June 17, 2024

Previous drilling at Blackhawk returned up to 1,270 g/t Ag (BHD006) beneath the historic Endowment Mine, previous rock chip sampling returned +1% silver from the Morning Star Mine1

Sierra Nevada Gold (ASX: SNX) is pleased to announce it is preparing a drilling program to follow up drill hole BHD006 which returned results including 0.5m at 1,270 g/t Ag and 1m at 823g/t Ag at Endowment Mine, part of its Blackhawk Epithermal project in Nevada, USA.1

Highlights

- SNX plans seven-hole 1,500m reverse circulation (RC) drill program to follow up on drillhole BHD006, which was drilled beneath the historic Endowment Mine.

- High-grade silver intercepts are associated with very high-grade lead-zinc (see table 1), demonstrating potential for extremely high value ore at Blackhawk Epithermal Project.

- SNX’s geological team will initiate a field program to complete geological mapping, soil geochemistry surveys and rock chip sampling on vein target areas, to further refine drill targets in preparation for drilling in the third quarter of 2024.

- Underground 3D scanning survey of accessible historic workings at the Endowment Mine will map extent and location of historic workings to accurately target planned drill holes following up on drill hole BHD006.

- SNX will initiate a focused, 100m dipole-spaced Induced Polarization (IP) geophysics survey over preferred portions of the vein field to assist with drill hole targeting.

- Blackhawk epithermal project has potential for a significant silver discovery, with 22.5- line kilometres of high-grade silver-gold-lead-zinc veins identified1.

- SNX completed a $2.6 million capital raising in May 2024 to advance exploration at Blackhawk epithermal project.2

- It has commenced a strategic review to progress full or partial asset sales or joint venture partnerships over remaining copper, gold and silver assets in Nevada, USA.

SNX Executive Chairman Peter Moore said “We were encouraged by the strong support for our recent $2.6 million share placement and proceeds from this will allow the company to accelerate our exploration program at Blackhawk as we look to uncover its potential to be a significant silver discovery. We have several activities planned to ensure our drill targets are well defined ahead of mobilising a rig to site in Q3 2024 to follow up these exciting earlier silver results.”

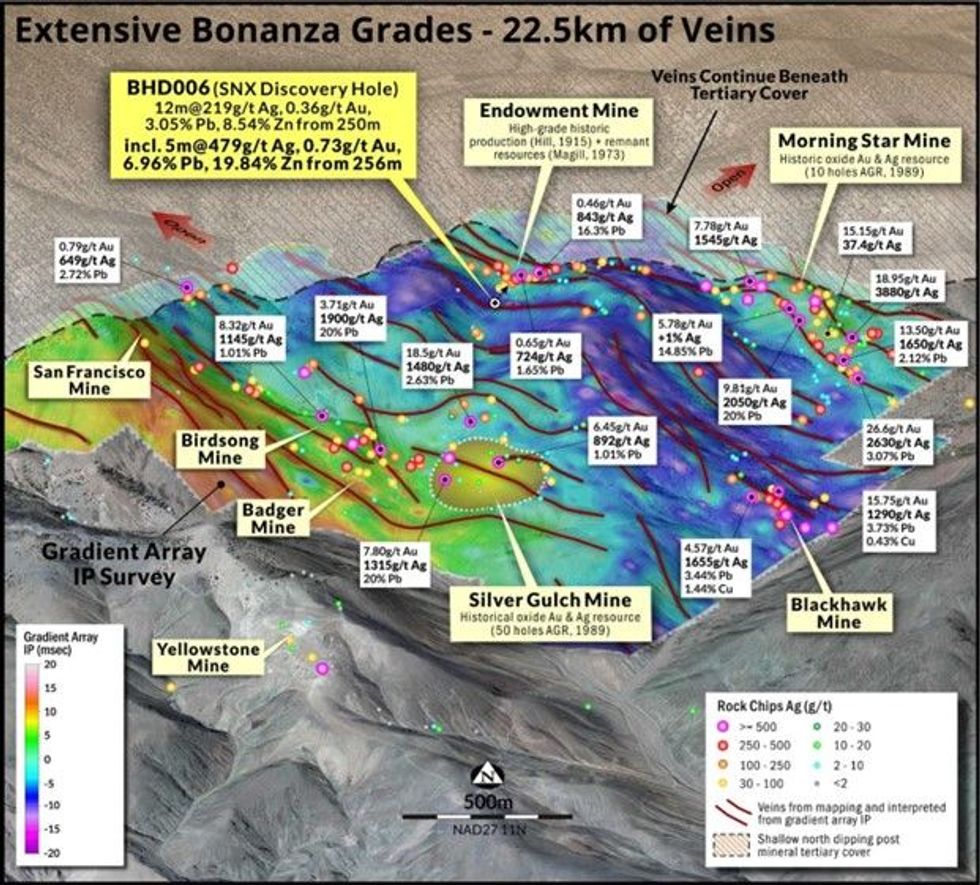

SNX has identified a large and high-grade intermediate sulphidation polymetallic epithermal Ag-Au-Pb-Zn vein system at Blackhawk, which is related to a large porphyry system. Partially coincident with, and located north of the Blackhawk Porphyry system, the vein field covers about 5km2 and is open under cover to the north and northeast, with 22.5-line km of veins identified to date (see figures 1 & 2).

SNX’s geological team will initiate a field program to complete geological mapping, soil geochemistry surveys and rock chip sampling on mapped vein target areas, to further refine drill targets in preparation for drilling. A program of seven reverse circulation (RC) holes is planned for 1500m in the third quarter of 2024 to follow up the result of 1,270 g/t Ag hit in BHD006 drilled in 2017.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00