November 05, 2024

With a market capitalization of approximately C$10 million and no debt, Riverside Resources (TSXV:RRI) has successfully advanced over 80 exploration projects and has completed seven successful spinouts and royalty transactions over its 17-year history. Founded in 2007, the company focuses on precious and base metals, with a unique business model designed to minimize financial risk while maximizing exploration opportunities.

Riverside's diversified portfolio spans different geographies and commodities, including gold, silver, copper and rare earth elements (REE) in Ontario and British Columbia in Canada, and across Mexico. Riverside is well-capitalized, with over $5 million in cash on hand, no debt, and a well-established royalty portfolio. This strong financial position allows the company to continue exploring new opportunities while reducing operational risks.

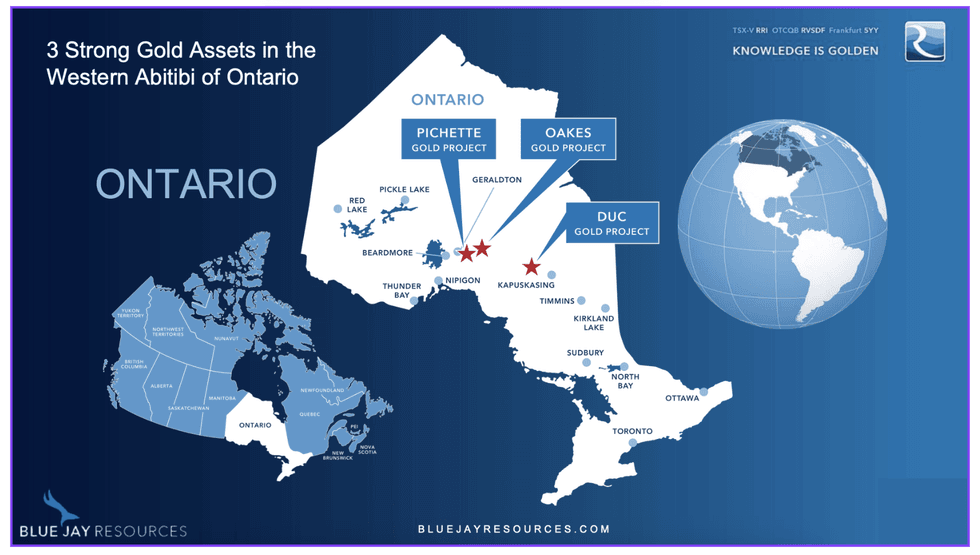

Riverside Resources' Ontario-based gold projects are located in the Western Abitibi region, one of Canada's most prolific gold-producing areas. The company's assets are near Equinox Gold's Greenstone gold mine, which provides significant potential for future development or acquisition. The Greenstone mine is expected to produce more than 390,000 ounces of gold annually for the first five years of its over 15 years of mine life. As this mine nears the end of its life, Riverside's nearby properties could provide valuable ore, potentially making them attractive targets for acquisition by Equinox or other major players in the region.

Company Highlights

- Riverside Resources has successfully advanced over 80 exploration projects using more than $85 million in partner-funded exploration.

- Riverside’s Ontario gold projects are strategically located near Equinox Gold’s Greenstone Mine, offering significant potential for future development or acquisition.

- The Cecilia gold-silver project in Sonora, Mexico, is advancing through a partner-funded drilling program with Fortuna Silver Mines, offering significant discovery potential.

- With over C$5 million in cash and no debt, Riverside Resources is financially strong, ensuring sustained exploration activity.

- The company has completed seven successful spinouts and royalty transactions over its 17 year history, creating substantial value for shareholders.

- The company’s business model minimizes financial risk by partnering with larger companies, enabling multiple simultaneous exploration projects.

This Riverside Resources profile is part of a paid investor education campaign.*

Click here to connect with Riverside Resources (TSXV:RRI) to receive an Investor Presentation

RRI:CC

The Conversation (0)

03 November 2024

Riverside Resources

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico Keep Reading...

10h

Metallurgical Testwork Commences at Oaky Creek High Grade Antimony Prospect

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the commencement of metallurgical testing work for the... Keep Reading...

13h

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

13 February

Editor's Picks: Gold, Silver Prices Dip and Bounce Back, Plus Top Takeover Candidate

Gold and silver were having a fairly quiet week until Thursday (February 12), when both precious metals experienced steep drops early in the day.The gold price, which had been steady above US$5,000 per ounce, and even briefly breached US$5,100, tumbled by over US$100, bottoming out around... Keep Reading...

13 February

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00