- WORLD EDITIONAustraliaNorth AmericaWorld

July 27, 2022

The Board of Galan Lithium Limited (Galan or the Company) is pleased to provide this Quarterly Activities Report for the quarter ended 30 June 2022 to the date of this report. The main focus for the quarter was the ongoing Definitive Feasibility Study (DFS) and associated works/activities and further drilling at its high-grade Hombre Muerto West (HMW) Project in Argentina as well as continued exploration at the Greenbushes South lithium project in Western Australia.

HIGHLIGHTS

- Outstanding initial well test results reported from first Pata Pila pumping well (PPB-01-21) at HMW Project

- Brine sampling confirmed high grade resource (Li > 910 mg/L)

- Hydraulic testing demonstrated favourable conditions for high volume brine production (15 – 20L per second)

- Long term (30-day) pumping tests underway and flowing steadily

- Positive results returned from porosity test (RBRC) on second Pata Pila well core samples (range of 10.21 – 21.0%, mean of 14.1%)

- Pumping tests to be completed on three further wells: a second well at Pata Pila and two wells at Rana de Sal

- HMW Project Definitive Feasibility Study activities continued during the quarter

- First pegmatite lens discovered at Greenbushes South

- Airborne radiometric, magnetic and DEM survey data processed

- Interpretation provided 18 key target zones for lithium pegmatites near the mineralising Donnybrook-Bridgetown Shear Zone

- Further soil samples and rock chips sent for geochemical analysis

- Key appointments

- Mr Alvaro Henríquez (ex SQM) commences as Geology Manager

- Ausenco commences as EIA consultant

- Galan continues to adhere to Covid-19 protocols in Argentina, Chile and Australia with personnel and community health and safety its number one priority

- Cash on hand at end of quarter was ≈A$54 million

OPERATIONS

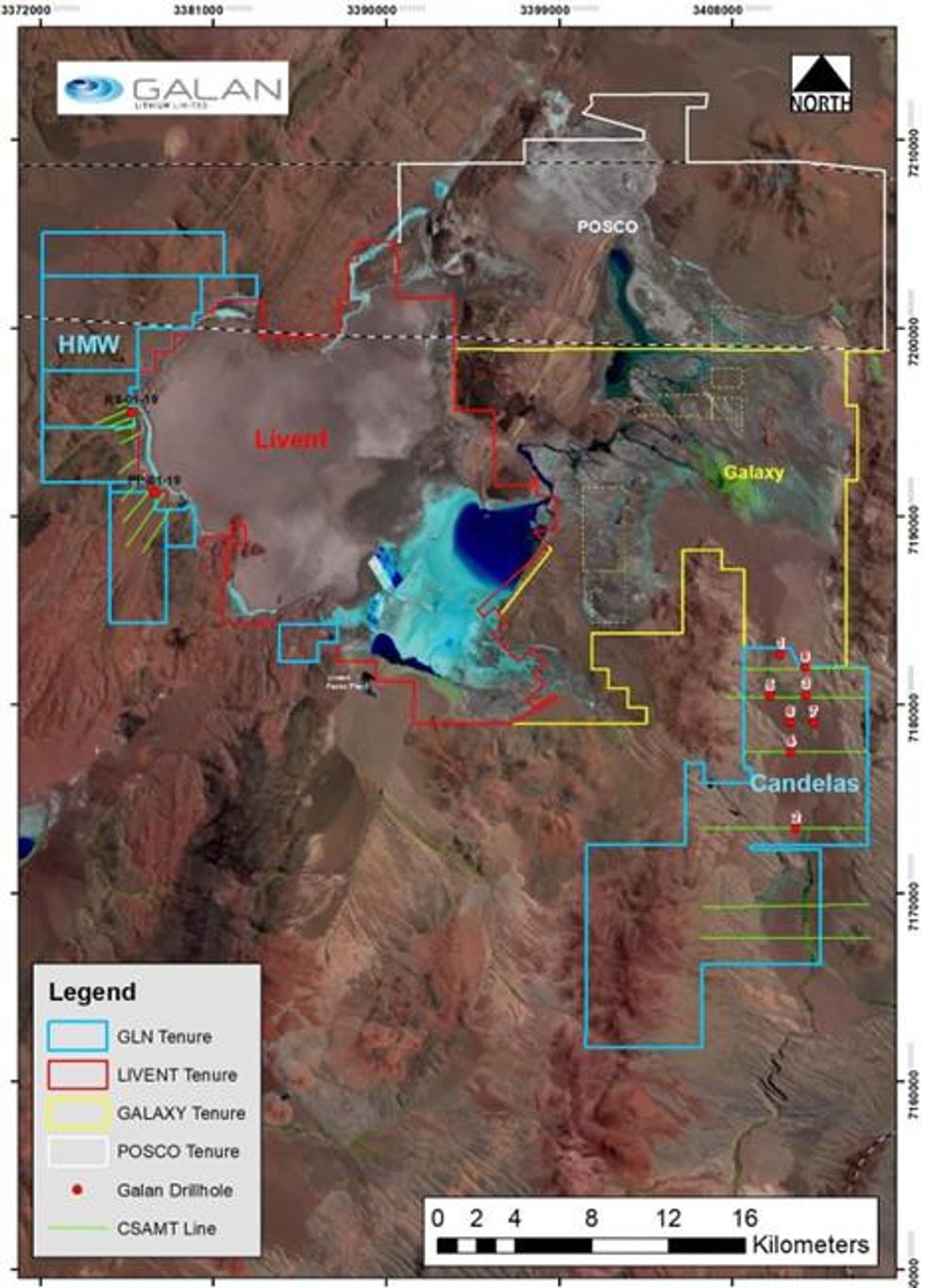

Figure 1: Galan’s HMW and Candelas concessions in Argentina have a current combined total Indicated Resource of ~ 3Mt LCE @ 858mg/l Li.

Hombre Muerto West (HMW) Project

On 14 July 2022, Galan provided an update on its well drilling and other DFS activities.

Galan’s Managing Director, JP Vargas de la Vega, said:

“We are extremely pleased with the outcomes from the 3-day constant rate pump test at the first Pata Pila well, PPB-01-21. High lithium grades, porosity and brine flow rates are a powerful combination for driving operational efficiency and economic performance. These outstanding hydrological outcomes are paramount to the project DFS foundations and further validates the world-class nature of the lithium brine resource we hold at HMW.

The results are a ready demonstration of the substantial progress we are making in advancing the Project. They also represent key de-risking of the planned HMW development. While we are focussed on a substantially lower risk, conventional process route and project development at HMW, we are ensuring that every aspect of our planned operation at HMW is comprehensively evaluated and proven, both technically and commercially.”

Click here for the full ASX Release

This article includes content from Galan Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00