- WORLD EDITIONAustraliaNorth AmericaWorld

May 15, 2023

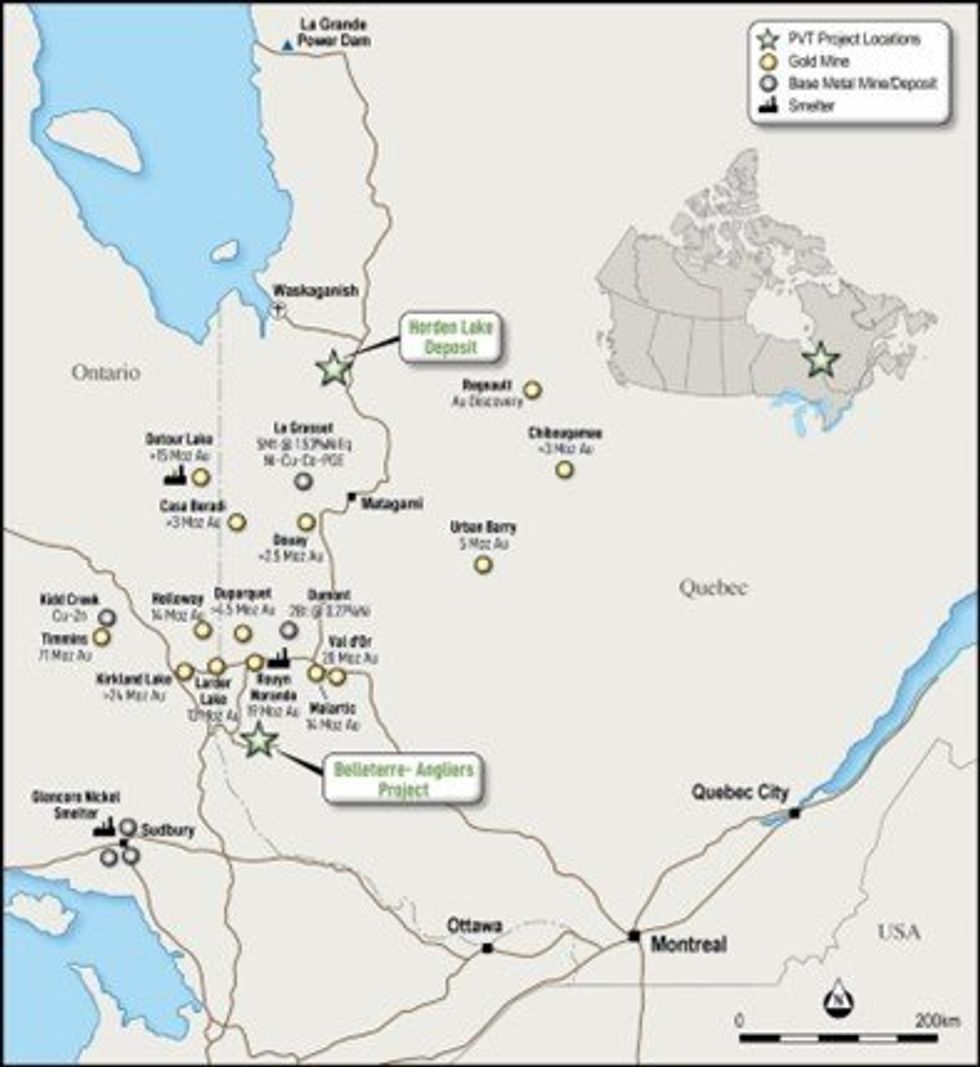

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) has received commitments totalling in excess of A$4m that will be used to advance the Quebec battery metals projects, Horden Lake, and Belleterre-Angliers Greenstone Belt (BAGB), via the Canadian Flow- Through Share scheme, and provide additional working capital.

Highlights

- This capital raise is a milestone achievement for the Company, comprising a combination of Canadian flow-through-shares and options (Flow-Through Units or FT Units) and private placement, that will allow Pivotal to greatly advance its Canadian portfolio.

- A$3.9m in commitments has been received to date, utilising the flow-through shares provision under Canadian tax law. The FT Unit will be placed at A$0.0634/unit, representing a 58.5% premium to Pivotal’s last closing price of A$0.04 on 10 May 2023 and an 84.3% premium to the 15-day VWAP of A$0.0344. The FTU will be immediately sold through a block trade agreement to select sophisticated and professional investors in Australia and abroad.

- As of the date of this announcement, A$0.2m has also been committed through a private placement at A$0.0325/share to sophisticated and professional investors, representing an 18.8% discount to the last closing price on 10 May 2023 and a 5.5% discount to the 15-day VWAP.

- For every two shares issued as part of this capital raise, the Company will also issue one free attaching two-year option, subject to shareholder approval. Each option will be unlisted and have an exercise price of A$0.065.

- The capital raise will be used for a drill program at the flagship Horden Lake copper- nickel-PGM project, for which all necessary drilling permits have been received. Furthermore, an extensive metallurgical test programme has been planned.

- Post drill program and metallurgical testing, the Company also intends to:

- update the current pit constrained JORC (2012) Inferred Resource of 27.8Mt @ 1.49% CuEq and allow for inclusion of further by-product metals in to the CuEq grade1;

- accurately estimate metal recoveries and concentrate payabilities; and

- complete a maiden pre-feasibility study (PFS) for Horden Lake.

- Additional exploration work at BAGB is also scheduled, in order to progress this exciting high-grade Ni-Cu-PGM exploration project.

Managing Director Steven Turner said: “Having secured a compelling battery metals portfolio in Quebec, the Company is delighted to be in a position to progress the much- anticipated exploration work to unlock its exceptional value potential for shareholders over the next 12 months. The flow-through shares tax provisions in Canada have allowed Pivotal to raise the funds for the exploratory work at a significant premium to the Company's last closing price on 10 May 2023. All funds committed, other than those requiring shareholder approvals, have been allocated to the flow through shares element, thereby maximising the capital to deploy in the field and minimising dilution to shareholders.”

Pivotal completed the acquisition of the Horden Lake copper-nickel-PGM project in December 2022. This acquisition represented the successful delivery by the Board of a strategic shift to focus on building a battery metals portfolio in the tier 1 mining jurisdiction of Quebec.

Horden Lake is an advanced exploration project containing a JORC compliant pit constrained resource of 27.8Mt at a 1.49% CuEq. The resource estimate does not include all of the gold, nor any of the significant cobalt and silver known to exist within the deposit. The planned drilling programme for 2023 will look to better define these various additional metals for inclusion in an updated MRE later in the year.

BAGB is a high impact exploration project that has demonstrated exceptional near-surface grades of nickel, copper and PGMs, potentially indicative of a large deeper system. A review of EM anomalies below 300m from recent VTEM surveys has identified 20 high priority targets never previously explored. These targets will be the focus of a survey programme scheduled for 2023.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00