January 17, 2023

Pan Asia Metals (ASX:PAM)) focuses on Southeast Asia's lithium and critical metals assets, developing projects that can meet the requirements of the clean energy transition. Asia is at the forefront of this transition, both in terms of adoption and opportunities, and the ASEAN countries to the south are following suit with Vietnam, Thailand, Indonesia and Malaysia positioning to attract battery and EV manufacturers.

Pan Asia Metals’ lithium and tungsten assets in Thailand are currently the only advanced lithium projects in Southeast Asia, creating a unique value proposition for low-cost operation and a significant opportunity to value-add its production. Pan Asia Metals is currently the only lithium explorer in Southeast Asia. The company is led by an experienced management team with direct experience in and a deep understanding of the geopolitical environment in southeast Asia.

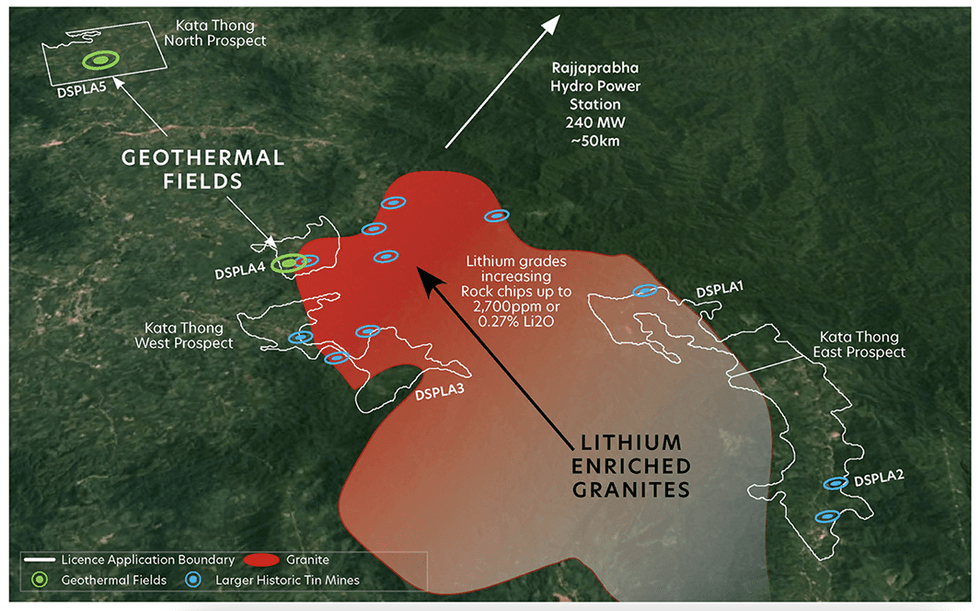

Pan Asia Metals’ Kata Thong project contains the proper geologic formation indicative of rich lithium deposits. The lithium-rich Kata Khwama granite formation is a 20-kilometer-long strike up to 10 kilometers wide and has produced rock-chip assays up to 0.27 percent lithium.

Company Highlights

- Pan Asia Metals is an exploration and development company with assets in Southeast Asia focusing on the critical minerals necessary for the clean energy transformation.

- Beyond developing highly prolific deposits, the company wants to move beyond the mine gate by refining and processing a high-grade product ready for cathode manufacturing.

- Pan Asia Metals operates three 100-percent-owned projects in Thailand targeting lithium and tungsten deposits.

- The Reung Kiet flagship project has a JORC-compliant resource estimate of 10.4 million tonnes of lithium at 0.44 percent, with a resource expansion due soon.

- Pan Asia Metals operates two additional assets with significant hard rock lithium and tungsten deposits for future development.

- An experienced managed team with a deep understanding of the Southeast Asian market and the mining industry leads the company towards fully developing its assets.

This Pan Asian Metals profile is part of a paid investor education campaign.*

Click here to connect with Pan Asia Metals (ASX:PAM) to receive an Investor Presentation

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00