July 06, 2023

Quimbaya Gold (CSE:QIM) is ideally positioned to become one of the most significant explorers in Colombia with over 40,000 hectares of mining assets across three projects. The company's Maitamac project is situated in an underexplored mineral district of Abejorral in the central cordillera. Known for its importance in Colonial times, the district and its surrounding regions host multiple world-class gold deposits and large-scale projects, including El Bagre, Gramalote, El Roble and Marmato. Prudent Minerals first began exploring Abejorral in 2020, with the establishment of its highly prospective Abe Gold Project.

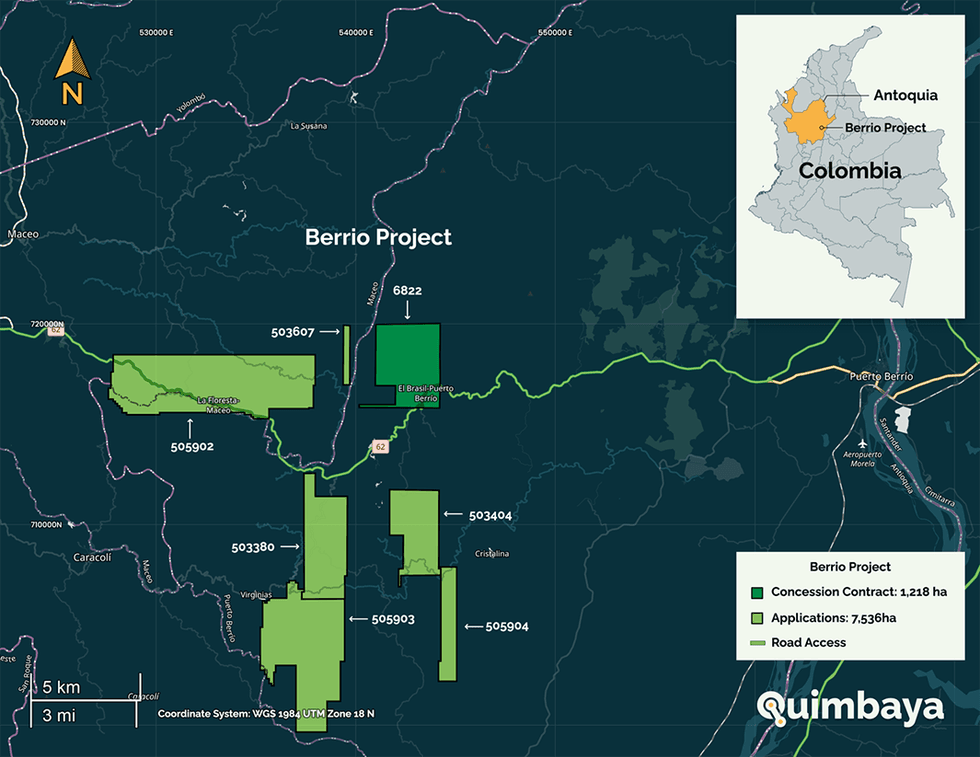

The Tahami and Berrio, are located in the Northeast Antioquia Region — the leading source of gold production in the country for centuries. The Segovia asset, held by GCM Mining (now known as Aris Mining), is arguably one of the most significant in the entire region. It's also a close neighbor of the Tahami Project and shares a geological corridor with Berrio.

Quimbaya's most valuable asset by far, however, is its people. The company has assembled a powerhouse team, combining extensive mining and corporate finance expertise with strong ties to communities throughout the country. Quimbaya's leadership includes Ernesto Cardenas, creator of the first interactive mining register in the country.

Company Highlights

- Quimbaya Gold is one of 10 junior mining companies and one of the most promising early-stage exploration companies in Colombia.

- Quimbaya has acquired over 40,000 hectares of mining assets with significant potential for high-grade gold, silver and copper along with the possibility of discovering Colombia's next world-class deposit.

- The company's three projects are all situated in Antioquia, considered the best mining district in Colombia. All three projects are surrounded by successful gold production operations, providing the company easy access to critical infrastructure.

- Quimbaya has a good capital structure and tight float, with 56 percent of shares held by the company's management and board of directors.

- Quimbaya employs a local team with strong community ties and an understanding of the region and its geology, including how to navigate Colombia's current political and environmental requirements.

- Quimbaya offers great value compared to competitors, with a current market cap of roughly C$7 million.

This Quimbaya Gold profile is part of a paid investor education campaign.*

Click here to connect with Quimbaya Gold (CSE:QIM) to receive an Investor Presentation

QIM:CC

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 July 2025

Quimbaya Gold

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district Keep Reading...

29 May 2023

Quimbaya Gold Inc. Announces Investor Relations Agreement

/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES / Quimbaya Gold Inc. (CSE: QIM) ("Quimbaya") is pleased to announce that it has entered into an Investor Relations Agreement (the "Agreement") with Pietro Solari (address: Torre de las Americas... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00