April 17, 2024

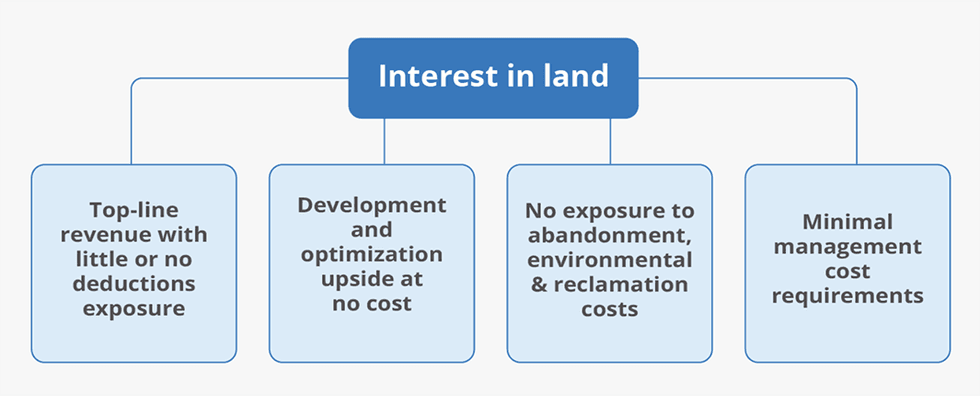

Source Rock Royalties (TSXV:SRR) focuses on oil & gas royalties in the provinces of Alberta and Saskatchewan. The company's portfolio comprises various gross overriding royalty interests in southeast Saskatchewan and a gross overriding royalty in largely contiguous Clearwater interests in Central Alberta. Source Rock Royalties offers investors low-risk and low-capital-cost exposure to the oil & gas sector with a royalty business model that shares in production revenue without exposure to the capital costs associated with drilling, development, maintenance, abandonment, environmental and other obligations.

Source Rock acquired new royalties worth nearly C$13 million in 2023 and a total of C$16.5 million since its IPO in March 2022 effectively doubling the company's royalty acreage. The acquisitions further enhanced its current royalty production and exposure to potential undeveloped drill locations. Source Rock generated C$6.6 million in royalty revenue in 2023, the highest in its 11-year history.

The majority of Source Rock's royalties are derived from top-line revenue, resulting in minimal exposure to deductions linked to production costs from wellbores and the sale of various commodities. Also, the majority of its current royalty payors are financially stable and possess robust capabilities to efficiently operate and enhance the value of the lands in which Source Rock holds royalties. Some of the key royalty payors include Whitecap Resources (TSX:WCP), Rubellite Energy (TSX:RBY), Surge Energy (TSX:SGY), Crescent Point Energy (TSX:CPG) and Anova Resources (Private), among many others.

Company Highlights

- Source Rock Royalties is a Calgary, Canada based pure-play oil and gas royalty company, with a focus on Alberta and Saskatchewan; the only junior oil and gas royalty company listed on the TSXV.

- Source Rock concentrates on acquiring royalties in areas with proved reserves, foreseeable future high rate-of-return drilling upside, and partnering with operators that are financially and operationally prudent.

- Owning and managing royalties is a capital-light business model offering the benefit of sharing in production revenue without exposure to the capital costs associated with drilling, development, maintenance, abandonment, environmental and other obligations.

- Source Rock Royalties has a diversified oil-focused portfolio of royalty interests concentrated in southeast Saskatchewan, central Alberta, and west-central Saskatchewan with well-positioned royalty payors. Oil exposure allows for a strong netback (profit) per barrel even during periods of lower commodity prices.

- Source Rock Royalties has a proven track record of executing on its balanced growth and yield business model. The company has achieved 11 years of positive cash flow and provided ~$17 million in dividends back to shareholders since 2014.

- Source Rock Royalties anticipates its current monthly dividend of $0.006 to be comfortably funded with cash flow by current operations down to oil prices of C$60/bbl (or US$50/bbl WTI).

- The management and board of directors have a proven track record of creating value in the oil & gas industry. The insiders own 9.5 percent of Source Rock’s common shares, aligning their interests to that of the shareholders.

- The company has a strong institutional shareholder base with CN Rail Pension Fund owning approximately 21 percent of Source Rock’s common shares.

- Insiders and key shareholders have an average cost on their shares of ~$0.90 (there were never any cheap Founders or seed shares issued).

- Source Rock Royalties does not use debt in its business and always maintains a cash balance (currently ~$2.2 million).

This Source Rock Royalties profile is part of a paid investor education campaign.*

Click here to connect with Source Rock Royalties (TSXV:SRR) to receive an Investor Presentation

SRR:CC

The Conversation (0)

09 December 2024

Source Rock Royalties

Pure-play on oil & gas royalties in Western Canada

Pure-play on oil & gas royalties in Western Canada Keep Reading...

20h

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

22h

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

27 January

Syntholene Energy Corp. Announces Issuance of Key U.S. Patent Covering Proprietary Fuel Synthesis Reactor

Newly granted patent represents a foundational innovation, engineered to deliver high-yield, low-cost, and ultra-pure synthetic fuels, including eSAFSyntholene Energy Corp. (TSXV: ESAF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the issuance of its first U.S. Patent granted by the... Keep Reading...

23 January

Chevron Reportedly Targeting Q1 Sale of Singapore Refining and Fuel Assets

Chevron (NYSE:CVX) is moving toward the exit from its downstream footprint in Singapore, with the US oil major aiming to finalize the sale of its refining and fuel distribution assets in the first quarter of the year.According to a Reuters exclusive, four people familiar with the matter said the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00