NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

Snowline Gold Corp. (CSE:SGD) (the "Company" or "Snowline") is pleased to announce that it has completed the second tranche of its previously announced (July 5, 2022) non-brokered private placement, issuing 2,342,293 units of the Company (the "Units") at a price of C$1.25 per Unit, for aggregate gross proceeds of C$2,927,866. Each Unit is comprised of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"), with each Warrant being exercisable for one common share of the Company at an exercise price of C$2.50 until August 2, 2024 (the "Offering

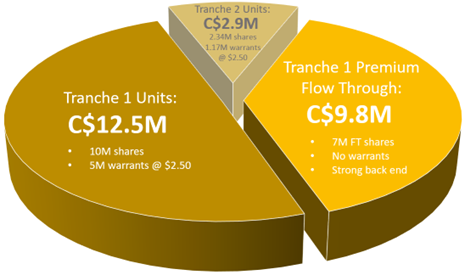

Figure 1 - A visual breakdown of the Offering. The Unit component is a "hard dollar" (i.e. non-flow through) raise, and the Warrants are valid for two years. The FT Shares do not involve warrants, and they are supported by strong back-end Snowline investors who do not receive the flow-through benefits.

The gross proceeds from the issue and sale of Units will be used to support advancement of exploration on the Company's Yukon Territory mineral properties and for general and working capital purposes.

All securities issued in connection with the second tranche of the Offering are subject to a hold period of four months and one day from the closing of the second tranche of the Offering, in accordance with applicable Canadian securities laws, expiring on December 3, 2022.

Crescat Capital LLC ("Crescat") subscribed to the Offering to maintain its pro-rata interest pursuant to its pre-emptive right granted under the terms of an investment agreement with Snowline, to participate in certain equity offerings undertaken by the Company. Crescat has beneficial ownership of, control or direction over, directly or indirectly, more than 10% of the issued and outstanding common shares of the Company. Accordingly, the Offering and the issuance of the Units insofar as they involve Crescat constitutes a related party transaction for the purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is not required to obtain a formal valuation for the Offering by virtue of section 5.4 of MI 61-101. In addition, the Company is relying on the exemption from the formal valuation and minority approval requirements of MI 61-101 set out in section 5.5(a) and section 5.7(a) of MI 61-101 as the fair market value of the Offering is not more than 25% of market capitalization. A material change report will be filed in connection with the Offering less than 21 days in advance of the closing of the Offering, which the Company deems reasonable in the circumstances so as to be able complete the Offering in an expeditious manner.

No finder's fees have been nor will be paid in connection with the Offering.

The securities issued under the Offering have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and were not to be offered or sold in the United States absentregistration or an applicable exemption from the registration requirements. This news release shall notconstitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securitiesin the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >127,000 ha. The Company is exploring its flagship >85,000 ha Rogue and Einarson gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the anticipated use of proceeds from the Offering, the intention to file a material change report and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things, risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/710659/Snowline-Gold-Announces-Completion-of-Second-Tranche-of-Non-Brokered-Private-Placement-for-C29-Million