(TheNewswire)

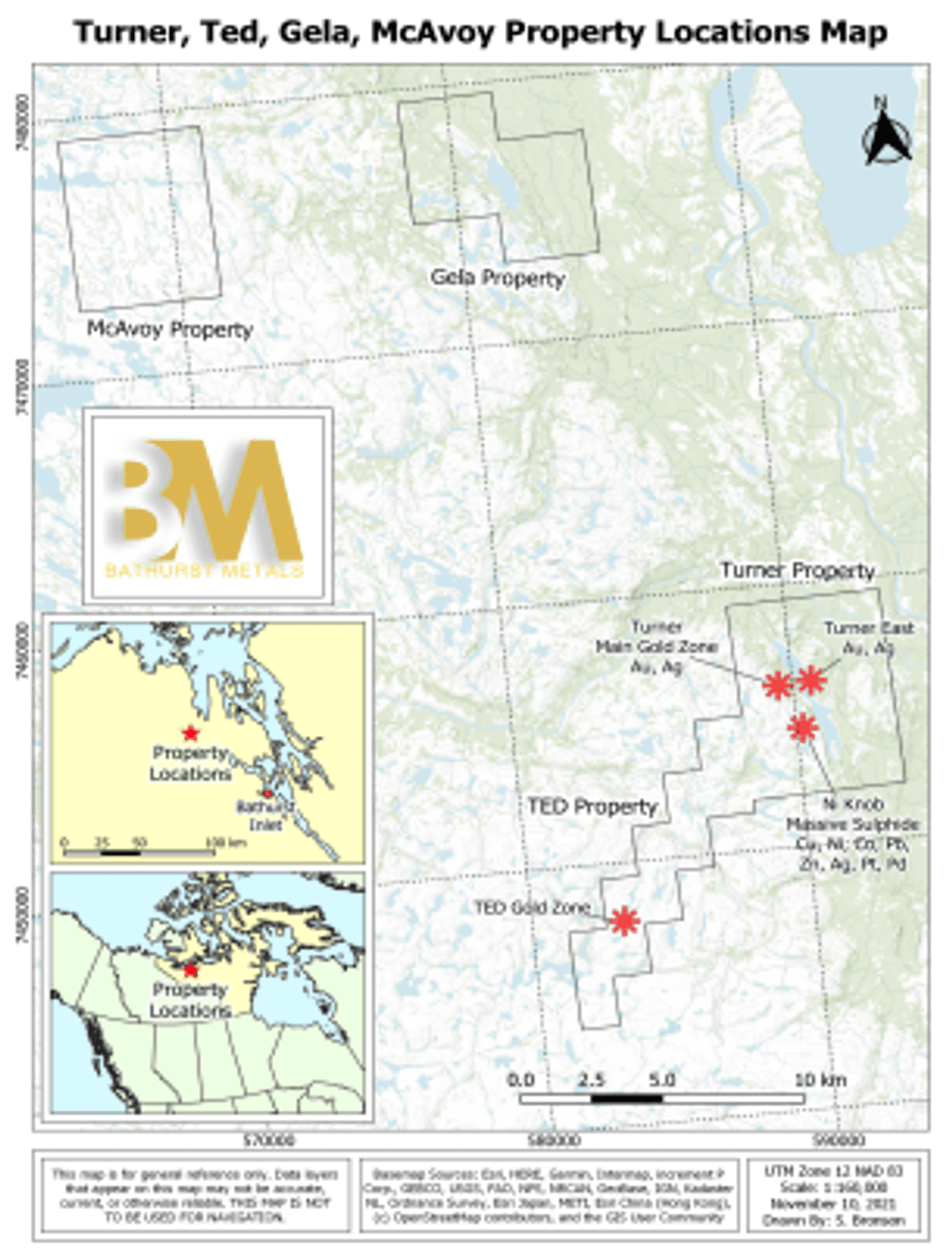

Bathurst Metal Corp. (TSXV:BMV) ("Bathurst" or the "Company") is pleased to announce assay results from 18 rock, grab samples collected from an Archean Age, Iron Formation from the TED Gold Zone of the Turner Lake Project, Nunavut, Canada, Figure # 1

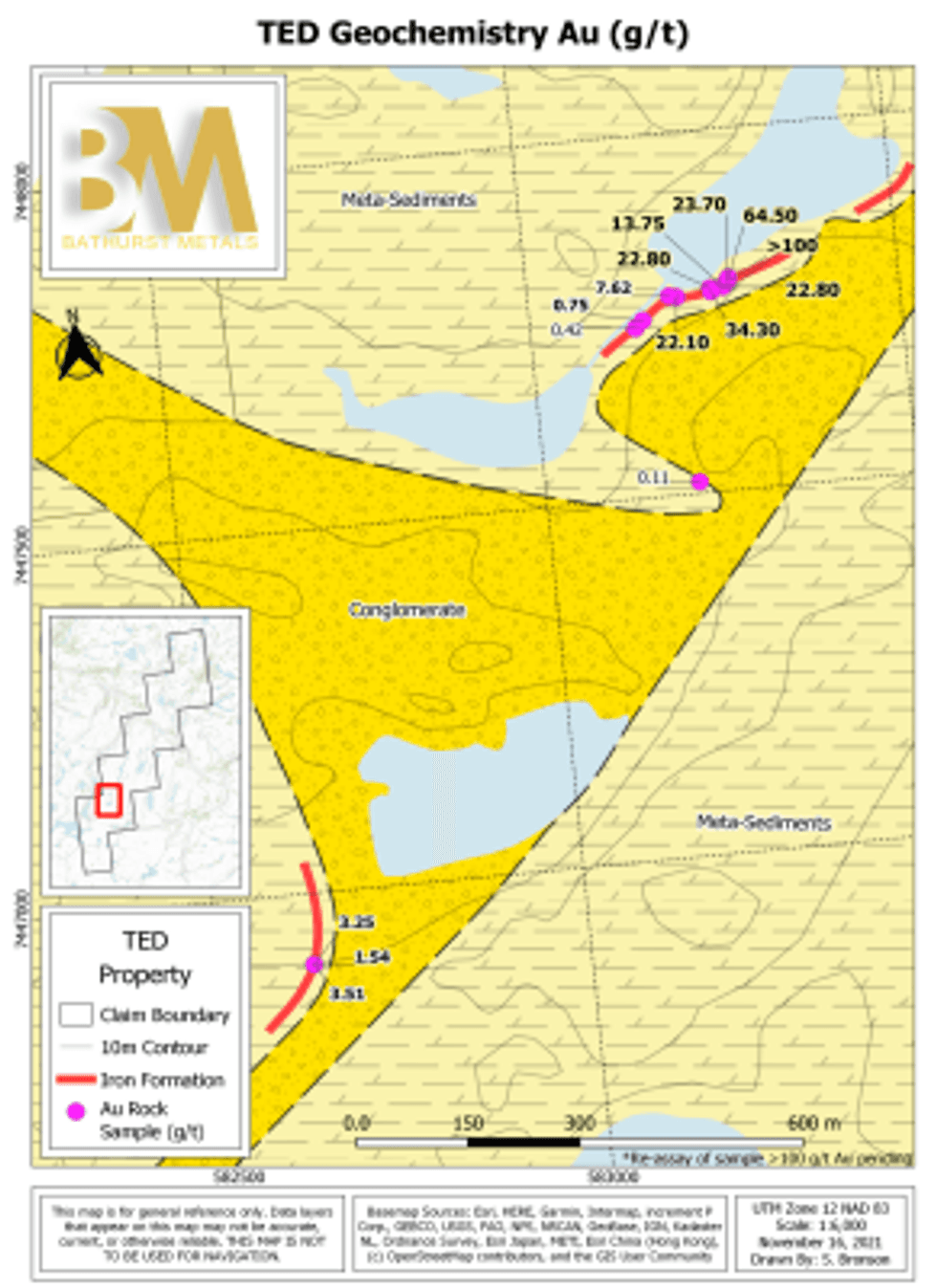

The TED Showing geological mapping and sampling program this summer confirmed historic sampling results and observations this summer of visible gold present within an Archean Age Iron Formation. Six of the eighteen samples assayed returned values greater than 20 g/tonne gold. A final assay result is still pending on sample number D365404 which contained an over limit assay value of greater than 100 g/tonne gold. The area hosting these higher grade gold values has not been drill tested. All gold and silver assay results are listed in Table # 1. The TED Geochemistry Map, Figure 2 outlines the sample locations and gold assay results. Anomalous arsenic and bismuth concentrations occur with the high grade gold mineralization.

| Table # 1 | ||||||

| UTM | UTM | Sample | Type of | Gold | Silver | |

| East | North | Number | Sample | g/tonne | g/tonne | |

| 583270 | 7447789 | D365401 | grab | 23.7 | 2.91 | |

| 583272 | 7447793 | D365402 | grab | 64.5 | 11.50 | |

| 583263 | 7447781 | D365403 | grab | 22.8 | 3.78 | |

| 583270 | 7447787 | D365404 | grab | >100 | 20.8 | |

| 583263 | 7447782 | D365405 | grab | 13.75 | 2.22 | |

| 583246 | 7447781 | D365406 | grab | 22.8 | 10.05 | |

| 583247 | 7447776 | D365407 | grab | 34.3 | 5.14 | |

| 583152 | 7447745 | D365408 | grab | 0.75 | 0.25 | |

| 583141 | 7447735 | D365409 | grab | 0.42 | 0.18 | |

| 583351 | 7447710 | D365410 | grab | 0.05 | 0.10 | |

| 583200 | 7447773 | D365411 | float grab | 22.1 | 4.25 | |

| 583190 | 7447775 | D365412 | float grab | 7.62 | 4.16 | |

| 583207 | 7447516 | D365413 | grab | 0.11 | 0.21 | |

| 582607 | 7446844 | D365414 | grab | 0.02 | 0.26 | |

| 582627 | 7446902 | D365415 | grab | 3.25 | 1.67 | |

| 582627 | 7446902 | D365416 | grab | 3.51 | 2.49 | |

| 582627 | 7446902 | D365417 | grab | 1.54 | 0.77 | |

| 582496 | 7446810 | D365418 | grab | 0.02 | 0.05 | |

Figure # 1

Click Image To View Full Size

Figure # 2

Click Image To View Full Size

Harold Forzley, Chief Executive Officer and Director of Bathurst Metals commented "This summer's work, although difficult to undertake due to stringent Covid-19 measures was highly successful in defining another, high grade gold zone so close to our drill ready, flag ship Turner Lake Main Zone. Company geologists are currently outlining plans for drill testing these zones next summer". Bathurst Metals has a strong 34,690 Ha portfolio of 100% owned properties in Nunavut employing experienced geotechnical staff familiar with Northwestern Nunavut."

Turner Lake Property

The Turner Lake Project area covers 7,071.97 Ha which also contains the Main and East Gold Zones and the Nickel Knob, massive sulphide mineral deposits. The gold zones are hosted along a classic Archean Age, Iron/Magnesium Tholeiitic contact with gold mineralization occurring mainly within a crackle fractured greywacke. Visible gold is common. Discovered in the 1960's the Main Gold Zone has only had 22 diamond drill holes test across the contact from Chevron Minerals in 1986-1989 and Northrock Resources Inc. in 2008/2009. Historical diamond drilling results include from Chevron Minerals:

28.00 g/tonne Au /4.75 metres

12.86 g/tonne Au/ 8.87 metre s

15.20 g/tonne Au/4.00 metres

10.00 g/tonne Au /4.00 metres

Northrock Resources diamond drilling results included:

13.20 g/tonne Au/13.00 metres

22.54 g/tonne Au/12.00 metres

16.20 g/tonne Au /8.50 metres

* All lengths presented are core lengths.

The East Gold Zone is approximately 2 kilometres east of the Main Gold Zone along the same strike. Grab rock samples have returned up to 31.0 grams/tonne gold and the zone has not been drill tested.

The Nickel Knob Massive Sulphide Deposit is approximately 1.9 kilometres south of the Main Gold Zone and has had only limited drill testing consisting of five diamond drill holes. All holes encountered massive sulphides with the best intercept recorded being 1.81% copper, 1.64% Nickel over 14.0 metre core length.

Quality Assurance/Quality Control – rock samples

All rock samples were collected by professional geoscientists. Samples were placed in plastic sample bags with samples tags placed in each bag before being sealed. Samples were transported to the field camp site and later to the ALS sample preparation facility in Yellowknife under the supervision of a professional geoscientist. The Yellowknife sample preparation laboratory crushed, and pulverized samples then used a riffle splitter to obtain up to 85 percent of a 250 gram sample passing through 75um screen. The pulverized samples were then securely transported to their laboratory in Vancouver and analyzed using procedure ME MS41(ultra trace Aqua Regia ICP-MS) followed by an Au-OG44, ore grade gold 50gram sample analysis.

Company Proceeding With Second Tranche

Further, the Company is pleased to announce it proceeding with the closing of the second tranche of its previously announced private placement. The Company will issue 1,500,000 Units at a price of $0.10 per Unit for gross proceeds of $150,000.

Each unit consists of one (1) common share and one (1) common share purchase warrant of the Company. Each whole share purchase warrant entitles the holder, on exercise, to purchase an additional common share of the Company at a price of $0.15 per share for a period of one year from closing. Finders' fees of 7% cash were paid on this tranche. The securities issued are subject to a four-month hold period.

Proceeds of the private placement will be used for working capital.

Lorne Warner, P.Geo, President of the company is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical content of this news release.

On behalf of the Board of Directors

"Harold Forzley"

CEO

Bathurst Metals Corp.

For more information contact Harold Forzley, CEO

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain of the statements made and information contained herein may contain forward- looking information within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, information concerning the Company's intentions with respect to the development of its mineral properties. Forward-looking information is based on the views, opinions, intentions and estimates of management at the date the information is made, and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated or projected in the forward-looking information (including the actions of other parties who have agreed to do certain things and the approval of certain regulatory bodies). Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of the Company, its financial or operating results or its securities. The reader is cautioned not to place undue reliance on forward-looking information.

BATHURST METALS CORP.

665 DOUGALL ROAD, GIBSONS BC WWW.BATHURSTMETALS.COM

Copyright (c) 2021 TheNewswire - All rights reserved.