- Hole V-22-014 returned 1.45 g/t Au over 285.2 m, including 2.48 g/t Au over 128.2 m from bedrock surface in 160 m step-out from previous holes

- Full results in for V-22-007 returned 1.89 g/t Au over 410.0 m (entire length in mineralization), including previously announced 3.24 g/t Au over 146.0 m

- Results further demonstrate scale and strong continuity within unusually high-grade reduced intrusion-related gold system

- Assays still pending for 24 of 32 holes (10,530 m of 13,320 m) drilled at Valley and Gracie in 2022

Snowline Gold Corp. (CSE:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional preliminary[1] assay results from its 2022 drilling program at the Valley Zone, Rogue Project, Yukon. Notably, hole V-22-014 intersected a broad zone of sheeted quartz vein mineralization within the Valley intrusion averaging 2.48 gt Au over 128.2 m from bedrock surface at 2.8 m downhole within a broader zone of 1.45 gt Au over 285.2 m (Tables 1 and 2). The hole was collared 160 m from the nearest previously announced hole. Full results have also been received for V-22-007, which is mineralized along its entire 410.0 m length from bedrock surface, averaging 1.89 gt Au along the length of the hole

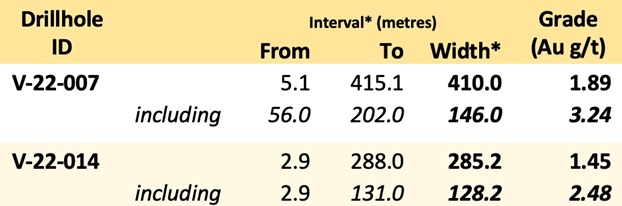

Table 1 - Preliminary highlight summary of V-22-007 and V-22-014, including previously reported upper 282.9 m (@ 2.30 g/t Au from 5.1 m) in V-22-007. *Interval widths reported; true widths of the system are not yet known. The geometry of the mineralized corridor is not determined by any individual vein nor structure and depends instead on the broader distribution of the many thousands of small, mineralized quartz veins present at Valley.

"Hole V-22-014 is the latest step-out drill hole to add significantly to the prospective scale and grade of our unfolding gold discovery at Valley," said Scott Berdahl, CEO & Director of Snowline. "The continuity of strong grades from Valley's central zone, seen both within holes along hundreds of metres and between holes spaced hundreds of metres apart, demonstrates the presence of a large and robust, unusually rich bulk tonnage gold system. Comparable quartz vein densities-often with numerous instances of trace visible gold-in many holes for which assays have yet to be received have the potential to carry similar grades. With analytical results pending for nearly 80% of our 2022 drilling, we expect further significant growth to this discovery in the coming weeks and months."

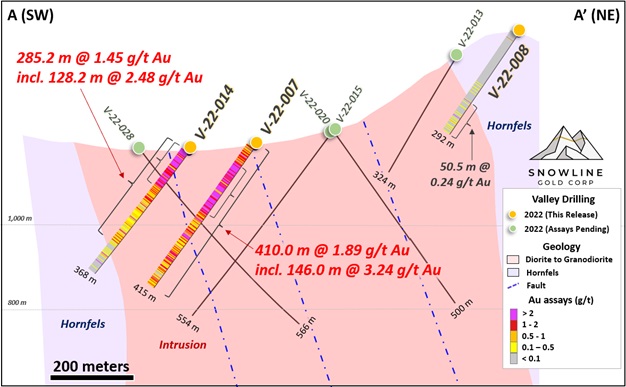

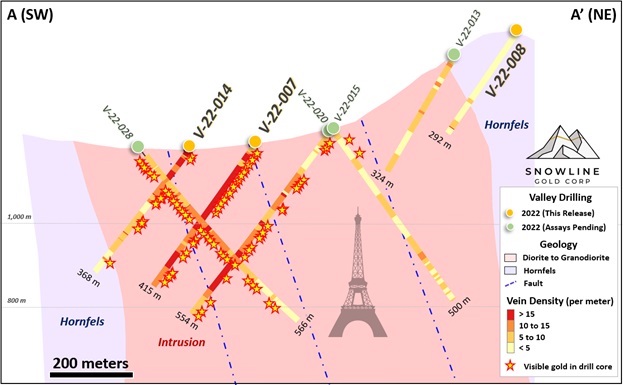

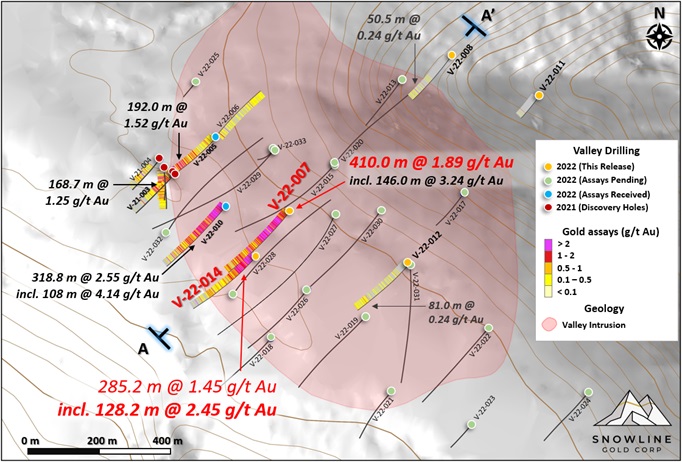

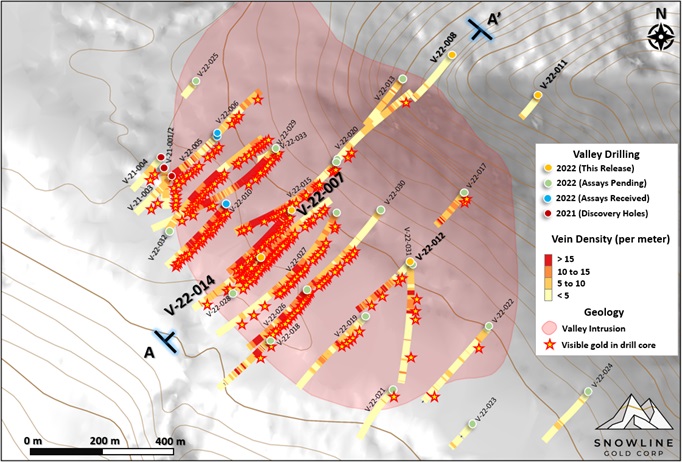

Figure 1 - Cross section showing V-22-007 & 014 results received to date (top) and vein densities alongside instances of visible gold observed during logging (bottom). Hole 014 suggests continuity of high-grade (>2 g/t Au) mineralization in 007 to surface, and it broadens the zone to the southwest. Views look northwest. Note that V-22-028 is slightly in the foreground (see Figure 2). As a scale reference, the Eiffel Tower is 330 m tall from base to tip.

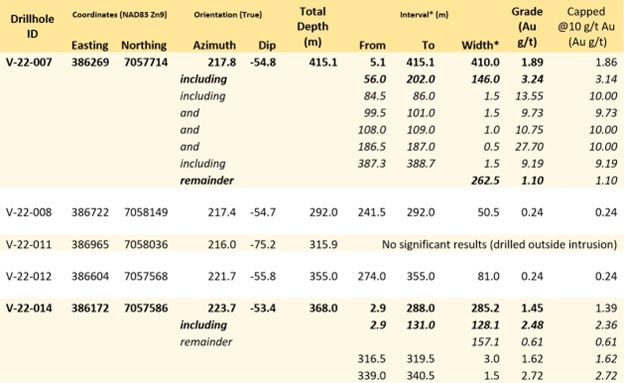

Table 2 - Summary of mineralization in current holes. Several zones of higher grades are present but capping these at 10 g/t Au shows that the intervals are carried by robust mineralization along much of the holes. Hole V-22-008, while not a highlight of the batch by grade, averaged 0.24 g/t Au across its final 50 m on entering the Valley intrusion, roughly 635 m from previously reported holes. Hole V-22-012 is dominated by a distinct vein orientation with an E-W trend, as opposed to the NW-SE orientation in the central zone. *Interval widths reported; true widths of the system are not yet known.

HOLE V-22-014

Hole V-22-014 was collared in the Valley intrusion, 160 m southwest of hole V-22-007 and 165 m southeast of hole V-22-010 (318.8 m @ 2.55 g/t Au including 108.0 m @ 4.14 g/t Au, see Snowline news release dated October 12, 2022). The hole demonstrates lateral and vertical continuity of near-surface, multi-gram-per-tonne gold mineralization encountered in previous holes at Valley (Figures 1 and 2).

V-22-014 encountered high densities of gold-bearing quartz veins in its top 128.2 m and remained largely in mineralization until exiting into hornfels sedimentary rocks at 326 m depth. The last >1.0 g/t Au gold assay occurs as 2.02 g/t Au over 1.5 m from 339.0-340.5 m downhole, within hornfels sedimentary rocks. Gold is typically associated with bismuthinite and telluride minerals in sheeted to near stockwork quartz veins. Overall sulphide content of the system is very low.

As with previous holes in this zone, V-22-014 exhibits a relatively high degree of consistency in gold grade. Of the top 128.2 m, 59 of 103 samples assayed higher than 2.0 g/t Au-representing 71.2 m (non-contiguous) or 55.5% of the downhole interval. While high grades of up to 22.4 g/t (1.4 oz/ton) Au are present, they are not primary drivers of the broader mineralized intervals. Applying a cap at 10 g/t Au reduces the top 128.2 m of the hole by just 4.8% to 2.36 g/t Au, while the broader 285.2 m interval is affected less, dropping 4.1% to 1.39 g/t Au (Table 2).

Figure 2 - 2022 drilling at the Valley Zone, showing assays received to date (top) and vein densities alongside instances of visible gold observed during logging (bottom). Visual results indicate the presence of a large central zone within the broader Valley intrusion bearing higher vein densities. Initial analytical results for this zone consistently carry unusually high grades for a reduced intrusion-related gold system.

ABOUT ROGUE

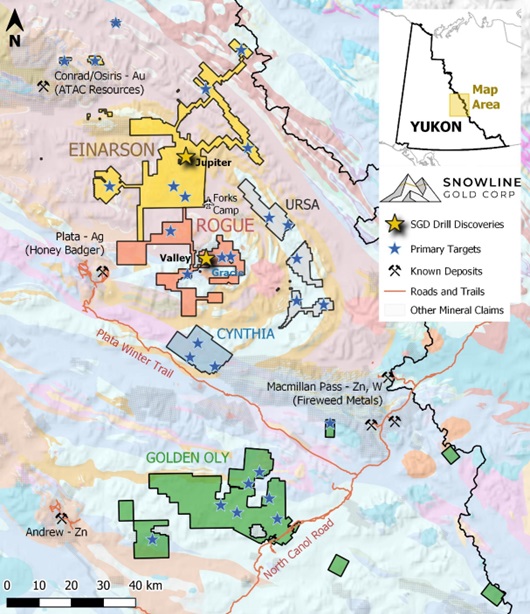

The geological setting and style of mineralization at Rogue's Valley Zone indicate the presence of a bulk tonnage gold target, with similarities to Kinross's Fort Knox Mine in Alaska and Victoria Gold's Eagle Mine in the Yukon. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays along the margins of a mid-Cretaceous aged Mayo-series intrusion. The Rogue Project hosts multiple intrusions of similar age and affinity to that at Valley along with widespread gold anomalism in stream sediment, soil and rock samples. The project is thus considered by the Company to have district-scale potential for reduced-intrusion related gold systems.

Valley is an early-stage exploration project without a resource estimate, and the presence or absence of an economically viable orebody cannot be determined until significant additional work is completed.

Figure 3 - Project location map for Snowline Gold's eastern Selwyn Basin properties. The Valley and Gracie Zones on the Rogue are the sites of Snowline's 2022 drill programs.

TOTAL METRES DRILLED - CORRECTION

Due to a tallying error that saw two holes summed twice, total drilling meterage for the 2022 season was incorrectly reported on Snowline's October 12, 2022 news release as 14,495 m. In fact, a total of 13,320 m was drilled by the Company on its Rogue project in 2022, with 11,168 m drilled at Valley in 27 holes and 2,152 m drilled at the nearby Gracie target in 5 holes. Presently, results for 2,789 m (8 holes) have been received from Valley, with assays pending for the remaining 8,378 m (19 holes). Results for all holes at Gracie remain pending.

QA/QC

On receipt from the drill site, Valley's NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's 2022 field camp. Sample lengths as small as 0.5 m were used to isolate features of interest, otherwise a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently) collected for analysis and one half stored as a record. Standard reference materials, blanks and duplicate samples were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor and by Snowline personnel to ALS Laboratories' preparatory facility in Whitehorse, Yukon, with analyses completed in Vancouver.

ALS is accredited to ISO 17025:2005 UKAS ref 4028 for its laboratory analysis. Samples were crushed by ALS to >70% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 48-element analysis on 0.25 g sample pulps (ALS code: ME-MS61L). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (ALS code: Au-AA23). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (ALS code: Au-GRA21).

Samples with visible gold and other samples returning >2.0 g/t Au by fire assay, along with a set of randomly selected samples, will undergo further processing, analysing the screen rejects to determine whether the screening process could introduce a sampling bias in current results by excluding coarse gold from analysis, resulting in an under-reporting of true grades. Other biases are also possible.

Results reported herein are considered preliminary following receipt of a low but expected percentage of abnormal assays from standard and blank samples inserted by the Company into the Valley sample stream. (Standard samples are prepared by a third-party laboratory to have known quantities of gold, and blank samples are known to contain very limited concentrations of gold.) Reanalysis of samples run along with these reference materials will provide greater certainty in the final assay numbers. These results will be reported if a material difference is identified between the current assays and the re-run sample batches. Based on the widespread and consistent mineralization throughout mineralized zones, however, the Company does not believe that the re-analysis of this relatively small number of samples will have a significant impact on the preliminary mineralized intervals reported herein.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seventeen-project portfolio covering >254,000 ha. The Company is exploring its flagship >111,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., Exploration Manager for Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company's drill program, results, implied significance of visual inspection of drill core, and surface work and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

[1] These results are considered preliminary as a small percentage of the Company's QA/QC insertions of blanks and standard reference materials returned values of outside of acceptable limits. This is not an unusual nor necessarily unexpected failure rate. In response, five samples on either side of failed insertions will be reanalysed along with the insertions themselves. Given the scale and general consistency of the gold mineralization across the holes where insertions did pass QA/QC screening, the Company deems these preliminary results to be strongly indicative of overall grade. Final assay results may be updated in a future release.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/725843/Snowline-Gold-Intersects-25-Grams-Per-Tonne-Gold-Over-1282-m-From-Surface-Within-2852-m-of-14-Grams-Per-Tonne-Gold-at-its-Valley-Zone-Rogue-Project-Yukon