(TheNewswire)

Sama Resources Inc. (" Sama " or the " Company ") (TSX-V:SME ) ( OTC:SAMMF) is pleased to announce that it has entered into an arrangement agreement (the " Arrangement Agreement ") with SRQ Resources Inc. (" SRQ "), a wholly-owned subsidiary of Sama, pursuant to which the parties intend to complete a spin-out transaction (the " Spin-Out ") of the SRQ common shares (the " SRQ Shares

The Spin-Out will be completed by way of a court approved plan of arrangement under the Canada Business Corporations Act (the " PoA "). Upon completion of the PoA, holders of common shares of Sama (" Sama Shares ") are to receive:

-

one new share in the reorganized capital of Sama ( New Sama Share ") for every one Sama Share held at the effective time of the PoA (the " Effective Time "); and

-

one SRQ Share for every ten Sama Shares held at the Effective Time.

"The SRQ Spin-Out marks a significant milestone for the Company and our shareholders. Following two years of grassroot efforts with exciting results on the SRQ properties, we believe this Spin-Out represents the best opportunity to create value for our shareholders and unearth the vast mineral potential of the Grenville region of Quebec," said M. Benoit La Salle, Executive Chairman of the Board for Sama Resources Inc.

Dr Marc-Antoine Audet, CEO and President of Sama Resources Inc. added "The SRQ Spin-Out represents an exciting chapter in our exploration journey for new base metals discoveries. Sama will continue to focus on the research and development of our base metal camp in West Africa, and SRQ will be solely focused on the creation of a North American nickel power play, notably with the Lac Brulé property in Quebec".

Further to the completion of the PoA, Sama shareholders will see their shareholding in Sama unchanged while obtaining the same pro rata participation in SRQ as their Sama Shares.

The Effective Time for determining the Sama shareholders who will be eligible to receive New Sama Shares will be announced by the Company in due course. For more details relating to the terms of the PoA, refer to the Arrangement Agreement which will be available on the Company's SEDAR profile.

While Sama's main business focus is on mineral exploration activities in West Africa, including notably its Samapleu Nickel-Copper project located in Ivory Coast (the " Sama Business "), the Spin-Out will allow SRQ to focus on mineral exploration and development operations in the province of Québec, Canada, specifically the properties of Lac Brulé and Lac Brennan (the " SRQ Business ").

The board of directors of Sama has determined that carrying out the PoA is in the best interests of Sama for numerous reasons, including the following:

-

The Sama shareholders will hold shares in two separate, focused, public companies.

-

Capital markets currently value the SRQ Business together with the Sama Business. By completing the Spin-Out, Sama believes that the capital markets will value the SRQ Business separately and independently of the Sama, which should create additional value for Sama shareholders.

-

Sama and SRQ will have separate board of directors and management. Each company will fill their roster with specialist who will focus on the growth and the advancement of the Sama Business and the SRQ Business, respectively.

-

The separation of Sama and SRQ is expected to expand the potential shareholder base of both companies and to allow each of them to access capital from investors focused on owning mining assets located in either Africa or Canada.

Sama intends to apply for a listing of the SRQ Shares on the TSX Venture Exchange (the " TSX-V "). Any such listing will be subject to SRQ fulfilling all requirements of the TSX-V.

Prior to the Spin-Out and as part of the PoA, Sama has funded SRQ with a cash injection of two million dollars. This capital injection allows SRQ to execute on its exploration objectives and meet the working capital listing requirement of the TSX-V. SRQ will be fully funded for the first phase of exploration. As such, a capital raise concurrently with the listing or immediately thereafter will not be necessary.

The PoA remains subject to customary conditions, including, among other things, the approval by the TSX-V, approval by an affirmative vote of two thirds of Sama shareholders in attendance at Sama's Annual and Special Shareholders meeting (the " Meeting "), and approval of the Superior Court of Québec. There can be no assurance that such approvals will be obtained or that the PoA will be completed on the terms contemplated, or at all.

Additional details of the PoA will be included in the information circular to be mailed to shareholders of Sama in connection with the Meeting which will be available on the Company's SEDAR profile. The Meeting is scheduled to be held in person, at the Company's offices, on June 29, 2023, at 10:00 AM (EDT).

The securities to be issued under the PoA have not been and will not be registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States absent registration or applicable exemption from registration requirements. It is anticipated that any securities to be issued under the PoA will be offered and issued in reliance upon the exemption from the registration requirements of the U.S. Securities Act of 1933 provided by Section 3(a)(10) thereof.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, any securities.

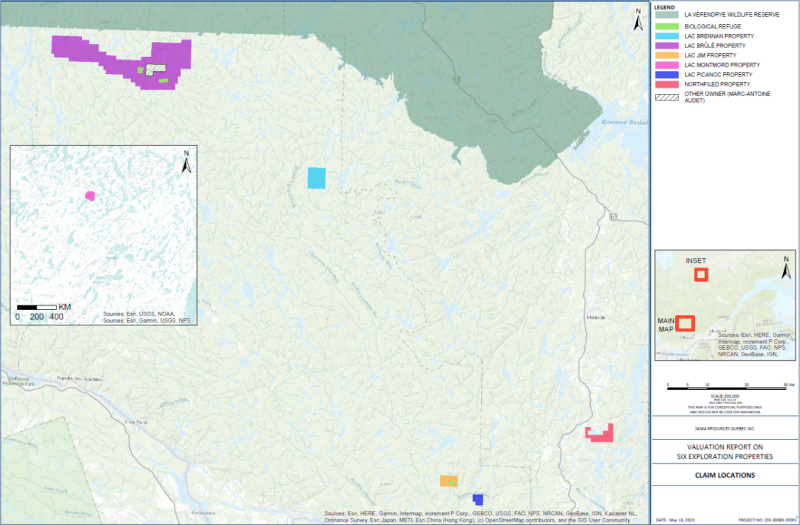

SRQ properties in Quebec province

SRQ owns a total of 525 exploration claims in the province of Québec, Canada , related to 6 different properties.

The Lac Brûlé property is the most advanced exploration target and consists of 401 contiguous mining claims covering an area of approximately 23,165 ha. It is located approximately 148 km west-northwest of the town of Mont-Laurier ( Figure 1 ). The Lac Brûlé claims are located in National Topographic System (NTS) map sheets 31K/13 and 31K/14 and are centered at approximately grid coordinates 314,700 mE and 5,198,400 mN (UTM Zone 18, NAD 83).

The Lac Brennan property consists of 42 contiguous mining claims covering an area of approximately 2,480 ha, located approximately 100 km north-northwest of Mont-Laurier. The Lac Brennan claims are located in NTS map sheet 31K/10 and are centered at approximately 340,000 mE, 5,165,000 mN (UTM Zone 18, NAD 83).

The Lac Jim property comprises 21 mining claims covering approximately 1,178 hectares.

The Lac Picanoc property includes 11 mining claims covering approximately 658 hectares, while the Northfield property encompasses 31 mining claims spanning approximately 1,843 hectares. These properties are all located within approximately 100 km of Gatineau, Québec.

The Lac Montmord property consists of a single contiguous block totalling 19 claims covering an area of approximately 1,025 ha. It is located 160 km north of Chibougamau, Québec.

Figure 1: SRQ properties in the province of Québec

In May 2021, Dr. Audet undertook an initial field visit to confirm his hypothesis regarding the mineralization potential of the Lac Brûlé property. The area of interest was characterized by a significant

deformation pattern outlined by regional magnetism and strong regional gravity response. The presence of the old Renzy nickel (" Ni ") and copper (" Cu ") mine located 50 kilometres to the south-east and at the centre of this large regional pattern added to its appeal for mineral exploration.

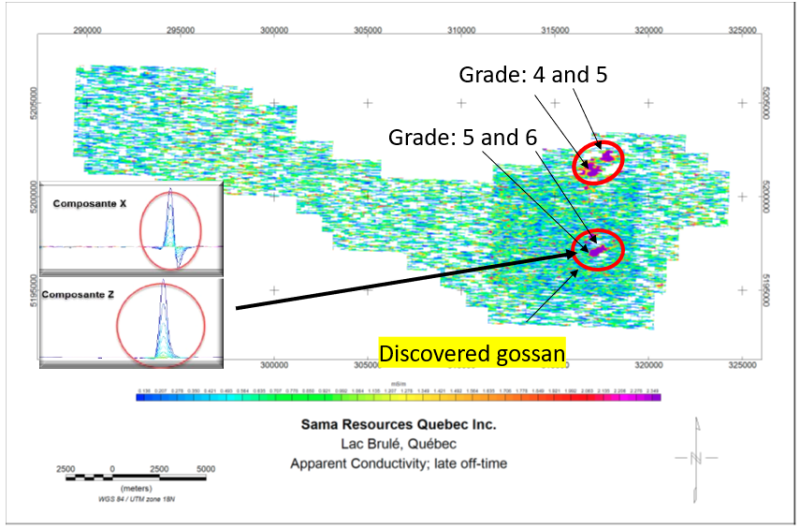

The initial field investigation was made easier by the presence of established bush tracks left behind from previous logging activities. During the visit, a well-developed gossan ( gossans are highly ferruginous rocks which are the product of the oxidation by weathering and leaching of a sulfide body: Elsevier Mineral Exploration 2013 ) was found in close proximity to the location indicated by SRQ's base metal exploration matrix. Additional visits in July and September 2021 further strengthened and refined the initial geological investigation.

The geology of the property surrounding the discovery gossan outcrop can be summarized by the following geological succession from bottom to top. At the base is a mineralized sequence of pyroxenite,

followed by a garnet-rich mafic horizon. Above that is a sequence of felsic migmatite gneiss, which is then succeeded by a horizon of garnet amphibolite, which is a few metres thick. Finally, there is another sequence of felsic migmatite gneiss. Metamorphism is of high grade. It varies from amphibolite facies to granulite facies. The regional structure has significant deformations, but it is notable that the regional foliation is characterized by a very low dip of 15° to 20 °. The pyroxenite unit shows a discrete mineralogical foliation weakly dipping towards the south.

Readers are referred to previous press releases (" PR ") describing the discovery of the gossan as well as showing results from an airborne HELITEM II electromagnetic survey flown in December 2021 ( Figure 2 ) (Ref: PR June 16, 2021: Sama acquires 370 exploration claims following the discovery of a mineralised gossan at the new Lac Brulé project, and PR March 22, 2022; Sama complete 1,494 line-km of HELITEM II survey ).

The Company is targeting possible accumulations of nickel and copper mineralisation at the Lac Brûlé property that could be of similar nature to that at the nearby defunct Renzy Ni-Cu mine, the Voisey's Bay Ni-Cu mine and at other well-known Ni-Cu deposits in Canada and worldwide.

Figure 2: Apparent Conductivity: late off-time channel/gates showing several distinc high conductivity areas at the Lac Brûlé property. The X and Z responses of the strong conductor (Conductor Grade: 5 and 6) located 300 metres east of the surface gossan are also shown.

The technical information in this release has been reviewed and approved by Dr. Marc-Antoine Audet, Ph.D. Geology, P.Geo and President and CEO of Sama, and a ‘qualified person', as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Sama Resources Inc.

Sama is a Canadian-based, growth-oriented resource company focused on exploring the Samapleu nickel-copper project in Côte d'Ivoire, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama is committed to developing and exploiting the Samapleu Nickel-Copper and Platinum Group Element Resources.

Sama's projects are located approximately 600 km northwest of Abidjan in Côte d'Ivoire and are flanked to the west by the Ivorian and Guinean borders . Sama's projects are located adjacent to the large world-class nickel-cobalt laterite deposits of Sipilou and Foungouesso, forming a 125 km-long new Base Metal Camp in West Africa.

Sama owns 70% interest in the Samapleu nickel-copper project in Côte d'Ivoire with its joint venture partner Ivanhoe Electric owning 30%. Ivanhoe Electric has the option to purchase up to a 60% interest in the project.

For more information about Sama, please visit Sama's website at www.samaresources.com .

Contact Information:

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835 or (877) 792-6688, Ext. 5

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the completion of the conditions of the Arrangement, the listing of SRQ on the TSXV, the proposed board of directors and management team of SRQ, the effects of the Arrangement on the Company and SRQ, the ability of SRQ to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with SRQ's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.