September 03, 2024

Commissioning of second NIMCIX column underway, ensuring Honeymoon remains on track to meet FY25 production target of 850,000lbs of U308 as set out in Feasibility Study

Boss Energy Limited (ASX: BOE; OTCQX: BQSSF) ) is pleased to provide an update on the strong progress being made as part of the commissioning and production ramp up at its Honeymoon Uranium Mine.

Highlights

Operations

- Commissioning and ramp-up to steady-state production proceeding to plan, with key production metrics meeting Feasibility Study forecasts

- First NIMCIX production column achieves nameplate uranium production

- A total of 72,516lbs of uranium produced in the months of July and August

- Preliminary updates on costs to be provided once the second and third IX circuits (NIMCIX columns) are commissioned

Construction

- NIMCIX production column 2 constructed with hydrotesting completed

- Wet commissioning and sequence testing of column 2 underway, on target for production in September 2024 as scheduled

- Second wellfield being flushed in preparation to supply Pregnant Leach Solution (PLS) to column 2

- RO Plant 2 commissioned and operating in line with expectations

- Construction of NIMCIX column 3 on target for commissioning and production in December quarter, 2024

Boss Managing Director Duncan Craib said: “We continue to meet or exceed all of our key targets and are comfortably on track to meet our production guidance.

“The first IX circuit is now operating at nameplate capacity, proving that the technology works at the rate and scale forecast in the Feasibility Study. This is a pivotal point in the project’s development. “Commissioning of the second IX circuit is underway and construction of the third is advancing rapidly.

“Supplies of the pregnant leach solution, grades and extraction rates are meeting or exceeding our targets and overall uranium production rates are rising in line with the schedules in the Feasibility Study”.

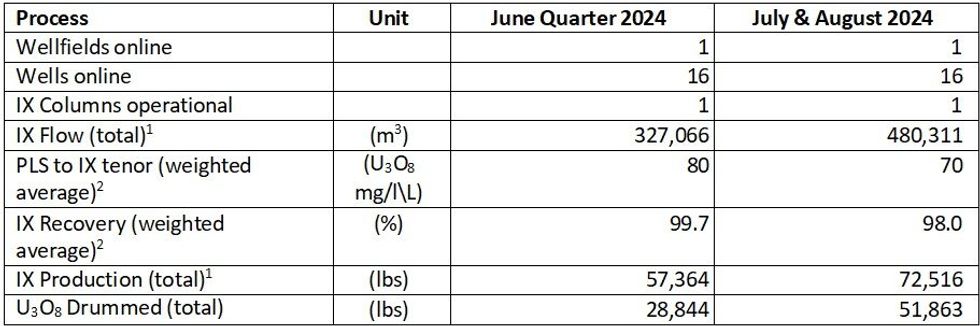

Honeymoon Production Results for months of July and August 2024

On 22 April 2024, the Company was pleased to announce a major milestone with production of the first drum of uranium at its 100 per cent-owned Honeymoon Uranium Project in South Australia.

As expected, and in-line with Feasibility Study forecasts, Honeymoon’s production continues to increase as set out in the results for the combined months of July and August 2024.

In August 2024, NIMCIX column 1 achieved nameplate production.

Bringing each new NIMCIX production column online will result in a proportional increase in production and lower the cost per pound produced.

Notes: (1) Conversions: There are 1,000 litres per m3 and 0.0000022 lbs per mg. (2) The weighted average is calculated based on total flow for the quarter.

Plant recovery continues to improve with production optimisation. The variance between IX Production and U308 drummed is due to a build-up of inventory in circuit as well as losses from the circuit. During commissioning and ramp up, losses from the precipitation and dewatering circuits were higher than design which has been a focus for the operations team over the previous month. Losses have been reduced to circa 3.5% in August as improvements were, and continue to be, implemented.

It is important to note that while the tenors being achieved from initial wellfields exceed the average LOM tenors forecast in the Feasibility Study1, the project is still in the ramp-up phase and therefore these tenors should not be extrapolated across the LOM. Boss’ production guidance remains based on the forecast tenors contained in the Feasibility Study.

Given the time taken to ramp-up wellfields in ISR projects, preliminary cost updates will be provided once columns 2 and 3 are commissioned.

Since acquiring Honeymoon in December 2015, Boss has invested significant time and capital in making technical improvements to the project. Boss has now been able demonstrate that the first NIMCIX column can operate at nameplate uranium production which adds confidence that the Company will meet its FY25 production target of 850,000 lbs of U308 as set out in Feasibility Study.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00