January 02, 2024

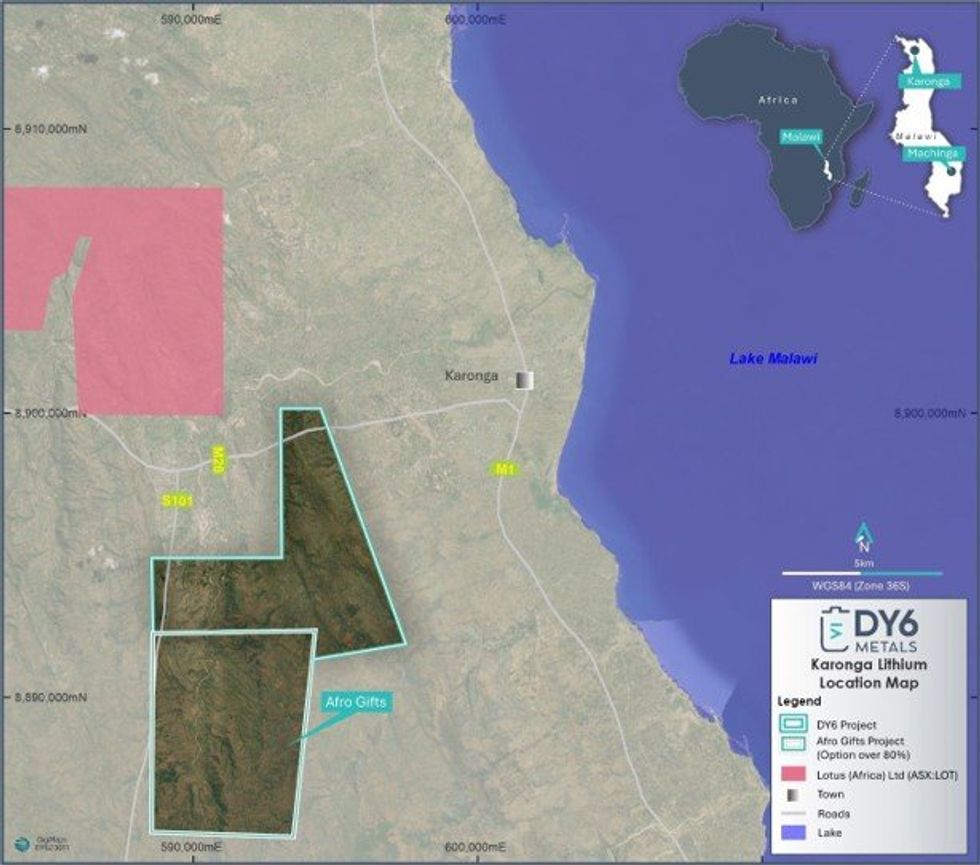

DY6 Metals Ltd (ASX: DY6, “DY6” or “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to announce that it has entered into an exclusive option to acquire an 80% interest in the Karonga Lithium Project (granted licence EPL0659) (the Project) located in northern Malawi.

HIGHLIGHTS

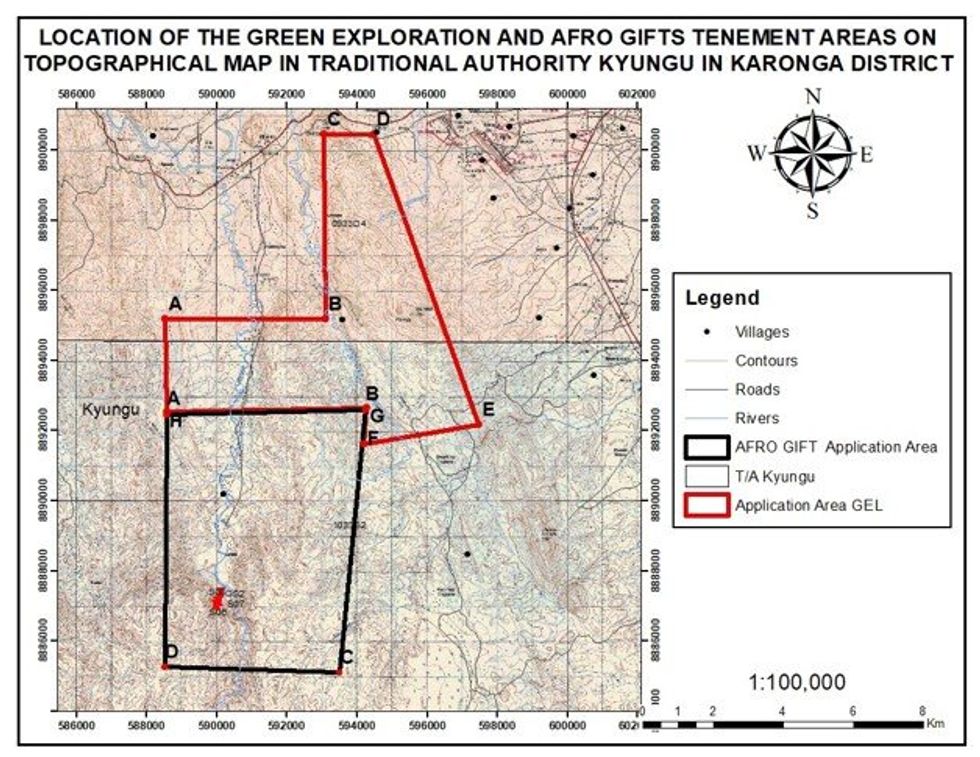

- DY6 has secured a 6-month option to acquire an 80% interest in the Karonga Lithium Project located in northern Malawi, a granted licence covering a total area of 39km2

- The licence borders the Company’s recent exclusive prospecting license application at Karonga (for a combined ~75km2)

- Reconnaissance field work at the Karonga Lithium Project identified a number of pegmatites of up to 500m metres in length with the potential to host lithium mineralisation

- Rock chip samples taken from the Karonga Lithium Project include visually observed spodumene and lithium micas (lepidolite)*. Samples have been despatched for laboratory analysis in Johannesburg

- The Company is planning on undertaking a detailed geological mapping and sampling program across the Project early in 2024

The granted licence covers ~39km2 and adjoins the Company’s recent license application at Karonga (together, both licences cover ~75km2).

The Company’s geological team recently undertook a reconnaissance field visit at the Karonga Lithium Project. Ten reconnaissance rock chip samples from four outcrops were collected and have been submitted for laboratory analysis in South Africa.

The Company’s CEO, Mr Lloyd Kaiser said: “We are pleased to have reached an agreement to secure an 80% interest in the Karonga Lithium Project in northern Malawi. The project adjoins our recently applied for prospecting license near Karonga, adding scale potential. Importantly, field reconnaissance at the project identified a number of pegmatites – up to 25 metres in width and 500 metres in length – with visually observed lithium-bearing minerals. We await assay results from the reconnaissance rock chip sampling and look forward to getting back on the ground in the coming weeks.”

Karonga Lithium Project

The Project is located about 440km north of the capital Lilongwe (refer Figure 2) and covers a total area of approximately 39.27km2. The area can easily be accessed using Karonga-Chitipa M1 Road turning to the west at Kasikisi School signpost along the M1 Road.

The Karonga area is associated with a series of N-S trending ridges with metamorphic Basement complex rocks commonly identified as windows within the Karroo System which overlies the basement. The Karroo System units are typically sandstones with carbonaceous shales formations.

Pegmatite float material was noted in the Mwesa River which cuts NE-SW through the area. The sampling focused on pegmatite intrusions that are traceable for up to 500m in length. In hand specimen, these pegmatites have high percentages of albite, microcline and occasional K-feldspar with associated muscovite and biotite micas. The pegmatites are within the basement complex as biotite schist and gneisses with medium sized dark coloured micas. Quartz-feldspathic granulites were also observed. Exposures of these were found with copper coatings on joints and weathered reddish brown cuprite was observed.

Within the pegmatites, light greenish to purplish elongated feldspar-like crystals were observed, using a hand lens and tentatively identified as spodumene*. Samples were collected and some had structures which shows shearing effect depicting the structure of spodumene (refer Table 1).

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00