- Panasonic Energy and GM (together, the "Anchor Customers") concurrently commit to multiyear offtake agreements for NMG's active anode material, covering approximately 85% of NMG's planned Phase-2 fully integrated production, from ore to battery materials.

- Offtake agreements are complemented by an aggregate US$50 million Tranche 1 Investment from Panasonic and GM to advance the development of NMG's Phase-2 Matawinie Mine and Bécancour Battery Material Plant as per their respective specifications.

- Strategic partner Mitsui and long-time investor Pallinghurst inject a total of US$37.5 million into NMG's development, the aggregate proceeds of which will be used to repurchase their previously announced convertible notes.

- Offtake agreements and investments support NMG's execution plan for its Phase-2 Matawinie Mine and Bécancour Battery Material Plan, marking a significant milestone toward future funding by Anchor Customers of up to US$275 million, subject to certain conditions and a maximum ownership threshold agreed between the relevant parties.

- Shareholders, analysts, and media are invited to attend an Investor Briefing today at 10:30 a.m. ET hosted by NMG's Management Team via webcast .

On the back of agreed-upon offtake agreements with Panasonic Energy Co., Ltd. ("Panasonic Energy"), a wholly owned subsidiary of Panasonic Holdings Corporation ("Panasonic") (TYO: 6752), and General Motors Holdings LLC, a wholly owned subsidiary of General Motors Co. (collectively, "GM") ( NYSE: GM ), Nouveau Monde Graphite Inc. ("NMG" or the "Company") ( NYSE: NMG , TSX.V: NOU ) has rallied Mitsui & Co., Ltd ("Mitsui") (TYO: 8031) and Pallinghurst Bond Limited ("Pallinghurst") for an aggregate combined investment of US$87.5 million to advance its development toward commercial operations. Projected to become the first fully integrated natural graphite active anode material production of its kind in North America, NMG is set to provide a carbon-neutral, reliable, sizeable, and ESG-driven source of Canadian natural graphite for the local electric vehicle ("EV") and lithium-ion battery market.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240214714914/en/

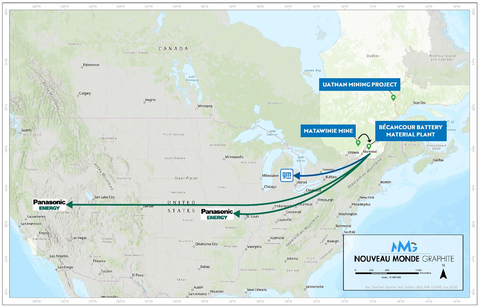

Map of NMG's integrated extraction and advanced manufacturing routes to supply Panasonic Energy and GM.

Arne H Frandsen, Chair of NMG, declared: "Today, influential actors in strategic minerals, modern commodities, batteries, and EVs are coming together to drive the establishment of a Canadian source of graphite to support energy autonomy, national security, and global decarbonization. I am confident that such commercial and investment levers will constitute the bedrock on which NMG can build its Phase 2 operations and more. Congrats to colleagues at Panasonic Energy, GM, Mitsui and Pallinghurst for this multifaceted transaction; together we will support the world's transitions towards a cleaner future."

Eric Desaulniers, Founder, President, and CEO of NMG, reacted: "In our journey to position NMG as the North American leader of responsible mining and advanced manufacturing, we had been looking for top-tier EV and battery manufacturers to bolster our commercial vision. Thanks to visionary customers and investors, we are now moving toward establishing a fully local and traceable value chain. From the Matawinie ore, to the Bécancour active anode material, to our clients' U.S. battery factories, we are pioneering a resilient supply chain for the EV market."

A Solid Commercial Backing

The multiyear offtake agreements cover the supply of a committed combined annual volume of 36,000 tonnes of active anode material by NMG to the Anchor Customers, representing approximately 85% of the Company's Phase-2 production. With agreed upon pricing formula linked to future prevailing market prices and project financing ratio requirements, NMG can now demonstrate strong long-term bankability underpinnings to lenders, investors, and shareholders.

In parallel, the Company maintains intensive commercial discussions and continued product qualification with other tier-1 battery manufacturers for the balance of its Phase-2 production. Current market dynamics in North America, reflecting recent Chinese graphite exportation limitations and stringent U.S. sourcing requirements for battery materials, favorably position NMG's local production. The Company's recent acquisition of the Uatnan Mining Project for its Phase-3 expansion also provide an attractive supply opportunity for Western EV and battery manufacturers looking to secure and grow active anode material volumes as their production increases.

Strategic Participation into NMG's Business Plan

The Anchor Customers, directly or through an affiliate, have each agreed to make an initial US$25 million equity investment in NMG subject to certain conditions (the "Tranche 1 Investment"), for a total of US$50 million, to support the advancement of NMG's Phase-2 operations – the Matawinie Mine and the Bécancour Battery Material Plant – aligned with their respective battery specifications.

In line with the previously announced framework agreement between NMG, Panasonic Energy and Mitsui , the Company's strategic partner Mitsui supports the attainment of this milestone and further development efforts towards a final investment decision ("FID") by investing US$25 million, subject to regulatory approvals and the requirements of MI 61-101 (as defined below), pursuant to which Mitsui has agreed to subscribe for 12,500,000 Common Shares in the capital of NMG (the "Common Shares") and 12,500,000 warrants on the same pricing and other terms as the Tranche 1 Investment, such proceeds to be used to repurchase Mitsui's convertible note dated November 8, 2022, as amended and restated (the "Mitsui Convertible Note"). NMG will also enter into an investor rights agreement (the "Investor Rights Agreement") and registration rights agreement with Mitsui at the closing of their investment. Pursuant to the Investor Rights Agreement, Mitsui will be required to "lock-up" its securities for a period of 12 months from the date of their investment. The Investor Rights Agreement also provides Mitsui with certain rights relating to its investment in NMG, namely certain board nomination and anti-dilution rights. Mitsui will be subject to a standstill limitation whereby it will not be able to increase its holdings beyond 20% of the issued and outstanding NMG Common Shares for a period of three years.

Long-time strategic investor Pallinghurst has also agreed to participate via a US$12.5-million investment, also subject to regulatory approvals and the requirements of MI 61-101, pursuant to which Pallinghurst has agreed to subscribe to 6,250,000 Common Shares and 6,250,000 warrants on the same pricing and other terms as the Tranche 1 Investment, such proceeds to be used to repurchase Pallinghurst's convertible note dated November 8, 2022, as amended and restated (the "Pallinghurst Convertible Note" and together with the Mitsui Convertible Note, the "Notes"). NMG will also enter into a registration rights agreement with Pallinghurst at the closing of their investment.

Such warrants are generally exercisable in connection with the Tranche 2 Investment at FID in accordance with their terms. Each warrant will entitle the holder thereof to acquire one Common Share (a "Warrant Share") at a price per Warrant Share equal to the lower of (i) the amount in US$2.38 per Common Share and (ii) the amount in US Dollars per Common Share equal to the closing price of the Common Shares on the trading day immediately following the date on which the investments described above are announced. The exercise of the warrants is subject to certain ownership limitations.

Upon a positive FID, the parties' commercial relationship is also intended to expand through further investments into NMG as part of the construction financing. The Anchor Customers, directly or through an affiliate, together with potential co-investors, intend to participate in future funding of a total amount valued at approximately US$275 million, subject to certain conditions and a maximum ownership threshold agreed between the relevant parties. Assisted by its financial advisors, the Company continues to advance financing efforts, including with its other convertible noteholder, and is engaged with export credit agencies, governments, and strategic investors, in addition to customers to frame a robust capital structure that leverages international debt, government funding and equity. BMO Capital Markets is acting as financial advisor to the Company in connection of certain of the transactions described herein.

Related Party Disclosure

Currently, Mitsui may have beneficial ownership of, or control or direction over, directly or indirectly, the Mitsui Convertible Note that can be converted into units comprising an aggregate of 5,000,000 Common Shares and 5,000,000 Common Share purchase warrants (the "Mitsui Warrants"), as well as 1,052,695 Common Shares issuable in connection with accrued interest under the Mitsui Convertible Note, which in the aggregate represent approximately 14.14% of the issued and outstanding Common Shares on a diluted basis (assuming conversion of the Mitsui Convertible Note and exercise of the Mitsui Warrants). In connection with the Mitsui investment described above, Mitsui is expected to acquire 12,500,000 Common Shares and 12,500,000 Common Share purchase warrants (the "Mitsui Tranche 1 Warrants"). Following the completion of the investments by GM, Panasonic, Mitsui, and Pallinghurst and the repayment of the Mitsui Convertible Note, Mitsui is expected to have beneficial ownership of, or control or direction over, directly or indirectly, an aggregate of 13,552,695 Common Shares and 12,500,000 Mitsui Tranche 1 Warrants, which in the aggregate will represent approximately 20.85% of the issued and outstanding Common Shares on a partially diluted basis (assuming exercise of the Mitsui Tranche 1 Warrants).

Currently, Pallinghurst may have beneficial ownership of, or control or direction over, directly or indirectly, 11,541,013 Common Shares and the Pallinghurst Convertible Note that can be converted into units comprising an aggregate of 2,500,000 Common Shares and 2,500,000 Common Share purchase warrants (the "Pallinghurst Warrants"), as well as 526,348 Common Shares issuable in connection with accrued interest under the Pallinghurst Convertible Note, which in the aggregate represent approximately 23.50% of the issued and outstanding Common Shares on a diluted basis (assuming conversion of the Pallinghurst Convertible Note and exercise of the Pallinghurst Warrants). In connection with the Pallinghurst investment described above, Pallinghurst is expected to acquire 6,250,000 Common Shares and 6,250,000 Common Share purchase warrants (the "Pallinghurst Tranche 1 Warrants"). Following the completion of the investments by GM, Panasonic, Mitsui, and Pallinghurst and the repayment of the Pallinghurst Convertible Note, Pallinghurst is expected to have beneficial ownership of, or control or direction over, directly or indirectly, an aggregate of 18,317,361 Common Shares and 6,250,000 Pallinghurst Tranche 1 Warrants, which in the aggregate will represent approximately 20.70% of the issued and outstanding Common Shares on a partially diluted basis (assuming exercise of the Pallinghurst Tranche 1 Warrants).

Mitsui and Pallinghurst are "interested parties" in respect of the transactions described herein, and their investment as well as the repayment of the Notes each constitutes a "related party transaction" (collectively, the "Related Party Transactions") within the meaning of Regulation 61-101 respecting Protection of Minority Security Holders in Special Transactions ("MI 61-101") and the TSX Venture Exchange Policy 5.9 - Protection of Minority Security Holders in Special Transactions.

The independent directors of the Company, determined in accordance with MI 61-101, are responsible for (i) evaluating the applicability of MI 61-101 to the Related Party Transactions; (ii) considering whether any exemptions from any formal valuation and/or minority approval requirements of MI 61-101 determined to be applicable would be available to NMG in connection with the Related Party Transactions or whether to seek regulatory exemptive relief in respect thereof; and (iii) if required or advisable, determining and confirming whether a formal valuation pursuant to MI 61-101 is required in connection with the Related Party Transactions and, if required or advisable, determining the terms of such valuator's engagement (including the fees to be paid to such valuator) and supervising the preparation of such valuation.

The Related Party Transactions are conditional on compliance with the requirements of MI 61-101 or NMG receiving exemptive relief from the requirements of MI 61-101. A material change report in respect of the Related Party Transactions will be filed by NMG.

Settlement of Accrued Interests

Upon the approval of the TSX Venture Exchange and the New York Stock Exchange (the "Exchanges"), the accrued interest owed to Pallinghurst and Mitsui (together, the "Holders") under the Notes for the period from January 1, 2024, until the date of their respective subscription agreements, will satisfy as follows. 232,191 Common Shares at a price of US$2.07, representing an aggregate amount of US$480,637, will be issued and share certificates will be delivered to the Holders upon the repurchase of the Notes. The issuance of Common Shares is subject to the approval of the Exchanges and, when issued, will be subject to a hold period of four (4) months and one day. Upon repurchase of the Notes, previously announced reserved but unissued Common Shares in respect of accrued interest will be issued and delivered to the Holders.

Complementary Information

Shareholders and analysts are invited to attend a webcast Investor Briefing this morning, Thursday, February 15, 2024, at 10:30 a.m. ET. Hosted by President and CEO Eric Desaulniers with the participation of NMG's Management Team, the briefing will entail a technical presentation followed by a question-and-answer session. Registration should be completed prior to the start of the briefing at: https://us06web.zoom.us/webinar/register/WN_VmhZvajOQJ2yICWrk9ySzQ .

Members of the media may download high-resolution files of the brief interview with Eric Desaulniers on this announcement at https://we.tl/t-t9Nwt9RiQR and make additional interview or information requests to Julie Paquet, Vice President, Communications & ESG Strategy at NMG.

Completion of the transactions described herein remains subject to customary regulatory approvals, including approval of the TSX Venture Exchange and NYSE, and other customary closing conditions. Copies of the referenced subscription, offtake, investor rights and registration rights agreements will be available on the Company's page on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov , and the summary of the such agreements contained herein is qualified in its entirety by the reference to such documents.

About Nouveau Monde Graphite

Nouveau Monde Graphite is striving to become a key contributor to the sustainable energy revolution. The Company is working towards developing a fully integrated source of carbon-neutral battery anode material in Québec, Canada, for the growing lithium-ion and fuel cell markets. With enviable ESG standards, NMG aspires to become a strategic supplier to the world's leading battery and automobile manufacturers, providing high-performing and reliable advanced materials while promoting sustainability and supply chain traceability. www.NMG.com

About Panasonic Energy

Panasonic Energy established in April 2022 as part of the Panasonic Group's switch to an operating company system, provides innovative battery technology-based products and solutions globally. Through its automotive lithium-ion batteries, storage battery systems and dry batteries, the company brings safe, reliable, and convenient power to a broad range of business areas, from mobility and social infrastructure to medical and consumer products. Panasonic Energy is committed to contributing to a society that realizes happiness and environmental sustainability, and through its business activities the company aims to address societal issues while taking the lead on environmental initiatives. For more details, please visit www.Panasonic.com/global/energy

About GM

General Motors (NYSE:GM) is a global company focused on advancing an all-electric future that is inclusive and accessible to all. At the heart of this strategy is the Ultium battery platform, which will power everything from mass-market to high-performance vehicles. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Chevrolet, Buick, GMC, Cadillac, Baojun and Wuling brands. More information on the company and its subsidiaries, including OnStar, a global leader in vehicle safety and security services, can be found at www.gm.com .

About Mitsui

Mitsui & Co., Ltd. ( TYO: 8031 .JP ) is a global trading and investment company with a diversified business portfolio that spans approximately 63 countries in Asia, Europe, North, Central & South America, The Middle East, Africa and Oceania.

Mitsui has about 5,500 employees and deploys talent around the globe to identify, develop, and grow businesses in collaboration with a global network of trusted partners. Mitsui has built a strong and diverse core business portfolio covering the Mineral and Metal Resources, Energy, Machinery and Infrastructure, and Chemicals industries.

Leveraging its strengths, Mitsui has further diversified beyond its core profit pillars to create multifaceted value in new areas, including innovative Energy Solutions, Healthcare & Nutrition and through a strategic focus on high-growth Asian markets. This strategy aims to derive growth opportunities by harnessing some of the world's main mega-trends: sustainability, health & wellness, digitalization and the growing power of the consumer.

Mitsui has a long heritage in Asia, where it has established a diverse and strategic portfolio of businesses and partners that gives it a strong differentiating edge, provides exceptional access for all global partners to the world's fastest growing region and strengthens its international portfolio.

For more information on Mitsui & Co's businesses visit, www.Mitsui.com

About Pallinghurst

For almost 20 years, The Pallinghurst Group has been a world-leading investor in the metals and natural resources sector with a key focus on battery materials – facilitating the vital, global shift towards sustainable energy storage. www.pallinghurst.com

Subscribe to our news feed: https://bit.ly/3UDrY3X

Cautionary Note

All statements, other than statements of historical fact, contained in this press release including, but not limited to those describing the closing transactions described in this press release, closing of the Tranche 1 Investment, the anticipated benefits of the transactions described herein, the satisfaction of the conditions to closing the transactions and the timing thereof, receipt of any regulatory approvals in respect of the transactions described herein, receipt of exemptive relief in respect of the requirements of MI 61-101, use of proceeds from the private placement, the impact of the transactions on a related party's ownership amount, a positive final investment decision and closing of project financing, closing of the potential total equity investments of US$350 million from GM, Panasonic and its co-investors, the Company's projection of becoming North America's largest fully integrated active anode material producer, the Company's relationship with its stakeholders, including First Nations and communities, the positive impact of the foregoing on project economics and shareholder value, the realization of the condition precedents of the supply agreements and their entry into force, the Company's planned all-electric operations, fulfillment of the closing conditions and completion of the transactions described in this press release, the intended production of eco-friendly advanced materials, trends in legislation, consumer preferences, industry standards, markets and technology, the intended results of the initiatives described in this press release, and those statements which are discussed under the "About Nouveau Monde" paragraph and elsewhere in the press release which essentially describe the Company's outlook and objectives, constitute "forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements") within the meaning of Canadian and United States securities laws, and are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Moreover, these forward-looking statements were based upon various underlying factors and assumptions, including the current technological trends, the business relationship between the Company and its stakeholders, the ability to operate in a safe and effective manner, the timely delivery and installation at estimated prices of the equipment supporting the production, assumed sale prices for graphite concentrate, the accuracy of any Mineral Resource estimates, future currency exchange rates and interest rates, political and regulatory stability, prices of commodity and production costs, the receipt of governmental, regulatory and third party approvals, licenses and permits on favorable terms, sustained labor stability, stability in financial and capital markets, availability of equipment and critical supplies, spare parts and consumables, the various tax assumptions, CAPEX and OPEX estimates, all economic and operational projections relating to the project, local infrastructures, the Company's business prospects and opportunities and estimates of the operational performance of the equipment, and are not guarantees of future performance.

Forward-looking statements are subject to known or unknown risks and uncertainties that may cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Risk factors that could cause actual results or events to differ materially from current expectations include, among others, those risks, delays in the scheduled delivery times of the equipment, the ability of the Company to successfully implement its strategic initiatives and whether such strategic initiatives will yield the expected benefits, the availability of financing or financing on favorable terms for the Company, the dependence on commodity prices, the impact of inflation on costs, the risks of obtaining the necessary permits, the operating performance of the Company's assets and businesses, competitive factors in the graphite mining and production industry, changes in laws and regulations affecting the Company's businesses, political and social acceptability risk, environmental regulation risk, currency and exchange rate risk, technological developments, the impacts of the global COVID-19 pandemic and the governments' responses thereto, and general economic conditions, as well as earnings, capital expenditure, cash flow and capital structure risks and general business risks. A further description of risks and uncertainties can be found in NMG's Annual Information Form dated March 23, 2023, including in the section thereof captioned "Risk Factors", which is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov . Unpredictable or unknown factors not discussed in this Cautionary Note could also have material adverse effects on forward-looking statements.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

The market and industry data contained in this press release is based upon information from independent industry publications, market research, analyst reports and surveys and other publicly available sources. Although the Company believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any survey. The Company has not independently verified any of the data from third-party sources referred to in this press release and accordingly, the accuracy and completeness of such data is not guaranteed.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information regarding the Company is available in the SEDAR+ database ( www.sedarplus.ca ), and for United States readers on EDGAR ( www.sec.gov ), and on the Company's website at: www.NMG.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20240214714914/en/

MEDIA

Julie Paquet

VP Communications & ESG Strategy

+1-450-757-8905 #140

jpaquet@nmg.com

INVESTORS

Marc Jasmin

Director, Investor Relations

+1-450-757-8905 #993

mjasmin@nmg.com