April 27, 2022

Latin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is pleased to report on its activities for the three months ending 31 March 2022.

Highlights

Salinas Lithium Project, Brazil

- Diamond drilling permits for the Company’s maiden drilling campaign were approved in January 2022, and drilling commenced February 2022.

- High-grade lithium assays were returned from the first drill hole, with logging confirming the continuity of high-grade lithium pegmatites and the thickening of the logged pegmatites to the south, with the logged mineralisation open along strike and down dip.

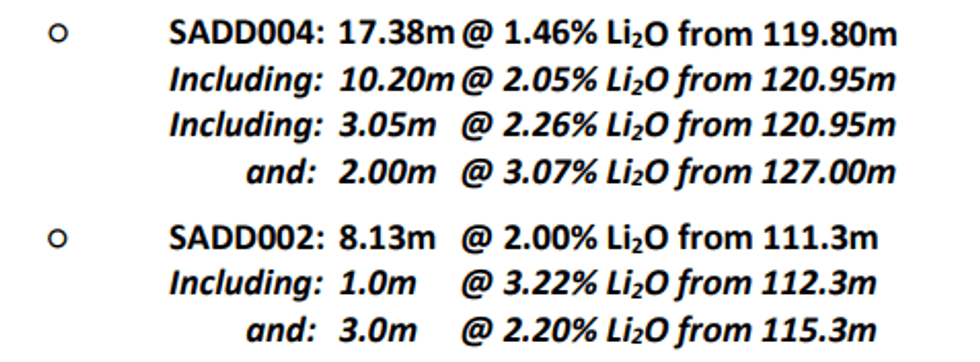

- Assay results included:

- Additional tenure was secured with the 50-hectare Monte Alto lithium tenement, to the east of its existing position, in the highly prospective Bananal Valley district in eastern Brazil.

Cloud Nine Halloysite-Kaolin Deposit, WA

- High-grade halloysite results were received from close spaced drilling in January 2022 and large diameter drilling commenced in March 2022.

- The Company has commenced the permitting and approvals process in parallel with the ongoing resource estimation work, including application for a trial mining test-pit; applications to convert the current Exploration Licence to a full Mining Licence; and scheduling for the commencement of baseline environmental studies.

Environmental, Social and Governance (ESG)

- Latin advanced progress on its ESG reporting measures, refer to Appendix 2 for the latest ESG Report for period ending 31 March 2022.

Corporate

- Latin held $3.4 million in cash and $1.9 million in investments as at 31 March 2022.

- The Company received $1.8 million in cash from option holders exercising in-the-money LRSOC Options ($0.012 LRSOC, Expiry 31 Dec 2022) during the quarter.

- Subsequent to the end of the quarter, Latin raised $35 million in a placement anchored by Canadian cornerstone investor, Electrification and Decarbonization AIE LP Fund.

At the Salinas Lithium Project in Brazil, drilling permits were approved1 and drilling commenced on the Company’s maiden diamond drilling program with 14 holes planned for a total of 2,000m2 . The diamond drilling program confirmed multiple zones of spodumene pegmatites345 and high-grade lithium assays were returned.

Subsequent to this reporting period, additional tenure was secured with a further 50-hectare lithium tenement, to the east of its existing position in the highly prospective Bananal Valley district in eastern Brazil.

The Company made progress on the Cloud Nine Halloysite-Kaolin Deposit (“Cloud Nine”) during the quarter, with ongoing infill drilling confirming high-grades and continuity within the area9 . Large diameter diamond drilling commenced to provide an upgrade of the JORC Mineral Resource and to provide samples for detailed metallurgical test work.

Permits were submitted to conduct trial mining via a small test-pit10, allowing Latin to:

- Collect a large sample for bulk metallurgical testing; and

- Provide product samples to a number of potential offtake partners for their qualification test work.

As has been the case for the past two years, the Company is working with Governments to observe best practices and procedures are in place to manage staff, contractors and activities during the Covid19 pandemic.

1. SALINAS LITHIUM PROJECT, BRAZIL

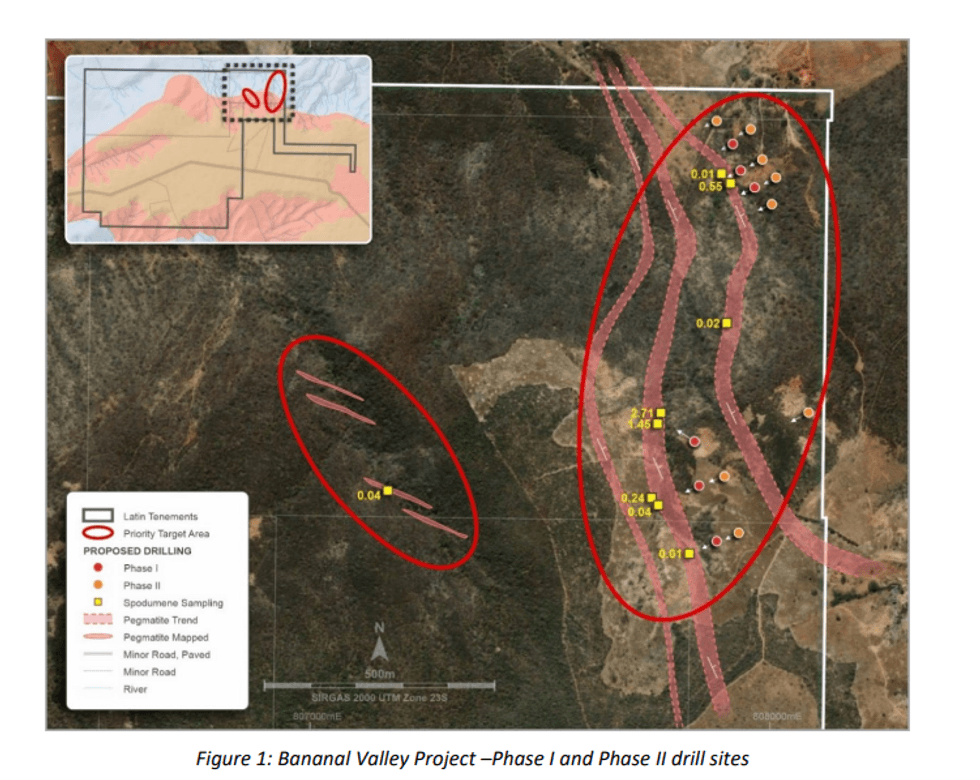

During the quarter, the Company had drilling permits approved to commence a program of diamond drilling on 14 drill sites to test the outcropping high-grade Li bearing pegmatites identified in previous mapping and geochemical sampling programs.

The drilling was designed to test two priority target areas (Figure 1) where sampling had previously returned multiple high-grade results including 2.71% Li2O and 1.45% Li2O from highly weathered spodumene bearing pegmatites, mapped over a strike length of over 1.2 kilometres within the Company’s tenure.

The drilling campaign is the first drilling to test this highly anomalous and outcropping mineralised trend in an underexplored region that currently contains 100% of Brazil’s official lithium reserves.

Click here for the full ASX Release

This article includes content from Latin Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

22h

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00