1.17% Ni, 0.80% Cu, 0.08% Co, 1.46 ppm Pd and 0.23 ppm Pt over 25.86m in PN-22-009

Including 11.00m @ 1.50% Ni, 0.93% Cu, 0.10% Co, 1.85 ppm Pd and 0.36 ppm Pt

and 1.80m @ 1.97% Ni, 0.41% Cu, 0.14% Co and 2.03 ppm Pd

Highlights

- Recent assay results from the current drill program at the Nisk deposit continue to return high-grade Ni-Cu- Co sulfide and PGE mineralization.

- Significant results from this batch of assays include:

- 25.86m @ 1.17% Ni, 0.80% Cu, 0.08% Co, 1.46 ppm Pd and 0.23 ppm Pt (PN-22-009)

- And: 11.00m @ 1.50% Ni, 0.93% Cu, 0.10% Co, 1.85 ppm Pd and 0.36 ppm Pt

- Including 1.80m @ 1.97% Ni, 0.41% Cu, 0.14% Co, 2.03 ppm Pd

- And: 11.00m @ 1.50% Ni, 0.93% Cu, 0.10% Co, 1.85 ppm Pd and 0.36 ppm Pt

- Visual observations of the core confirm semi-massive to massive sulfide mineralization in holes PN-22-008, PN-22-010, PN-22-012 and PN-22-017

- Mineralization intercepted 150m below the deepest known intercepts

- Drilling is to be extended by another 7,500 m to 10,000 m in Q1 2023

Power Nickel Inc. (the "Company" or "Power Nickel") (TSX-V:PNPN, OTCQB:CMETF, Frankfurt:IVVI) is pleased to announce initial results from its current drill program at its "Nisk" project near James Bay. These initial drill results confirm the presence of high-grade Ni-Cu-Co-PGE mineralization in the Nisk Main zone and extends mineralization by an additional 150 m at depth and to the east and below to the central portion

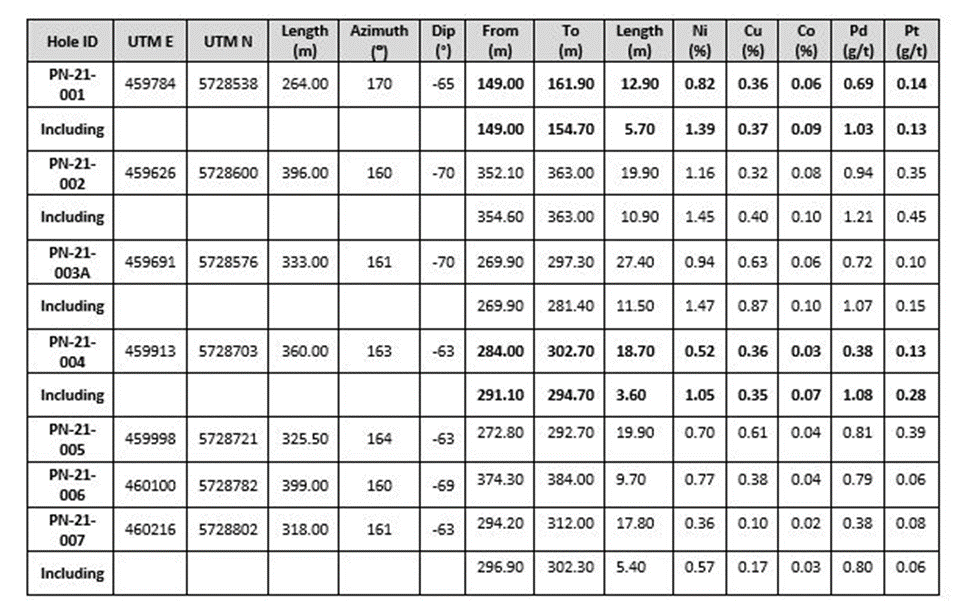

While assay results are still pending for most of the holes drilled to date, results received so far are very encouraging and continue to demonstrate the robustness of the system. Table 1 below presents the significant results received to date.

Table 1: Significant results from the current 2022 drilling program.

Hole ID | UTM E1 | UTM N1 | Length (m) | Azimuth (°) | Dip (°) | From (m) | To (m) | Interval Length(m)2 | Ni (%) | Cu (%) | Co (%) | Pd (g/t) | Pt (g/t) |

PN-22-008 | 459978 | 5728698 | 408 | 159 | -73 | PENDING | |||||||

PN-22-0094 | 459889 | 5728656 | 411 | 160 | -73 | 337.70 | 363.56 | 25.86 | 1.17 | 0.80 | 0.08 | 1.46 | 0.23 |

Including | 337.70 | 342.00 | 4.30 | 1.28 | 0.56 | 0.09 | 1.88 | 0.20 | |||||

and | 344.75 | 355.75 | 11.00 | 1.50 | 0.93 | 0.10 | 1.85 | 0.36 | |||||

PN-22-0103 | 459948 | 5728683 | 327 | 160 | -68 | PENDING | |||||||

PN-22-011 | 459857 | 5728679 | 355 | 164 | -60 | PENDING | |||||||

PN-22-012 | 459709 | 5728637 | 465 | 160 | -75 | PENDING | |||||||

PN-22-0133 | 459623 | 5728604 | 480 | 154 | -78 | 475.00 | 479.70 | 4.70 | 1.11 | 0.54 | 0.09 | 0.58 | 0.07 |

Including | 476.00 | 478.50 | 2.50 | 1.60 | 0.54 | 0.13 | 0.65 | 0.06 | |||||

PN-22-0143 | 460001 | 5728714 | 516 | 160 | -80 | PENDING | |||||||

PN-22-0153 | 460176 | 5728829 | 544 | 160 | -75 | PENDING | |||||||

PN-22-0163 | 460313 | 5728831 | 321 | 157 | -63 | PENDING | |||||||

PN-22-0173 | 459534 | 5728554 | 333.5 | 156 | -68 | PENDING | |||||||

PN-22-018 | 459534 | 5728552 | 465 | 180 | -70 | PENDING | |||||||

- UTM NAD83, Zone 18N.

- True widths are estimated to be 60 to 70% of the Interval Length.

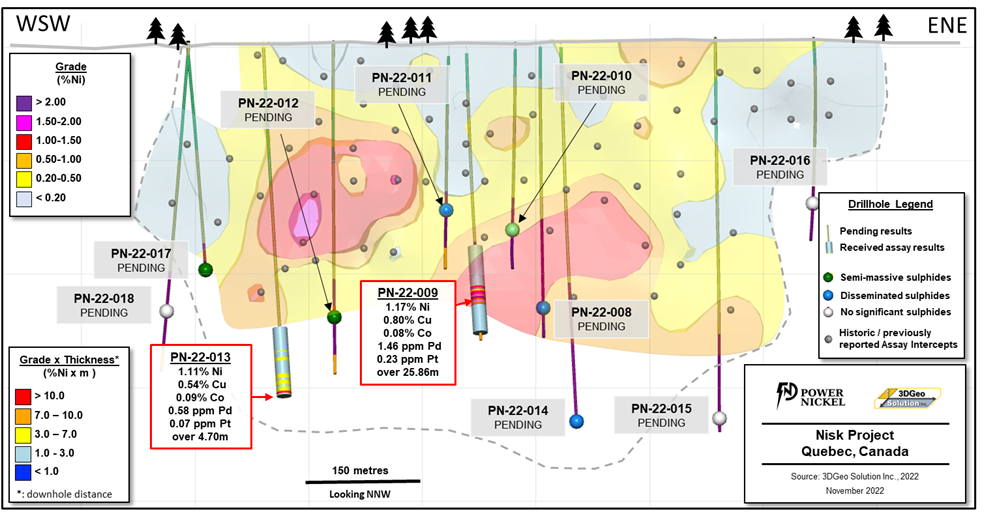

Eleven (11) holes are completed to date for this second phase of drilling, but assay results covering the mineralized target area are available only for two (2) holes (Figure 1).

Figure 1 - Longitudinal view of the Nisk Main presenting the currently available assay results.

Core logging has confirmed the presence of sulfide mineralization in the areas defined as targets. Such visual observation indicates that the mineralization extends to a minimum of 150 metres below the deepest know intercepts.

While such intercepts look promising, their description is based solely on visual logging of the core, for which assay results are pending. The presence of nickel is supported by XRF measurements made as part of the core logging procedure, but such readings should be considered indicative only. Caution is therefore required as interpreted extent of the mineralization should also be determined once assay results are available. The company will update the market once these results become available.

"The initial assays of our fall program are very encouraging for Power Nickel shareholders. These holes were drilled in an area where no resource was modeled and as a result, will not only help us better understand our deposit but also of course add substantial tonnage to our model.

The PN-22-009 hole in particular shows that there will be solid very high-grade sections of the deposit which will raise resource grade and improve economics in any future mine plan.

From what we have seen in this drilling round we believe our aspiration to become Canada's next Nickel mine is something our drill bit is turning into a very high probability outcome. When compared with other high-grade Nickel sulfides exploration projects around the world, ours trades at a tenth or much less of the value. Results like this will hopefully cause investors to look at Power Nickel and Nisk in a new light." - Commented CEO Terry Lynch.

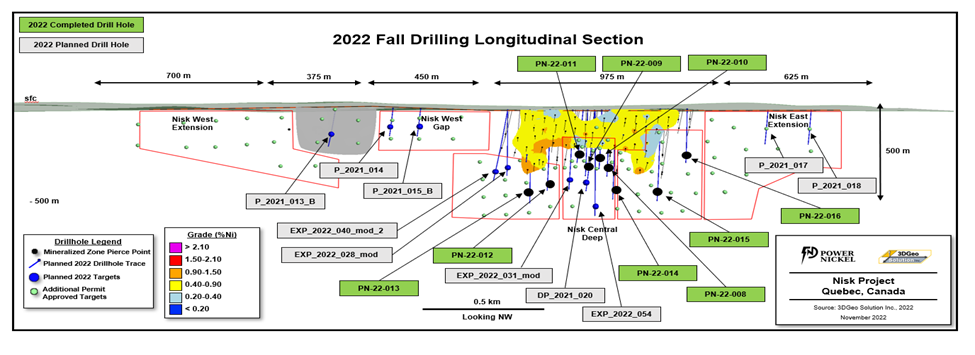

Figure 2 below presents the holes completed and those that are remaining to be drilled from the current 2022 drilling program

Figure 2 - Current status of the 2022 Drilling Program at Nisk.

On the basis of such optimistic results, the Company has recently announced (see Press Release of November 22th, 2022) that it would ramp up drilling by another 7,500m to 10,000m starting in Q1 2023.

About the Nisk Project

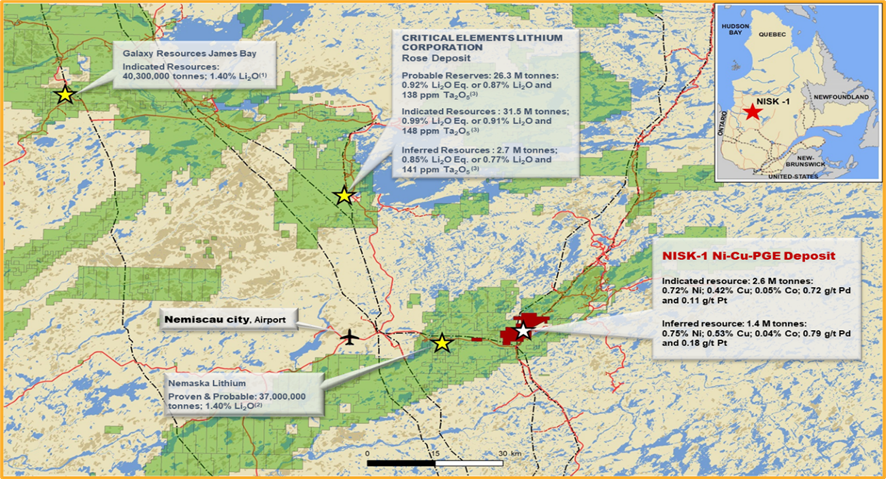

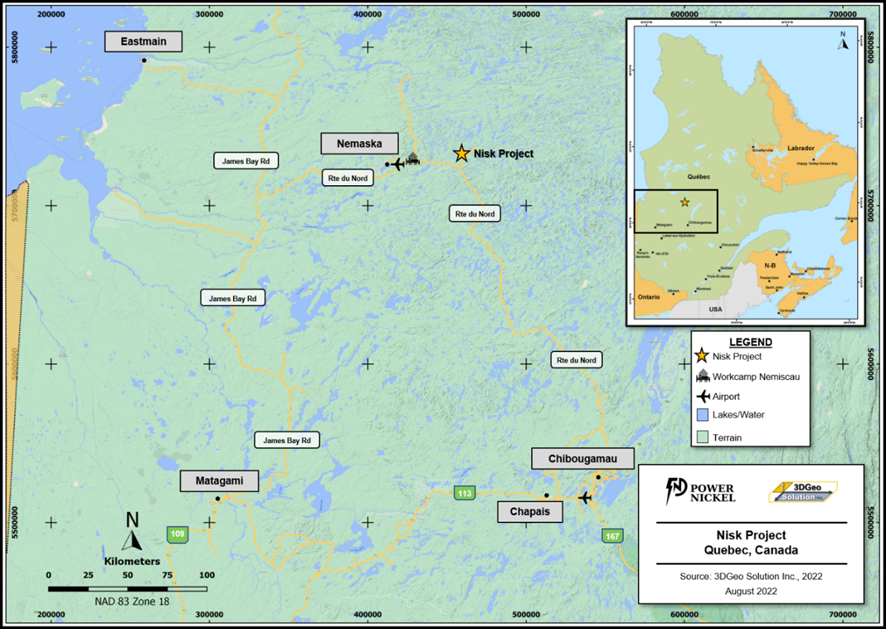

The Nisk Project is located in the southern portion of the Eeyo Istchee James Bay territory, Québec, a region that is the site of a number of mining projects (Figure 3) and improving infrastructure (Figure 4).1

The Nisk Project is a known Nickel-PGE occurrence on which former operators have performed technical work at a relatively high level of expertise. This historical work, which included preliminary metallurgical test work, led to an evaluation of the mineral resource potential in the Nisk-1 Main zone.

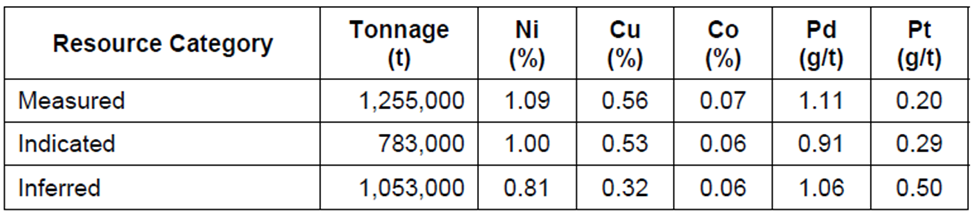

The existing resource estimates at the Nisk project are of historic nature and the Company's geology team has not completed sufficient work to confirm a NI 43-101 compliant mineral resource. Therefore, caution is appropriate since these historic estimates cannot, and should not be relied on. For merely informational purposes see Table 2.

Table ‑2: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters, and methods used to prepare the mineral resource estimates described above are set out in the technical report. This report, prepared by RSW Inc in 2009, can be found on the SEDAR website.

The information regarding the metallurgical test work done to support the above-cited 2009 MRE, was performed by SGS and is described in an undisclosed report titled: "11863-001: An investigation into the recovery of Ni, Cu and PGMs from the Lac Levac deposit, prepared for Golden Goose Resources, July 22, 2009".

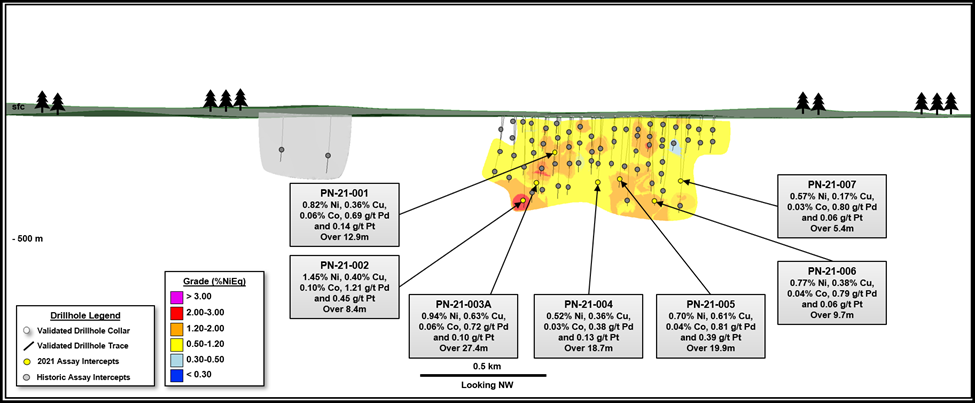

Power Nickel completed the acquisition of its option to acquire up to 80% of the Nisk Project from Critical Elements Lithium Corp. (CRE: TSXV). The Nisk Project comprises a large land position (20 kilometers of strike length) with numerous high-grade Nickel intercepts. Since the completion of the option, Power Nickel retained 3DGeo Solution Inc to create a geological model of the Nisk Project and used this as a guide to the very successful initial Power Nickel 2400-metre drill program completed last December and reported in March of 2022. (See Figure 5 and Table 3 below, modified from the Press Release dated March 30, 2022).

Figure 3 - Location of the Nisk Project with respect to the location of other known deposits.

Figure 4 - Location of the Nisk Project with respect to the current infrastructure available in the area.

Figure 5. A long section of the 2021 drill program results.

Table 3: Significant results obtained during the 2021 drilling campaign.

*UTM NAD83, Zone 18N

**True widths are estimated to be 70 to 90% of the core length

QAQC and SAMPLING

GeoVector Management Inc is the Consulting company retained to perform the actual drilling program, which includes core logging and sampling of the drill core.

All samples were submitted to and analyzed at ALS Global ("ALS"), an independent commercial laboratory located in Val-d'Or, Québec for both the sample preparation and assaying. ALS is a commercial laboratory independent of Power Nickel with no interest in the Project. ALS is an ISO 9001 and 17025 certified and accredited laboratory. Samples submitted through ALS are run through standard preparation methods and analyzed using ME-ICP61a (33 element Suite; 0.4g sample; Intermediate Level Four Acid Digestion) and PGM-ICP27 (Pt, Pd, and Au; 30g fire assay and ICP-AES Finish) methods. ALS also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

GeoVector's QAQC program includes the regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

The results presented in the current Press Released are complete within the mineralized intervals, but results are still pending for the top portion of both holes reported. QAQC and data validation was performed on these portions of the holes where assays are fully integrated, and no material error was observed.

Qualified Person

Kenneth Williamson, Géo, M.Sc. from 3DGeo Solution Inc and consultant to Power Nickel, is the independent qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV)

The NISK property comprises a large land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding its current high-grade nickel-copper PGE mineralization Ni 43-101 resource with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.

Power Nickel announced on June 8th, 2021 that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and Magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is also 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, which was sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $ 3 million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements that may be deemed "forward-looking statements" with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "indicates", "opportunity", "possible" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company's ability to raise sufficient capital to fund its planned activities at the NISK Property and for general working capital purposes; the timing and costs of future activities on the Company's properties; maintaining its mineral tenures and concessions in good standing; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates, and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

1References to nearby properties is for information purposes only and there is no assurance that Power Nickel will achieve the same results as on the nearby properties.

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/728810/Power-Nickel-Extends-High-Grade-Nickel-Mineralization-at-Nisk