March 08, 2023

Mt Monger Resources Limited (ASX:MTM) (Mt Monger or the Company) is pleased to advise shareholders that the option agreements to acquire the Pomme REE-Nb project in Quebec, Canada (the Project) have been exercised.

Highlights:

- Option agreements exercised to facilitate the commencement of the exploration program at the Pomme REE-Nb project

- Recent successful $3 million capital raising to fund maiden diamond drilling program and associated work

Pursuant to the previously announced agreement over the Project (refer to Mt Monger ASX announcement dated 23 February 2023) the company has exercised its option agreement to acquire Critical Elements Exploration Pty Ltd (CEE). CEE in turn has exercised its exclusive option agreement with Geomega Resources Inc. (Geomega) to acquire the claims that comprise the Project.

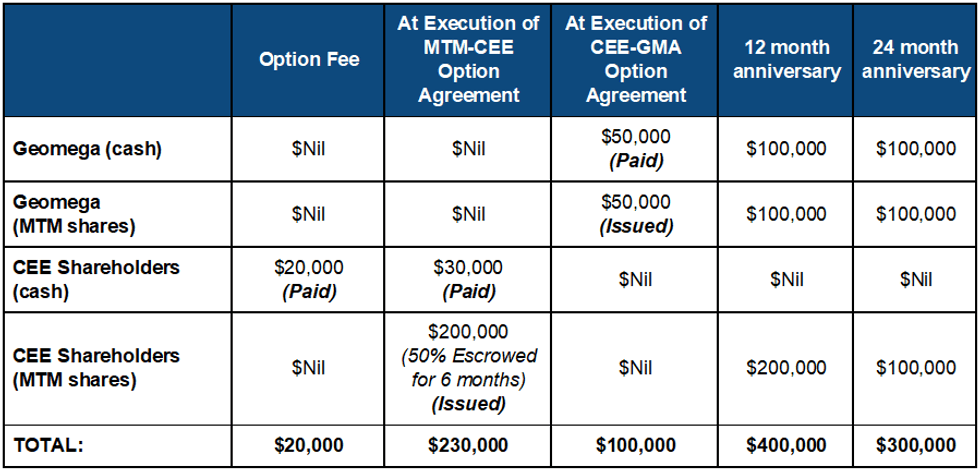

Relevant cash consideration and share-based payment have been made to shareholders of CEE and to Geomega by the Company, as specified in the option agreements (Table 1). Mt Monger is pleased to start the process of working with Geomega on the Project and it is pleased to have Geomega on its register.

The Company has successfully secured commitments of A$3 million additional capital in order to support the forthcoming REE exploration program (see Mt Monger ASX announcement dated 28 February 2023). The Placement was strongly supported by new and existing professional and sophisticated shareholders. The first tranche of capital has been received and tranche 2 will be received after shareholder approval at the upcoming EGM (details to be provided in due course).

OPTION AGREEMENTS

Under the Option Agreements that were entered into to acquire the Pomme REE project in Québec, the Company is required to satisfy aggregate consideration of AUD $1,050,000 in cash and shares in order to complete the acquisition of the Project. AUD $350,000 of this consideration (combination of cash and shares) has now been paid (Table 1). The Company has a AUD $2,000,000 exploration expenditure commitment on the Pomme Project over the next 3 years. Exploration programmes are anticipated to commence in the northern summer.

This announcement has been authorised for release by the Board of Directors.

Click here for the full ASX Release

This article includes content from Mt Monger Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

25 September 2023

MTM Critical Metals

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00