June 16, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) advises that it has lodged a prospectus with ASX and ASIC on 17 June 2024 (Prospectus) pursuant to which the Company is undertaking a non-renounceable entitlement offer.

Entitlement Offer

A non-renounceable entitlement offer of one (New Share) for every one Share held by Eligible Shareholders on Thursday, 20 June 2024 (Record Date) at an issue price of $0.004 per Share together with one free attaching option (New Options) for every two Shares applied for and issued to raise up to $3,986,139 (based on the number of Shares on issue as at the date of the (Prospectus). The Entitlement Offer is open to Eligible Shareholders who have a registered address within Australia or New Zealand, and who hold Shares on the Record Date. The Entitlement Offer will close at 5:00pm on Tuesday, 9 July 2024 (unless extended), and Eligible Shareholders can apply for any shortfall in excess of their entitlement. As the Entitlement Offer is non-renounceable, Eligible Shareholders cannot trade their rights under the Entitlement Offer.

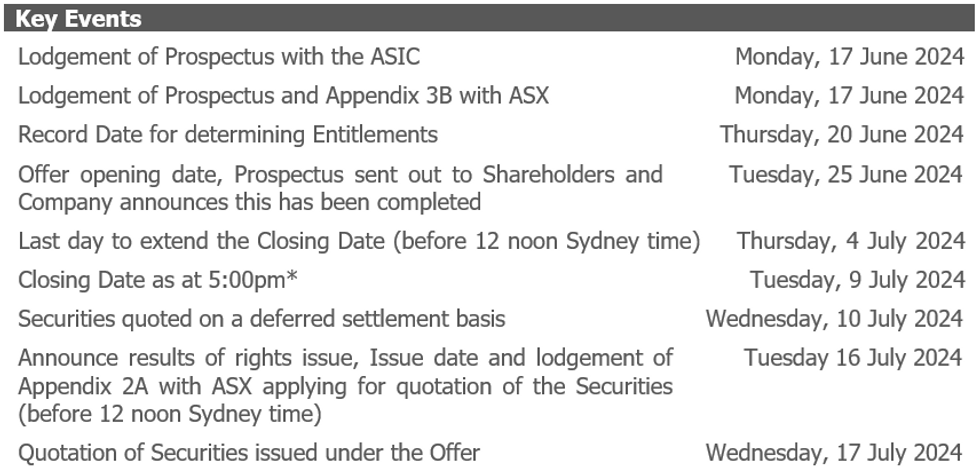

Indicative Timetable

The indicative timetable of the Entitlement Offer is set out below:

* The Directors may extend the Closing Date by giving at least 3 Business Days’ notice to ASX prior to the Closing Date. Accordingly, the date the Securities are expected to commence trading on ASX may vary.

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

10h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

15h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

17h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

17h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

18h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00