Outcrop Silver & Gold Corporation (TSX: OCG) (OTCQX: OCGSF) (DE: MRG) ("Outcrop Silver") is pleased to announce new drill results from its ongoing exploration program at the Santa Ana high-grade silver project in Colombia. Recent drilling has extended the Aguilar vein system by 450 metres to the south, confirming continuity beneath younger volcanosedimentary cover and identifying multiple high-grade intercepts in blind targets. These results significantly expand the known footprint of the vein system and support the potential emergence of a new high-grade shoot. Outcrop Silver continues to drill with three rigs along the fully permitted 17 kilometres mineralized trend in preparation for its Q1 2026 mineral resource update.

Highlights

- DH535 intercepted 0.84 metres grading 1,659 g/t AgEq (Table 1).

- DH524 intercepted 1.04 metres grading 779 g/t AgEq (Table 1).

- Five drill holes (DH514, DH517, DH520, DH524, and DH528) represent a 450 metre step out to the south, confirming the Aguilar vein continues beneath volcanic cover and remains open along strike and at depth.

- Step-out drilling, demonstrated Outcrop Silver's ability to identify high-grade silver mineralization in blind targets and reinforcing the potential that remains open along strike and at depth.

- Results lay the groundwork for future drilling and reinforce the company's expansion strategy ahead of its Q1 2026 Mineral Resource Update.

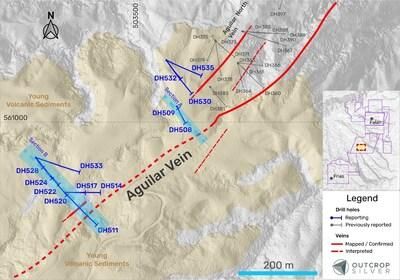

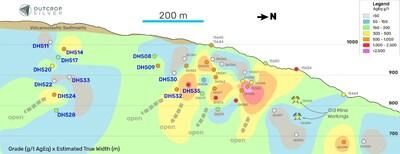

These new results, together with previously reported intercepts, confirm the Aguilar vein's continuity in blind targets and significantly expand its known footprint. Importantly, drill holes DH514, DH517, DH520, DH524, and DH528 represent a step-out of 450 metres to the south from known mineralization and support the potential discovery of a new mineralized shoot (Figure 1 and Figure 2). DH532 and DH535 are part of the resource definition program and demonstrate that the previously known high-grade shoot remains open along strike and at depth (Figure 2).

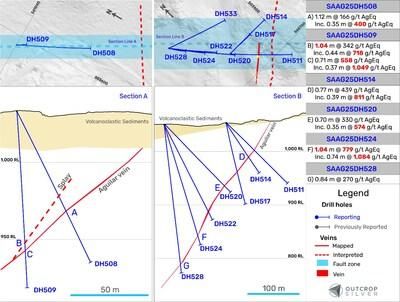

The Aguilar vein system continues to exhibit a complex structural architecture, with multiple splays, subparallel structures, and shallow, high-grade mineralization (Figure 3). These features suggest multi-phase mineralizing events and reinforce the interpretation of the system as a robust epithermal vein corridor.

"This latest round of drilling marks a major leap in our understanding of the Aguilar system," commented Guillermo Hernandez, Vice President of Exploration. "The consistent intercepts in blind targets and the emergence of multiple high-grade centers add substantial value to our resource model. We now interpret at least three distinct mineralized shoots along Aguilar, which positions us well for continued resource expansion ahead of our Q1 2026 update."

| Hole ID | From | To | Interval * | Ag | Au | AgEq1 | Vein |

| DH508 | 72.53 | 73.65 | 1.12 | 118 | 0.54 | 166 | Aguilar |

| Including | 73.30 | 73.65 | 0.35 | 315 | 0.97 | 400 | |

| DH509 | 91.22 | 92.26 | 1.04 | 198 | 1.63 | 342 | Aguilar Splay |

| Including | 91.22 | 91.66 | 0.44 | 411 | 3.49 | 718 | |

| DH509 | 98.47 | 99.18 | 0.71 | 363 | 2.21 | 558 | Aguilar |

| Including | 98.47 | 98.84 | 0.37 | 685 | 4.12 | 1,049 | |

| DH514 | 83.19 | 83.96 | 0.77 | 197 | 2.74 | 439 | Aguilar |

| Including | 83.19 | 83.58 | 0.39 | 360 | 5.11 | 811 | |

| DH514 | 87.45 | 87.76 | 0.31 | 455 | 1.79 | 613 | Aguilar Splay |

| DH517 | 95.05 | 95.68 | 0.63 | 94 | 0.77 | 162 | Aguilar |

| DH520 | 158.24 | 158.94 | 0.70 | 265 | 0.73 | 330 | Aguilar |

| Including | 158.59 | 158.94 | 0.35 | 473 | 1.15 | 574 | |

| DH524 | 218.00 | 219.04 | 1.04 | 164 | 6.97 | 779 | Aguilar |

| Including | 218.00 | 218.74 | 0.74 | 225 | 9.74 | 1,084 | |

| DH528 | 263.32 | 264.16 | 0.84 | 102 | 1.90 | 270 | Aguilar |

| DH532 | 179.62 | 180.58 | 0.96 | 392 | 1.97 | 566 | Aguilar |

| Including | 179.62 | 180.11 | 0.49 | 619 | 2.02 | 798 | |

| DH535 | 178.73 | 179.57 | 0.84 | 835 | 9.33 | 1,659 | Aguilar |

| Including | 179.12 | 179.57 | 0.45 | 1,549 | 17.35 | 3,080 |

Table 1. Drill hole assay results reported in this release. *The current knowledge of the step-out in the Aguilar vein does not allow for estimating the true width of the intercepts. Holes DH511, DH522, DH530, and DH533 intercepted the Aguilar vein with No Significant Results. No Significant Result means an intercept lower than 150 g/t AgEq1

The Aguilar vein system represents one of the most significant and laterally extensive mineralized corridors within the Santa Ana project (Figure 1). Over time, exploration efforts have revealed that this corridor comprises multiple discrete but genetically related veins, most notably the Aguilar, Jimenez, and Guadual veins (see News Releases dated October 16, 2024, December 5, 2024, and September 3, 2025). These structures form a continuous mineralized trend that extends for more than two kilometres along strike, with high-grade shoots defined across multiple segments, particularly in the Aguilar vein, where three distinctive shoots have been identified to date (Figure 2).

Recent step-out drilling to the south has added a new dimension to the geological understanding of the system. Drill holes have intercepted mineralized veins beneath a younger volcanosedimentary cover (Figure 1 and Figure 3), confirming the presence of blind targets —areas where veins do not outcrop at the surface but remain mineralized at shallow to moderate depths.

Mineralization continues to display strong structural control, with veins hosted in competent wall rocks and demonstrating continuity along both strike and dip. Texturally and mineralogically, the Aguilar system is consistent with the broader Santa Ana district. The highest-grade intervals typically coincide with bands or breccia-clasts of pyrite and coarse-grained argentite, sometimes accompanied by electrum or sulfosalts. These associations reinforce the interpretation of the epithermal vein system characterized by strong metal zoning along strike and depth (Figure 3).

Outcrop Silver continues drilling with three rigs on-site, targeting further step-outs, resource definition, and testing of parallel structures across the 17-kilometre-long permitted mineralized corridor. The results at Aguilar underscore the company's strategy of combining geological modeling, structural understanding, and phased drilling to drive both short-term and long-term mineral resource growth.

| Sample | Easting | Northing | Elevation | Sample | Width | Ag | Au | AgEq1 | Release Date |

| 15444 | 504066.36 | 561441.93 | 838.66 | Channel | 0.40 | 281 | 1.28 | 393 | January 3, 2023 |

| 15644 | 503814.26 | 561085.24 | 998.69 | Channel | 0.40 | 349 | 1.57 | 488 | May 9, 2022 |

| 15645 | 503814.64 | 561084.92 | 998.94 | Channel | 0.50 | 441 | 1.14 | 541 | May 9, 2022 |

| 15650 | 503933.46 | 561219.08 | 949.37 | Channel | 0.70 | 254 | 2.91 | 510 | January 3, 2023 |

| 15654 | 503994.26 | 561297.82 | 904.41 | Channel | 0.25 | 1,045 | 5.64 | 1,542 | May 9, 2022 |

Table 2. Surface channel sample results in the Aguilar vein target from the regional exploration program, previously reported and referred to in Figure 2 (see News Releases dated May 9, 2022, and January 3, 2023). * By their nature, grab and chip samples are selective, and the assay results may not necessarily represent true underlying mineralization. Coordinates are in the UTM system, zone 18N, and in the WGS84 projection.

| Hole ID | Hole Code | Easting | Northing | Elevation | Depth | Azimuth | Dip |

| DH360 | SAAG24DH360 | 503749.358 | 561149.079 | 1007.27 | 130.03 | 135 | -46 |

| DH361 | SAAG24DH361 | 503749.135 | 561149.302 | 1006.88 | 116.90 | 135 | -77 |

| DH363 | SAAG24DH363 | 503748.969 | 561149.485 | 1007.11 | 129.27 | 0 | -90 |

| DH364 | SAAG24DH364 | 503748.164 | 561148.475 | 1006.99 | 120.09 | 169 | -58 |

| DH366 | SAAG24DH366 | 503749.707 | 561150.295 | 1007.26 | 117.04 | 100 | -58 |

| DH367 | SAAG24DH367 | 503760.247 | 561229.999 | 1003.08 | 170.03 | 109 | -45 |

| DH369 | SAAG24DH369 | 503760.228 | 561230.341 | 1003.04 | 196.29 | 93 | -65 |

| DH371 | SAAG24DH371 | 503693.046 | 561205.427 | 1010.86 | 195.37 | 135 | -73 |

| DH373 | SAAG24DH373 | 503692.991 | 561205.470 | 1011.55 | 224.94 | 135 | -86 |

| DH375 | SAAG24DH375 | 503690.899 | 561207.532 | 1011.06 | 243.84 | 315 | -86 |

| DH378 | SAAG24DH378 | 503692.107 | 561204.972 | 1010.84 | 200.00 | 174 | -64 |

| DH379 | SAAG24DH379 | 503691.436 | 561205.009 | 1010.78 | 199.94 | 203 | -75 |

| DH381 | SAAG24DH381 | 503678.496 | 561088.999 | 1021.45 | 173.12 | 142 | -68 |

| DH383 | SAAG24DH383 | 503678.154 | 561089.407 | 1021.40 | 175.26 | 0 | -90 |

| DH385 | SAAG24DH385 | 503759.368 | 561230.615 | 1003.01 | 213.37 | 0 | -90 |

| DH386 | SAAG24DH386 | 503759.564 | 561230.611 | 1003.07 | 191.71 | 94 | -55 |

| DH388 | SAAG24DH388 | 503759.963 | 561230.614 | 1003.07 | 189.48 | 94 | -78 |

| DH390 | SAAG24DH390 | 503760.128 | 561229.924 | 1003.08 | 197.14 | 111 | -62 |

| DH508 | SAAG25DH508 | 503593.713 | 561039.824 | 1033.40 | 110.33 | 153 | -63 |

| DH509 | SAAG25DH509 | 503593.713 | 561039.824 | 1033.40 | 115.85 | 153 | -86 |

| DH511 | SAAG25DH511 | 503310.947 | 560819.904 | 1053.51 | 160.87 | 137 | -45 |

| DH514 | SAAG25DH514 | 503311.004 | 560821.696 | 1053.53 | 129.84 | 89 | -47 |

| DH517 | SAAG25DH517 | 503311.481 | 560821.686 | 1053.48 | 160.62 | 89 | -73 |

| DH520 | SAAG25DH520 | 503237.175 | 560908.789 | 1050.13 | 176.47 | 141 | -45 |

| DH522 | SAAG25DH522 | 503237.146 | 560908.914 | 1050.12 | 200.22 | 141 | -63 |

| DH524 | SAGU25DH524 | 503237.069 | 560909.078 | 1050.05 | 235.48 | 141 | -73 |

| DH528 | SAAG25DH528 | 503236.914 | 560909.205 | 1050.02 | 280.11 | 141 | -83 |

| DH530 | SAAG25DH530 | 503567.040 | 561156.890 | 1030.23 | 170.07 | 144 | -51 |

| DH532 | SAAG25DH532 | 503568.197 | 561155.748 | 1029.60 | 200.59 | 144 | -72 |

| DH533 | SAAG25DH533 | 503236.130 | 560910.340 | 1050.36 | 200.25 | 110 | -55 |

| DH535 | SAAG25DH535 | 503567.040 | 561156.890 | 1030.23 | 200.55 | 114 | -61 |

Table 3. Collar and survey table for drill holes and exploratory trenches reported and referred to in this release. All coordinates are UTM system, Zone 18N, and WGS84 projection.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Mr. Guillermo Hernandez, CPG-AIPG, Vice-President Exploration at Outcrop Silver. Mr. Hernandez is a Qualified Person for the Company as defined by National Instrument 43-101.

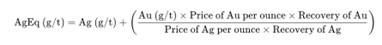

1Silver Equivalent

Metal prices used for equivalent calculations were US$2,760/oz for gold, and US$32/oz for silver. Metallurgical recoveries based on Outcrop Silver's metallurgical test work are 98.5% for gold and 96.3% for silver (see news release dated June 25, 2024). The equivalency formula is as follows:

QA/QC

Outcrop Silver applied its standard protocols for sampling and assay for exploration activities. Core diameter is a mix of HTW and NTW, depending on the drill hole depth. Diamond drill core boxes were photographed, sawed, sampled, and tagged. Samples were bagged, tagged, and packaged for shipment by truck from Santa Ana's core logging facilities in Falan, Colombia to the Actlabs certified sample preparation facility in Medellin, Colombia. ActLabs is an accredited laboratory independent of the Company. HQ-NTW core is sawn with one-half shipped. Samples delivered to Actlabs were AA assayed on Au, Ag, Pb, and Zn at Medellin using 1A2Au, 1A3Au, Multi-elements AR (Ag Cu Pb Zn), and Code 8 methods. Then, samples were sent to Actlabs Canada in Ancaster, Ontario, for ICP multi-elemental analysis under code 1E3. In line with QA/QC best practices, blanks, duplicates, and certified reference materials are inserted into the sample stream at approximately 3 control samples every 20 samples to monitor laboratory performance. A comparison of control samples and their standard deviations indicates acceptable assay accuracy and no detectable contamination. No material QA/QC issues have been identified with respect to sample collection, security, and assaying. The samples are analyzed for gold and silver using a standard fire assay on a 30-gram sample with a gravimetric finish for over-limits. Multi-element geochemistry was determined by ICP-MS using either aqua regia or four acid digestions. Crush rejects, pulps, and the remaining core are stored in a secured facility at Santa Ana for future assay verification.

About Santa Ana

The 100% owned Santa Ana project spans over 28,000 hectares within the Mariquita District, encompassing both titles and applications, and is recognized as the largest and highest-grade primary silver district in Colombia, with mining records dating back to 1585.

Santa Ana's maiden resource estimate, detailed in the NI 43-101 Technical Report titled "Santa Ana Property Mineral Resource Estimate," dated June 8, 2023, prepared by AMC Mining Consultants, indicates an estimated indicated resource of 1,226 thousand tonnes containing 24.2 million ounces silver equivalent1 at a grade of 614 grams per tonne and an inferred resource of 966 thousand tonnes containing 13.5 million ounces at a grade of 435 grams per tonne of silver equivalent1. The identified resources span seven major vein systems that include multiple parallel veins and mineralized shoots: Santa Ana (San Antonio, Roberto Tovar, San Juan shoots); La Porfia (La Ivana); El Dorado (El Dorado, La Abeja shoots); Paraiso (Megapozo); Las Maras; Los Naranjos, and La Isabela.

The drilling campaign aims to extend known mineralization and test new high-potential areas along the permitted section of the project's extensive 30 kilometres of mineralized trend. The current exploration strategy seeks to establish a clear pathway for substantially expanding the mineral resource. These efforts underscore the scalability of Santa Ana and its potential for substantial resource growth, positioning the project to develop into a high-grade, economically viable, and environmentally responsible silver mine.

About Outcrop Silver

Outcrop Silver is a leading explorer and developer focused on advancing its flagship Santa Ana high-grade silver project in Colombia. Leveraging a disciplined and seasoned team of professionals with decades of experience in the region. Outcrop Silver is dedicated to expanding current mineral resources through strategic exploration initiatives.

At the core of our operations is a commitment to responsible mining practices and community engagement, underscoring our approach to sustainable development. Our expertise in navigating complex geological and market conditions enables us to consistently identify and capitalize on opportunities that enhance shareholder value. With a deep understanding of the Colombian mining landscape and a proven track record of successful exploration, Outcrop Silver is well-positioned to transform the Santa Ana project into a significant silver producer, making a positive contribution to the local economy and setting new standards in the mining industry.

ON BEHALF OF THE BOARD OF DIRECTORS

Ian Harris

Chief Executive Officer

+1 604 638 2545

harris@outcropsilver.com

www.outcropsilver.com

Kathy Li

Vice President of Investor Relations

+1 778 783 2818

li@outcropsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "potential," "we believe," or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop Silver to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop Silver have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop Silver will not update any forward-looking statements or forward-looking information that are incorporated by reference.

SOURCE Outcrop Silver & Gold Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/26/c7302.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/26/c7302.html