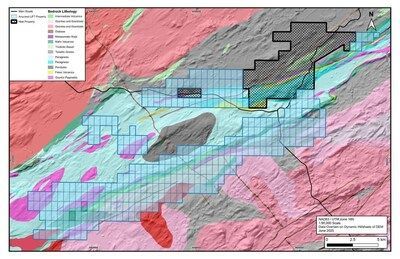

Power Metallic Mines Inc . (the "Company" or "Power Metallic") (TSXV: PNPN,OTC:PNPNF) (OTCBB: PNPNF) (Frankfurt: IVV) Power Metallic is pleased to announce it has closed on the definitive agreement dated June 9, 2025 to acquire a 100% interest in 313 mineral claims totalling 167 km² from Li-FT Power Ltd. (" Li-FT ") (TSXV: LIFT) (OTCQX: LIFFF) (FRA: WS0). The claims adjoin the Company's 45.86km² Nisk property, where exploration is expanding the high–grade Lion Cu–PGE discovery and the Nisk Cu–Ni-PGE-Co deposit. Power Metallic currently holds ~212.86 km² of land in the Nisk camp, securing approximately 20 km of strike on the northern basin margin and 30 km on the southern margin that envelope the Nisk, Lion, and Tiger discoveries (Figure 1 map of regional play with new property, showing relative size with original Nisk property).

Purchase Agreement Terms

With the closing conditions met, including final TSX Venture Exchange approval received, Power Metallic has advanced a $700,000 cash payment to Li-FT and issued 6,000,000 common shares of the Company (the " Shares "). All the Shares have a statutory hold period of four months and a day from issuance in accordance with Canadian securities laws. 3,000,000 of the 6,000,000 Shares also bear a 12 month hold and restriction from transfer. Additionally, Li-FT retains a 0.5% NSR on all acquired claims under a royalty agreement between Li-FT and the Company effective the closing date. Certain of the claims also retain certain underlying royalties and in some cases buy back rights that were contained in previous agreements between Li-FT and prior property vendors.

Qualified Person

Joseph Campbell , P.Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

Administrative Updates

The Company has appointed MNP LLP, Chartered Professional Accountants, as its new auditor. In alignment with its ongoing growth and strategic objectives, the Company elected to engage a PCAOB-registered mid-tier audit firm to support potential listings on senior stock exchanges.

For the Company's recently completed Q2 ended June 30, 2025 , for its interim financial statements (when filed), it will add a comparative figures note as it relates to investor relations expenses in prior periods: "Certain comparative figures have been reclassified to conform with the current year's presentation. Amounts from Investor relations have been reclassified to Shareholder Communications, Listing fees, and Advisory and Business development. This reclassification should provide greater clarity to investors regarding the breakdown of the Company's expenditures. The reclassification of comparative figures had no impact on the June 30, 2024 , December 31, 2024 and 2023 statement of financial position or statement of changes in shareholders' (deficit) equity." For the FYE December 31, 2023 , the total investor relations expense of $3,181,461 is reclassified as $497,134 to Shareholder Communications, $33,372 to Listing Fees, $1,784,661 to Advisory and Business Development, and $866,294 retained as Investor Relations to provide greater clarity on the nature of the expenses.

About Power Metallic Mines Inc.

Power Metallic is a Canadian exploration company focused on advancing the Nisk Project Area (Nisk–Lion–Tiger)—a high–grade Copper–PGE, Nickel, gold and silver system—toward Canada's next polymetallic mine.

On 1 February 2021 , Power Metallic (then Chilean Metals) secured an option to earn up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX–V: CRE). Following the June 2025 purchase of 313 adjoining claims (~167 km²) from Li–FT Power, the Company now controls ~212.86 km² and roughly 50 km of prospective basin margins.

Power Metallic is expanding mineralization at the Nisk and Lion discovery zones, evaluating the Tiger target, and exploring the enlarged land package through successive drill programs.

Beyond the Nisk Project Area, Power Metallic indirectly has an interest in significant land packages in British Columbia and Chile, by its 50% share ownership position in Chilean Metals Inc., which were spun out from Power Metallic via a plan of arrangement on February 3, 2025.

It also owns 100% of Power Metallic Arabia which owns 100% interest in the Jabul Baudan exploration license in The Kingdom of Saudi Arabia's JabalSaid Belt. The property encompasses over 200 square kilometres in an area recognized for its high prospectivity for copper gold and zinc mineralization. The region is known for its massive volcanic sulfide (VMS) deposits, including the world-class Jabal Sayid mine and the promising Umm and Damad deposit.

For further information, readers are encouraged to contact:

Power Metallic Mines Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others; the timing for various drilling plans; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-closes-on-li-ft-power-land-acquisition-302504029.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-closes-on-li-ft-power-land-acquisition-302504029.html

SOURCE Power Metallic Mines Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2025/14/c5488.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2025/14/c5488.html