Program to start with a series of deep (1,000 m) holes

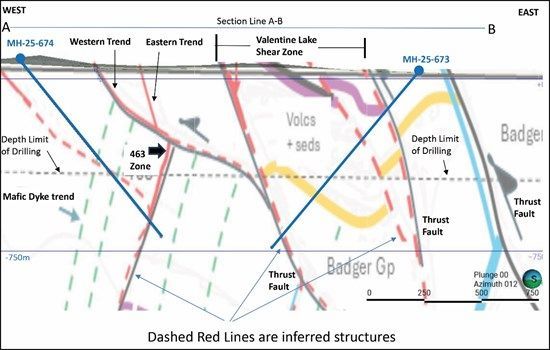

Sokoman Minerals Corp. (TSXV: SIC,OTC:SICNF) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to announce that diamond drilling will resume at the 100%-owned Moosehead Gold Project in central Newfoundland. The initial focus will be a series of deep, 1,000 m depth, downhole drill holes testing the Eastern Trend and Western Trend gold zones for depth extensions, as well as testing for undiscovered parallel zones. Since 2018, a total of 135,325 m of core in 672 drill holes, across the property, have resulted in the definition of five significant zones of gold mineralization and several smaller, less defined zones, with most remaining open for expansion. All the main gold zones have high-grade intersections of at least 100-gram metres of gold to a maximum of 636.12-gram metres from MH-18-39. Please see the table of Moosehead's Top 25 Holes below.

Timothy Froude, P.Geo., President and CEO, states, "We are extremely excited to be back drilling at Moosehead, given the significance of the deep holes and the impact they could have on the mineralization on the property. Drilling to date has focused on the near surface, to an average depth of about 300 m vertically, where we have been extremely successful in defining high-grade mineralization in five previously unknown zones. The time is right to go deeper than we have in the past, to downhole depths of 1,000 m, and armed with the knowledge we have gained over the past few years, hopefully locating continuous high-grade zones at depth. We expect to be on site in early October and anticipate a four- to five-week timeline to complete drilling."

Deep Drilling Program

The deep drilling program will start with two to three holes, each at least 1,000 m in length, positioned to establish key geological, mineralogical and structural information at depths never before tested, critical for planning future deep drilling. This drilling is part of a larger 2025 program of up to 15,000 m, including multiple holes to expand the Western Trend, the 75 and 552 Zones, as well as reconnaissance drilling on the remainder of the property, testing high-priority regional targets.

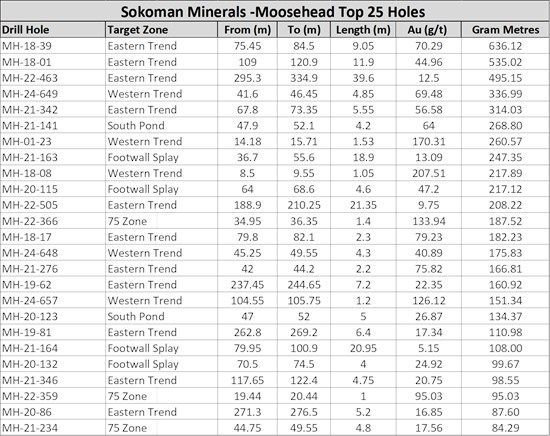

The first deep hole, MH-25-673, will be the most easterly hole drilled, testing from east to west the deep regional structures of the Eastern Trend and zones proximal to it. The drill hole will test the full width of what is believed to be the Valentine Lake shear zone, and will extend through the inferred southeastern projection of the Eastern Trend at a planned vertical depth of 650 m. The initial 200 m to 300 m will test ground with no previous drilling, where an unsourced 1988 float sample assayed 10 g/t Au.

The second hole, MH-25-674, will be drilled, from west to east, testing the footwall units below the Western Trend for 463-Zone-type veins, continuing to test the inferred 463 Zone Structure at ~650 m vertically below surface. The 463 Zone is around 250 m to 300 m vertically below ground, giving a drill intercept of 39.60 m at 12.50 g/t Au, from 295.30 m downhole, including 10.25 m at 41.97 g/t Au, from 312.35 m downhole (see the December 15, 2022, news release). This 463 Zone is unique in that it lies in the footwall and is nearly perpendicular to the trend of the adjoining Eastern Trend Zone, possibly representing a feeder conduit.

The third proposed hole is a 500 m step out to the south of the first deep hole (MH-25-673) to get a better understanding of the regional structures and their trend at depth.

See the plan view and cross-section view of the proposed deep drilling below.

Figure 1: Plan View - Deep Drilling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/266188_28f1fe1784fd2b7b_002full.jpg

Figure 2: Cross Section - Deep Holes MH-25-673 and 674

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/266188_28f1fe1784fd2b7b_003full.jpg

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a "Qualified Person" under National Instrument 43-101, and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes: the entire sample being crushed to -10 mesh, and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland. These projects target Dalradian-type orogenic gold mineralization, similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement, please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

- East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

- Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/266188_28f1fe1784fd2b7b_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266188