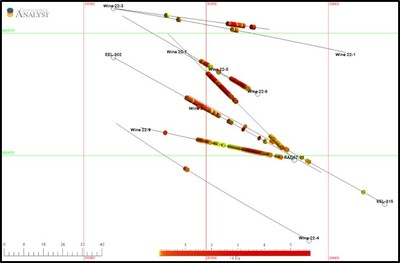

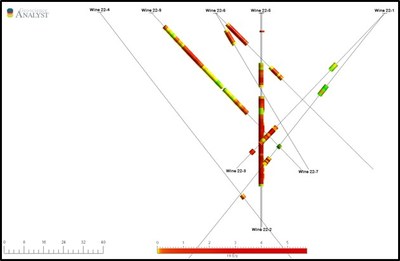

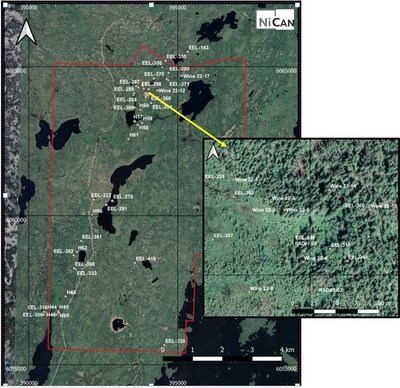

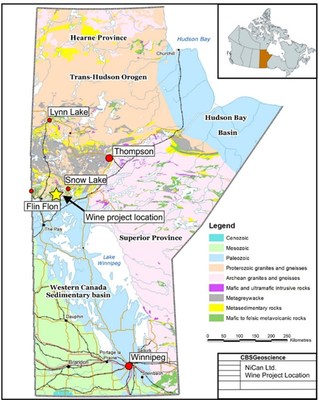

NiCan Limited ("NiCAN" or the "Company") (TSXV: NICN) reports additional assay results from its 2022 reconnaissance diamond drilling program at the Wine project in Manitoba, Canada (Figure 4). These drill holes were completed to further the understanding of the overall mineralization encountered on the Wine Occurrence and to assist in the targeting of future drilling within the Wine Gabbro area.

Highlights (complete assays set out in Tables 1 and 2):

- Diamond drill hole Wine-22-03 intersected 8.6 metres at an average grade of 1.01% Cu, 1.89% Ni (2.22% NiEq), 0.10% Co, and 0.46g/t PGM from 66.6 to 75.4 metres and 1.8 metres at an average grade of 3.64% Cu, 0.33% Ni (1.53% NiEq), 0.01% Co and 0.81g/t PGM from 79.5 to 81.3 metres.

- Diamond drill hole Wine-22-09 intersected 7.0 metres at an average grade of 1.57% Cu, 0.54% Ni (1.07% NiEq), 0.59% Co and 0.24g/t PGM from 21.0 to 28.0 metres.

| Note: Nickel equivalent ("NiEq") was calculated using copper and nickel values only, Ni+(Cu*0.33) |

Brad Humphrey , President, and CEO of NiCAN stated, "We are very happy with the overall results from this initial reconnaissance drilling program on the Wine Occurrence. The grades and widths of mineralization, including newly defined zones, exceeded our initial expectations for this program. We have gained a much better understanding of the potential geological model, and the configuration and grade of the mineralization, and will apply this knowledge to test multiple targets in the Wine Gabbro in upcoming drilling programs."

Drill Hole Wine-22-01

Hole Wine-22-01 (-50⁰) was drilled 20 meters north of hole Wine-22-05 in order to intersect the Main mineralized zone and encountered 1.75 metres of massive and disseminated pyrrhotite that averaged 1.93% NiEq and 2.56g/t PGMs (estimated true width of 1.2 metres). The mineralization is hosted in a light-coloured gabbro unit. It is interpreted that this correlates to the base of the 27-metre mineralized zone seen in hole Wine-22-05.

Drill Hole Wine-22-03

Hole Wine-22-03 (-45⁰) was drilled from the same drill pad and azimuth as hole Wine-22-01 and was designed to intersect the Main mineralized zone. The hole intersected massive, semi-massive and stringer sulphides hosted by a light-coloured gabbro over 8.6 metres at an average grade of 1.01% Cu, 1.89% Ni (2.22% NiEq) and 0.46g/t PGM from 66.75 to 75.35 metres (estimated true width of 5.8 metres). A gabbro unit from 79.45 to 81.25 with disseminated chalcopyrite and pyrrhotite averaged 3.64% Cu, 0.33% Ni (1.53% NiEq) and 0.81g/t PGMs over 1.8 metres (estimated true width of 1.2 metres). The Main mineralized zone remains open to the north.

Drill Hole Wine-22-04

Hole Wine-22-04 was drilled 25 metres south of hole Wine-22-02 and was designed to intersect the Main zone. The hole encountered 1.8 metres at an average grade of 0.14% NiEq (estimated true width of 1.2 metres) within disseminated chalcopyrite and pyrrhotite hosted by a gabbro unit. The hole appears to have undercut the Main mineralized zone.

Drill Hole Wine-22-09

Hole Wine-22-09 (-45⁰) was drilled from the same collar location as historical holes EEL 346 and RAD07-01 (Az 315⁰) but at an azimuth of 280⁰. The hole was designed to intersect the Main mineralized zone approximately 15 metres south of the mineralization encountered in hole Wine-22-02. The hole unexpectedly hit a lens of mineralization further up the hole from 19.0 to 30.6 metres that averaged 1.12% Cu, 0.4% Ni (0.77% NiEq) and 0.22g/t PGMs over 11.6 metres (estimated true width of 7.8 metres). This included a 7.0-metre zone averaging 1.57% Cu, 0.54% Ni (1.07% NiEq), 0.59% Co and 0.24g/t PGM from 21.0 to 28.0 metres (estimated true width of 4.7 metres). Two lower grade zones further down the hole are interpreted to represent the Main zone. These include 6.8 metres averaging 0.19% NiEq and 0.42 metres averaging 0.62% NiEq. Additional analysis is required to determine if the first zone intersected in this hole is a new mineralized pod or lens, or if it is part of the Main mineralized zone.

| * Historical drill hole assays are listed in Table 4. |

2022 Exploration Program

The initial 2022 reconnaissance and confirmation exploration program included an airborne geophysical survey, partial resampling of a historical drill hole, downhole geophysical (electro-magnetic) surveys and diamond drilling testing an area known as the Wine Occurrence, as well as other nearby anomalies. This program successfully achieved NiCAN's objective to confirm the presence of nickel-copper mineralization at the Wine Occurrence, better understand the orientation of the mineralization and improve NiCAN's understanding of the geological model, which will be used to better target future drilling programs. Subsequently, NiCAN completed an Airborne VTEM survey over the entire Wine property area. The final analysis and compilation of this survey is nearly complete and will be used, along with the 2022 exploration program and all historical data, to design the upcoming drilling program.

Assay, Analysis and QA/QC

All core samples were sent to the Saskatchewan Research Council ("SRC") in Saskatoon (an accredited laboratory) by secure transport for base and precious metal assay. Base metals were assayed by their ICP3 package, which includes a total of 35 analytes by ICP-OES (Inductively Coupled Plasma – Optical Emission Spectroscopy). Partial digestions were performed on a 0.5 gram aliquot of sample pulp which was digested in a mixture of HCl:HNO3, in a hot water bath and then diluted to 15 ml using deionized water. Over-limits for copper, nickel and cobalt had an aliquot of 1.0 gram sample pulp digested in a concentration of HCl:HNO3. The digested volume was then made up with deionized water for analysis by ICP-OES. Fire Assay Techniques involved a 30 gram aliquot of sample pulp which was mixed with a standard fire assay flux in a clay crucible and a silver inquart added prior to fusion. After the mixture was fused, the melt was poured into a form which was cooled. The lead bead was then recovered and cupelled until only the precious metal bead remained. The bead was then parted in dilute HNO3. The precious metals were then dissolved in aqua regia and then diluted for analysis by ICP-OES

Laboratory Quality Control protocols were applied to the assay sample package by SRC. NiCAN submitted a regular schedule of standards, blanks and duplicates into the sample stream for Quality Control measures. Drill core samples are split in half using a diamond saw with half saved for reference and the other half shipped for assay. In the case of duplicate samples the half core is quarter split with the two quarter splits sent for separate assay.

NiCAN does not have any historic QA/QC data for the 2007 or earlier drill results.

Qualified Person

Mr. Bill Nielsen , P.Geo, a consultant to NiCAN, who is a qualified person under National Instrument 43-101 – Standards of Disclosure of Mineral Projects ("NI 43-101") has reviewed and approved the scientific and technical information in this press release.

About NiCAN

NiCan Limited is a mineral exploration company, trading under the symbol "NICN" on the TSX-V. The Company has a strong balance sheet and is actively exploring two nickel projects, both located in well-established mining jurisdictions in Manitoba, Canada .

To receive news releases by e-mail, please register using the NiCAN website at www.nicanltd.com .

Cautionary Note Regarding Forward-Looking Statements

The information contained herein contains certain "forward-looking information" under applicable securities laws concerning the proposed financing, business, operations and financial performance and condition of NiCan Limited. Forward-looking information includes, but is not limited to, the size and timing of the drill program, results of the drill program, NiCAN's ability to identify mineralization similar to that found in prior drill holes, the benefits and the potential of the properties of the Company; future commodity prices (including in relation to NiEq calculations); drilling and other exploration potential; costs; and permitting. Forward-looking information may be characterized by words such as "plan," "expect," "project," "intend," "believe," "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. Factors that could cause actual results to vary materially from results anticipated by such forward-looking information includes changes in market conditions, fluctuating metal prices and currency exchange rates, the possibility of project cost overruns or unanticipated costs and expenses and permitting disputes and/or delays. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking information.

Neither TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

| Drill Hole | From | To | Length | Cu | Ni | NiEq | Co | Au | Pt | Pd | PGM |

| Wine-22-1 | 77.5 | 79.2 | 1.8 | 1.30 | 1.50 | 1.93 | 0.04 | 0.19 | 0.97 | 1.40 | 2.56 |

| Wine-22-3 | 66.8 | 75.4 | 8.6 | 1.01 | 1.89 | 2.22 | 0.10 | 0.06 | 0.07 | 0.33 | 0.46 |

| Wine-22-3 | 79.5 | 81.3 | 1.8 | 3.64 | 0.33 | 1.53 | 0.01 | 0.39 | 0.06 | 0.36 | 0.81 |

| Wine-22-4 | 93.8 | 95.6 | 1.8 | 0.33 | 0.04 | 0.14 | 0.00 | 0.07 | 0.00 | 0.07 | 0.13 |

| Wine-22-9 | 19.0 | 30.6 | 11.6 | 1.12 | 0.40 | 0.77 | 0.04 | 0.10 | 0.03 | 0.09 | 0.22 |

| incl Wine-22-9 | 21.0 | 28.0 | 7.0 | 1.57 | 0.55 | 1.07 | 0.06 | 0.13 | 0.02 | 0.09 | 0.24 |

| Wine-22-9 | 50.7 | 57.5 | 6.8 | 0.18 | 0.13 | 0.19 | 0.01 | 0.07 | 0.01 | 0.09 | 0.17 |

| Wine-22-9 | 76.4 | 76.8 | 0.4 | 1.66 | 0.07 | 0.62 | 0.00 | 3.19 | 0.00 | 0.06 | 3.25 |

| Hole Number | From (m) | To (m) | length (m) | Co% | Cu% | Ni% | Au gm/t | Pt gm/t | Pd gm/t | Ag gm/t | PGM g/t | Ni Eq % |

| Wine 22-1 | 76.4 | 77.4 | 1.0 | 0.00 | 0.10 | 0.01 | 0.03 | 0.00 | 0.00 | 0.70 | 0.04 | 0.04 |

| Wine 22-1 | 77.4 | 78.2 | 0.8 | 0.10 | 1.20 | 3.61 | 0.06 | 2.35 | 1.09 | 10.10 | 3.50 | 4.01 |

| Wine 22-1 | 78.1 | 78.6 | 0.5 | 0.00 | 0.08 | 0.02 | 0.04 | 0.02 | 0.02 | 1.20 | 0.08 | 0.05 |

| Wine 22-1 | 78.6 | 79.2 | 0.6 | 0.01 | 1.85 | 0.13 | 0.46 | 0.08 | 2.80 | 20.90 | 3.34 | 0.75 |

| Wine 22-1 | 79.2 | 80.0 | 0.8 | 0.00 | 0.06 | 0.01 | 0.00 | 0.00 | 0.01 | 0.40 | 0.01 | 0.03 |

| Wine 22-1 | 41.4 | 42.4 | 1.0 | 0.00 | 0.19 | 0.00 | 0.01 | 0.00 | 0.00 | 1.20 | 0.01 | 0.07 |

| Wine 22-1 | 42.4 | 43.4 | 1.0 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-1 | 38.4 | 39.4 | 1.0 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-1 | 39.4 | 40.4 | 1.0 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.30 | 0.00 | 0.00 |

| Wine 22-1 | 40.4 | 41.4 | 1.0 | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.01 |

| Wine 22-3 | 29.5 | 30.2 | 0.7 | 0.00 | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.02 |

| Wine 22-3 | 30.1 | 31.1 | 1.0 | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.02 |

| Wine 22-3 | 31.1 | 32.1 | 1.0 | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-3 | 32.1 | 33.0 | 0.9 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-3 | 65.7 | 66.7 | 1.0 | 0.00 | 0.40 | 0.01 | 0.03 | 0.00 | 0.16 | 1.10 | 0.18 | 0.14 |

| Wine 22-3 | 66.7 | 67.3 | 0.6 | 0.01 | 5.01 | 0.24 | 0.12 | 0.16 | 0.24 | 12.00 | 0.53 | 1.91 |

| Wine 22-3 | 67.3 | 68.3 | 1.0 | 0.17 | 0.63 | 3.47 | 0.04 | 0.01 | 0.58 | 5.70 | 0.63 | 3.68 |

| Wine 22-3 | 68.3 | 69.1 | 0.8 | 0.15 | 0.70 | 3.12 | 0.08 | 0.01 | 0.36 | 3.00 | 0.45 | 3.35 |

| Wine 22-3 | 69.1 | 70.1 | 1.0 | 0.18 | 0.34 | 3.67 | 0.00 | 0.06 | 0.14 | 0.10 | 0.20 | 3.78 |

| Wine 22-3 | 70.1 | 71.1 | 1.0 | 0.00 | 0.01 | 0.08 | 0.00 | 0.01 | 0.00 | 0.10 | 0.01 | 0.08 |

| Wine 22-3 | 71.1 | 72.1 | 1.0 | 0.07 | 1.14 | 1.38 | 0.09 | 0.02 | 0.46 | 3.80 | 0.56 | 1.76 |

| Wine 22-3 | 72.1 | 73.0 | 0.9 | 0.09 | 0.41 | 1.86 | 0.08 | 0.21 | 0.83 | 1.50 | 1.12 | 1.99 |

| Wine 22-3 | 73.0 | 73.7 | 0.7 | 0.00 | 0.01 | 0.02 | 0.00 | 0.00 | 0.01 | 0.10 | 0.01 | 0.02 |

| Wine 22-3 | 73.7 | 74.5 | 0.8 | 0.13 | 0.27 | 2.29 | 0.09 | 0.10 | 0.17 | 8.00 | 0.37 | 2.38 |

| Wine 22-3 | 74.3 | 75.3 | 1.0 | 0.01 | 0.15 | 0.15 | 0.04 | 0.01 | 0.05 | 1.20 | 0.11 | 0.20 |

| Wine 22-3 | 75.3 | 76.7 | 1.4 | 0.00 | 0.29 | 0.02 | 0.04 | 0.03 | 0.03 | 2.00 | 0.10 | 0.12 |

| Wine 22-3 | 76.7 | 78.0 | 1.3 | 0.00 | 0.12 | 0.01 | 0.00 | 0.01 | 0.01 | 1.00 | 0.02 | 0.05 |

| Wine 22-3 | 78.0 | 79.5 | 1.5 | 0.00 | 0.02 | 0.01 | 0.00 | 0.00 | 0.01 | 0.40 | 0.01 | 0.02 |

| Wine 22-3 | 79.5 | 80.4 | 0.9 | 0.00 | 1.77 | 0.14 | 0.50 | 0.06 | 0.27 | 15.20 | 0.84 | 0.73 |

| Wine 22-3 | 80.4 | 81.3 | 0.9 | 0.01 | 4.79 | 0.45 | 0.20 | 0.05 | 0.38 | 43.50 | 0.64 | 2.05 |

| Wine 22-4 | 93.8 | 94.8 | 1.0 | 0.00 | 0.20 | 0.03 | 0.04 | 0.00 | 0.07 | 2.00 | 0.11 | 0.10 |

| Wine 22-4 | 94.8 | 95.6 | 0.8 | 0.00 | 0.49 | 0.04 | 0.09 | 0.00 | 0.07 | 5.80 | 0.16 | 0.20 |

| Wine 22-9 | 7.8 | 9.0 | 1.2 | 0.01 | 0.21 | 0.07 | 0.00 | 0.01 | 0.06 | 0.30 | 0.08 | 0.14 |

| Wine 22-9 | 9.0 | 10.2 | 1.2 | 0.00 | 0.03 | 0.01 | 0.00 | 0.00 | 0.01 | 0.10 | 0.02 | 0.02 |

| Wine 22-9 | 10.2 | 11.0 | 0.8 | 0.00 | 0.08 | 0.02 | 0.00 | 0.00 | 0.03 | 0.10 | 0.04 | 0.05 |

| Wine 22-9 | 11.0 | 12.0 | 1.0 | 0.00 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 12.0 | 13.0 | 1.0 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-9 | 13.0 | 14.0 | 1.0 | 0.00 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.02 |

| | | | | | | | | | | | | |

| Hole Number | From (m) | To (m) | length (m) | Co% | Cu% | Ni% | Au gm/t | Pt gm/t | Pd gm/t | Ag gm/t | PGM g/t | Ni Eq % |

| Wine 22-9 | 14.0 | 15.0 | 1.0 | 0.01 | 0.07 | 0.09 | 0.00 | 0.00 | 0.01 | 0.30 | 0.01 | 0.11 |

| Wine 22-9 | 15.0 | 16.0 | 1.0 | 0.01 | 0.17 | 0.09 | 0.01 | 0.00 | 0.02 | 0.80 | 0.03 | 0.15 |

| Wine 22-9 | 16.0 | 17.0 | 1.0 | 0.01 | 0.02 | 0.04 | 0.00 | 0.00 | 0.01 | 0.10 | 0.02 | 0.05 |

| Wine 22-9 | 17.0 | 18.0 | 1.0 | 0.00 | 0.14 | 0.02 | 0.00 | 0.00 | 0.03 | 0.40 | 0.03 | 0.07 |

| Wine 22-9 | 18.0 | 19.0 | 1.0 | 0.00 | 0.03 | 0.01 | 0.00 | 0.00 | 0.01 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 19.0 | 20.0 | 1.0 | 0.01 | 0.64 | 0.14 | 0.02 | 0.03 | 0.18 | 2.00 | 0.23 | 0.35 |

| Wine 22-9 | 20.0 | 21.0 | 1.0 | 0.02 | 0.63 | 0.17 | 0.10 | 0.06 | 0.20 | 2.60 | 0.35 | 0.38 |

| Wine 22-9 | 21.0 | 22.0 | 1.0 | 0.04 | 0.67 | 0.37 | 0.04 | 0.00 | 0.37 | 2.40 | 0.41 | 0.60 |

| Wine 22-9 | 22.0 | 23.0 | 1.0 | 0.10 | 0.48 | 0.81 | 0.13 | 0.04 | 0.10 | 1.60 | 0.27 | 0.97 |

| Wine 22-9 | 23.0 | 24.0 | 1.0 | 0.11 | 0.91 | 1.00 | 0.07 | 0.00 | 0.03 | 1.40 | 0.09 | 1.30 |

| Wine 22-9 | 24.0 | 25.0 | 1.0 | 0.10 | 1.04 | 1.05 | 0.00 | 0.00 | 0.01 | 1.60 | 0.01 | 1.40 |

| Wine 22-9 | 25.0 | 26.0 | 1.0 | 0.03 | 0.99 | 0.30 | 0.07 | 0.01 | 0.05 | 5.70 | 0.13 | 0.63 |

| Wine 22-9 | 26.0 | 27.0 | 1.0 | 0.01 | 4.64 | 0.12 | 0.41 | 0.07 | 0.04 | 20.80 | 0.52 | 1.66 |

| Wine 22-9 | 27.0 | 28.0 | 1.0 | 0.02 | 2.26 | 0.17 | 0.20 | 0.01 | 0.03 | 13.30 | 0.23 | 0.92 |

| Wine 22-9 | 28.0 | 29.0 | 1.0 | 0.02 | 0.29 | 0.19 | 0.03 | 0.00 | 0.05 | 1.40 | 0.08 | 0.29 |

| Wine 22-9 | 29.0 | 30.0 | 1.0 | 0.01 | 0.28 | 0.05 | 0.03 | 0.00 | 0.01 | 1.00 | 0.04 | 0.14 |

| Wine 22-9 | 30.0 | 30.6 | 0.6 | 0.04 | 0.24 | 0.37 | 0.03 | 0.19 | 0.04 | 1.00 | 0.26 | 0.45 |

| Wine 22-9 | 30.6 | 31.6 | 1.0 | 0.00 | 0.03 | 0.02 | 0.01 | 0.00 | 0.00 | 0.10 | 0.01 | 0.03 |

| Wine 22-9 | 31.6 | 33.0 | 1.4 | 0.00 | 0.07 | 0.02 | 0.01 | 0.00 | 0.02 | 0.10 | 0.03 | 0.05 |

| Wine 22-9 | 33.0 | 34.5 | 1.5 | 0.00 | 0.01 | 0.02 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 34.5 | 36.0 | 1.5 | 0.00 | 0.03 | 0.02 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.03 |

| Wine 22-9 | 36.0 | 37.5 | 1.5 | 0.01 | 0.03 | 0.03 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.04 |

| Wine 22-9 | 37.5 | 39.0 | 1.5 | 0.00 | 0.02 | 0.02 | 0.00 | 0.00 | 0.01 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 39.0 | 40.5 | 1.5 | 0.00 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.01 |

| Wine 22-9 | 40.5 | 41.7 | 1.2 | 0.00 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.01 |

| Wine 22-9 | 41.7 | 42.7 | 1.0 | 0.00 | 0.04 | 0.01 | 0.01 | 0.00 | 0.01 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 43.7 | 44.7 | 1.0 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.01 | 0.10 | 0.01 | 0.01 |

| Wine 22-9 | 44.7 | 45.7 | 1.0 | 0.00 | 0.04 | 0.01 | 0.00 | 0.00 | 0.01 | 0.10 | 0.02 | 0.03 |

| Wine 22-9 | 45.7 | 46.7 | 1.0 | 0.00 | 0.05 | 0.02 | 0.00 | 0.00 | 0.01 | 0.10 | 0.01 | 0.03 |

| Wine 22-9 | 46.7 | 47.7 | 1.0 | 0.00 | 0.03 | 0.01 | 0.00 | 0.00 | 0.00 | 0.20 | 0.00 | 0.02 |

| Wine 22-9 | 47.7 | 48.7 | 1.0 | 0.00 | 0.02 | 0.01 | 0.02 | 0.00 | 0.01 | 0.10 | 0.03 | 0.01 |

| Wine 22-9 | 48.7 | 49.7 | 1.0 | 0.00 | 0.03 | 0.01 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.02 |

| Wine 22-9 | 49.7 | 50.7 | 1.0 | 0.00 | 0.09 | 0.04 | 0.03 | 0.01 | 0.03 | 0.80 | 0.06 | 0.07 |

| Wine 22-9 | 50.7 | 51.8 | 1.1 | 0.00 | 0.43 | 0.08 | 0.15 | 0.03 | 0.08 | 4.00 | 0.25 | 0.22 |

| Wine 22-9 | 51.8 | 52.5 | 0.7 | 0.00 | 0.07 | 0.08 | 0.29 | 0.04 | 0.18 | 0.40 | 0.51 | 0.10 |

| Wine 22-9 | 52.5 | 53.5 | 1.0 | 0.00 | 0.06 | 0.02 | 0.01 | 0.00 | 0.01 | 0.20 | 0.02 | 0.05 |

| Wine 22-9 | 53.5 | 54.5 | 1.0 | 0.00 | 0.10 | 0.09 | 0.02 | 0.00 | 0.01 | 0.60 | 0.03 | 0.12 |

| Wine 22-9 | 54.5 | 55.5 | 1.0 | 0.02 | 0.08 | 0.40 | 0.01 | 0.00 | 0.04 | 0.50 | 0.06 | 0.42 |

| Wine 22-9 | 55.5 | 56.5 | 1.0 | 0.00 | 0.21 | 0.09 | 0.05 | 0.00 | 0.28 | 1.40 | 0.34 | 0.16 |

| Wine 22-9 | 56.5 | 57.5 | 1.0 | 0.00 | 0.25 | 0.13 | 0.05 | 0.00 | 0.03 | 2.20 | 0.08 | 0.22 |

| | | | | | | | | | | | | |

| Hole Number | From (m) | To (m) | length (m) | Co% | Cu% | Ni% | Au gm/t | Pt gm/t | Pd gm/t | Ag gm/t | PGM g/t | Ni Eq % |

| Wine 22-9 | 76.0 | 76.4 | 0.4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.00 |

| Wine 22-9 | 76.4 | 76.8 | 0.4 | 0.00 | 1.66 | 0.07 | 3.19 | 0.00 | 0.06 | 8.40 | 3.25 | 0.62 |

| Wine 22-9 | 76.8 | 77.3 | 0.5 | 0.00 | 0.01 | 0.00 | 0.01 | 0.00 | 0.00 | 0.10 | 0.01 | 0.01 |

| Drill Hole | From | To | Length | Co | Ni | Cu | NiEq | Au | Pt | Pd | PGM |

| RAD07-01 | 55.7 | 76.0 | 20.4 | 0.05 | 1.38 | 2.14 | 2.09 | 0.4 | 0.13 | 0.27 | 0.80 |

| EEL-346 | 54.0 | 70.4 | 16.5 | - | 0.85 | 1.50 | 1.35 | 0.16 | - | - | - |

| incl EEL-346 | 60.3 | 70.4 | 10.1 | - | 1.13 | 1.81 | 1.73 | 0.15 | 0.10 | 0.29 | 0.54 |

| EEL-302 | 51.5 | 64.4 | 12.8 | - | 0.52 | 0.97 | 0.84 | 0.21 | 0.12 | 0.16 | 0.49 |

| incl EEL-302 | 51.5 | 57.9 | 6.3 | - | 0.93 | 0.88 | 1.32 | 0.27 | 0.12 | 0.13 | 0.52 |

| EEL-315 | 68.8 | 68.9 | 0.2 | - | 1.20 | 3.08 | 2.20 | - | - | - | - |

| Note: "-" indicates not assayed. |

SOURCE Nican Ltd.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/09/c5047.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/09/c5047.html