Outback Goldfields Corp . (the " Company " or " Outback ") (TSXV: OZ) (OTCQB: OZBKF) is pleased to provide results from its reconnaissance-style air-core drill program at its Yeungroon gold project (" Yeungroon " or the " Project "), central Victoria, Australia .

Highlights

- Defined multiple broad corridors of elevated arsenic across the tenement :

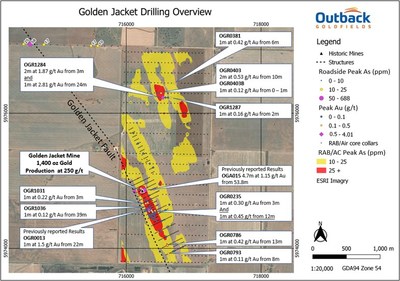

- Numerous north-west trending zones of strong arsenic anomalism from top-of-bedrock samples parallel to the Golden Jacket corridor have been defined northeast of the Golden Jacket mine.

- A strongly anomalous and open zone of high-arsenic, locally coincident with prominent north-trending structural features, has been defined north of the unexplored Moondyne target area.

- Arsenic is a well established pathfinder element for high-grade gold mineralization across the Victorian Goldfields.

- Strongly anomalous gold values returned from multiple top-of-bed rock samples:

- Anomalous gold results from air-core holes collared over 800 metres along trend to the south of historical Golden Jacket mine suggest significant potential of the structure along strike.

- A broad zone of anomalous gold and arsenic from top-of-bedrock samples located over 1.4 kilometres north-east of the Golden Jacket mine define a new high-priority target area that is open for expansion.

- Deeper diamond drilling at both target areas is warranted to test for high-grade, structurally controlled quartz reefs associated with the anomalous top-of-bedrock air-core samples.

"We are excited to update our shareholders on our exploration progress so far at our highly prospective Yeungroon gold project," commented Chris Donaldson , CEO . "The results of our multi-rig drill program to date suggest that the historical Golden Jacket and Moondyne workings are not isolated targets but appear to be part of a much larger gold system. Anomalous gold assays have been identified for up to 800 metres south along strike of the Golden Jacket mine, and a new zone of gold mineralization was discovered 1.5 kilometres to the northeast of the mine. More significant is the identification of a new target zone on the western side of the tenement, near the Moondyne reef-hosted gold target.

Although our current exploration focus is at our Ballarat West project, we will continue to evaluate the new targets at Yeungroon and will plan additional exploration in the areas northeast of Golden Jacket and near Moondyne. Our systematic and methodical approach to grassroots exploration across the Victorian Goldfields is proving effective as we have now defined multiple new and significant drill targets in areas that were previously unexplored."

Program Overview

The drill program comprised 968 metres of diamond drilling, 3,616 metres of RAB and 9,403 metres of air-core drilling (see March 30, 2022 news release). The focus of the composite drill program was to investigate the structural setting and the dip- and strike-extent of reef-hosted gold mineralization at the Golden Jacket mine as well as to map and sample the top-of-bedrock below shallow cover across prospective trends and interpreted structural offsets identified in geophysical data from the Golden Jacket and Moondyne target areas.

The highly portable air-core drill rig was used to sample and map the top of bedrock below cover. A footprint of approximately 4.4 square kilometres was covered in the Golden Jacket grid and 8.5 kilometres of 100 metre spaced holes along road-side traverses were covered on the western side of the property near the Moondyne target. Drill cuttings were analysed using a portable Xray fluorescence spectrometer (pXRF). The focus for these analyses were pathfinder element geochemical concentrations (e.g., arsenic). The relationship between gold mineralization and disseminated arsenopyrite and high-arsenic contents in host rocks peripheral to gold-bearing quartz reefs is well established throughout the Victorian Goldfields (e.g., Arne et al., 2008) and has been used to focus exploration and vector to high-grade mineralization. Selected samples with anomalous pathfinder elements were sent to the Gekko Assay laboratory for fire assay gold analyses. Samples from 95 of the 591 air-core holes have been analysed for gold so far.

Based on results from this reconnaissance-style air-core drill program, multiple new drill targets have been defined. The preliminary pXRF and gold fire assay results support the high-prospectivity of the Yuengroon project. The Company is planning additional sampling and follow-up drilling to fully investigate the gold mineralization potential of the Golden Jacket, Moondyne and O'Connors targets.

Golden Jacket Drilling Results

The Golden Jacket mine is associated with the property-scale, northwest-trending Golden Jacket fault, which transects the property for over 30 kilometres of strike length. Historical small-scale production from the Golden Jacket mine was reportedly 1,400 ounces of gold at approximately 250 grams per tonne (Bibby and More, 1998). Shallow air-core holes were drilled on a grid pattern around the Golden Jacket Mine to explore for potential extensions and parallel zones of reef-hosted gold mineralization.

The combined drilling program has defined possible extensions to mineralization along strike to the south for up to 800 metres from the high-grade quartz reefs historically mined in the Golden Jacket Mine (Figure 1). Anomalous gold values were from near top-of-bedrock chip samples that also contained highly anomalous arsenic contents. This significant strike-length of gold and arsenic anomalism represents a priority target area for deeper diamond drilling.

A new broad zone of gold mineralization was discovered approximately 1.5 kilometres to the northeast of the Golden Jacket mine in an area that was previously undrilled and unexplored. Samples were submitted to the lab for gold assay based on highly anomalous arsenic contents. This area warrants additional drilling aimed at investigating possible structural controls to local gold mineralization as well as expanding the grid to the north where the high-arsenic trends are open (Figure 1).

Drill intercepts from the air-core program to date is given in Table 1.

Western Roadside Drilling Results

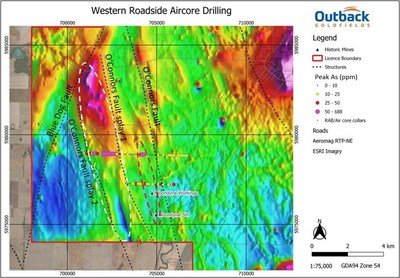

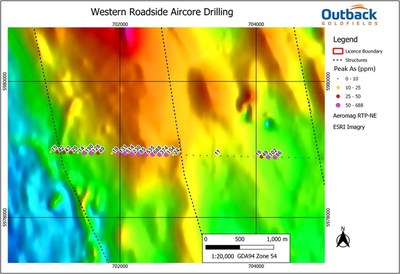

A series of roadside air-core drill hole traverses were completed on the western side of Yeungroon to map and sample the top of bedrock along strike from the historic Moondyne gold workings as well as across numerous project-scale, north-trending, structural corridors defined in geophysical data (Figure 2). A summary of results from the western roadside drilling campaign is shown in Figure 2.

The western roadside drilling program returned highly anomalous arsenic contents from zones along trend from the Moondyne workings. These results suggest that the structural zone host to mineralized quartz-reefs at Moondyne may extend for over 2 kilometres to the north.

A new target, O'Connors zone, has been identified between two splay faults off the project-scale O'Connors fault (Figure 2). Air-core chip samples from across this structurally complex zone returned highly anomalous arsenic contents covering a 1 kilometer east-west oriented transect. This zone is within a broadly north-south trending structural corridor approximately 9 kilometres long (Figure 2 and 3). Drill chips from this zone were also submitted for fire assay gold analysis. No significant results were returned from this first batch of samples; however, most of the holes were drilled to maximum depth of 15 metres on widely spaced 100 meter centres therefore the results were not unexpected.

The relatively high-arsenic contents together with the broad, km-scale target footprint makes the O'Connors zone a priority area for follow-up soil sampling, additional grid-based air-core drilling and possible deeper diamond drilling.

Table 1. Summary of Significant Intercepts from the Yeungroon air-core drill program.

| HoleID | Depth From | Depth To | Interval | Gold Grade |

| OGR1284 | 3 | 5 | 2 | 1.87 |

| and | 24 | 25 | 1 | 2.81 |

| OGR0013 | 22 | 23 | 1 | 1.5 |

| and | 27 | 32 | 5 | 0.23 |

| OGR0403 | 10 | 12 | 2 | 0.53 |

| OGR0403_B | 0 | 1 | 1 | 0.12 |

| OGR0381 | 6 | 7 | 1 | 0.42 |

| OGR0235 | 3 | 4 | 1 | 0.3 |

| and | 12 | 13 | 1 | 0.45 |

| OGR0786 | 13 | 14 | 1 | 0.42 |

| OGR1031 | 3 | 4 | 1 | 0.22 |

| OGR0233 | 28 | 29 | 1 | 0.2 |

| OGR1287 | 2 | 3 | 1 | 0.16 |

| OGR1036 | 39 | 40 | 1 | 0.12 |

| OGR1245 | 21 | 22 | 1 | 0.12 |

| OGR1247 | 39 | 40 | 1 | 0.12 |

| OGR0793 | 8 | 9 | 1 | 0.11 |

| | |

| | True widths have not been estimated as structural measurements are unable to be determined from air-core drill holes. A full list |

| | |

Yeungroon Project

The 698 km 2 Yeungroon project is transected by the north-trending, crustal-scale Avoca fault, which separates the western Stawell zone from the Eastern Bendigo zone. The western side of the Project contains the historic Golden Jacket hard-rock reef mine associated with the regional-scale, northwest-trending Golden Jacket fault. Historical mining records indicate the Golden Jacket mine produced quartz-rich ore with grades of up to 250 grams per tonne gold (Bibby and More, 1998), however, the vertical and lateral extent of mineralization remains unknown.

The eastern side of the project is underlain by Ordovician rocks of the Castlemaine group and comprises the northern extent of the Wedderburn Goldfield, where numerous small-scale, historical alluvial and hard-rock mines are located.

Data Collection, Verification and QA/QC

Air core samples were collected in 1 metre intervals down hole from surface to end of hole for all holes drilled. A representative sample of each 1 metre interval was collected in chip trays as drilling was undertaken, as well as a larger sample (nominally 1.5kg) which was retained for additional testing where required. Basic chip logging was carried out in the field by Company geologists. This included sample lithologies, colour, quartz veining and mineral observations, and was completed concurrent with sampling. All samples were transported from the drill site to the Company's exploration office in Ballarat by Outback staff.

Preliminary analysis of the samples collected in chip trays was carried out using an Olympus Vanta portable XRF. Analysis was carried out in "Geochem mode" running two beams for a total of 30 seconds each. Based on the results of the preliminary XRF Geochemical analysis, a number of the larger 1.5 kg samples were submitted to the Gekko Assay Laboratory in Ballarat to be analysed for gold using fire assay analysis. Entire samples were pulverised using an LM5 pulveriser ensuring that 90% of the sample was ground to less than 75 μm before 30g subset was taken for fire assay analysis.

For both portable XRF analysis and Fire Assay analysis, QA/QC protocols involved the insertion of Certified Reference materials and blanks at a minimum rate of 1 for every 50 samples tested. Reference material was routinely tested with the portable XRF for arsenic concentrations and the results were deemed acceptable for the scope of the exploration program and specifically identifying anomalous results above background levels. Fire assay analyses of Certified Reference materials for and blanks returned results within acceptable tolerances.

The Qualified Person has supervised all stages of the exploration program relevant to this news release. This includes regular visits to the drill site to supervise, drilling, logging and sample collection practices. The qualified person also supervised the analysis of Samples using the portable XRF and performed a number of impromptu laboratory audits at the Gekko Assay laboratory.

Community Engagement

Outback recognises the importance of open and honest community engagement in all our exploration activities. We approach all our exploration activities in a sustainable manner and ensure our activities comply with the Victorian Code of Practice for Mineral Exploration. As such, community consultation with local landowners has commenced and is ongoing.

National Instrument 43-101 Disclosure

This news release has been approved by Mr. Matthew Hernan (FAusIMM, MAIG) an independent consultant and "Qualified Person" as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's property.

References

Bibby, L.M., and Moore, D.H., 1998, Charlton 1:100,000 map area geological report, Geological Survey of Victoria Report 116, 95 p.

Arne, D.C., House, E., and Lisitsin, V., 2008, Lithogeochemical haloes surrounding central Victorian gold deposits: Part 1 – Primary alteration, Geoscience Victoria Gold Undercover Report 4, 95 p.

Table 2. Table of collar and assay information for 95 drillholes submitted for fire assay gold analyses. Collar information for all holes is posted on the Company's website. Coordinates GDA94 Z54

| HoleID | Easting | Northing | Dip | Azimuth | Depth | Depth To | Interval | Gold | Target Zone |

| OGR1284 | 716,544 | 5,976,232 | -60 | 70 | 3 | 5 | 2 | 1.87 | Golden Jacket |

| and | | | | | 24 | 25 | 1 | 2.81 | Golden Jacket |

| OGR0013 | 716,328 | 5,974,575 | -90 | 360 | 22 | 23 | 1 | 1.5 | Golden Jacket |

| and | | | | | 27 | 32 | 5 | 0.23 | Golden Jacket |

| OGR0403 | 716,517 | 5,976,299 | -90 | 360 | 10 | 12 | 2 | 0.53 | Golden Jacket |

| OGR0403_B | 716,517 | 5,976,297 | -90 | 360 | 0 | 1 | 1 | 0.12 | Golden Jacket |

| OGR0381 | 716,720 | 5,976,446 | -90 | 360 | 6 | 7 | 1 | 0.42 | Golden Jacket |

| OGR0235 | 716,391 | 5,974,539 | -90 | 360 | 3 | 4 | 1 | 0.3 | Golden Jacket |

| and | | | | | 12 | 13 | 1 | 0.45 | Golden Jacket |

| OGR0786 | 716,609 | 5,974,045 | -90 | 360 | 13 | 14 | 1 | 0.42 | Golden Jacket |

| OGR1031 | 716,279 | 5,974,718 | -60 | 74 | 3 | 4 | 1 | 0.22 | Golden Jacket |

| OGR0233 | 716,427 | 5,974,556 | -90 | 360 | 28 | 29 | 1 | 0.2 | Golden Jacket |

| OGR1287 | 716,657 | 5,976,230 | -60 | 70 | 2 | 3 | 1 | 0.16 | Golden Jacket |

| OGR1036 | 716,346 | 5,974,462 | -60 | 74 | 39 | 40 | 1 | 0.12 | Golden Jacket |

| OGR1245 | 716,342 | 5,974,546 | -60 | 70 | 21 | 22 | 1 | 0.12 | Golden Jacket |

| OGR1247 | 716,375 | 5,974,561 | -60 | 70 | 39 | 40 | 1 | 0.12 | Golden Jacket |

| OGR0793 | 716,625 | 5,973,919 | -90 | 360 | 8 | 9 | 1 | 0.11 | Golden Jacket |

| OGR0015 | 716,364 | 5,974,593 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0040 | 716,312 | 5,974,701 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0043 | 716,366 | 5,974,727 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0058 | 716,340 | 5,974,781 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0069 | 716,579 | 5,974,564 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0096 | 716,697 | 5,973,954 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0097 | 716,715 | 5,973,963 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0104 | 716,841 | 5,974,024 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0123 | 716,494 | 5,974,949 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0148 | 716,639 | 5,974,647 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0196 | 716,349 | 5,975,252 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0230 | 716,275 | 5,974,549 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0231 | 716,293 | 5,974,558 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0232 | 716,310 | 5,974,567 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0246 | 716,543 | 5,974,546 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0248 | 716,417 | 5,974,485 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0250 | 716,381 | 5,974,467 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0262 | 716,523 | 5,974,404 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0275 | 716,504 | 5,974,260 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0291 | 716,592 | 5,974,170 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0299 | 716,328 | 5,976,902 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0303 | 716,528 | 5,976,899 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0373 | 716,320 | 5,976,452 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0374 | 716,370 | 5,976,452 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0375 | 716,420 | 5,976,451 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0376 | 716,470 | 5,976,450 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0377 | 716,520 | 5,976,449 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0378 | 716,570 | 5,976,448 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0379 | 716,620 | 5,976,447 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0380 | 716,670 | 5,976,446 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0402 | 716,467 | 5,976,300 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0404 | 716,567 | 5,976,298 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0405 | 716,617 | 5,976,297 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0406 | 716,667 | 5,976,296 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0407 | 716,717 | 5,976,296 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0408 | 716,767 | 5,976,295 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0428 | 716,465 | 5,976,150 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0429 | 716,515 | 5,976,149 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0430 | 716,565 | 5,976,148 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0431 | 716,615 | 5,976,147 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0432 | 716,665 | 5,976,147 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0433 | 716,715 | 5,976,146 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0434 | 716,765 | 5,976,145 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0462 | 716,862 | 5,975,993 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0499 | 716,107 | 5,975,706 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0538 | 716,755 | 5,975,545 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR0554 | 716,252 | 5,975,404 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR1030 | 716,257 | 5,974,774 | -60 | 74 | No Significant Intercept | Golden Jacket | |||

| OGR1034 | 716,326 | 5,974,539 | -60 | 74 | No Significant Intercept | Golden Jacket | |||

| OGR1035 | 716,336 | 5,974,499 | -60 | 74 | No Significant Intercept | Golden Jacket | |||

| OGR1163 | 716,171 | 5,975,550 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR1189 | 716,401 | 5,975,196 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR1238 | 714,578 | 5,977,021 | -90 | 360 | No Significant Intercept | Golden Jacket | |||

| OGR1250 | 716,366 | 5,974,495 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1251 | 716,382 | 5,974,502 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1252 | 716,399 | 5,974,510 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1253 | 716,417 | 5,974,518 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1254 | 716,435 | 5,974,526 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1255 | 716,394 | 5,974,435 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1256 | 716,410 | 5,974,443 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1257 | 716,427 | 5,974,451 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1262 | 716,449 | 5,974,404 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1265 | 716,320 | 5,974,674 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1271 | 716,348 | 5,974,622 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1285 | 716,582 | 5,976,232 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1286 | 716,619 | 5,976,231 | -60 | 70 | No Significant Intercept | Golden Jacket | |||

| OGR1038 | 701,079 | 5,978,960 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1039 | 701,179 | 5,978,957 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1040 | 701,279 | 5,978,955 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1041 | 701,379 | 5,978,953 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1042 | 701,479 | 5,978,950 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1043 | 701,579 | 5,978,948 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1044 | 701,679 | 5,978,946 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1045 | 701,779 | 5,978,944 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1046 | 701,879 | 5,978,941 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1047 | 701,979 | 5,978,939 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1049 | 702,179 | 5,978,935 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1050 | 702,279 | 5,978,932 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1051 | 702,379 | 5,978,930 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1052 | 702,479 | 5,978,928 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

| OGR1053 | 702,579 | 5,978,926 | -90 | 360 | No Significant Intercept | Western Roadsides | |||

About Outback Goldfields Corp.:

Outback Goldfields Corp. is actively exploring its package of highly prospective gold projects located around the Fosterville Gold Mine in Victoria . The goldfields of Victoria are home to some of the highest grade and lowest cost mining in the world.

~signed

Chris Donaldson , CEO and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "forward-looking statements" and "forward-looking information" under applicable Canadian securities legislation that are not historical facts. Forward-looking statements involve risks, uncertainties, and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the Company's business and prospects; the Company's objectives, goals or future plans; resumption of trading in the Company's common shares; and the business, operations, management and capitalization of the Company. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic and social uncertainties; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; delay or failure to receive board, shareholder or regulatory approvals; those additional risks set out in the Company's public documents filed on SEDAR at www.sedar.com ; and other matters discussed in this news release. Accordingly, the forward-looking statements discussed in this release, including the resumption of trading, may not occur and could differ materially as a result of these known and unknown risk factors and uncertainties affecting the companies. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

SOURCE Outback Goldfields Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/October2022/19/c1294.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/October2022/19/c1294.html