agreements on the Project for an additional two years beyond the initial five-year term of the original agreements.

5- to 7-Year Strategic plan - Vertically Integrated production in the Americas

South Star's 5- to 7-year strategic plan forecasts Santa Cruz and BamaStar each producing approximately 50,000 tpa of high-quality graphite concentrates. Part of this production will be directed to a value-add plant in the southeast corridor of the U.S. producing 50-70,000 tpa of following value-add products:

- Micronized, purified graphite;

- Coated/uncoated SPG; &

- Expandable/Expanded graphite.

The concentrate plants will be modular to allow for the standardization of the supply chain and maintenance requirements. The modular design will reduce OPEX and accelerate construction while guaranteeing continuity in CAPEX and the quality of the finished product. The development will be phased so we can ensure our CAPEX is financeable, profitability, and leverage our future balance sheet with a reasonable cost of capital to minimize dilution. The goal is to deliver a broad range of diversified products that can be profitably produced and provide a risk-reduced return on our investments. The location of the value-add plant will be a function of required power type and costs, logistics, as well as supply chain considerations. Ideally, it will be located near our BamaStar project, which will supply most feedstock.

South Star has scalable, low capital intensity assets, with first quartile OPEX, and fantastic access to existing infrastructure and logistics, entering the production stage in strategic, Tier 1 jurisdictions when supply and demand are essentially out of balance in the coming years. The Company also has the right team of builders and operators in place to deliver high-quality products to the markets. Production and cash flows will begin in 2024 at Santa Cruz and the Company's goals are to scale as quickly as possible with a very reasonable cost of capital based on a risk-averse, disciplined approach. BamaStar provides the next project in the pipeline in a fundamental strategic jurisdiction, with production planned for 2027.

The team is working hard to position the Company to deliver genuine, long-term, sustainable returns for shareholders and partners based on producing safely, responsibly, and profitably while bringing good value to the marketplace and stakeholders. Safety, environmental compliance, community involvement, cash flows, P&Ls, and balance sheets will be the scorecard.

In August 2023, South Star strengthened the team by adding Roger Mortimer as a board member, an experienced capital-markets executive and global climate/energy-transition fund manager. He will also serve as an advisor to the Company. In addition, Tyler Dinwoodie, a graphite industry veteran, senior corporate advisor, and specialist in Li-ion battery materials, has joined the executive team as a senior technical/commercial advisor and the Company's Chief Commercial Officer.

Share Structure, Stock Performance & Share Liquidity

Shareholders had a great year in 2023 with an overall return of 36.4%, while the S&P returned 23.8%, iShares Micro-Cap ETF (IWC) was up 9.1%, and EQM's Lithium and Battery Tech Index was down 9.2%. The team tracks about 40 graphite or graphite-related companies listed on TSX/ASX/AIM in our database. STS was the best-performing graphite company out of the group, where the average annual 2023 return was (-34.4%). The Company's market capitalization has grown from C$1.9M(C$0.25/sh) at the close of 2020 to C$31M(C$0.75/sh) at the close of 2023. While it's important to maintain perspective and try never to get too high or too low based on the whims of the markets, junior mining markets are notoriously volatile.

Nevertheless, it's essential to have a scorecard for our peer group to track overtime, and investors/stakeholders deserve to see value delivered and earnings growing over time. South Star's executive management team and Board see themselves as the stewards of the shareholder's capital and balance sheet. Management is constantly challenging ourselves and are very focused on keeping the cost of capital low, dilution to a minimum and investing only in opportunities that present a high return on capital invested.

- In November 2022, South Star successfully closed a non-brokered private placement for total proceeds of C$2.33M as well as closed on the US$10M financing from Sprott Private Resource Streaming and Royalty Corp so that Santa Cruz Phase 1 construction was fully financed. An additional non-brokered private placement for a total of C$230,166 was closed in January 2023

- In July 2023, South Star successfully closed an oversubscribed, non-brokered private placement for total proceeds of C$4.52M.

- In November 2023, South Star was awarded a US$3.2M grant from the Department of Defense ("DoD") under the Defense Production Act ("DPA") Title III authorities utilizing funds appropriated by the Inflation Reduction Act, to advance a National Instrument 43-101 Feasibility Study ("FS") for the BamaStar Graphite Project, South Star's flagship graphite project in the USA, located in central Alabama.

- In December 2023, South Star announced a non-brokered private placement for C$5M. Subsequently, this was upsized and closed in March 2023 for a total of C$6.7M.

- South Star's share price started 2023 at C$0.55 and finished the year at C$0.75, or an overall annual return of 36%.

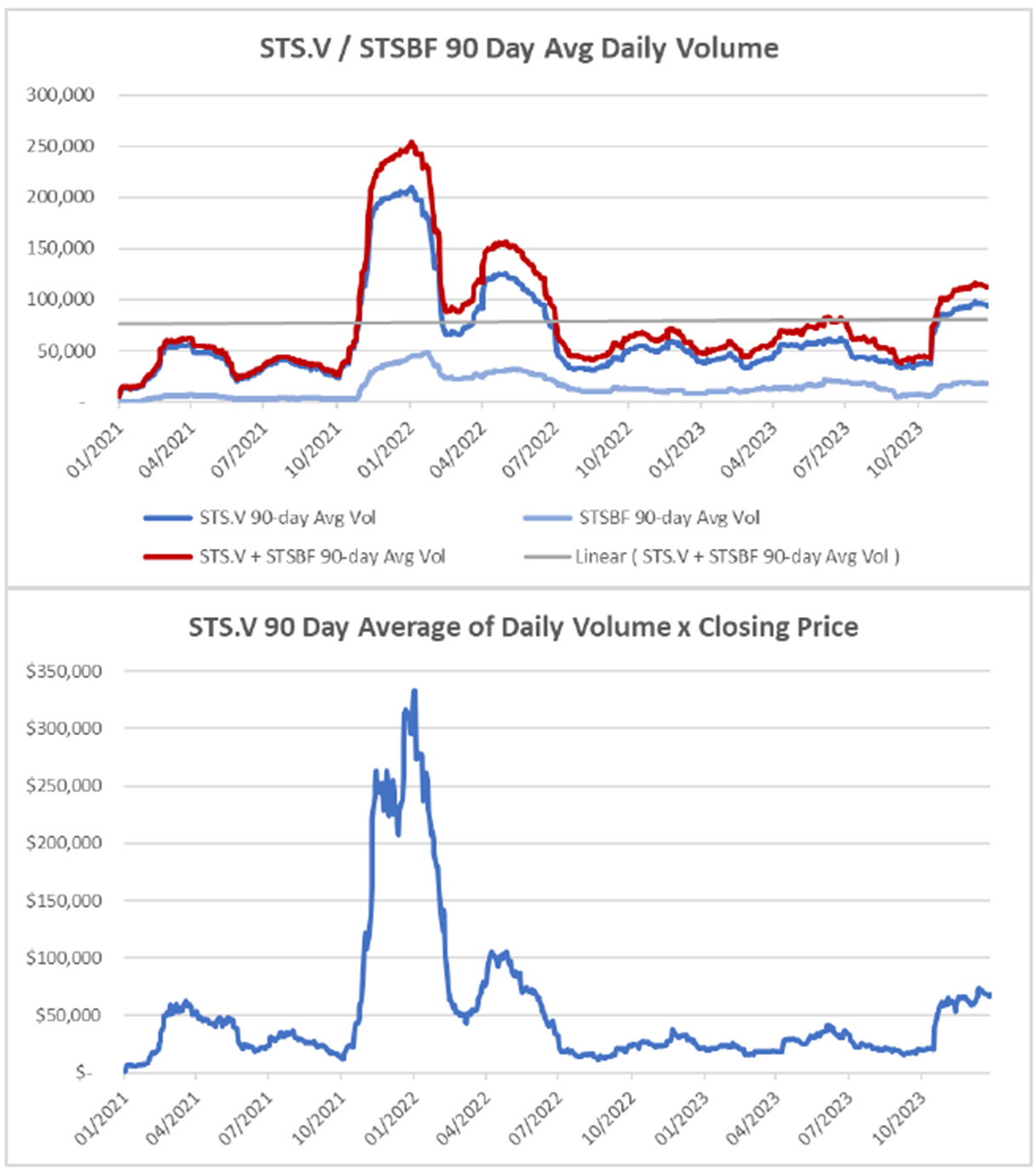

- The 2023 average TSX.V daily trading volume was around C$31,300, with a maximum of C$75,000 during the year. A positive trend in November and December developed where the average daily volumes increased to around C$64,250. The trading in the US markets continues to be a very small percentage of the overall liquidity. See Figure 1 below.

- STS.V market capitalization has progressed as follows: C$2.15M at EOY 2020, C$33.7M EOY 2021, C$18.5M EOY 2022, and C$31M EOY 2023. Insiders own approximately 10% of shares outstanding. See Table 1 below.

Figure 1: Share Liquidity 2023

Table 1: South Star Cap Table December 2023

Balance Sheet & Expenses

Despite challenging equity and capital market conditions, South Star is closing 2023 in excellent financial shape, with near-term cashflows beginning in 2024. The Company closed 2023 with C$6.5M in cash and a current account surplus of C$4.4M. This total doesn't include the most recent private placement with gross proceeds of C$6.7M. There is zero debt on the debit side, and the Company will make the final payment on the farm where all the Phase 1 operations are planned. Commercial production and the start of revenues are scheduled for August 2024, scaling to 1,000 tpm of production in Q4 2024.

In 2023, the Company has a net loss from operations of C$4.2M while also investing C$12.8M into the Santa Cruz Phase 1 Plant, Property, and Equipment, as well as land purchases. The result is a 2023 basic loss per share of C$0.14, compared to C$0.21 in 2022. The finance team has done an excellent job on FX with a positive C$629,000 impact on our cash in 2023. The team continues to evaluate adding key executive management and technical staff as we scale operations in Brazil to production and advance BamaStar. The three categories of most significant expenditures in 2023 included the CAPEX investments and owners team expenses of Santa Cruz, the BamaStar project development expenses, and corporate G&A/IR.

The Company continues to work diligently on investor relations, business development and raising the profile of the Company. While extremely challenging market conditions moderated investor engagement efforts, South Star has been successful in growing awareness and building a core investor base that enabled us to have progressively less dilutive private placements, while attracting strategic institutional investors who believe in the strategic vision of the company, the team and are invested for the long-term. We are confident that our efforts will result in a fair valuation as we continue to advance quickly to positive operating cash flows at Santa Cruz and emerge as one of the first new graphite producers in the USA in the great state of Alabama, with production estimated in 2027.

Market Supply/Demand & Graphite Pricing

Overall, graphite pricing declined in 2023 due to the continued oversupply of cheap fines and a slowing of EV sales growth. Graphite prices are near 5-year lows. The biggest news occurred in October when China published the requirements for export licenses for graphite products. It's unclear how this will impact pricing until the actual effects of this potential restriction are made clearer. However, current pricing doesn't change the fundamentals of the impending market imbalance that is in the making, but it probably won't make an impact on pricing until 2025. Graphite market highlights from Benchmark Mineral Intelligence and other sources follow:

- 2023 saw the -100#/95% graphite concentrate prices decrease around 32%, and it appears prices are near the marginal cost of production for fines. Two ex-China graphite suppliers stopped production for several months during 2023 because of growing inventories and lack of pricing power/profits. See Figure 2.

- Demand for natural flake graphite continues to grow at about >20% CAGR.

- Global demand for graphite grew by 52% between 2018 and 2023 and is forecast to grow 70% between 2023 and 2028.

- Natural graphite anode material supply will grow by 95 percent by 2030, with demand increasing by 450 percent over the same period.

- Global graphite concentrate production grew to approximately 1.4M tpy in 2023 and is expected to grow to around 1.65M tpy in 2024. The supply deficit is expected to widen over the next 4-5 years and likely require 8-10 years to resolve.

- The U.S. markets alone will require around 700-900k tpa of graphite concentrates by 2030 while current production is zero tpa.

- Permitting and licensing projects continue to be a global bottleneck and constrain near-term production, while current pricing is a real barrier to financing new production.

In summary, a significant imbalance in supply and demand is coming in the near term. A CAGR of approximately >20% is estimated in graphite markets over the next decade, which suggests that 10-15 new average-sized mines must come online to meet demand by 2025 and then double again by 2030. Benchmark Minerals estimates that 97 average-sized mines are needed to come online by 2035 to meet demand. Whatever the final number, it still takes 8-12 years to bring a typical mine into production from discovery. Supply will continue to be constrained for the foreseeable future.

Given this bullish outlook, it is an exciting time to deliver on our commitment and bring Santa Cruz online to deliver very high-quality material in a proven producing district. The team is working towards bringing BamaStar online a few years behind Santa Cruz, with the first production planned for 2027. We expect to be one of the first movers in new production and to be in the first quartile of costs. Santa Cruz is projected to generate operating profits during Phase 1 and grow more profitable as Phases 2 and 3 scale.

China & the rest of Asia will continue to dominate the battery metals supply chain for the foreseeable future and graphite is no exception. The region produces roughly 70% of global graphite concentrates and nearly 100% of all LiB active anode materials. This major macro trend took 30 years to occur and will take time to evolve. It's also conceivable that the price of fines will overtake the price of midsize fraction in the near term, which could add pressure to industrial applications as more miners grind their medium flake material to deliver fines for battery applications.

Figure 2: December 2023 Graphite Concentrate Pricing

SUDENE - Corporate Income Tax Exemptions Under Regional Development Program

South Star is also pleased to announce that it was granted eligibility to receive tax incentives and exemptions under an economic development program administered by SUDENE, a Brazilian federal government agency. The main tax benefits under the SUDENE program include a 75% federal corporate income tax reduction for 10 years after the Company reaches more than 20% of its annual production capacity and incentivized accelerated depreciation of assets. The tax incentives will decrease the project's effective tax rate to around 15.25%. There are additional tax incentives for products that are exported as well. The SUDENE tax incentives can be renewed for additional 10-year periods.

2024 Catalysts Santa Cruz/BamaStar

2024 will be an eventful year for South Star with significant catalysts that should create value for our communities, clients, and our shareholders. Projected milestones include:

Santa Cruz | BamaStar |

|

|

|

|

|

|

|

|

| |

| |

| |

Concentrate Production Targets (Totals tpy) | |

|

|

Value-Add Production Targets (Totals tpy) | |

| |

| |

| |

Conclusions

South Star will have a transformational year in 2024 as Santa Cruz emerges as the first new graphite production and sales in the Americas since 1996, and the BamaStar PEA is published with graphite concentrate and battery anode production in the contiguous U.S. planned for 2027. The team will continue to be focused on safe, responsible production as the Company transitions from development into production and on profitable execution of our business plan and growth initiatives.

The Company has two great, scalable assets in strategic, stable Tier 1 jurisdictions and a strong team executing an exciting 5- to 7-year strategic plan that is sustainable, realistic, financeable, and demonstrates strong financial metrics. The goal is to produce a vertically integrated, diversified range of high-quality products for the battery metals and industrial sectors. Management and Board are focused on risk management, good governance, and intelligent capital allocation. With construction and operations underway, the team will remain dedicated to a culture of responsible operations, health & safety, social integration into the communities in which the Company operates, and being a positive environmental steward for future generations.

South Star is just getting started, and the team is excited about the bright future ahead of us. In closing, Winston Churchill's quote often comes to mind, "Success is not final, failure is not fatal; it is the courage to continue that counts." The Company will continue to focus on putting one foot in front of the other and delivering value to our communities, clients, partners, and shareholders. As always, thanks to everyone for their continued interest and support of South Star during 2024 and our continued journey together.

About South Star Battery Metals Corp

South Star Battery Metals Corp. is a Canadian battery metals project developer focused on the selective acquisition and development of near-term production projects in the Americas. South Star's Santa Cruz Graphite Project, located in Southern Bahia, Brazil is the first of a series of industrial and battery metals projects that will be put into production. Brazil is the second-largest graphite-producing region in the world with more than 80 years of continuous mining. Santa Cruz has at-surface mineralization in friable materials, and successful large-scale pilot-plant testing (> 30t) has been completed. The results of the testing show that approximately 65% of Cg concentrate is +80 mesh with good recoveries and 95%-99% Cg. With excellent infrastructure and logistics, South Star is fully funded for Phase 1, and the construction and commissioning are underway. Santa Cruz will be the first new graphite production in the Americas since 1996 with Phase 1 commercial production projected in Q2 2024. Phase 2 production (25,000 tpa) is 2/3 funded and planned for 2026, while Phase 3 (50,000 tpa) is scheduled for 2028.

South Star's second project in the development pipeline is strategically located in Alabama in the center of a developing electric vehicle, aerospace, and defense hub in the southeastern United States. The BamaStar Project is a historic mine active during World Wars I & II. A NI43-101 technical report with the maiden resource estimate has been filed on SEDAR. Trenching, phase 1 drilling, sampling, analysis, and preliminary metallurgical testing have been completed. The testing indicates a traditional crush/grind/flotation concentration circuit that achieved grades of approximately 94-97% Cg with approximately 86% recoveries. South Star is executing on its plan to create a multi-asset, diversified battery metals company with near-term operations in strategic jurisdictions. South Star trades on the TSX Venture Exchange under the symbol STS, and on the OTCQB under the symbol STSBF.

South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles based on transparency, stakeholder engagement, ongoing education, and stewardship. To learn more, please visit the Company website at http://www.southstarbatterymetals.com.

This news release has been reviewed and approved by Richard Pearce, P.E., a "Qualified Person" under National Instrument 43-101 and President and CEO of South Star Battery Metals Corp.

On behalf of the Board,

MR. RICHARD PEARCE

Chief Executive Officer

For additional information, please contact:

South Star Investor Relations

Email: invest@southstarbatterymetals.com

+1 (604) 706-0212

Twitter:https://twitter.com/southstarbm

Facebook: https://www.facebook.com/southstarbatterymetals

LinkedIn: https://www.linkedin.com/company/southstarbatterymetals/

YouTube: South Star Battery Metals - YouTube

CAUTIONARY STATEMENT

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Information

This press release contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements". Forward-looking statements in this press release include, but are not limited to, statements relating to the successful closing of the Private Placement and anticipated timing thereof and the intended use of proceeds and statements regarding moving Santa Cruz into production and scaling operations as well as advancing the Alabama project; and the Company's plans and expectations.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

SOURCE: South Star Battery Metals Corp.

View the original press release on accesswire.com