Maiden Mineral Resource Estimate at Pepas, Anzá Project, Colombia

Maiden Mineral Resource Estimate at Pepas of 1.14 Mt at 5.46 g/t Au in Indicated classification for 201,000 ounces of contained gold.

Additional Inferred Mineral Resource of 0.19 Mt at 2.99 g/t Au for 18,000 ounces of contained gold.

LONDON, UK / ACCESS Newswire / February 10, 2026 / Orosur Mining Inc. ("Orosur" or the "Company") (TSXV:OMI,OTC:OROXF)(AIM:OMI), is pleased to announce the completion of a maiden Mineral Resource estimate ("MRE") for the Pepas deposit, at the Company's Anzá Project in Colombia.

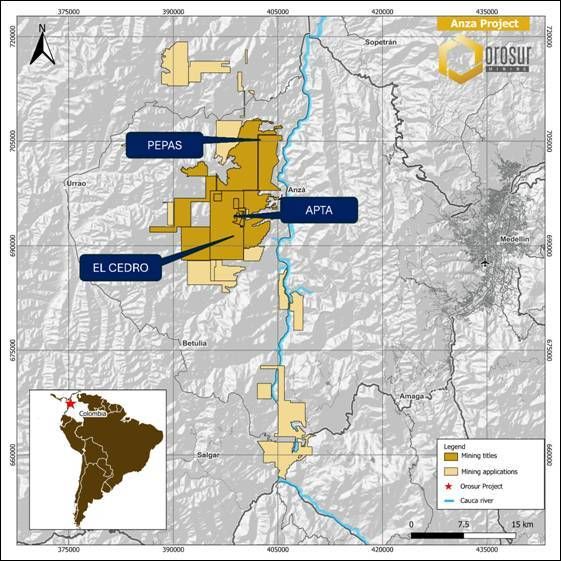

The Anzá Project comprises a number of granted exploration titles and applications totalling roughly 330km2 within the Mid-Cauca gold belt, west of the city of Medellin, Antioquia state, Colombia. Orosur owns 100% of these titles and applications through two Colombian wholly owned subsidiary companies, Minera Anzá, and Minera Monte Aguila.

The Pepas gold deposit is located in the northern part of the Anzá project area and was discovered by the Company's previous JV partners in early 2022, but not advanced. When the Company reassumed 100% ownership of Anzá in November 2024, it commenced drilling immediately at Pepas with positive results, leading to the decision in June 2025 to focus drilling entirely at Pepas to allow estimation of a Mineral Resource as quickly as possible.

Orosur CEO Brad George commented:

"The Company's decision to focus its efforts on moving the Pepas deposit toward an MRE has been justified with this result. We will now immediately move Pepas into the economic study and permitting stage, while at the same time expanding our exploration effort to begin testing e other prospects within the Anzá project."

Figure 1. Anzá Project

Pepas Mineral Resource Estimate

A Mineral Resource Estimate ("MRE") has been completed for the Pepas deposit by international mineral consulting firm, Bara Consulting Limited, with an effective date of 16 January 2026. The MRE was prepared in accordance with the 2019 Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines and 2014 CIM Definition Standards for Mineral Resources & Mineral Reserves and disclosed to National Instrument 43-101 ("NI 43-101"). Details of the MRE evaluation will be provided in a Technical Report prepared in accordance with NI 43-101 filed under the Company's SEDAR profile within 45 days of this release.

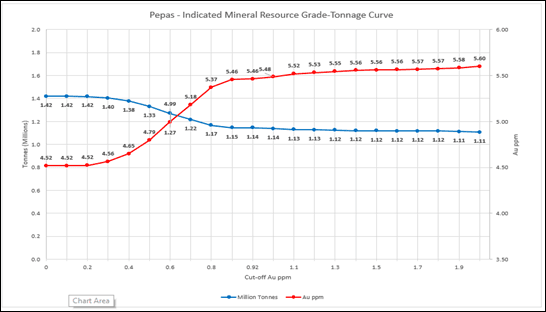

The Pepas Mineral Resource comprises an estimated 1.14 million tonnes at a grade of 5.46 g/t gold for 201,000 ounces of gold in the Indicated Mineral Resource category and 0.19 million tonnes at a grade of 2.99 g/t gold for 19,000 ounces of gold in the Inferred Mineral Resource category and assumes extraction via an open pit mining scenario. Mineral Resources are classified as Indicated and Inferred based on CIM Definition Standards.

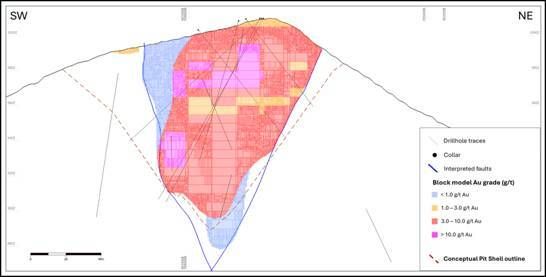

The resource is entirely contained within an open pit shell, down to a vertical depth of approximately 100m, with mineralisation starting at surface. The MRE and pit shell have been generated using a gold price of US$3000/oz and a reporting cut-off grade of 0.92g/t Au.

Deposit | Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Contained Gold (ozs) |

Pepas | Indicated | 1.14 | 5.46 | 201,000 |

Pepas | Inferred | 0.19 | 2.99 | 18,000 |

Table 1. Resource table, Pepas

Tonnages are rounded to the nearest 10,000t to reflect this as an estimate.

Metal content is rounded to the nearest 1,000ozs to reflect this as an estimate.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Mineral Resources are reported above a cut-off grade of 0.92 g/t Au within a conceptual pit shell generated in support of reasonable prospects of eventual economic extraction (RPEEE) as per CIM Estimation of Mineral Resources and Mineral Reserves Best Practise Guidelines prepared by the CIM Mineral Resource and Mineral Reserve Committee and adopted by the CIM Council on November 29, 2019 which incorporates gold price, payability, recovery, throughput, mining costs, processing costs and transport cost assumptions which are considered reasonable at a conceptual level.

The conceptual pit shell has been generated using the following assumptions and parameters; throughput of 250ktpa, gold price (USD$3,000), payability (99.5%), Au recovery (88.75%), ROM transport cost (USD$2.50/t) processing costs (USD$60/t), G&A cost (USD$10/t) and mining costs (US$2.05/t, US$3.40/t and USD$3.50/t for oxide, transitional and fresh material respectively)

The QP is not aware of any legal, permitting, title, taxation, socio-economic, marketing, political environmental or other risk factors that might materially affect the estimate of Mineral Resources

Figure 2. Grade tonnage curve

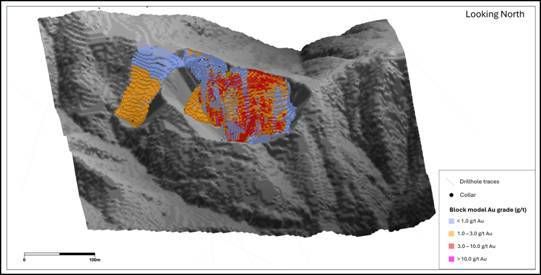

Figure 3. Plan of holes, block model and pit shell

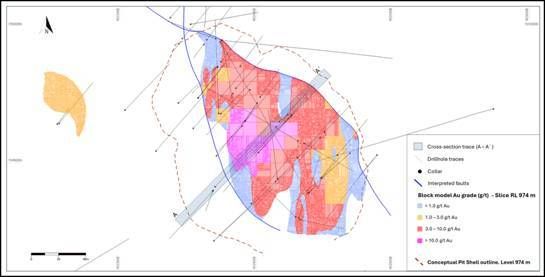

Figure 4. Example block model cross section and pit shell above 0.92g/t Au cutoff

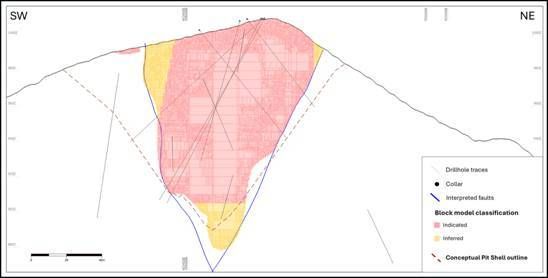

Figure 5. Block model cross section, resource classification

MRE Parameters and Methodology

The Mineral Resource estimate is estimated from diamond drill hole data contained within a database at a cut-off date of 16 January 2026. The data set used for estimation includes a total of 79 diamond drill holes representing 10,592.10 metres of drilling. The current drill hole spacing ranges from approximately 15m to 30m over the deposit.

Mineral Resource domains were created within a NW-SE fault-bounded block whose dimensions are approximately 200m (strike length) x 100m (width) to a maximum depth of 100m in which gold is hosted within a broadly NNW-SSE to NNE-SSW trending sinuous zone of quartz veining. Bounding structures have been modelled and are broadly coincident with the broad extents of silic/sericitic alteration as defined from logging and fundamentally constrain the mineralised zones to a NW-orientated lozenge, mirrored by a nominal 0.15g/t Au threshold. Two spatial grade domains (LG and HG - the latter above 1.0g/t Au) are modelled using implicit modelling in Leapfrog™ software, supported by statistical analysis of the dataset, orientated broadly N-S with subvertical dip. In addition, a small, near surface domain hosted in colluvium has also been modelled at a 0.5g/t gold cut-off.

In addition to mineralised domains, bounding faults and weathering surfaces are modelled, constrained to topography and a flagged block model created into which gold grade is estimated. Parent cell dimensions of 10m x 10m x 5m were sub-celled down to a minimum 0.5m x 0.5m x 0.5m to ensure accurate representation of mineralised domain geometries and volumes. Gold assay data within mineralised domain was composited to 2m to ensure equal support in grade estimation and appropriate grade capping was applied to mitigate the influence of extreme grade values during estimation. Statistical and geostatistical (variography) analysis was completed on 2m composites to assess directions and ranges of grade continuity and inform estimation parameters used. Density was assigned to the model via Inverse Distance Weighting (IDW) using density values obtained from drill core samples across the deposit. Grade estimation into parent blocks was run via Ordinary Kriging (OK) in three passes of increasing search pass volume until all model blocks received an estimated grade. Block model validations (global and local) were performed including visual inspection of block grades against input composite grades, comparison of global mean values, volume checks and swath plots to ensure no significant bias in the estimate.

The Mineral Resource estimate meets the requirements of reasonable prospects of eventual economic extraction (RPEEE) by reporting only material above a cut-off of 0.92g/t Au derived from a conceptual open pit optimisation using the following parameters; throughput of 250ktpa, gold price (USD$3,000), payability (99.5%), Au recovery derived as the average from recent test work results from drill core composite samples (88.75%), ROM transport cost (USD$2.50/t) processing costs (USD$60/t), G&A cost (USD$10/t) and mining costs (US$2.05/t, US$3.40/t and USD$3.50/t for oxide, transitional and fresh material respectively).

The Mineral Resource Estimate classification is informed by adequate close spaced exploration drilling, sufficient understanding of the geological and structural framework at Pepas, appropriate QA/QC controls providing acceptable confidence in the overall quality of sampling and accuracy/precision of assay data, confidence in the mineralisation domain interpretations and geostatistical analysis, sufficient to assume (in the case of Indicated Mineral Resources) or imply (in the case of Inferred Mineral Resources) geological and grade continuity. Indicated Mineral Resources have been classified where block grade estimates have been captured in the first search pass (up to 30m - the range of continuity as defined by the variogram).

Orosur Mining Inc. staff follow standard operating and quality assurance procedures to ensure that sampling techniques and sample results meet international reporting standards. Drill core is split in half over widths that vary between 0.3m and 2m, depending upon the geological domain. One half is kept on site in the Minera Anzá core storage facility in the case of the Anzá Project with the other sent for assay.

Drillhole samples from PEP001 to PEP011 (2022 programme) were submitted to ALS Medellín, Colombia for sample preparation, with pulps subsequently analysed at ALS Lima, Peru. Both laboratories hold ISO/IEC 17025:2017 accreditation for the preparation and analytical methods performed. In a limited number of instances, samples were forwarded within the ALS network to other ALS facilities for final analysis, including laboratories in Canada, Laos, and South Africa.

Drillhole samples from PEP012 to PEP074 (2024/2025 programme) were submitted to Actlabs Colombia S.A.S. for both sample preparation and analysis. The laboratory is certified to ISO 9001

Samples submitted to ALS were bar-coded and logged into the Laboratory Information Management System, weighed, dried, and finely crushed to over 70% passing a 2-millimetre screen. A sub-sample of up to 250g is taken using a riffle splitter and pulverized to over 85% passing 75 microns. The pulverised sample is then split for delivery to the analysis lab. Gold was analysed by fire assay at ALS using a 30 g charge with an atomic absorption spectroscopy (AAS) finish (ALS method Au-AA23). Samples returning gold values above the upper limit of the Au-AA23 method were re-analysed by fire assay with gravimetric finish. Where coarse gold was suspected based on geology and/or assay behaviour, selected samples were re-analysed by Screen Fire Assay (SFA).

Samples sent to Actlabs were logged into the Laboratory Information Management System manually, oven dried, and finely crushed to over 80% passing a 2-millimetre screen. A sub-sample of up to 250g is taken using a riffle splitter and pulverized to over 95% passing 105 microns. A 30g is then split for the analysis. Gold was analysed by fire assay with AAS. samples returning >10 g/t Au were routinely re-analysed by fire assay with gravimetric finish.

a QA/QC program is in place to ensure that sampling, laboratory submission, data handling, and verification practices meet accepted industry standards suitable for public reporting. Roles and responsibilities are defined across project management and geology personnel, with implementation verified through staff training and periodic (scheduled and unscheduled) audits covering field methods, sample custody, laboratory processes, and database integrity.

Quality control monitoring is based on routine insertion of control samples to assess contamination, precision, and accuracy. Control samples include coarse blanks (BKG) to monitor preparation contamination, certified reference materials (CRM) to monitor analytical accuracy, and duplicates to monitor precision at multiple stages: field duplicates (DU), coarse/crush duplicates (DUG), and pulp duplicates (DUP) at insertion rates of 1 in 40 (12.5%).

The QP has reviewed the QA/QC procedures, analytical data and information provided in relation to lab audits, non-conformity reporting, sample security and completed analysis of available data which indicates that, overall, the analytical dataset is acceptable for use in a Mineral Resource Evaluation.

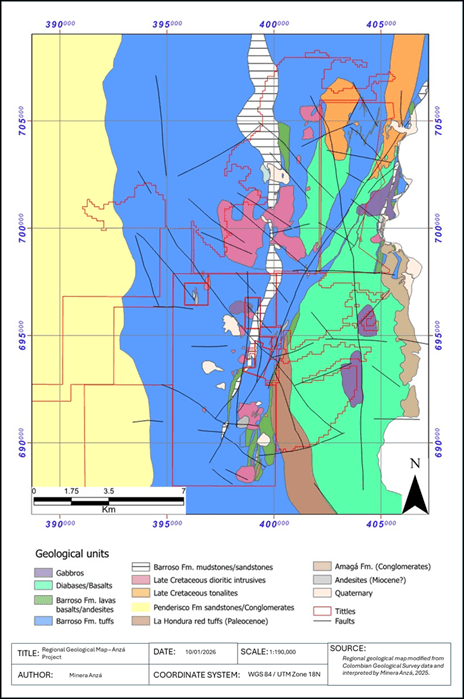

Pepas and Anzá Project Geology

The Anzá Project is located in the Middle Cauca belt of Colombia on the west side of the Romeral-Cauca fault system. The project predominantly overlies Upper Cretaceous to Palaeocene mafic and intermediate volcanic rocks and sediments of the Western Cordillera, deposited in oceanic plateau to intra-oceanic arc settings and intruded by co-magmatic stocks of gabbro to quartz-diorite composition. More localised Miocene porphyritic intrusions are of diorite to granodiorite composition.

The Pepas deposit is located in the northern portion of the Anzá Project and is interpreted as an intermediate sulphidation epithermal gold system. Gold mineralization at Pepas is hosted within volcaniclastic and epiclastic rocks of the Upper Cretaceous Barroso Formation

The Pepas Mineral Resource occurs within a NW-trending fault zone termed the Pepas fault zone, an antithetic fault relative to the NE-trending Aragón fault. The Mineral Resource is bounded by two strands of the fault, the southwest bounding fault dipping to the northeast and the northeast bounding fault dipping to the southwest. These faults and their splays also converge to the northwest and southeast and, as a result, the Mineral Resource has been estimated within an enclosed fault-bounded lens or lozenge.

Within the fault lozenge, the tuffaceous and epiclastic host rocks show strong to intense silicification, quartz-sericite alteration, and steeply-dipping quartz veining at 1-10 cm scale. Veining has a dominant north- to NNE-trend which is parallel to the regional grain but oblique to the bounding faults. Overprinting argillic alteration in the fault and shear zones is variably pyritic but only weakly anomalous in gold.

Veining is banded and sinuous banded with thin sulphidic laminae and selvedges, suggestive of epithermal style with multi-stage repeated pulses of mineralizing fluid over an extended period of time. The sulphide content is low, with predominant pyrite and sphalerite and subordinate galena and chalcopyrite. Gold grade is closely related to intensity of veining and abundance of sulphide, predominantly low-iron sphalerite and pyrite, with subordinate galena and chalcopyrite.

Figure 7. Regional Geology, Anzá Project area.

For further information, visit www.orosur.ca, follow on X @orosurm or please contact:

Orosur Mining Inc

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Jen Clarke / Devik Mehta

Tel: +44 (0) 20 3470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/Guy McDougall

Tel: +44 (0)20 3657 0050

Flagstaff Communications and Investor Communications

Tim Thompson

Mark Edwards

orosur@flagstaffcomms.com

Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has been incorporated into UK law by the European Union (Withdrawal) Act 2018. Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Orosur Mining Inc.

Orosur Mining Inc. (TSXV:OMI,OTC:OROXF)(AIM:OMI) is a minerals explorer and developer currently operating in Colombia and Argentina.

Qualified Persons Statement

"The Mineral Resource estimate disclosed herein and other scientific and technical information which supports this news release was prepared under the supervision of Mr. Galen White, BSc (Hons), FAusIMM, FGS, Principal Consultant - Bara Consulting Limited, in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI43-101"). Mr. White is a Qualified Person ("QP") as defined under NI 43-101. Mr White is independent of the Company. Verification activities included a site visit by Mr. White to the property in November 2025 for the purposes of ground truthing, geological review, drill hole inspection, verification of data collection activities, QA/QC review and validation of input data used in MRE estimation. Mr White has reviewed and approved the contents of this news release in the form and context in which it appears.

A technical report relating to the Anzá Property, and which includes Mineral Resource estimation material disclosure, prepared in accordance with NI 43-101, will be filed under the Company's profile on SEDAR+ at www.sedarplus.ca within the required regulatory deadline."

Forward Looking Statements

All statements, other than statements of historical fact, contained in this news release constitute "forward looking statements" within the meaning of applicable securities laws, including but not limited to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and are based on expectations estimates and projections as of the date of this news release.

Forward-looking statements include, without limitation, the continuing focus on the Pepas prospect, the exploration plans in Colombia and the funding of those plans, and other events or conditions that may occur in the future. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such forward-looking statements. Such statements are subject to significant risks and uncertainties including, but not limited to, those described in the Section "Risks Factors" of the Company's MD&A for the year ended May 31, 2025. The Company's continuance as a going concern is dependent upon its ability to obtain adequate financing. This material uncertainty may cast significant doubt upon the Company's ability to realize its assets and discharge its liabilities in the normal course of business and accordingly the appropriateness of the use of accounting principles applicable to a going concern. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events and such forward-looking statements, except to the extent required by applicable law.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Orosur Mining Inc

View the original press release on ACCESS Newswire