Lomiko Metals Inc. ("Lomiko") (TSX-V: LMR, OTC: LMRMF, FSE: DH8C ) is focused on the exploration and development of flake graphite in Quebec for the new green economy. Lomiko has been monitoring emerging legislation aimed at reducing dependence on Chinese supply of graphite, lithium, and other electric vehicle battery materials. The US Geological Society notes that 100% of graphite anodes are currently imported to the United States as there is no domestic graphite mines able to produce the material used in Electric Vehicles. Please also refer to Lomiko news release October 26, 2020 related to changing government policies regarding critical minerals in the USA and Canada.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201109005383/en/

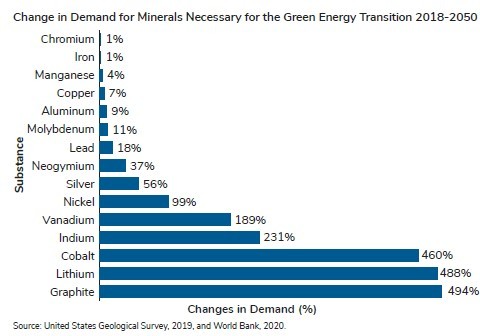

Change in Demand for Minerals Necessary for the Green Energy Transition - US Geological Society and World Bank (Graphic: Business Wire)

Key Elements of Biden-Harris Platform on Clean Energy

The Biden administration will make a historic investment in clean energy and innovation, developing rigorous new fuel economy standards aimed at ensuring 100% of new sales for light- and medium-duty vehicles will be zero emissions and annual improvements for heavy duty vehicles;

Biden will invest $400 billion over ten years, as one part of a broad mobilization of public investment, in clean energy and innovation and aims to create 10 million jobs in the process. The funds will accelerate the deployment of clean technology throughout the US. Biden also sets a target of reducing the carbon footprint of the U.S. building stock 50% by 2035, creating incentives for deep retrofits that combine appliance electrification, efficiency, and on-site clean power generation. The new government will work with governors and mayors to support the deployment of more than 500,000 new public charging outlets by the end of 2030.

Further, the Biden campaign has privately told US miners it would support boosting domestic production of metals used to make electric vehicles, solar panels and other products crucial to his climate plan, according to three sources familiar with the matter. The President-elect also supports bipartisan efforts to foster a domestic supply chain for graphite, lithium, copper, rare earths, nickel and other strategic materials that the United States imports from China and other countries, the sources said. Biden is also well-regarded by the Canadian government on issues of mining and green energy which has a Canada-US supply strategy agreement.

Lomiko's Opportunity in the Supply Chain

Graphite demand is expected to increase exponentially for the mined natural graphite material, as more is used in the production of spherical graphite for graphite in the anode portion of Electric Vehicle Lithium-ion batteries.

With a completion of a $ 750,000 financing October 23, 2020 , Lomiko plans to work on its near-term goals of the company are as follows:

1) Complete 100% Acquisition of the Property, currently 80% owned by Lomiko Metals.

2) Complete metallurgy and graphite characterization to confirm li-ion anode grade material.

3) Complete a Technical Report to confirm the extent of the mineralization equals or surpasses the nearby Imerys Mine, owned by international mining conglomerate.

A "technical report" means a report prepared and filed in accordance with this Instrument and Form 43-101F1 Technical Report, and includes, in summary form, all material scientific and technical information in respect of the subject property as of the effective date of the technical report;

4) Complete Preliminary Economic Assessment (PEA)

A PEA means a study, other than a pre-feasibility or feasibility study, that includes an economic analysis of the potential viability of mineral resources.

For more information on Lomiko Metals, Promethieus, review the website at www.lomiko.com , and www.promethieus.com , contact A. Paul Gill at 604-729-5312 or email: info@lomiko.com .

On Behalf of the Board

"A. Paul Gill"

Director, Chief Executive Officer

We seek safe harbor.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), accept responsibility for the adequacy or accuracy of this release .

View source version on businesswire.com: https://www.businesswire.com/news/home/20201109005383/en/

A. Paul Gill

604-729-5312

info@lomiko.com