June 23, 2022

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce results from recent drilling targeting extensions to the mineralisation at the Company's flagship Hualilan Gold Project, in San Juan Argentina. The results include the first drill holes that were not included in the Company’s recent maiden 2.1 million ounce AuEq1 Mineral Resource Estimate (MRE) which includes a high-grade core of 1.1 Moz at 5.6 g/t AuEq1 .

Highlights

- First drilling post the CEL's 2.1 million ounce (AuEq)1 MRE significantly expands mineralisation, particularly the high-grade core of 1.1 Moz at 5.6 g/t AuEq1 , in multiple directions.

- Significant intersections outside the current MRE boundary include (see Table 1):

- 28.5 metres at 5.3 g/t AuEq (5.0 g/t Au, 23.9 g/t Ag, 0.02 % Pb, 0.03 % Zn) - (GNDD-530) Extends the Verde Zone 60 metres below the current resource boundary and GNDD-500 (40 metres at 0.8 g/t AuEq) and demonstrates significantly improved grades at depth

- 2.4 metres at 64.7 g/t AuEq (60.8 g/t Au, 53.4 g/t Ag, 0.04 % Pb, 7.1 % Zn) - (GNDD-520) Confirmed a high-grade zone at depth in the Verde Zone that remains open at depth and along strike and, based on recent drilling (assays pending), has significant upside potential

- 6.6 metres at 6.4 g/t AuEq (4.2 g/t Au, 50.0 g/t Ag, 0.01 % Pb, 3.4 % Zn) - (GNDD-536) 24.2 metres at 0.9 g/t AuEq (0.7 g/t Au, 1.7 g/t Ag, 0.02 % Pb, 0.2 % Zn) Intersected a new zone of near surface mineralisation (24.2m at 0.9) and extended the Verde Zone 200 metres below the current MRE boundary (6.6m at 6.4 g/t AuEq)

- 15.0 metres at 3.9 g/t AuEq (3.9 g/t Au, 3.7 g/t Ag, 0.03 % Pb, 0.2 % Zn) - (GNDD-547) 3.7 metres at 8.5 g/t AuEq (2.6 g/t Au, 50.5 g/t Ag, 4.9 % Pb, 9.3 % Zn) Extends the Gap Zone mineralisation to near surface and intersected a new zone of high grade mineralisation (3.7m at 7.3 g/t AuEq) 50 metres east of the current MRE boundary

- 14.4 metres at 2.1 g/t AuEq (1,2 g/t Au, 69.4 g/t Ag, 0.06 % Pb, 0.1 % Zn) - (GNDD- 532) 37.0 metres at 1.4 g/t AuEq (1.3 g/t Au, 8.6 g/t Ag, 0.01 % Pb, 0.1 % Zn) 10.9m metres at 2.6 g/t AuEq (2.0 g/t Au, 14.8 g/t Ag, 0.2 % Pb, 0.9 % Zn) Returned significantly higher grades than surrounding holes and intersected a new zone of higher-grade Verde style mineralisation 125 metres below the current MRE boundary

- The maiden MRE was based on 125,700 metres and the Company has now completed 197,000 metres with assays to be received progressively as core is sampled and sent for assay.

Commenting on the first drilling results after the resource, CEL Managing Director, Mr Kris Knauer, said

“We indicated when we released our Maiden Resource Estimate at Hualilan it was very much an interim and we expect it to increase significantly. It was based on 126,000 metres of our 204,000 metre drill program and 2.2 of the 3.5 kilometres of strike, over which the high-grade mineralisation has been intersected. These first results following the Mineral Resource Estimate confirm this.

All the more exciting, is that if assays confirm what we have logged in several recent holes, we have some significant new zones to follow up in addition to the areas we are currently targeting. It now firmly appears that mineralisation at Hualilan will remain open at the end of the current 204,000 metre program."

The MRE was based on 125,700 metres of the Company's 204,000 metre diamond core drill program. The current holes that were not included in the MRE comprise an additional 13,800 metres of drilling. As of this morning the Company has completed 197,000 of the 204,000 metres with results for the next 64,500 metres in the 204,000 metre program expected progressively over the next 4 months.

The results continue to exceed the Company's expectations and confirms that mineralisation remains open in all directions, the majority of the new mineralisation is high-grade, and there is clear potential for the MRE to grow significantly via extension and infill drilling. Several recently completed holes (assays pending) have opened new high-grade targets for extension drilling and the Company believes that Hualilan will remain open in all directions at the completion of the current 204,000 metres.

In addition to the strong results from drilling designed to extend the mineralisation outside the interim MRE boundary several infill holes, often between holes with minimal grade, have returned significant high grade results which is enormously encouraging.

SIGNIFICANT INTERSECTIONS RECEIVED AFTER THE MRE CUT-OFF DATE

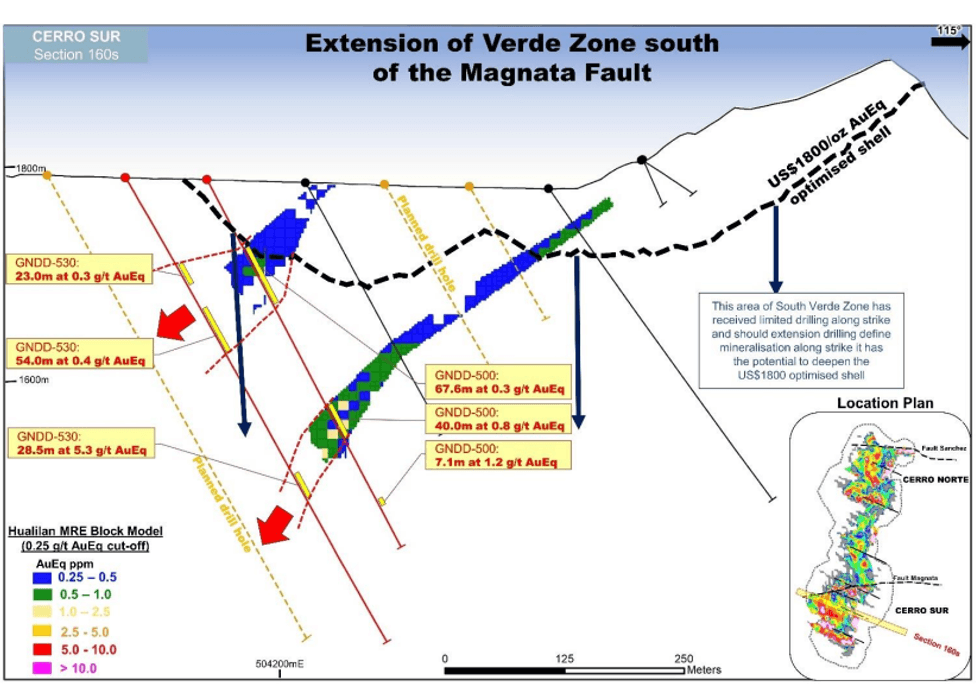

GNDD-530 - Verde Zone (South of the Magnata Fault)

GNDD-530 was a test for extensions of the Verde style mineralisation, south of the Magnata Fault, at depth. The hole was collared to test 80 metres below GNDD-500 which intersected 67.6 metres at 0.3 g/t AuEq from 81.5m and 40.0 metres at 0.8 g/t AuEq from 267.0m. GNDD-530 intersected three zones of mineralisation - 28.5 metres at 5.3 g/t AuEq (5.0 g/t Au, 23.9 g/t Ag, 0.02 % Pb, 0.03 % Zn) from 357.5m, 23.0 metres at 0.3 g/t AuEq (0.3 g/t Au, 1.2 g/t Ag, 0.01 % Pb, 0.02 % Zn) from 107.0m, and 54.0 metres at 0.4 g/t AuEq (0.3 g/t Au, 2.0 g/t Ag, 0.01 % Pb, 0.06 % Zn) from 159.0m.

All three intersections extended the mineralisation 80 metres down dip of the current MRE boundary with the deepest intersection (28.5m at 5.3 g/t AuEq) demonstrating significantly improved grades at depth which is becoming common in the Verde Style mineralisation at depth. The second intersection (54.0m at 0.4 g/t AuEq) significantly expanded the width of the mineralisation.

Figure 1 shows the MRE block model in section and GNDD-530. On this section the mineralisation below the US$1800 optimised pit shell was not included in the MRE as it has a grade of less than the 1.0 g/t AuEq cut off used for reporting the underground component of the MRE. This area of the MRE is relatively lightly drilled with additional drilling planned along strike and both up and down-dip. The higher grade mineralisation intersected at depth in GNDD-530, and any additional high-grades in infill and extensional drilling, has the potential to significantly deepen the US$1800 optimised pit shell which would provide a material increase to the current MRE.

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00