April 25, 2023

Maiden nickel sulphide exploration program confirms district-scale potential of Pulju Project; Nordic to receive funding and technical support after being accepted into BHP’s inaugural Xplor Program

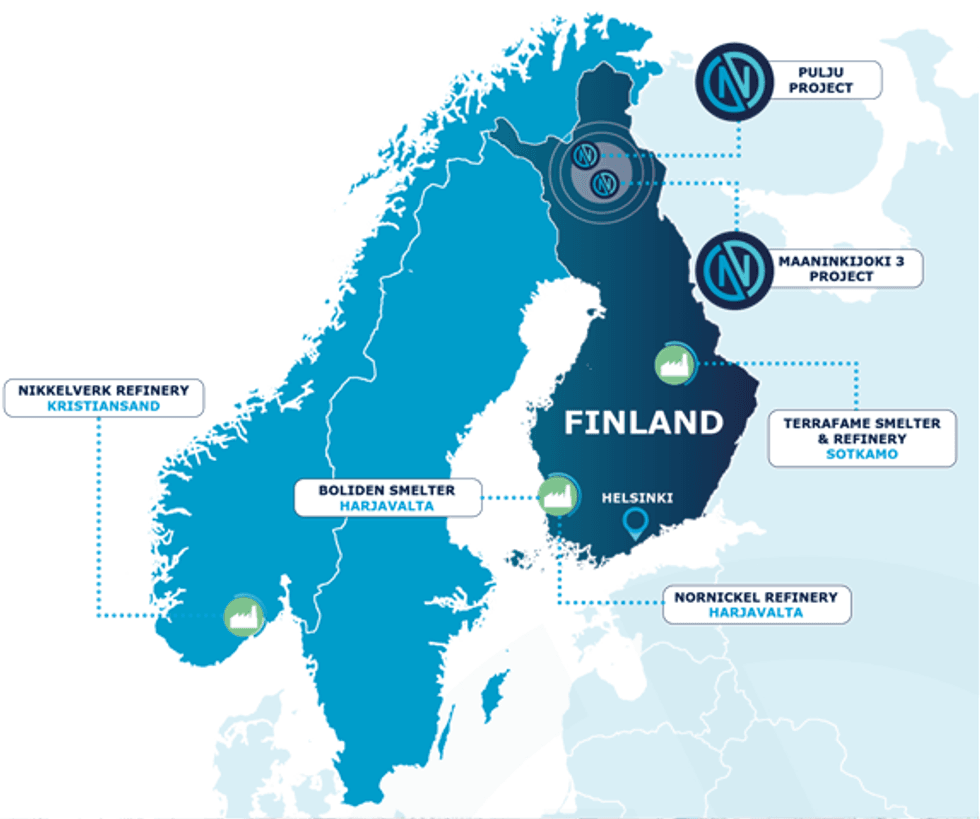

Nordic Nickel Limited’s (“Nordic Nickel” or “the Company”) (ASX: NNL) flagship 100%-owned Pulju Nickel Project is located in the Central Lapland Greenstone Belt (CLGB), 50km north of Kittilä in Finland, with access to world-class infrastructure, grid power, a national highway, international airport and, importantly, Europe’s only two nickel smelters.

HIGHLIGHTS

- Nordic’s maiden 14-month diamond drilling campaign commenced at the Hotinvaara Prospect, with two diamond drill rigs in operation.

- Moving Loop Electromagnetic (MLEM) and Borehole Electromagnetic (BHEM) geophysical surveys completed at the Hotinvaara Prospect, with multiple discrete EM conductors detected both within and external to the existing JORC Mineral Resource.

- Regional UAV (drone) magnetic survey recently completed over the entire Pulju ground holding, with interpreted results to be released shortly.

- Nordic accepted into BHP’s inaugural Xplor program, which provides non- dilutionary exploration funding for early-stage exploration companies looking for metals vital to the energy transition as well as providing access to BHP’s deep expertise and global partnerships.

- Cash of $8.02m as of 31 March 2023.

PULJU NICKEL PROJECT

The known nickel mineralisation in the CLGB is typically associated with ultramafic cumulate and komatiitic rocks with high-grade, massive sulphide lenses and veins enveloped by very large, lower grade disseminated nickel sulphide near-surface. The disseminated nickel at Pulju is widespread and indicates the presence of a vast nickel-rich system, as indicated by the near-surface maiden JORC (2012) Mineral Resource Estimate (MRE) for the Hotinvaara deposit of 133.6Mt @ 0.21% Ni, 0.01% Co1.

During the March 2023 Quarter, Nordic Nickel commenced a major diamond drilling program at Hotinvaara, designed to:

- Evaluate the scale of the broader, district-scale disseminated nickel system;

- Target extensions of the near-surface mineralisation for an updated MRE later this year; and

- Test multiple EM conductors for potential accumulations of high-grade massive sulphides.

Pulju is located 195km from Boliden’s Kevitsa Ni-Cu-Au-PGE mine and 9.5Mtpa processing plant in Sodankylä, Finland. Kevitsa provides feed for the 19ktpa Harjavalta smelter, which is located approximately 950km to the south and processes concentrate from Kevitsa’s low-grade disseminated nickel sulphide ore (Mineral Resource Estimate Ni grade ~0.21%). Europe’s only other smelter is Terrafame’s 37ktpa Sotkamo smelter, located 560km south-east of Pulju.

Management Comment

Commenting on the March Quarterly Activities Report, Nordic Nickel Managing Director, Todd Ross, said: “We are now well and truly underway with our maiden diamond drilling program at our flagship Pulju Nickel Project, and we’re very excited about what we’ve seen so far. Visual observation of the drill core indicates the widespread presence of sulphide mineralisation of varying intensity, with first assay results from the drilling expected soon2.

“We also completed a highly successful MLEM survey at the high-priority Hotinvaara Prospect during the quarter, with multiple discrete EM conductors detected both inside and outside the existing JORC (2012) Mineral Resource Estimate envelope, expanding the mineralised footprint over an estimated strike length of around 3.4km.

Click here for the full ASX Release

This article includes content from Nordic Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00