March 13, 2024

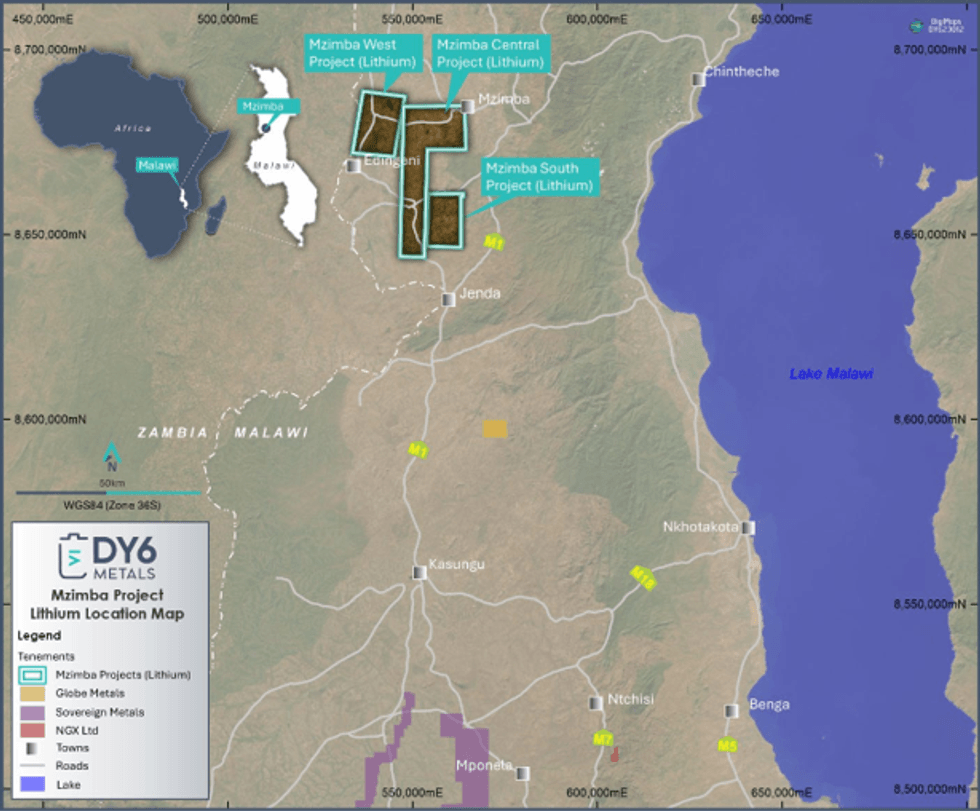

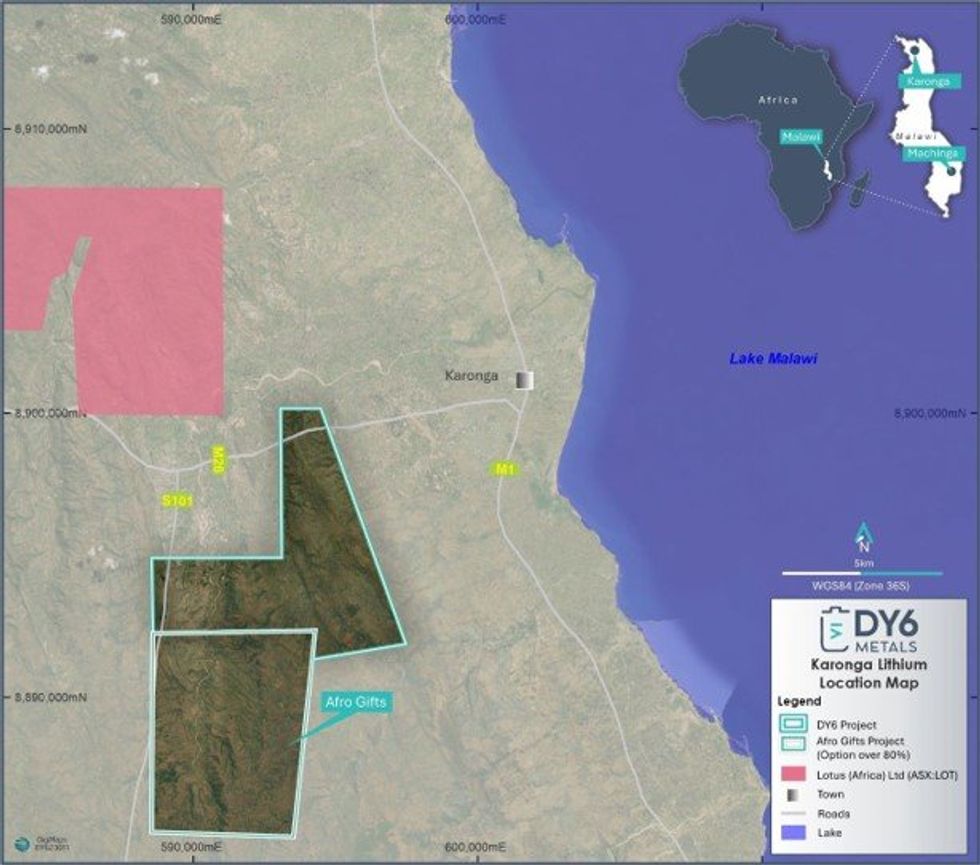

DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to provide this update to shareholders on its initial lithium focused ground reconnaissance program completed late last year at its Mzimba South (Figure 1) and Afro Gifts (Karonga South) licence (Figure 2).

HIGHLIGHTS

- DY6 has undertaken the first lithium focused exploration program reported in Malawi – initial reconnaissance indicates huge potential for a major Li discovery

- Initial ground reconnaissance sampling at Mzimba South licence returned grades of 6.2% Li2O (lepidolite mica) and 0.3% Li2O (pegmatite rock assemblage), and also high in cesium and rubidium with significant potential for LCT pegmatite hosted mineralisation

- The first pass program at Mzimba South consisted of 8 samples from 5 outcrop locations, where artisanal workers have been excavating pegmatites for gemstones (tourmaline, aquamarine and beryl)

- The exposed pegmatites are heavily kaolonised, with the lepidolite and quartz zones appearing less weathered

- A recent follow-up rock chip sampling program consisting of 6 samples from 6 outcrop locations has been undertaken at Mzimba South and Central, with samples being prepared for dispatch to SGS South Africa

- The Mzimba licences cover a very large area (710.5km2) and remain significantly underexplored for LCT pegmatites

- DY6 has recently submitted environmental and social management plans (ESMPs) for Mzimba, Karonga and Tundulu, with the licences expected to be granted in the coming weeks

- Following grant, DY6 is preparing to undertake a more detailed mapping and sampling program across these new lithium projects

Assay results were received from eight (8) samples from Mzimba and eleven (11) samples from Karonga project (Afro Gifts Licence Area) providing indications of locally fractionated pegmatite systems which have the potential to host lithium mineralisation. The Mzimba samples were collected from an artisanal mining area in the Southern licence targeting gemstones with the pegmatites identified by observing the presence of weathered quartz, large flakes of weathered biotite, muscovite and phlogopite micas and kaolinised feldspars (Figure 3).

One rock chip sample composed predominantly of Mica with minor Quartz, and Feldspar returned exceptional Lithium grade (Li2O) of 6.2% and notably high in Cesium (Cs) and Rubidium (Rb), all excellent LCT mineralisation pathfinders. The samples were collected at the far NE region of the southern licence with the observance of outcropping along strike direction ranging NNE to WSW. (Figure 4). Furthermore, on a visual observation perspective, the topography and geology of the three Mzimba tenements are similar and as such the strike length of the pegmatites of the three tenements combined is significantly high.

The standout rock chip samples were:

- 0.279% Li2O, 1,018ppm Cs and 3,802ppm Rb (01A)

- 6.20% Li2O, 3,089ppm Cs and >10,000ppm Rb (01C)

The sample (01C) highlighted in (Figure 5a) has a low K:Rb (potassium to rubidium) ratio <7 indicating the prospectivity of Mzimba with numerous pegmatite zones identified to date. The analysis and anomalous Rb concentration along with mineral identification implies the presence of lepidolite mineralisation in the sample. A similar rock chip sample (MZB006) (Figure 5b) was collected from the same district in a recent field visit in February and appears composed of lithium hosted in Lepidolite mica. Pegmatites and potential lithium rich micas are evident across the Mzimba prospects with future exploration work to determine the extent of the lithium bearing pegmatites.

Our early-stage assays of 11 samples of pegmatite intrusions at Karonga South have delivered the geochemical information required to develop an understanding of the intrusive fractionation processes that have occurred in the district and identifying the location of fractionated rocks is the first important step to the discovery of pegmatitic LCT mineralisation. The initial sampling focused on a small area of the Afro Gifts licence and future exploration in the coming weeks will target a strike zone from South to North.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

1h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00