May 06, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) is pleased to advise the results of the Scoping Study for the first stage of the proposed Nueva Sabana gold-copper mine in Cuba. The Study has been prepared by the 50:50 Cuban joint venture company, Minera La Victoria SA (“MLV”), which is undertaking the project.

- The 752ha concession covering the Nueva Sabana deposit also hosts the El Pilar, Gaspar, and Camilo porphyry copper intrusives, and numerous shallow gold targets identified by artisanal mining.

- The Nueva Sabana deposit has a small 3g/t gold cap, an underlying copper-gold zone, and a deeper sulphide copper zone that is open at depth at 150m, and could potentially transition into the El Pilar porphyry copper deposit which is offset to the south.

- The Study has been based on a pit limited to 100m depth which at a mining rate of 500,000tpa of ore, will result in an initial mine life of 4 years.

- With additional exploration by the joint venture, and a greater mining depth, the project life and NPV could be increased.

- The Initial MRE for Nueva Sabana which is incorporated as ATTACHMENT A in the Study, established approximately 30M lb of 0.8% copper in Inferred Resources within the 50m below the planned 100m mining depth for the first stage of the development which is a positive indication of the potential to increase the mine life.

- Metallurgical testwork set out in ATTACHMENT C has indicated the mine will initially produce a gold concentrate with a grade of ~70.9g/t Au, followed by a blended copper-gold concentrate with an average grade of ~27.4% Cu, and 25g/t Au.

- The off-take agreement is expected to include a provision for advanced payments for concentrates by the buyer, to assist in the funding of construction costs.

Payables for these concentrates have been received from the two international commodity traders the joint venture is negotiating with to establish an off-take agreement.

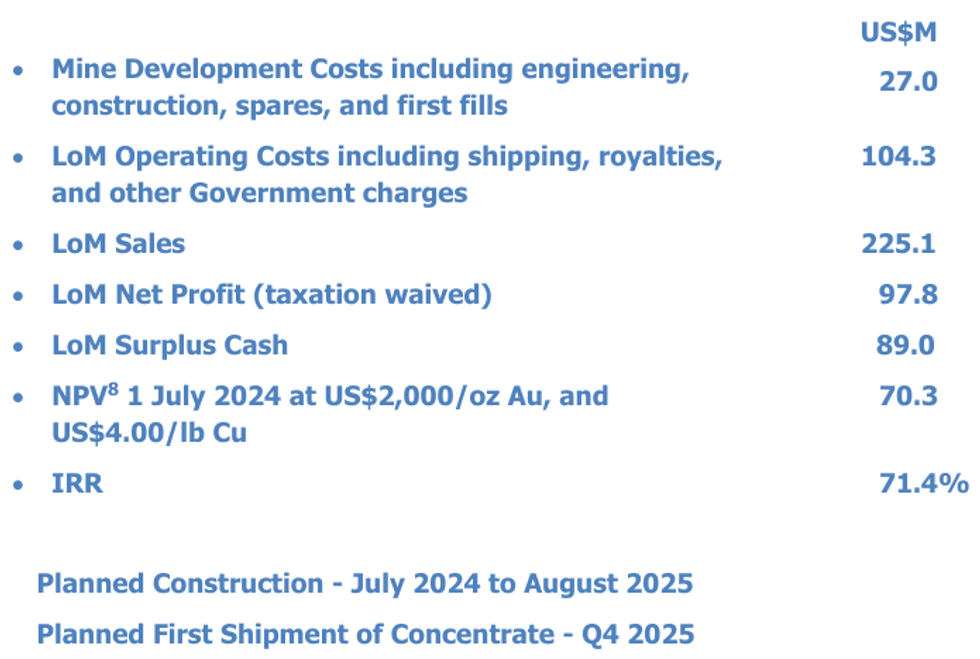

HIGHLIGHTS OF FINANCIAL ANALYSIS FOR STAGE ONE OF THE NUEVA SABANA MINE:

- Pre-development Costs of ~USD5.0M including the concession acquisition are being met by MLV

The Chairman of Antilles Gold, Mr Brian Johnson, commented that “even though the first stage of the Nueva Sabana project is quite small, it is fortunate that it will be development-ready within a short period of time.

This is economically advantageous considering the joint venture’s flagship development, the La Demajagua gold-silver-antimony mine, had to be delayed after being expanded to allow the production of a gold doré when the market for its gold-arsenopyrite concentrate became an issue in August 2023.

Antilles Gold intends to subscribe the final US$2.0M of its US$15.0M earn-in for a 50% shareholding in the joint venture company, Minera La Victoria (“MLV”), within the next few months. Thereafter, the Company’s cash burn will be substantially reduced.

If MLV decides to undertake an exploration program on the copper properties before cash flow becomes available from the Nueva Sabana mine in Q4 2025, the required capital will probably have to come from a share issue by MLV to Antilles Gold, and, or a third party.

With respect to this possibility, MLV has recently presented commercial propositions to two major investors interested in becoming a shareholder in MLV, and participating in the exploration of its highly prospective copper properties, and the development of La Demajagua, and other gold projects potentially available to the joint venture.

However, MLV’s near term priority is to finalise negotiations on a concentrate off-take agreement for Nueva Sabana, and to arrange project financing.

Antilles Gold’s share of the NPV8 for the first stage of Nueva Sabana is ~A$70M at current metal prices of US$2,300 per oz Au, and US$4.30 per lb Cu, and an exchange rate of A$1.00 = US$0.65, which is significantly higher than the Company’s current market capitalisation of A$10.4M.

The opportunity for growth will increase with the proposed development of the La Demajagua gold- silver-antimony mine, where the Company’s share of NPV8 reported to ASX on 30 March 2023 was ~A$150M, prior to the decision to expand the project to produce gold doré from its gold arsenopyrite concentrate, and increase antimony production.”

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

16h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

21h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

23h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

23h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00