(TheNewswire)

Tocvan Ventures Corp. ( CSE:TOC) (CNSX:TOC.CN) (" Tocvan " or the " Corporation ") is pleased to announce additional key observations and conclusions from recent technical studies focused on the identification of a Phase 1 program of drill-hole targets at the Pilar Gold-Silver Project in Sonora, Mexico

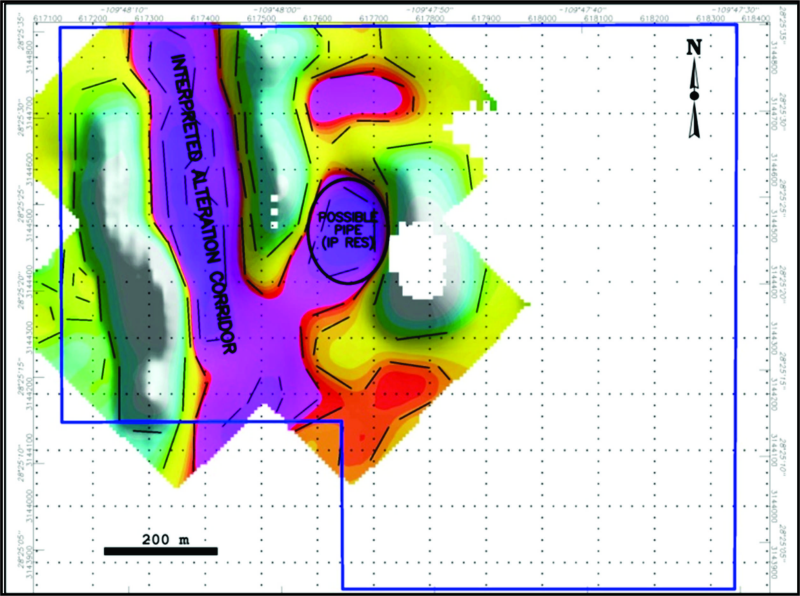

As noted in the most recent press release dated September 29, 2020, several significant conclusions were made, one of which is the interpretation of a sub-vertical pipe-like feature in the east-central part of the property, this feature may represent a breccia feeder pipe related to epithermal mineralization (Figures 1, 2). The pipe is ~100m in diameter, oval shaped, and has a steep plunge (~70?) to SSW with a 195? azimuth.

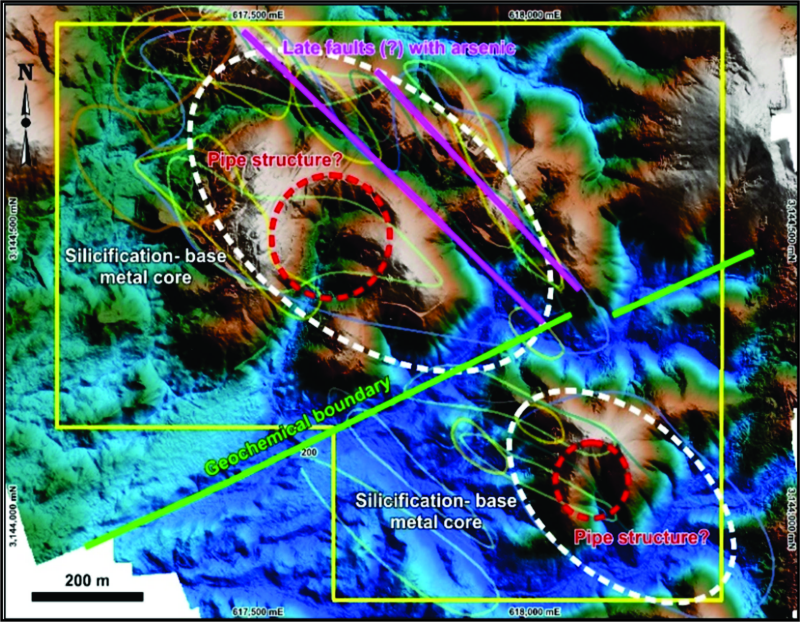

A second circular feature is noted through geochemistry analysis and is tentatively interpreted as a pipe-like feature. It is located in the south-east part of the property, and is south-east of the pipe-like feature described above, interestingly both pipe-like features follow the main north-west to south-east shear structure that runs across the property.

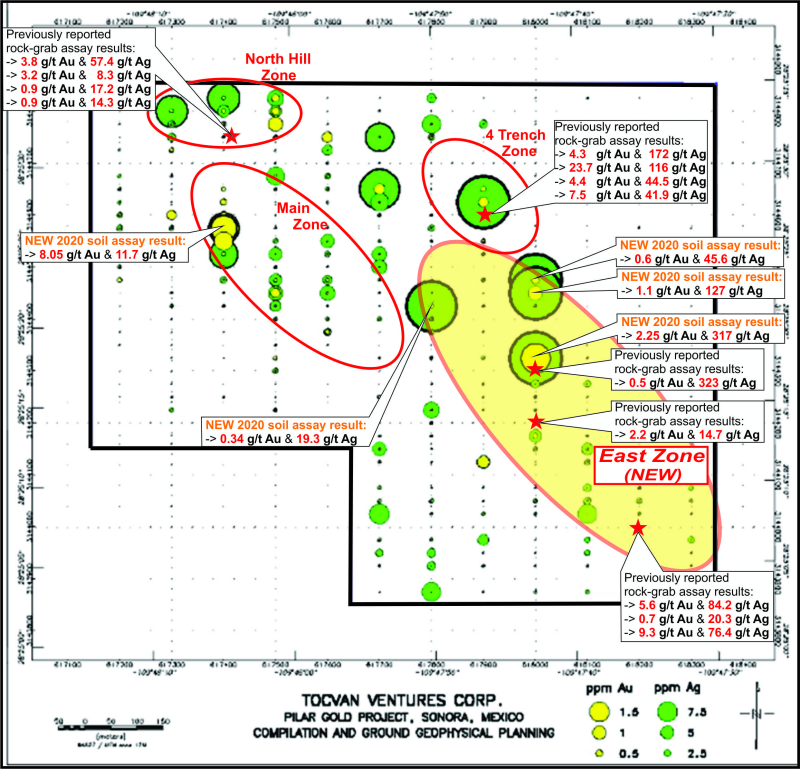

Interesting to note, are the results of the assay soil survey program released in the press release dated June 24, 2020 where the highest soil silver assay result was recorded on the property (317 g/t Ag) and the highest rock-grab silver assay result recorded on the property (323 g/t Ag) (press release: January 7, 2020). Other discoveries and assay results taken together revealed a second parallel mineralized trend of gold and silver to the east of the drilled area and a new high-grade silver zone termed the East Zone (press release: June 24, 2020) (Figure 3).

Key to note, the second circular feature located in the south-east part of the property (Figure 2) (press release: September 29, 2020) , tentatively interpreted as a pipe-like feature, is coincident with the recently discovered high-grade silver East Zone (Figure 3) (press release: June 24, 2020) , in fact the two highest silver assay results are in this area, along with several other gold and silver high grade results. Pipes, and breccia-pipes are significant features in epithermal gold-silver models and can hold bonanza grades (>1opt) of gold and silver.

Figure 1. Interpretation of ground Induced Polarization data (MPH Consulting Ltd).

Note on Figure1. An Induced Polarization Resistivity Inversion depth slice at 325m ASL is shown, with interpretation notes. A significant NNW-SSE ~100m wide corridor is present as a strong resistivity low, and is coincident with much of the drilling performed on the property to date. It is interpreted as increased rock porosity related to an alteration corridor. Another resistivity low is present to the east of this, and takes the form of a discrete 100m diameter oval. Although visibly controlled by a NNE-SSW structure, it terminates abruptly and is interpreted as a potential epithermal feeder pipe.

Figure 2. Geochemical interpretation of shallow soil data (from Aurum Exploration Services).

Figure 3. Results from the 2020 Soil Survey at Pilar Au-Ag Project

Special Note:

The current world health situation requires adjustments to work programs, health and safety is considered first.

Current health advice is for families and groups to self-isolate and to use caution with suggested recommendations from health leaders when social-distancing becomes a challenge. Countries are beginning to allow businesses to operate again. Isolation is an inherent part of mineral development programs.

About the Pilar Property

The Pilar Gold-Silver property is interpreted as a structurally controlled low-sulphidation epithermal project hosted in andesite and rhyolite rocks. Hydrothermal fluids carrying gold, silver and other elements are transported through the pre-existing structures and precipitate from the fluids to become mineralized veins within the structures and surrounding host rock. Three zones of mineralization have been identified in the north-west part of the property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4 Trench. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Over 17,700m of drilling have been completed to date. Significant results are highlighted below from previous operators:

- 17,700m of Core & RC drilling. Highlights include ( all lengths are drilled thicknesses ):

- - 0.73g/t Au over 40m - 0.75g/t Au over 61m - 17.3g/t Au over 1.5m - 5.27g/t Au over 3m - 53.47g/t Au & 53.4g/t Ag over 16m - 9.64g/t Au over 13m - 10.6g/t Au & 37.8g/t Ag over 9m

- - 55g/t Au over 3m - 28.6g/t Au over 6m - 3.39 g/t Au over 50m

Additional areas of mineralization have been identified resulting from surface rock-grab-sample assay results that extend known mineralized trends and show a second NW-SE trend of mineralization to the east parallel to the trending zone described above; gold-silver mineralization is indicated across the property from the north to the south, see press release dated January 7, 2020. Significant results from that particular survey are highlighted below:

---------------------------------------- |Sample # |Au g/t|Ag g/t|Cu % |Pb % | |--------------------------------------| |PILAR-MTS-02|0.9 |14.3 |0.261|0.003| |--------------------------------------| |PILAR-MTS-03|1.3 |5.4 |0.338|0.002| |--------------------------------------| |PILAR-MTS-05|0.8 |12.7 |0.129|0.002| |--------------------------------------| |PILAR-MTS-06|3.2 |8.3 |0.350|0.001| |--------------------------------------| |PILAR-MTS-09|0.2 |2.2 |1.255|0.005| |--------------------------------------| |PILAR-MTS-10|0.9 |17.2 |0.734|0.010| |--------------------------------------| |PILAR-MTS-11|3.8 |57.4 |0.846|0.005| |--------------------------------------| |PILAR-MTS-12|0.0 |5.6 |1.910|0.001| |--------------------------------------| |PILAR-MTS-13|0.0 |12.9 |0.946|0.001| |--------------------------------------| |PILAR-MTS-14|0.1 |3.3 |1.400|0.001| |--------------------------------------| |PILAR-MTS-19|0.8 |1.7 |0.013|0.008| |--------------------------------------| |PILAR-MTS-20|5.6 |84.2 |0.088|1.710| |--------------------------------------| |PILAR-MTS-21|0.7 |20.3 |0.027|0.185| |--------------------------------------| |PILAR-MTS-22|9.3 |76.4 |0.120|2.150| |--------------------------------------| |PILAR-MTS-25|0.5 |323.0 |0.016|0.242| |--------------------------------------| |PILAR-MTS-26|1.4 |2.4 |0.002|0.013| |--------------------------------------| |PILAR-MTS-27|2.2 |14.7 |0.012|0.259| |--------------------------------------| |PILAR-MTS-29|4.3 |172.0 |0.086|1.125| |--------------------------------------| |PILAR-MTS-30|23.7 |116.0 |0.089|0.040| |--------------------------------------| |PILAR-MTS-33|4.4 |44.5 |0.109|0.036| |--------------------------------------| |PILAR-MTS-34|7.5 |41.9 |0.044|0.022| |--------------------------------------| |PILAR-MTS-35|2.2 |3.5 |0.179|0.008| ----------------------------------------

The technical information in this news release pertaining to geological data and its interpretation has been prepared by Mark T. Smethurst, P.Geo., COO, Director of the Company, and a "qualified person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Tocvan Ventures Corp .

Tocvan is a well-structured exploration mining company. Tocvan was created in order to take advantage of the prolonged downturn the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan Ventures Currently has approximately 17.7 million shares outstanding and is earning into two exiting opportunities. The Pilar Gold project in the Sonora state of Mexico and the Rogers Creek project in Southern British Columbia, Management feels both projects represent tremendous opportunity.

Cautionary Statement Regarding Forward Looking Statements

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tocvan Ventures CORP.

Derek A. Wood, President and CEO

Suite 1150 Iveagh House,

707 - 7 th Avenue SW

Calgary, Alberta T2P 3H6

Telephone: (403) 200-3569

Email: dwood@tocvan.ca

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Copyright (c) 2020 TheNewswire - All rights reserved.