June 06, 2023

Further visible gold from deep mineralised intercept well over 100m below the current resource

Gascoyne Resources Limited (“Gascoyne” or “Company”) (ASX: GCY) is pleased to report the latest assay results received from ongoing resource and exploration drilling at the Dalgaranga Gold Project in Western Australia.

Key Points:

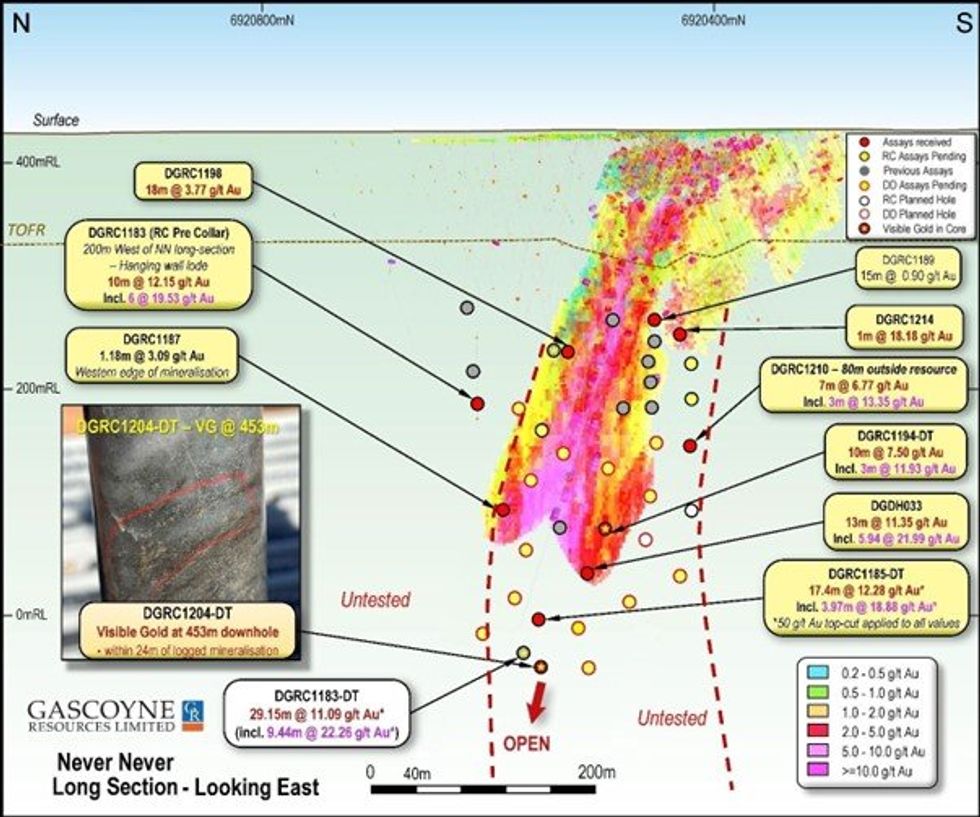

- Analysis of pre-collar RC chips from deeper Diamond Tail drillholes targeting Never Never at depth continues to return anomalous assays from a new shallow “hangingwall” position further west of the Never Never Gold Deposit.

- DGRC1183 (RC Pre-collar) returned the following assays in a new location;

- 10.0m @ 12.15g/t gold from 237.0m, including 6.0m @ 19.53g/t (DGRC1183-PC)

- This result follows on from DGRC1187-PC which returned 4m @ 24.46g/t gold from 160m downhole in the same new prospect area (reported 16 May 2023)

- 10.0m @ 12.15g/t gold from 237.0m, including 6.0m @ 19.53g/t (DGRC1183-PC)

- Deeper infill. DGRC1185-DT has intercepted;

- 17.4m @ 12.28g/t gold from 488.16m, including 3.97m @ 18.88g/t, infilling the untested area up-plunge from DGRC1183-DT (previously reported) and well below the current resource envelope.

- 17.4m @ 12.28g/t gold from 488.16m, including 3.97m @ 18.88g/t, infilling the untested area up-plunge from DGRC1183-DT (previously reported) and well below the current resource envelope.

- DGDH033 testing the lowest point of Unclassified material (unreported) from the current Never Never MRE has returned good confirmatory widths and grades in this area;

- 13.0m @ 11.35g/t gold from 403.0m, including 5.94m @ 21.99g/t (DGDH033)

- 13.0m @ 11.35g/t gold from 403.0m, including 5.94m @ 21.99g/t (DGDH033)

- DGRC1194-DT testing beyond the edges of the deeper southern portion of the current MRE returned;

- 10.0m @ 7.50g/t gold from 355.0m, including 3.0m @ 11.93g/t (DGRC1194-DT)

- 10.0m @ 7.50g/t gold from 355.0m, including 3.0m @ 11.93g/t (DGRC1194-DT)

- DGRC1210 has intercepted mineralisation 80m further south of the current MRE envelope and down dip of the footwall Gilbey’s stratigraphic sequence.

- 7.0m @ 6.77g/t gold from 318.0m, including 3.0m @ 13.35g/t (DGRC1210)

- 7.0m @ 6.77g/t gold from 318.0m, including 3.0m @ 13.35g/t (DGRC1210)

- New deep mineralised intercept. DGRC1204-DT intercepted ~24m of strong Never Never- style mineralisation from 445.7m downhole, including visible gold at 453m downhole. Assays pending.

Drilling continues to provide further insights into the potential scale, significance, and growth upside of the rapidly emerging Never Never gold deposit at Dalgaranga, with the latest assays returning significant high-grade mineralisation 110 metres below the current Mineral Resource Estimate (“MRE”) boundary.

Gascoyne Managing Director and Chief Executive Officer, Simon Lawson, said: “This round of assays is targeting and testing the extremities of the Never Never Gold Deposit system. We are looking to ascertain where the edges of this new system are for the upcoming MRE update.

We have another deep mineralised intercept with visible gold well below the current resource in DGRC1204-DT, with significant infill results within the deeper part of our upcoming resource update in DGRC1185-DT, there continues to be good widths and grades outside the resource to the south in DGRC1210 and at depth in DGDH033 and DGRC1194-DT illustrating that this mineralised system appears to be improving with depth, and to top that another solid high-grade hit, 10m @ 12g/t gold in the pre-collar of DGRC1183-DT. The deepest drill-hole assayed so far at Never Never returned an incredible 29m @ 11.09g/t gold from over 400m downhole and now we get 10m @ 12g/t from 237m in the same hole.!

To add to the growing high-grade Never Never system and the nearby high-grade prospects being discovered, the Company is drilling the deepest hole yet into Never Never targeting 550-600 metres down-plunge to test the depth extension. The Company is also drilling several high-priority high-grade targets in the near vicinity of Never Never and will provide an update as that work progresses. The exploration team is not resting on the Never Never discovery, but looking to take what has been learned and test other high-grade opportunities in and around the Dalgaranga mill as quickly as possible.”

Never Never is a new high-grade gold deposit which strikes and plunges to the west-south-west. The deposit was discovered while following up wide, high-grade drill intercepts from the earlier Gilbey’s North extension discovery immediately north of the Gilbey’s open pit at Dalgaranga. Due to the high-grade and apparent scale of Never Never, this deposit now represents the foundation of the Company’s new operating and growth plan.

Never Never is distinct from the Gilbey’s North discovery due to considerable differences in tenor, thickness of mineralisation, mineralogy, scale, orientation and host structure/rock-type. Despite these differences, due to the close spatial association of the two deposits, the Never Never and Gilbey’s North deposits are collectively known as the “Never Never Gold Deposit”.

Never Never is much higher grade than any of the previously defined ore bodies at Dalgaranga and appears to be far more structural, fold and/or shear-hosted as opposed to the more stratigraphic/shale- associated historically defined Gilbey’s series of gold deposits.

On 23 January 2023 Gascoyne released an updated Never Never Gold Deposit Mineral Resource Estimate of 303,100 ounces @ 4.64g/t gold (comprising 1.0Mt @ 2.45g/t for 86,500oz Au “Open Pit” (>0.5g/t Au) and 0.93Mt @ 7.22g/t for 216,600oz Au “Underground” (>2.0g/t Au)).

Please Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Click here for the full ASX Release

This article includes content from Gascoyne Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00